In recent years, Coinbase has garnered a vast user base, establishing itself as a leading global platform for purchasing, trading, and converting cryptocurrencies. For newcomers to Coinbase, navigating the process of withdrawing funds from your account may present a slight learning curve. However, we’re here to help you. Read this guide to know how to withdraw from Coinbase account.

What is Coinbase? Coinbase Overview

Established in 2012, Coinbase now boasts over 4,500 employees worldwide and extends support to numerous cryptocurrencies. Operating in over 100 countries, it facilitates a staggering quarterly trading volume of approximately $145 billion.

Coinbase offers access to over 250 tradable cryptocurrencies, including popular options like Bitcoin, Ethereum, and Dogecoin. The original Coinbase interface provides a user-friendly experience, allowing individuals to purchase cryptocurrencies using U.S. dollars. On the other hand, Coinbase Pro offers advanced charting tools, enabling users to engage in crypto-to-crypto transactions while using features like market, limit, and stop orders.

Coinbase users have various payment options to buy cryptocurrencies at their disposal. However, the fee structure is complicated to comprehend. At the same time, Coinbase does disclose fees before you finalise your transactions. This can pose difficulties for newcomers seeking their first exchange platform and those prioritising fee sensitivity.

For further details about Coinbase trading services, fee structures and customer support, you can read our detailed Coinbase review.

How to Withdraw from Coinbase?

You can withdraw funds from your Coinbase account either in fiat currency or cryptocurrency. Fiat withdrawals are supported in multiple currencies and can be sent directly to your bank account via debit card or wire transfer. For instance, you can convert USDT to USD before withdrawing it to your bank account. However, Coinbase restricts cashing out and withdrawing money directly to a bank account based on your country of residence.

On the other hand, crypto withdrawals from Coinbase can be made to an external wallet of your choice. This allows you to select the coin to withdraw and transfer it to a third-party wallet. You can also transfer funds to PayPal, and the process for withdrawing funds to PayPal is similar to bank and card withdrawals. However, this feature is only available in specific countries and regions.

How to Withdraw Fiat from Coinbase?

Cash out of Coinbase may initially seem complex, but you can simplify the process by following the steps below. We assume you have a Coinbase account and hold some cryptocurrencies in your wallets. You must add a payment method and ensure a sufficient balance to initiate the withdrawal.

Step 1: Log in to your Coinbase account

Go to the Coinbase website and access your account by tapping the ‘Sign In’ icon. Enter your registered email address and password to log in. Navigate to the ‘Assets’ page to view your portfolio in your wallet. Your available balances for each coin will show the amount you can withdraw.

Step 2: Enter the trading amount

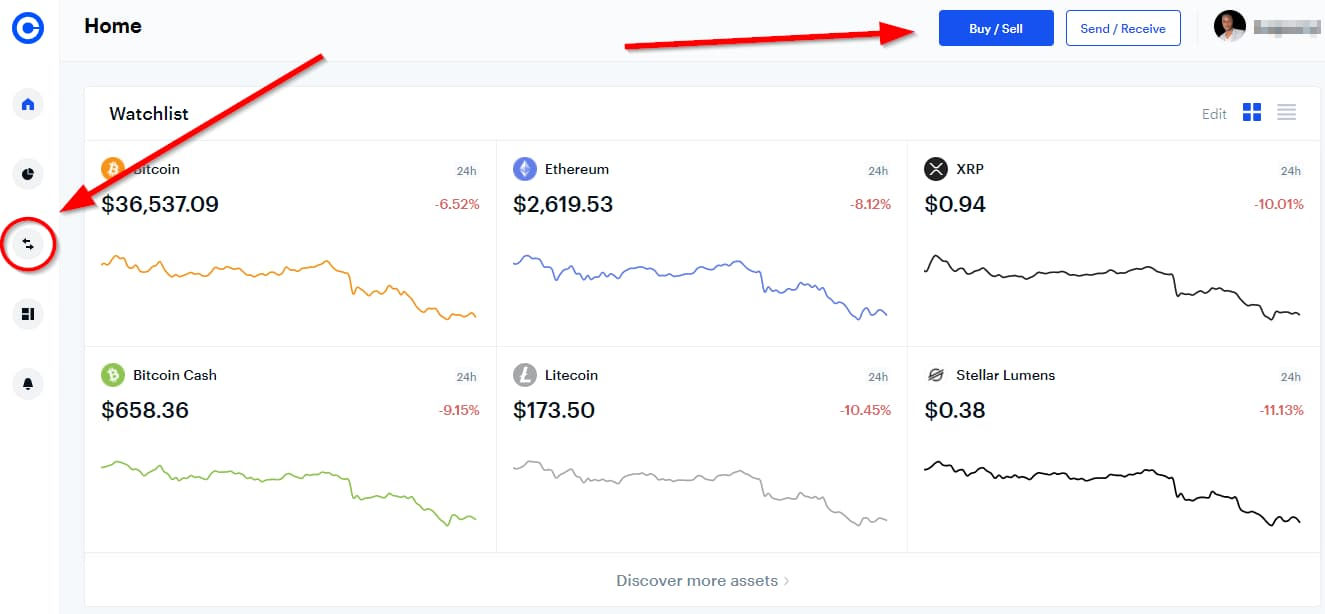

To convert your crypto holdings to fiat on the Coinbase platform, click the Trade button on the left navigation or the Buy/Sell button on the top right. Then, select the crypto asset from which you want to convert the balance and select the fiat currency for withdrawal.

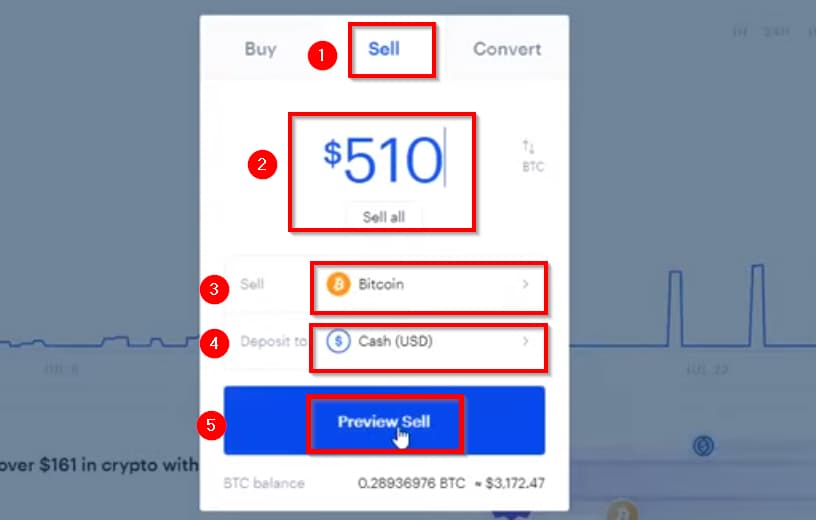

Step 3: Convert your crypto to fiat

Click on the ‘Sell’ tab at the top to enter the amount to convert to fiat. Confirm the details of your transaction by selecting ‘Preview Sell.’ The confirmation window will display the transaction fees and the amount you will receive in your fiat wallet. Once your crypto has been converted to fiat, it’s time to withdraw the funds.

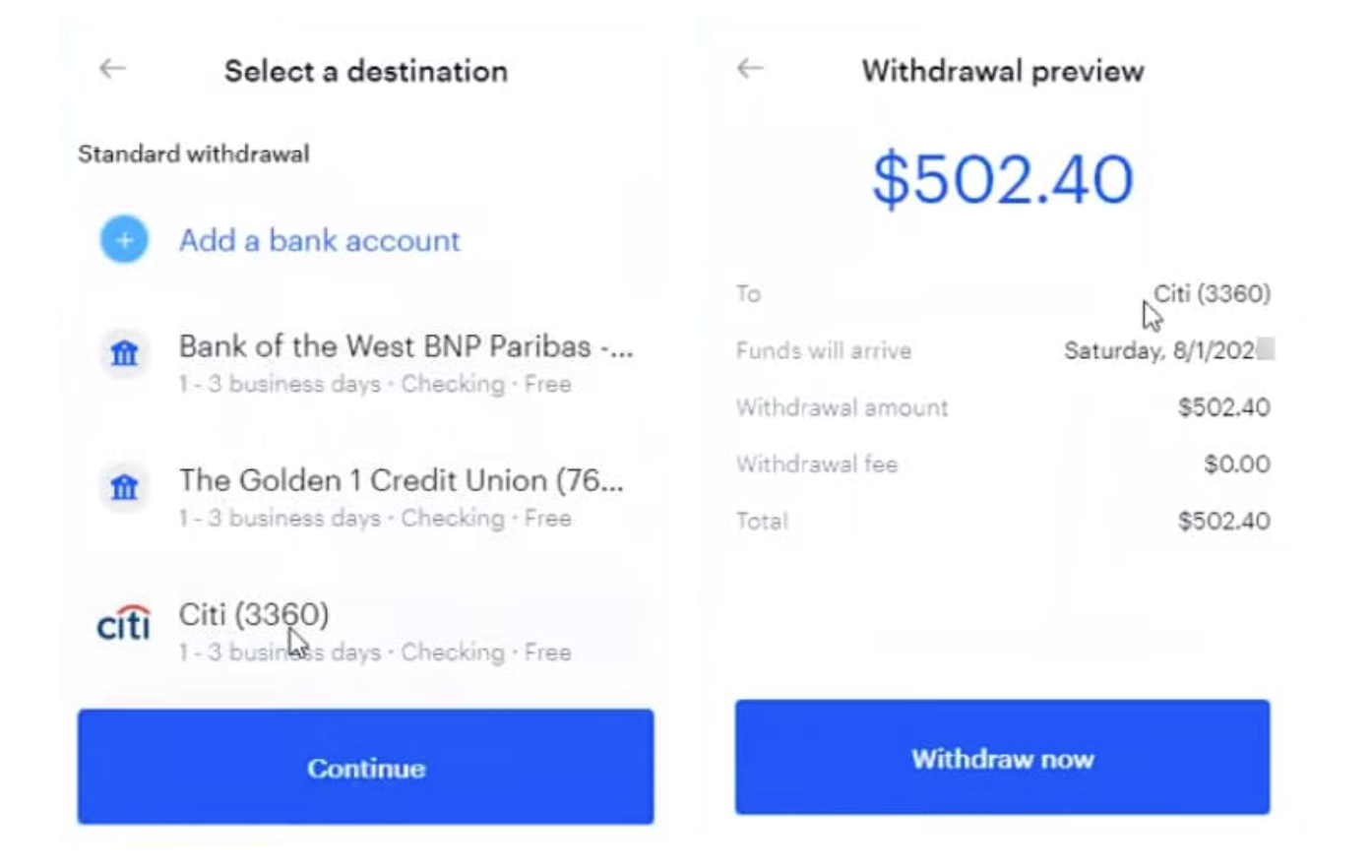

Step 4: Withdraw fiat from Coinbase

Access the ‘Assets’ screen, where the converted fiat balance will be displayed. Choose your preferred payment method, such as bank transfers, PayPal, SEPA, credit/debit card, or wire transfer and click the ‘Continue’ button. Review the transaction details, and if everything is correct, click on the ‘Withdraw now’ button to confirm the transaction

Coinbase does not charge any amount for the withdrawal of fiat at this stage, but a conversion fee was charged earlier in the process. Your transaction will now be processed, and your funds will be sent to your chosen payment method within the indicated timeframe.

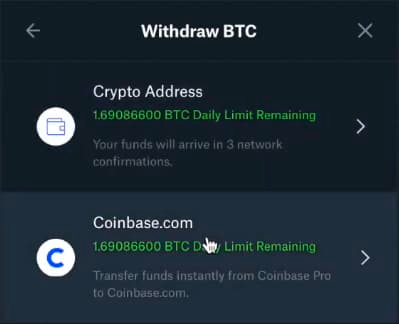

How to Withdraw Crypto from Coinbase?

Withdrawing cryptocurrency from Coinbase does not require swapping or conversion. You can flexibly transfer funds from Coinbase to Metamask, Trust Wallet, or any other crypto exchange. Note that the Coinbase wallet must be sufficient to initiate the withdrawal.

Step 1: Log in to your Coinbase account

Go to the Coinbase website and log in to your account using your registered email address and password. New account owners will need to provide these credentials to access their accounts. You should have a fully verified Coinbase account to enjoy higher daily limits.

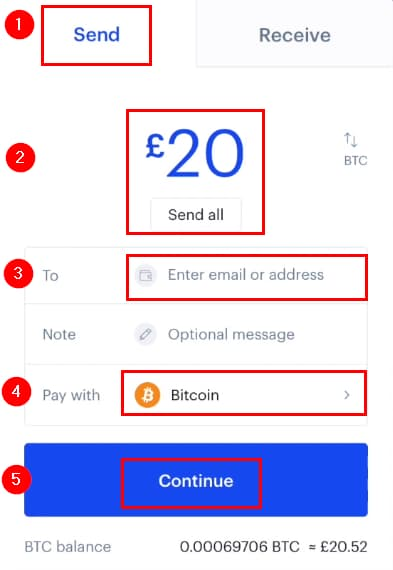

Step 2: Select the coin and specify the amount

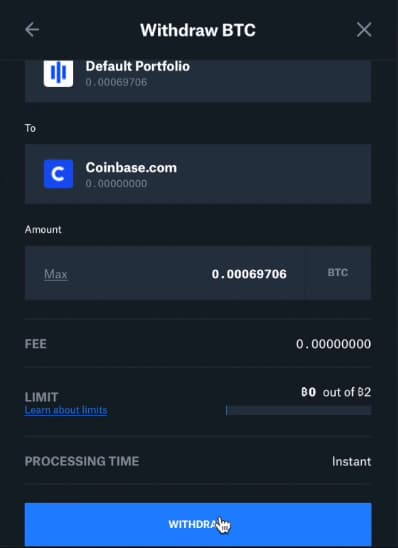

From the Coinbase user dashboard, click the ‘Assets’ icon and navigate to the ‘Send/Receive’ section. Choose the specific crypto to withdraw from the list. Enter the desired amount you want to send. You will see a dialogue box where you can add an email or crypto address in the designated field. Click on ‘Continue’ to proceed.

Step 3: Enter the receiving address

At this stage, you need to select the network for the transaction. Note that each blockchain network has different transaction speeds and associated costs. For example, the cost of transferring USDT may be as high as 20 USDT. Be cautious during this step, as sending your assets to the wrong address may result in permanent loss.

Step 4: Review and confirm the withdrawal

Carefully review all the provided details, including the selected crypto, blockchain network, receiving address, etc. Once you find the information is correct, confirm the transaction details and click on ‘Withdraw’. Depending on the coin and its network, it may take a few minutes or even days for the withdrawn funds to reach the receiving account.

How Much Does Coinbase Charge for Cashout?

Coinbase does not impose internal withdrawal fees on most transactions; however, traders still encounter various costs throughout the process. These expenses primarily arise from depositing fiat currency and subsequently requesting a withdrawal, which incurs charges from banks or credit card providers. The specific fees vary depending on the location and chosen payment options. For instance:

- Many credit/debit cards entail a 3.99% fee.

- SWIFT transactions are subject to a €5.00 cost.

- Traders opting for US bank wire withdrawals will incur a $25 fee.

- Instant card withdrawals may include additional charges of up to 2.00%.

Traders need to consider two types of costs. Firstly, there are fees associated with placing trades on Coinbase. If a trader wishes to withdraw funds from Coinbase but only holds cryptocurrencies, they must first convert them by initiating a sell order. For amounts above $200, a 1.49% charge applies. For amounts below $200, a fixed commission ranging from $0.99 to $2.99 is charged.

Additionally, traders must account for network transaction fees, which depend on the congestion level of the network. On average, traders report Bitcoin fees ranging from $1.00 to $5.00, while other cryptocurrencies generally incur lower fees.

How Long to Withdraw from Coinbase Australia?

For all regions, the exact timing of withdrawals can be subject to certain variables, including the specific payment service provider, any intermediary processes involved, and the overall banking infrastructure.

Australia: For Australian users, the withdrawal speed for fiat currency can vary depending on the payment service provider used. Withdrawals to a linked Australian bank account may typically take 1 to 5 business days to arrive. The processing time depends on factors such as the banking system and intermediary processes.

The United States: US customers can use the ACH Transfer system to withdraw funds to their provided bank account. Withdrawals via ACH usually take around 3-5 business days to finish. Alternatively, US customers can also use wire transfers, which typically take 2 to 3 days for the money to arrive to the provided account.

The United Kingdom: Like Europe, UK customers can keep their local currency in the Coinbase account, allowing instant deposits and withdrawals. However, GBP bank transfers usually take around 1 to 2 business days.

Europe: European customers can make instant deposits and withdrawals on Coinbase. However, as the exchange platform mentions, international transactions may take 2 to 3 working days to complete.

Frequently Asked Questions

How to get my funds out of Coinbase?

In Australia, Coinbase does not directly support fiat withdrawals. However, you can still transfer your funds from Coinbase to your Australian bank account. One option is to use another cryptocurrency exchange, such as CoinSpot, Digital Surge or Swyftx, as an intermediary. You need to transfer your funds from Coinbase to CoinSpot and then withdraw from CoinSpot to your bank account.

What is the instant cashout?

With instant cashouts, you can receive your funds instantly, 24/7. If you reside in the US, UK, or EU and have a linked bank account or a Visa Fast Funds-enabled credit and debit card, you can cash out instantly using your card. If you live in the U.S., you can withdraw funds from your USD wallets directly to your Real-Time Payments (RTP) supported US bank account without any delay.

Why can’t I withdraw money from Coinbase?

If you’re experiencing difficulties withdrawing money from Coinbase, there could be several reasons behind it. It could be due to regional restrictions, you being a new account holder, incomplete verification, your account being flagged for fraud, etc. The appropriate solution will depend on the specific reason preventing the withdrawal.

Are there withdrawal limits on Coinbase?

Coinbase implements withdrawal limits that vary depending on the type of account. Regular Coinbase accounts typically have a minimum withdrawal limit for fiat currencies, usually below $0.10. On the other hand, there is no maximum amount or limit for high-net-worth individuals. For Coinbase Pro accounts, the daily withdrawal limit is $50,000 for digital assets and supported fiat currencies.

How to sell on Coinbase to cash out?

To sell and cash out on Coinbase, log in to your Coinbase account and navigate to the “Accounts” tab. Locate the crypto to sell, click on the “Sell” button, enter the amount to sell, or specify the amount in your local currency. Review the transaction details and confirm the sale. Once the sale is done, you can cash out from Coinbase to your bank account or select an alternative withdrawal method supported by Coinbase, such as PayPal. Note that withdrawal options may vary depending on your location.

Can I sell Bitcoin on Coinbase in Australia?

In Australia, you cannot sell Bitcoin directly on Coinbase and withdraw the proceeds in AUD to your Australian bank account. You can transfer your crypto to an Australian crypto exchange like CoinSpot to overcome this drawback. On Coinspot, you can sell your crypto and easily withdraw your funds, allowing you to access your money seamlessly.

Final thoughts

Withdrawing funds from the exchange requires only a few simple steps, and if conducted within Coinbase accounts, it is easy. However, be cautious about the fees associated with trading between crypto or crypto-to-fiat pairs. To minimise trading fees on Coinbase, you can transfer your balance to Coinbase Pro or another exchange such as CoinSpot, conduct the trade there, and cash out. Despite some additional steps, this saves some of your funds, especially for frequent traders who may enjoy even more substantial savings.