The rise of cryptocurrency has been a global phenomenon since the inception of Bitcoin in 2009. With significant ups and downs, it is a volatile asset, and investors must comprehend that crypto investment carries substantial risk. But is cryptocurrency a good investment? It may offer promising prospects for investors who can handle risk effectively.

What Is Cryptocurrency?

Cryptocurrency, or crypto, is a digital currency that serves as a medium of exchange. It utilises cryptography to ensure transaction security, regulate the creation of new units of a specific digital currency, and verify transactions. Cryptocurrencies differ from fiat currencies like the US dollar or the British pound because they are not issued by any central authority, making them potentially resistant to government intervention or manipulation.

Most cryptocurrencies operate without the backing of a central bank or government. Instead, they work on decentralised technology, such as blockchain. They do not exist physically as notes or coins; instead, they only exist online as virtual tokens. Their value is determined by market forces created by those buying or selling them.

The process of creating a cryptocurrency is called crypto mining. It involves using computer processing power to solve complex mathematical problems to earn coins. Users can also purchase cryptocurrencies from brokers or crypto exchanges, and store them in encrypted wallets to spend as needed.

Blockchains generally use two consensus algorithms: proof-of-work (PoW) and proof-of-stake (PoS). PoW relies on miners, who often use specific computing machines. PoS, on the other hand, operates through staking. The staking system distributes rewards to those holding assets in designated wallets to help run the network. Some PoS assets allow for master nodes, a more complex staking process that usually requires a minimum number of coins.

History of Cryptocurrency Adoption

The history of cryptocurrency adoption has been a slow but steady process. While there have been recorded transactions of individuals and small businesses using cryptocurrency, it has taken quite some time for large corporations to feel comfortable with the concept of cryptocurrency as a payment method.

However, in 2014, Microsoft, Twitch, PayPal, and Overstock allegedly became the first major corporations to adopt Bitcoin or cryptocurrency. Although Twitch went back on this in 2019, it is still considering reintroducing it someday, while PayPal has diversified to allow its users to have a cryptocurrency wallet.

The Covid-19 pandemic had an unexpected impact on the crypto industry in 2020. Due to the change in trade, industry supply, and demand worldwide, governments’ policies from the pandemic helped feed the rise of cryptocurrency. The rise in digital spending due to the isolation rules enforced by law caused individuals to become better educated on various ways of spending money online, as well as investment and saving options. In 2020, the value of Bitcoin rose by over 400%, reaching its all-time high of $63,558 on April 12, 2021.

In June 2021, El Salvador became the first country to adopt Bitcoin as a legal tender. It caused a positive flux in the market and inspired more countries worldwide to reconsider their legislation and rulings on Bitcoin and cryptocurrencies. Malta is considered one of the most crypto -friendly countries and home to many crypto-friendly banks. Canada is the largest Bitcoin-friendly country in the West, with reportedly over 1,400 Bitcoin-friendly ATMs.

In Europe, Slovenia is the best place to be a crypto investor, as individuals who make money through trading Bitcoin or other cryptocurrencies are not subject to income taxes. Besides, crypto mining is not considered a VAT transaction in Slovenia, which makes crypto investing and mining plausible and profitable. Estonia is another European country leading the way in its open-mindedness to cryptocurrency, with its legal and crypto-friendly economy and banking system, making it a hotspot for cryptocurrency firms, investors, and traders.

Pros & Cons of Crypto Investment

Pros

Cryptocurrencies offer a new decentralised paradigm for money, eliminating the need for centralised intermediaries like banks and monetary institutions. This removes the possibility of a single point of failure, which can trigger global crises like the one in 2008.

Crypto transfers between two parties are secured by public and private keys and different incentive systems, such as proof of work or proof of stake, making them faster than standard money transfers. Decentralised finance’s loans are processed without backing collateral and can be executed within seconds and used in trading.

Investing in cryptocurrencies can generate profits, as cryptocurrency markets have skyrocketed in value over the past decade. For instance, Bitcoin was valued at over $540 billion in crypto markets as of April 2023.

Cryptocurrencies like Bitcoin serve as intermediate currencies, streamlining money transfers across borders, making the remittance economy one of their most prominent use cases.

Cons

While cryptocurrencies claim to be anonymous, they leave a digital trail that agencies like the FBI can investigate. This exposes the possibility of government, authorities, and other parties tracking financial transactions.

Ownership of cryptocurrencies is highly concentrated, with just 100 addresses holding roughly 12% of circulating bitcoin and total value, despite being meant to be decentralised.

Mining popular cryptocurrencies requires considerable energy, sometimes as much as entire countries consume, and is unpredictable. This has led to mining concentration among large firms whose revenues run into billions of dollars.

Off-chain crypto-related key storage repositories, such as exchanges and wallets, can be hacked, compromising their security. Over the years, this has resulted in losing millions of dollars worth of coins from many cryptocurrency exchanges and wallets.

Cryptocurrencies traded in public markets suffer from price volatility, with rapid surges and crashes in their value. Many people consider cryptocurrencies a short-lived fad or speculative bubble because of this.

Criminals often use cryptocurrencies for nefarious activities like money laundering and illicit purchases, and hackers favour them for ransomware activities.

Different Types of Cryptocurrency Investing

If you are interested in investing in cryptocurrency, several options are available. Here are some of the different types of cryptocurrency investing:

- Buy cryptocurrency directly: This is the most common way to invest in cryptocurrency. You can purchase and store cryptocurrencies like Bitcoin and Ethereum and lesser-known coins released in an initial coin offering (ICO).

- Invest in cryptocurrency companies: You can invest in companies with a partial or total focus on cryptocurrency. This includes mining companies, mining hardware makers, and such companies as Robinhood and PayPal that support cryptocurrency. You can also invest in firms like MicroStrategy that hold large amounts of cryptocurrency on their balance sheets.

- Invest in crypto-focused funds: Instead of investing in individual companies, you can invest in a cryptocurrency-focused fund, such as an ETF or investment trust.

- Invest in a cryptocurrency Roth IRA: If you want to invest in cryptocurrency and enjoy the tax advantages of an IRA, you can invest in a cryptocurrency Roth IRA. Using a crypto IRA provider can also help secure your holdings’ storage.

- Become a crypto miner or validator: Mining or acting as a validator in a crypto network is a direct way to invest in cryptocurrency. Miners and validators earn rewards in crypto, which they can hold as investments or exchange for other currencies.

Factors to Consider When Investing in Cryptocurrency

Your Motivations

Before investing in cryptocurrency, you must ask yourself why you’re interested in it. Are you drawn to its popularity, or do you have a specific reason for investing in a particular digital token? Personal investment goals vary, so exploring the crypto market may make sense for some investors more than others.

To get started, take a comprehensive approach to evaluating your investment strategy, risk tolerance, and portfolio diversification. Cryptocurrency can be an alternative asset to your existing investments, offering potentially higher returns with higher risks. However, before investing, clearly understand your goals and expectations to guide your decision-making process.

Your Market Insights

Investors, especially those new to the world of digital currencies, should prioritise developing an understanding of how this market operates before making any investments. Begin by educating yourself about the various cryptocurrencies available, as there are thousands of coins and tokens beyond well-known names such as Bitcoin and Ether.

It’s also crucial to explore the underlying technology behind cryptocurrencies: blockchain. Familiarising yourself with blockchain can give you a sense of how this aspect of the cryptocurrency world functions. For instance, each blockchain has a consensus protocol that ensures the integrity of its ledger, but there are different types of consensus protocols. Proof-of-work protocols require significant mining setups to validate transactions, while proof-of-stake protocols reward the holders with the highest stakes with validation rewards.

Understanding the nuances of these protocols can impact your investment decisions. For example, you can stake your cryptocurrency to generate rewards and increase your holdings. However, proof-of-stake coins may be inflationary if validator rewards are not carefully monitored.

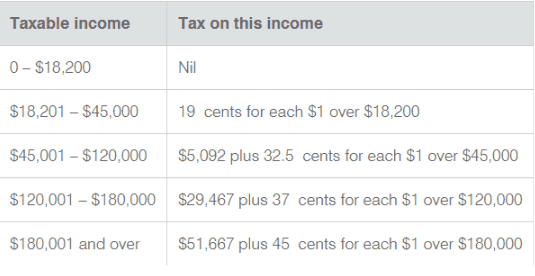

Crypto Tax Issues

Cryptocurrencies are legal in such countries as the United States and Australia, although some countries like China have effectively prohibited their use. However, the legality of cryptocurrencies is just one aspect of the broader legal considerations surrounding them. Factors such as taxation and the ability to use cryptocurrencies for purchases also require attention.

Countries have varying approaches to cryptocurrencies, with some, like El Salvador, adopting Bitcoin as legal tender, while others, like China, are developing their digital currencies. In the United States, what you can buy with cryptocurrency is ultimately up to the seller’s preference.

Regarding taxes, cryptocurrencies are considered property rather than currency, meaning they are taxed as such in the United States. Capital gains tax applies to the difference between the purchase and sale price when selling cryptocurrencies. If you receive cryptocurrency as payment or reward, such as through mining, you will be taxed on its value at the time of receipt.

Assets Management

Keeping crypto assets safe is crucial for anyone who intends to buy and hold cryptocurrencies. For individuals not well-versed in crypto cybersecurity, the best option is to use a reputable custody provider with robust and audited security protocols. Such providers typically have security measures that are suitable for novice users.

Meanwhile, those who want to take a more active role in managing their crypto assets can opt for self-custody and security. This involves purchasing cryptocurrencies on a crypto trading platform and transferring them to a private digital or physical cold wallet (a device that looks like a USB for crypto storage).

However, self-custody requires more responsibility as there is no customer service team to help in case of issues. If your private or exchange accounts get hacked, the crypto trading platform becomes insolvent, or you transfer your coins to the wrong wallet address, you could permanently lose access to your assets. Although self-custody offers greater flexibility, it also requires more knowledge and caution.

Tips for Investing in Cryptocurrency

Before investing in crypto, ensuring your financial situation is in order is crucial. This includes having an emergency fund, manageable levels of debt, and a diversified investment portfolio. Adding crypto to your portfolio can increase your overall returns, but it should not be the only investment you rely on. You can also refer to these tips for crypto investment.

Research First

Con artists are known to use customised influence strategies to exploit the psychological vulnerabilities of their targets. They carefully assess their victims’ psychological weaknesses and design persuasive tactics accordingly. For instance, if you tend to be a risk-taker, fraudsters might leverage your confidence to lure you into high-risk investments.

Similarly, if you’re facing financial difficulties or are dissatisfied with your job, they might dangle the prospect of quick profits and financial freedom in front of you. To avoid falling prey to such scams, you should conduct background checks on individuals or firms offering lucrative crypto investment opportunities. Remember, it’s always wise to research thoroughly before investing to avoid scams and fraud.

Diversify Your Portfolio

Investing in cryptocurrency should not be limited to just Bitcoin. Having a diverse portfolio is more resilient as it reduces your exposure to the volatility of any single coin. Although the market is top-heavy, with the five largest coins making up 76% of all cryptocurrency value, it’s advisable to spread your crypto investments across various digital tokens. This increases the likelihood of picking a coin that outperforms the rest and offers better returns.

A diversified portfolio helps you rebalance crypto investments when one coin gets too heavy. For instance, if you own three coins and decide to allocate half of your crypto assets to one coin and split the remaining 50% between the other two, but the first coin’s value spikes to become 60% of your portfolio, you can sell some of it to fund the other two and maintain the 50-25-25 split. This way, you use your gains to build a more stable position.

Manage Your Risk

Managing risk is crucial when trading any asset, especially volatile ones like cryptocurrency. As a new trader, you had better develop a risk management process that helps you mitigate losses. This process will vary from person to person, depending on their trading strategy:

For a long-term investor, risk management might mean holding onto their position no matter the price. This mentality allows them to stick with their investment for the long run. Meanwhile, for a short-term trader, risk management might involve setting strict rules for selling, such as selling when an investment falls 10%. By following these rules, the trader can prevent a slight decline from becoming a huge loss later.

Newer traders should consider setting aside a specific amount of trading money and using only a portion of it, at least in the beginning. This way, if a position moves against them, they’ll still have money in reserve to trade with later. Remember, you can’t trade without money, so keeping some in reserve ensures you’ll always have a bankroll to fund your trading.

Managing risk can be emotionally challenging. Selling a losing position can be painful, but it can help you avoid even more significant losses later.

Stick to a Plan

Investing in cryptocurrency carries significant risk due to the volatile nature of the market, which can cause hasty decisions and potential losses. To avoid such outcomes, every crypto investor needs to establish clear guidelines on how much to invest and when to sell.

These rules may differ depending on individual preferences and goals. For example, long-term investors may choose to hold their crypto assets, even after a significant decline in value, while short-term traders might set a threshold of selling a coin if it falls by 10% to minimise their potential losses.

Regardless of the approach, new investors should not exceed the amount of money they are willing to risk and consider starting with a fraction of their portfolio. By doing so, they can preserve some of their capital if the market turns against them. Additionally, it’s essential to have an exit plan in place before entering any crypto trade, regardless of the desired financial outcome.

Perform Due Diligence

In this digital era, access to the internet has made it easier than ever to gain knowledge about cryptocurrency before making an investment. With whitepapers available online for almost every coin, investors have no excuse for making uninformed decisions. Similar to keeping a map in the car, it is essential to be prepared when delving into the world of crypto investing.

Resources like All Crypto Whitepapers are invaluable to stay informed about potential investments. This site offers information on a wide range of coins, from the heavily traded to the most obscure altcoins. If you cannot understand how a coin operates or generates revenue, it is wise to seek alternative investment opportunities. All Crypto Whitepapers have you covered, from the biggest initial coin offerings (ICOs) to the most niche altcoins.

How to Invest in Cryptocurrency in 2023

The crypto space is rapidly becoming more accessible with each passing day. Several exchanges similar to those used for traditional investments are available, and you can set up an account in just a few minutes. However, as with any investment, research a particular currency thoroughly before investing your money. If you’re a beginner wondering how to invest in cryptocurrency, the following five steps can help you get started on the right foot.

Step 1: Choose a Crypto to Invest in

Similar to evaluating a company’s potential risks and financial health before investing in its stock, it’s important to carefully understand and evaluate the unique characteristics of each cryptocurrency you are considering investing in. You may choose to invest in one or multiple cryptocurrencies. Remember that it is your responsibility to analyse the investment risk of a particular cryptocurrency, and it’s not advisable to rely solely on social media experts as they may not have your best interests in mind.

Although investing through a large and reputable platform may help minimise exposure to fraud and cybersecurity risks, it’s essential to note that the entire industry is not regulated. Therefore, it’s impossible to eliminate these risks completely. For instance, in 2022, we discovered that FTX, which was previously regarded as a reputable platform, was being operated by bad actors who misappropriated clients’ funds.

Step 2: Select an Exchange or Broker

Now, it’s time to select the right platform. Generally, you have two options: a traditional broker or a dedicated cryptocurrency exchange.

Traditional brokers are online brokers that allow you to trade cryptocurrencies and other financial assets such as stocks, bonds, and ETFs. They often charge higher fees than exchanges and may sell your trading information to other companies. In addition, some brokers may not allow you to store your crypto in a wallet outside their native platform. Popular cryptocurrency brokers include Robinhood and SoFi.

Crypto exchanges act as online marketplaces for buying and selling cryptocurrencies. They typically have low fees, but their beginner-friendly interfaces can be more expensive. If you’re new to crypto, look for exchanges that are easy to use, offer educational resources, and have reliable customer support. Some of the most popular platforms are Coinspot, Binance, Coinbase, Kraken, Gemini, and Bisq. Before making a decision, compare the features of different exchanges using online comparison tools.

Step 3: Fund Your Account

After selecting a platform for trading, the subsequent step is to add funds to your account to begin trading. Most crypto exchanges permit users to purchase crypto using fiat currencies such as the US Dollar, British Pound, or Euro using their debit or credit cards, although this varies across platforms.

However, purchasing crypto with credit cards is deemed risky, and some exchanges do not support it. Additionally, certain credit card companies prohibit crypto transactions. This is because digital assets are highly volatile, and it is not recommended to risk going into debt or potentially incurring high credit card transaction fees for certain assets.

Some platforms also accept ACH transfers and wire transfers. The accepted payment methods and the time taken for deposits or withdrawals vary per platform. Similarly, the time taken for deposits to clear depends on the payment method.

Fees are essential to consider, including deposit and withdrawal transaction fees and trading fees. Fees will differ depending on the payment method and platform, something to be researched initially.

Step 4: Make Crypto Purchases

You can initiate an order using your exchange’s web or mobile platform. To buy cryptocurrencies, select “buy,” specify the order type, enter the amount you want to purchase, and confirm your order. The same applies to “sell” orders.

Apart from exchanges, there are other ways to invest in cryptocurrencies. Popular payment services like PayPal, Cash App, and Venmo allow users to buy, sell or hold cryptocurrencies. Additionally, you can explore the following investment vehicles:

- Bitcoin trusts: Regular brokerage accounts can be used to purchase shares of Bitcoin trusts. These vehicles provide retail investors with exposure to crypto via the stock market.

- Bitcoin mutual funds: Bitcoin ETFs and Bitcoin mutual funds are also available to choose from.

- Blockchain stocks or ETFs: Indirect investment in crypto is possible through blockchain companies specialising in the technology behind crypto and crypto transactions. Alternatively, you can invest in stocks or ETFs of blockchain technology companies.

Your preferred option will depend on your investment objectives and risk tolerance.

Step 5: Store Cryptocurrency

After purchasing cryptocurrency, you need to store it securely to prevent hacks or theft. Cryptocurrency is commonly stored in crypto wallets, which can be physical devices or online software that securely store the private keys to your coins. Although some exchanges offer wallet services, not all of them do, so you may need to choose a separate wallet provider.

Wallet providers offer different options for storage, with “hot wallet” and “cold wallet” being the two main types. Hot wallets use online software to store your crypto assets’ private keys, while cold wallets (also known as hardware wallets) rely on offline electronic devices. Cold wallets tend to charge fees, while hot wallets usually don’t.

Remember that exchanges may charge a small fee when transferring crypto from an exchange to a separate wallet. Additionally, most brokers do not allow you to transfer crypto out of their platform at all.

Is Cryptocurrency a Good Investment?

Investing in cryptocurrency can be risky, and it’s essential to consider this before committing a large portion of your portfolio. A common guideline is to limit high-risk investments to no more than 10% of your overall portfolio. Prioritising retirement savings and paying off debt are also important considerations.

To manage risk within your crypto portfolio, it’s a good idea to diversify by investing in multiple cryptocurrencies. This way, if one asset experiences losses, the impact on your overall portfolio will be less severe.

Research is crucial when investing in cryptocurrency, as it can be difficult to discern which projects are viable. Cryptocurrencies are often linked to a specific technological product being developed or rolled out, and regulation is still evolving. Financial advisors who are familiar with cryptocurrency can provide valuable input.

Also, examine how widely a cryptocurrency is being used and to review publicly available metrics showing data, such as how many transactions are being carried out on their platforms. Additionally, most cryptocurrencies provide “white papers” explaining their technology and token distribution.

FAQs About Crypto Investment

Is Crypto Potential or Speculation?

Although digital currencies have the potential to be a part of daily life, the current crypto market is driven by speculative trading, with exchange trades being the primary use for cryptocurrencies. Prominent figures such as Warren Buffett, Bill Gates, and Jamie Dimon have cautioned against the possibility of a crypto bubble. While speculative behaviour is expected in cryptocurrency as a new technology, novice investors should be mindful of psychological traps like herd instinct, FOMO, and the Greater Fool Fallacy. Such traps could distinguish between a well-calculated risk and a foolish one.

What Kind of Investment is Crypto?

Although the term “currency” is part of “cryptocurrency,” only two countries, El Salvador and the Central African Republic, have recognised Bitcoin (BTC) as a legal tender. Various regulatory agencies in different countries classify crypto assets differently. For instance, some classify Bitcoin (BTC) as a commodity and most other crypto assets as securities, while others view crypto as property or stocks. Regulatory consistency is one of several reasons why investing in this asset class carries high risk.

How Does Someone Earn Cryptocurrency?

Two ways to acquire cryptocurrency are buying it or mining for it. Mining involves using computers to solve complex math problems that verify new crypto transactions and add them to the blockchain, which is like a long receipt or ledger showing the currency’s history. Those who mine for cryptocurrency are compensated in that currency for verifying transactions and maintaining the accuracy of the blockchain. The mining process does not require physical tools like shovels or pickaxes; it is simply an algorithmic process enabled by blockchain technology.

What Can You Purchase With Crypto?

Although most people view cryptocurrencies as investments, they are gradually gaining wider acceptance as a form of currency. This adoption could accelerate as trust in cryptocurrencies grows. Retailers such as Whole Foods, Etsy, Nordstrom, Expedia, and PayPal now allow customers to pay with crypto. Moreover, anyone who values the tokens can exchange them for goods or services with others.

What is the Future of Crypto Investment?

Diversification is critical when investing, as it’s important to balance safe and risky investments. Investors need not choose between cryptocurrency or stocks and can invest in both if they are comfortable with the associated risks. Those interested in pursuing a career or hobby in investment can benefit from online finance education programs, which offer a comprehensive education in financial services and portfolio management.