Compared to crypto trading and mining, staking emerges as a low-risk investment option. However, investors must be well-informed before venturing into speculative assets. Read this article to discover the various staking programs offered by the 11 best crypto staking platforms.

11 Best Crypto Staking Platforms 2023

We thoroughly evaluated exchanges and trading apps to identify the 10 best crypto-staking platforms. Our assessment considered multiple factors, including the range of coins available for staking, security measures, trading fees, customer service, educational resources, etc.

CoinSpot – Best Staking Platform for Australian Users

CoinSpot stands out as the premier staking platform for Australian users, boasting the highest staking yields in the country. At CoinSpot, users can earn attractive yields on 23 different tokens, with APYs ranging from 2.9% to an impressive 45%. This diverse selection includes popular coins like Cardano, Solana, and Avalanche, ensuring diverse opportunities for staking and earning rewards.

What truly sets CoinSpot apart is its unique tiered staking system, allowing users to maximise their earnings based on the amount they stake. With three tiers in place, users who stake higher amounts can enjoy even better yields on their crypto assets. Each tier has a specific minimum staking amount, ensuring flexibility for users to participate according to their preferences.

CoinSpot is widely recognised as the safest crypto exchange in Australia. By staking coins on this platform, users can rest assured that their investments are secure, as CoinSpot prioritises robust security measures. This peace of mind is particularly remarkable when compared to decentralised platforms like AAVE or Compound, which come with smart-contract risks.

For a more comprehensive understanding of CoinSpot’s features and security measures, you can read our detailed CoinSpot Review.

Coinbase – Best Staking Platform for Staking Services

As one of the best crypto-staking platforms, Coinbase offers a straightforward and user-friendly staking process. It supports staking for several popular cryptocurrencies like Ethereum, Cardano, and Polkadot. You can have the flexibility to stake your assets using different funding methods, including bank transfers and debit cards.

To further streamline the user experience, staking rewards are automatically deposited into users’ accounts, allowing for hassle-free passive income generation from crypto investments. Coinbase has implemented on-chain staking for various in-demand cryptocurrencies such as Tezos, Cosmos, Solana, and Cardano to enhance their services.

In response to regulatory uncertainties posed by the SEC, Coinbase has obtained a custody and trading licence from the Bermuda Monetary Authority. This strategic move enables the platform to extend additional services to institutional clients, ensuring a comprehensive and secure staking experience on the platform.

You can read our Coinbase review for more information.

Binance – Best Staking Platform for High Staking Rewards

Binance stands out as one of the best crypto-staking platforms for high staking rewards. This platform supports nearly 100 staking coins, encompassing many projects and APYs. It provides various options for the duration of token lockup, typically spanning 10, 30, 60, or 90 days.

Binance allows users to stake Moonbeam (GLMR) on their website with a 10-day lockup period, boasting an impressive yield of 239%. Other options, such as Shiba Inu and Solana, present APYs of 8.78% (30 days) and 10.12% (10 days) at the time of writing. The highest yields on Binance are often associated with shorter lockup periods as rates are subject to daily fluctuations, making securing promotional APYs for periods exceeding a month rare. Furthermore, each staking pool has a maximum allocation, meaning attractive deals may sell out quickly.

Beyond staking, Binance is also a one-stop trading platform for digital currencies. With over 1,000+ markets available, Binance charges industry-leading fees, with a maximum trading fee of 0.10% per transaction. For every $1,000 traded, a fee of only $1 is collected. Binance offers users an interest rate on idle crypto assets through its crypto savings account, another remarkable feature.

You can read our Binance review for more information.

eToro – Best Regulated Staking Platform for Beginners

eToro is reputed for its industry-leading fees and low account minimums. The broker has recently introduced a portal that enables users to stake their idle cryptocurrency investments. Once you purchase digital assets on eToro, the tokens are automatically staked on your behalf. You can earn staking rewards on eligible tokens in your eToro crypto wallet until you decide to cash out.

Currently, eToro offers automated rewards for three of the best staking coins: Ethereum, Cardano, and Tron. The fees associated with staking depend on your eToro member status and location. For instance, bronze members and US clients receive 75% of eToro’s monthly staking yield, while diamond account holders can keep 90%.

By choosing eToro as your preferred staking provider, you gain access to a range of additional benefits. For instance, your crypto assets are staked within a highly regulated ecosystem as eToro holds licences from the SEC, FCA, ASIC, and CySEC. When purchasing crypto on eToro, you can conveniently deposit funds with US dollars for free using a debit/credit card, ACH, bank wire, or an e-wallet. Instead of paying costly commissions, you only need to cover the spread.

You can read our eToro review for more information.

OKX – Best Crypto Platform for Staking on Major Coins

OKX, with a user base exceeding 20 million worldwide, provides crypto staking opportunities, with APY up to 70%. You can stake popular tokens such as Ripple, Shiba Inu, Litecoin, Dogecoin, Polygon, Avalanche, Polkadot, and more, for staking terms from 15 to 120 days. There are flexible staking options that do not require locking up tokens, with Ethereum 2.0 staking being at a rate of 4.09% APY.

Beyond crypto staking in the DeFi space, OKX extends its offerings to crypto savings accounts, allowing users to earn interest on stablecoins and tokens like Bitcoin. Tether and USD Coin offer an attractive 10% APY, while Bitcoin earns 5% APY. Celsius Network’s token yields an impressive 300% APY. Notably, tokens earning interest in savings accounts do not have a lock-in period, and interest is paid hourly.

OKX also introduces a unique staking option known as “flash deals.” These temporary, short-term offers allow users to earn up to 500% APY on in-demand tokens. Flash deals frequently include Bitcoin, Ethereum, and emerging cryptocurrencies that traders are keen to borrow.

You can read our OKX review for more information.

Gemini – Best Platform for Crypto Lending Services

Gemini is a well-established exchange offering various crypto services, including crypto staking and lending. It’s widely recognised for its rigorous security standards, boasting an AAA rating in CERtified and a Trust Score of 10 from CoinGecko. The New York State Department of Financial Services also regulates Gemini, giving users additional peace of mind.

Crypto lending operates similarly to staking, as both strategies generate passive income by “leasing” your coins in exchange for regular payments. Bear in mind a crucial distinction: stakers commit their crypto to support a blockchain network and earn rewards, while lenders earn interest by facilitating the borrowing process.

Gemini supports two prevalent coins for staking, namely Ether and Polygon. However, the platform’s standout feature lies in its crypto lending services. With higher APYs reaching up to over 8%, this platform boasts an attractive opportunity for users. There is no minimum asset requirement to participate in the lending program, and the platform imposes no transfer or withdrawal fees, enhancing the overall user experience.

You can read our Gemini review for more information.

Crypto.com – Best Staking Platform for Flexible Withdrawals

Crypto.com is among the world’s largest cryptocurrency exchanges, serving millions of clients. Besides features like digital asset loans, crypto credit and debit cards, and NFT markets, it provides staking services through its Crypto Earn facility. When you deposit your chosen digital tokens, Crypto.com will allocate the funds to provide loans to account holders seeking capital. The end-borrower repays the funds with added interest for you daily.

The amount you earn depends on APY rates which vary based on the specific token. For example, stablecoins like USDC and TrueGBP offer a 12% APY, while Bitcoin and Ethereum provide a 6.5% APY. Also, the time you are willing to lock your tokens—either one month, three months, or without a redemption clause—influences the rates.

If you stake CRO tokens, you can enjoy higher APYs. Regardless of the tokens you choose to stake and the terms you select, it’s important to remember that your tokens generate interest through Crypto.com’s lending activities. Moreover, by joining Crypto.com, you gain instant access to a wide range of digital tokens that can be purchased using a debit card at a mere 2.99% fee, making the platform suitable for active traders.

You can read our Crypto.com review for more information.

MyCointainer – Best Crypto Staking Platform for Various Rewards

MyCointainer offers multiple avenues to earn cryptocurrency. You can generate profits by holding coins in your wallet, delegating them to MyCointainer nodes directly from your wallet, or staking the coins offline. The platform aims to create a user-friendly and inclusive crypto community where earning staking rewards is no longer a complex endeavour but a transparent and accessible process.

The MyCointainer staking platform supports around 150 crypto assets, ranging from well-known altcoins like Polkadot and Cardano to promising up-and-coming coins that offer substantial potential for returns. Users can store their coins in a cold wallet to safeguard assets, keeping them offline rather than online.

MyCointainer allows for the purchase or exchange of coins starting from as little as 1 EUR. It also offers numerous airdrops and giveaways, allowing individuals to enter the crypto world without risking their investments. New users are also greeted with a welcome bonus upon joining. While MyCointainer does have a staking fee on earned rewards, their fees are among the lowest in the market.

YieldFlow – Best Staking Platform for High-Yield DeFi Services

YieldFlow stands out in DeFi by providing a comprehensive suite of tools under one roof: Staking, Lending, and Yield Farming. The staking feature lets users deposit tokens into a blockchain network, contributing to its security and stability while earning rewards. The lending feature allows users to generate income from their idle crypto tokens by lending them out at competitive APYs.

Significantly, YieldFlow operates as a decentralised platform, ensuring no single point of failure and that investors retain control over their digital assets. All transactions are executed through secure smart contracts, guaranteeing transparency and reliability. The privacy-focused approach of YieldFlow ensures that users can earn income without compromising their identities.

The platform takes pride in its historical performance, highlighting that investors have achieved an average Annual Percentage Yield (APY) of around 15%. The platform’s native token, $YFlow, offers various staking opportunities, including single-asset staking and Uniswap V2 LP staking. Profits are earned in $YFlow tokens and are disbursed based on the duration of the staking period, with more extended lockup periods corresponding to higher potential yields.

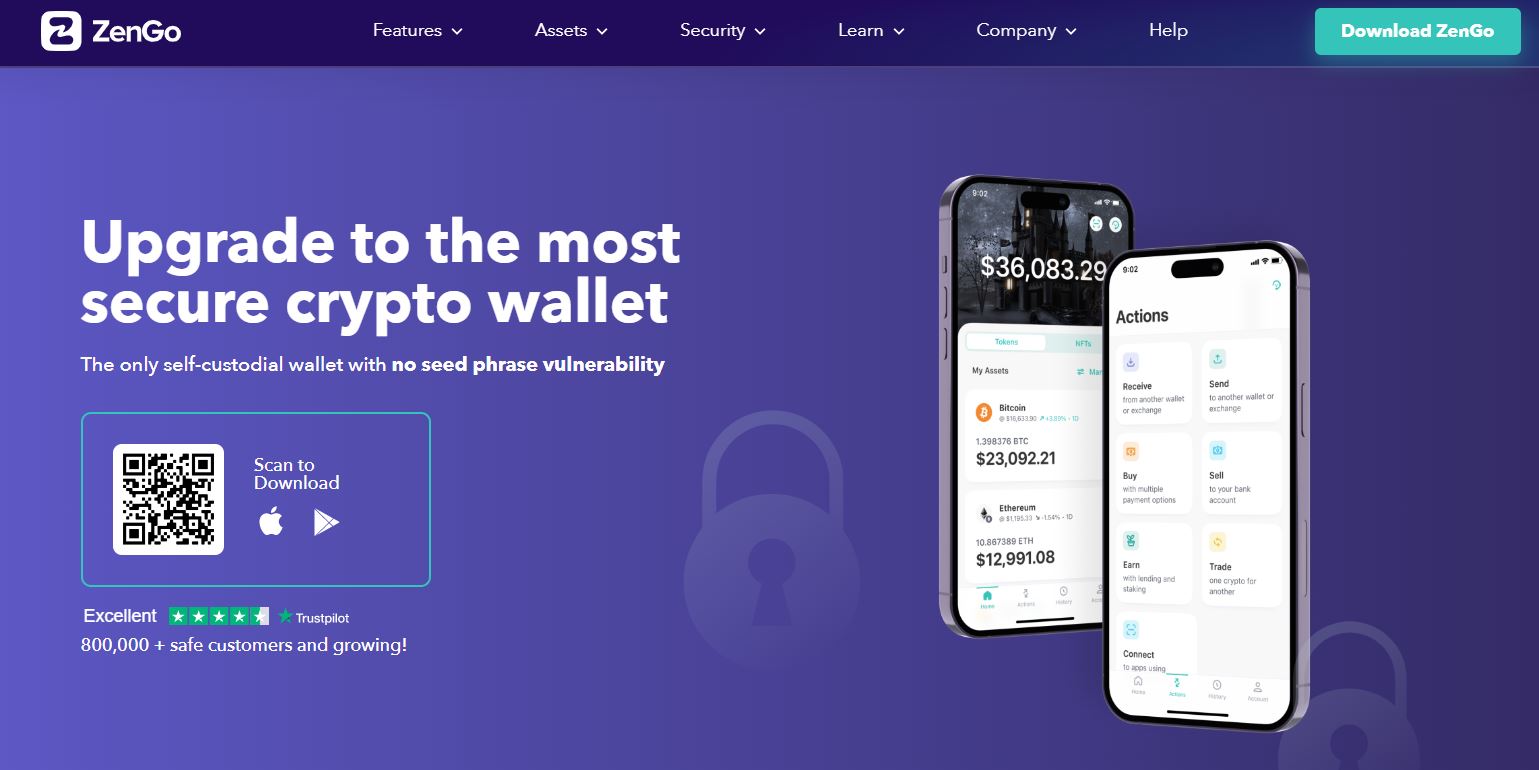

ZenGo – Best Wallet Exchange for Lending Services

ZenGo Wallet is a versatile cryptocurrency wallet that allows users to buy, stake, and swap cryptocurrencies. Its WalletConnect provides a secure connection to DApps, allowing users to trade NFTs and earn yields. It also serves as an excellent wallet option for US residents who want to convert their salaries, either in whole or in part, into Bitcoin, Ethereum, or USDC.

What sets ZenGo apart from many other crypto wallets is its ability to help users earn interest on their holdings. Users can participate in lending or staking activities by holding crypto in the wallet. Through lending, users can lend their crypto to Nexo, a trusted partner and a registered financial institution specialising in crypto lending. Another passive income option is staking, available only for Tezos on the ZenGo platform.

ZenGo offers a Savings account with an annual yield (APY) of up to 8% for users looking to earn interest on their crypto assets. The APY rates vary depending on the cryptocurrency held, with Bitcoin earning 3% APY, Ethereum earning 4% APY, and USDC, USDT, and TUSD potentially earning up to 8% APY.

AiDoge – Crypto Staking Platform for Daily Tokenized Rewards

AiDoge is a new and innovative AI-powered crypto project incorporating a built-in staking protocol offering daily rewards. According to the project’s whitepaper, AiDoge aims to tackle the challenges of meme creation by using artificial intelligence (AI) to generate memes aligned with crypto trends. This is achieved through AiDoge’s “meme generator,” which relies on text-based prompts, similar to ChatGPT.

AiDoge also implements a custom-built staking protocol, allowing users to “lock up” their $AI tokens and earn daily credit rewards. This staking feature allows users to create additional memes without incurring additional costs. Moreover, AiDoge’s staking protocol offers additional benefits to stakers. These benefits include access to exclusive meme templates, participation in special meme contests, and voting rights concerning governance proposals.

Naturally, the unique staking protocol and AI-powered features of the AiDoge project have garnered significant interest from the investment community. However, investors must know that presale cryptos like AiDoge often carry higher risks due to their illiquidity.

Crypto Staking FAQs

What is crypto staking?

Staking in the crypto world is an investment approach allowing passive earnings. Investors deposit their crypto assets into a blockchain protocol, contributing to the security and functionality of the network. In return, they receive an interest rate on the staked tokens for the duration of their stake. With its recent transition to a proof-of-stake consensus mechanism, Ethereum has emerged as the leading proof-of-stake coin for long-term investment.

What cryptos can I stake?

According to Staking Rewards, the proof of stake ecosystem holds over $132 billion in locked assets. Commonly staked coins for passive income include Algorand, Ethereum 2.0, Chainlink, Polkadot, and Cardano. Ethereum rewards are locked until the completion of Ethereum 2.0, and over 10% of Ethereum is currently staked. Traders can also stake stablecoins like USD Coin, Dai, and Tether.

What are the best crypto-staking platforms?

Numerous exchange platforms support staking, with some crypto wallets also offering this feature. CoinSpot, Binance, Gemini, KuCoin, Kraken and Coinbase are among the top exchanges for staking and rewards. However, other exchanges like Bitstamp and eToro also provide staking and rewards for crypto holdings.

Is staking risky?

Although staking is commonly regarded as a relatively low-risk method of generating passive income from crypto holdings, it is not entirely devoid of risks. One potential risk is the significant decline in the value of the staked coin, resulting in a net loss. Moreover, if the blockchain network being staked on encounters compromises or technical problems, you could potentially lose some or all of their staked cryptocurrency.

Are staking rewards taxed?

The Australian Taxation Office (ATO) considers crypto staking rewards as ordinary income upon receipt, requiring individuals to pay Income Tax based on the fair market value of their coins or tokens in AUD. Please read our Australia Crypto Tax Guide for further details.

Final Verdict

Staking can be a rewarding and potentially profitable method to contribute to the blockchain ecosystem while earning passive income. Best crypto staking platforms such as CoinSpot, Coinbase, Binance, Kucoin, and OKX provide resources and support to assist users in starting staking. Nevertheless, crypto staking carries certain risks. Beginners should conduct thorough research and consider factors such as staking rewards, lockup periods, withdrawal limitations and potential risks.