CommSec is Australia’s premier online trading platform that provides the standard minimum trade, facilitates access to global trading markets, and offers diverse educational resources. With these compelling attributes, CommSec emerges as the top preference for novice and experienced investors alike and individuals aiming to expand their trading activities beyond the ASX. Read this CommSec review to gain further insights into this platform.

CommSec Overview

CommSec, a Commonwealth Bank of Australia subsidiary, is an international brokerage and shares trading platform. Since its launch in 1995, CommSec has held its position as Australia’s premier international trading platform and broker. Catering to Australian traders, this retail broker presents various trading tools and products, including the notable CDIA.

The CDIA account, designed exclusively for CommSec users, functions as a specialised direct investment account. Serving as a money management and direct account with the associated bank, it streamlines the process of profiting from share market sales, offering a comprehensive solution for share trading.

An impressive achievement for CommSec came in the 2022 Best Innovation in Business Award for Business Secure. Before opening a CommSec broker account for online trading, acquaint yourself with the pivotal information in this CommSec review.

CommSec Pros & Cons

Pros

Cons

CommSec Products & Services

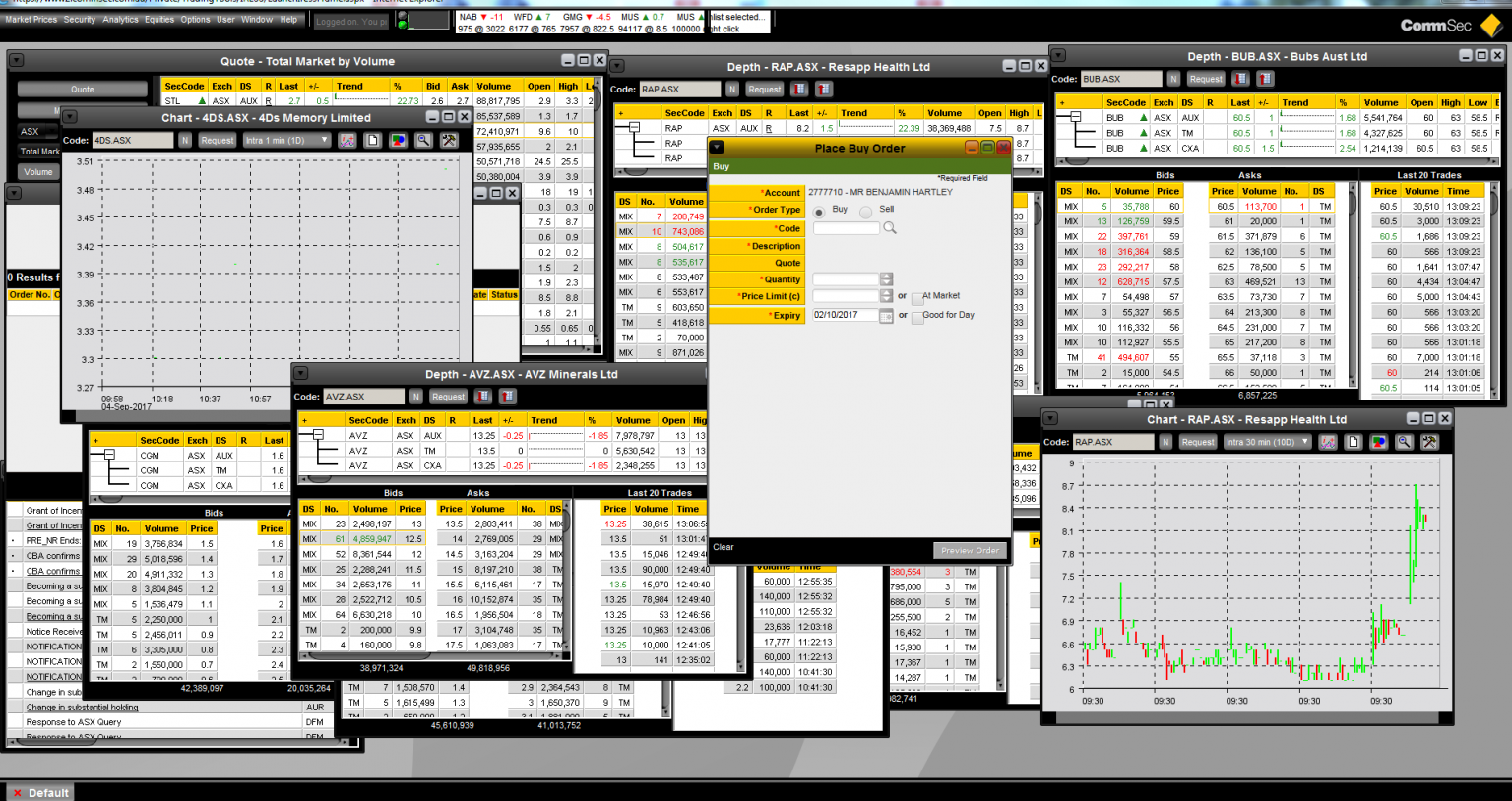

CommSec offers several products through its trading account and mobile version, CommSec Pocket. You can contact the broker to facilitate deposits and place orders at phone broker rates if you have a Commonwealth Bank Account linked for trade settlement. CommSec’s services, as outlined in its review, encompass the following:

Australian & International Share Trading

CommSec facilitates trading in both Australian and international shares, making it an attractive choice for those seeking to diversify and enhance their portfolio through strategic share trading.

International shares offer exposure to broader markets, and CommSec’s charting tools and auxiliary applications provide valuable support for intelligent investing. During share purchases or sales, a T+2 settlement process occurs, wherein ownership exchange takes place two working days after transactions. You also have the option to settle trades using a bank account of your preference.

Exchange-Traded Funds (ETFs)

CommSec empowers traders to engage with Exchange-Traded Funds (ETFs), including Australian Equity strategy, Global equity sectors, and other diverse options. ETFs contribute to portfolio security, allowing traders to expand while maintaining trade security limits. Monitoring positions online and trading ETFs is complemented by 24-hour customer service.

CommSec Margin Loan

CommSec share trading account holders gain access to ‘Margin loans,’ a distinctive feature designed to accelerate wealth creation. This feature enables secure investment in shares while utilising additional funds. With reasonable interest rates, traders can enjoy the comprehensive products and services of the broker.

Fixed Income Securities

CommSec assists traders in selecting appropriate Fixed Income securities to ensure favourable returns on investments, along with the issuer-provided interest. These debt investments, such as Australian government bonds, carry inherent risks and benefits, elaborated on the issuers’ websites. Effective risk management involves actively overseeing the portfolio and considering the time available for investment.

CHESS Sponsored Accounts

The Clearing House Electronic Subregister System (CHESS) manages share recording through computerisation and is overseen by the Australian Securities Exchange. CHESS enables easy tracking of share portfolios and market values in real time. CommSec extends CHESS sponsorship to new account holders through a request form, delivering various advantages, including enhanced security and centralised share dealings.

Other Products

Additional products encompass exchange-traded options, margin lending options, and warrants, catering to active traders’ needs in alignment with prevailing stock prices.

Tracking & Managing Tools

Personalized Watchlist for Tracking Stocks

When you initiate an account with CommSec, you can craft a custom watchlist. This watchlist serves as a tool for keeping a close eye on the stocks that align with your interests while you delve into market analysis. When in a contemplative phase seeking opportunities, you may find this method highly is effective for monitoring market movements. It eliminates the need to sift through numerous options, allowing you to focus solely on crucial financial instruments.

Insights from Top Management Series

CommSec’s analysts consistently engage in interviews with senior executives of major Australian firms as part of the Top Management Series. This initiative offers traders invaluable insights into potential trading prospects. This additional perspective can reveal market shifts that might have otherwise gone unnoticed. Despite these insights, my practice involves cross-referencing signals with my independent market research to ensure thoroughness before any action.

Thorough Statistical Market Analysis

The broker’s informs traders about market developments through live share market headlines, briefings, videos, share prices, and forecasts. The comprehensive market studies were particularly impressive, adding substantial value to my trading endeavours. Comparable third-party market research subscriptions can incur significant costs, making CommSec’s consolidated resourcefulness a convenient and cost-effective advantage.

Morningstar’s Premium Ratings

Subscribers to Morningstar Premium gain access to detailed research spanning a diverse spectrum of investment options. Morningstar Premium ratings prove invaluable when determining which stocks to engage with. Morningstar’s reputation for delivering top-notch research, analysis, and ratings for individual stocks and mutual funds underscores the significance of such access. Subscribing to Morningstar Premium ensures unrestricted use of this wealth of data, while the fund screener applications simplify narrowing down the extensive pool of available funds.

CommSec Trading Fees

CommSec promotes its CDIA-linked trading account with the tagline ‘Trade from $10.00.’ However, note that this rate applies solely to trades amounting to $1,000 or less. Trades surpassing $1,000 and up to $10,000 incur a fee of $19.95. For trades ranging from over $10,000 to $25,000, CommSec levies a charge of $29.95. Once the trade value exceeds $25,000, a percentage-based brokerage fee of 0.12% is implemented.

On the CommSec Pocket mobile app, the fee structure differs. Trades, including those up to $1,000, attract a fee of $2, while anything exceeding this amount is subject to a 0.2% fee. CommSec Pocket primarily caters to novice investors and provides a curated selection of ‘themed’ ETFs, in contrast to the broader range of shares, funds, derivatives, options, and CFDs available on the full CommSec platform.

For international trading, CommSec’s brokerage fees follow this pattern:

- Trades up to USD $5,000 are charged at USD $19.95

- Trades reaching up to USD $10,000 incur a fee of USD $29.95

- For trades surpassing USD $10,000, a 0.31% fee is applicable.

While CommSec’s fees might not be the most competitive, the platform justifies its pricing through a distinct value proposition. This aspect will be covered in more detail later in this CommSec review. Despite the relatively higher costs and the less streamlined international share trading registration process, around 55% of Australian investors opt for a CommSec share trading account. This suggests a shared sentiment among investors.

CommSec Pocket

CommSec Pocket mirrors the excellence of the website, offering a suite of valuable tools like interactive charts, customisable stock watchlists, and comparative charts. With the CommSec Mobile App, you can monitor the market and execute trades from anywhere. Investing apps prove incredibly beneficial for quick assessments of your holdings and the latest market updates.

For individuals who once considered investing beyond their reach, CommSec Pocket has revolutionised the landscape, making it more accessible than ever before. A mere $50 is a starting point on the journey toward wealth creation. It allows you to invest across seven distinct categories based on your preferences, encompassing technology, sustainability leaders, and Australia’s top 200 companies.

Your investment journey on CommSec Pocket involves purchasing shares of a dividend ETF. Similar to shares, ETFs are traded on stock exchanges, yet they represent an investment in a diverse basket of companies and assets rather than a single entity. This consolidated approach enables exposure to a broad spectrum of asset classes through a single ETF. Each CommSec Pocket ETF corresponds to a specific investment theme, such as a particular market or country.

CommSec Reliability,

Opting for a registered brokerage is pivotal, as it signifies compliance with investor-protection regulations. CommSec’s adherence to oversight instils confidence that its services align with legal trading standards.

While the Commonwealth Bank of Australia wholly owns Commonwealth Securities Limited (CommSec), they are not an unequivocal subsidiary. Operating as a participant in clearing and settlement processes, CommSec holds the status of a market member within the Australia Stock Exchange (ASX) and Cboe AU. Their operations strictly adhere to Australia’s privacy regulations, affirming their credibility.

Commsec reviews underscore the multi-layered security measures embedded within their accounts, including passwords, security questions, I-PIN on registered mobile numbers, and more. These comprehensive security protocols fortify trading accounts and linked bank accounts. Compared to other leading forex brokers, these measures bolster the efficacy of risk management assessments.

Commsec Customer Support

Given the scale of their operations and the volume of inquiries they handle, Commsec’s customer service is adequate. While the customer support team may be small in size, their knowledge and assistance are particularly commendable once you establish a connection. This is especially noticeable during the sign-up process, which is somewhat lacklustre overall. When I reached out, they offered a guided walk-through, which was immensely helpful.

Commsec’s customer service offers a multi-tiered support structure. This begins with their Frequently Asked Questions (FAQ) page, which is informative. Besides, they direct users to their Product Disclosure Statements and various informational guides.

Educational Resources

CommSec Learn is an invaluable free resource for novice and experienced investors, offering a range of educational tools to enhance your understanding of the market. CommSec’s seasoned professionals guide you through a wealth of materials, informing you about the latest stock market trends, news, videos, reports, and prices.

CommSec’s website houses three primary learning resources:

- Foundations: This section is the entry point for beginners, introducing fundamental concepts in investing and trading. It covers stock purchasing basics and essential insights to enhance your use of budgeting tools. The content is categorised into beginner, intermediate, and advanced levels.

- Insights & Techniques: This resource offers a range of insights, techniques, and trading ideas to foster your investment expertise. The diverse subject matter ensures that everyone can gain valuable knowledge. In-depth articles and professional videos aid in refining your trading approach.

- Webinars: CommSec provides an extensive library of pre-recorded webinars that delve into various trading concepts and methods. This repository allows you to explore how experts execute trades and strategise. It serves as an excellent opportunity to enhance your trading skills and gain insights from practical experiences shared by others.

CommSec Review: Conclusion

To conclude this CommSec review, its shares trading fees lean towards the higher end. However, the platform compensates with an impressive array of trading tools and comprehensive market research. Drawing upon two decades of industry leadership, As a pioneer in the field, CommSec excels in assisting proactive traders in optimising their portfolio management for wealth accumulation. Notably, the platform boasts excellent customer support and seamless mobile trading capabilities, ensuring secure transactions across the board.