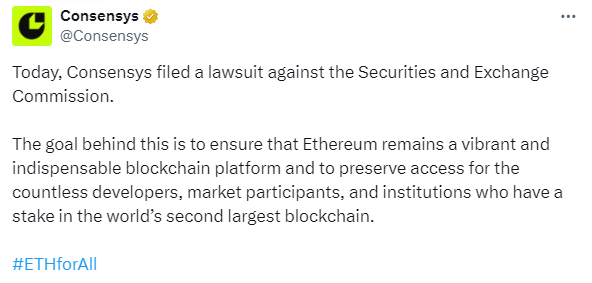

ConsenSys has taken legal action against the U.S. Securities and Exchange Commission (SEC), alleging an overreach of authority regarding Ethereum. They argue that Ethereum (ETH) should not be classified as a security and that such a designation would violate their constitutional rights and disrupt administrative procedures. The lawsuit emphasises that this isn’t just a technical dispute but a significant effort to protect Ethereum from being treated as a security.

Inherently, ConsenSys is not only advocating for itself but for the broader Ethereum community. They’ve initiated a federal court case to clarify Ethereum’s status, asserting that ETH is not a security and contesting any notion that their MetaMask wallet constitutes a brokerage service or that their staking services violate securities laws.

“ETH isn’t a security, and treating it as such would trample on their Fifth Amendment rights and mess with the Administrative Procedures Act.”

ConsenSys is also challenging the SEC’s investigation into MetaMask’s operations.

The lawsuit highlights potential negative impacts if the SEC were to regulate Ethereum as a security, warning of stifled innovation and reduced usage within the U.S. blockchain industry. This move could cause substantial losses for Ether holders and hinder blockchain development in critical sectors like healthcare and energy.

Joe Lubin, a key figure in Ethereum’s development and ConsenSys’s leadership, emphasises that the lawsuit is about preserving opportunities for developers and investors in Ethereum. He argues that Ether has been recognized as a commodity rather than a security, and regulating it otherwise would impede U.S. blockchain innovation.

ConsenSys is seeking legal affirmation that the SEC lacks jurisdiction over Ether, Ethereum-based tools, and the blockchain itself due to their non-security status. They stress that Ether functions as a commodity and supports various non-financial applications crucial to sectors beyond finance.

In addition to defending Ethereum’s status, ConsenSys emphasises that their MetaMask wallet facilitates user empowerment within web3 industries, including digital identity management and cryptocurrency transactions. They argue against classifying developers of such tools as securities brokers, which they believe would hinder progress in web3 innovation.