You might also like

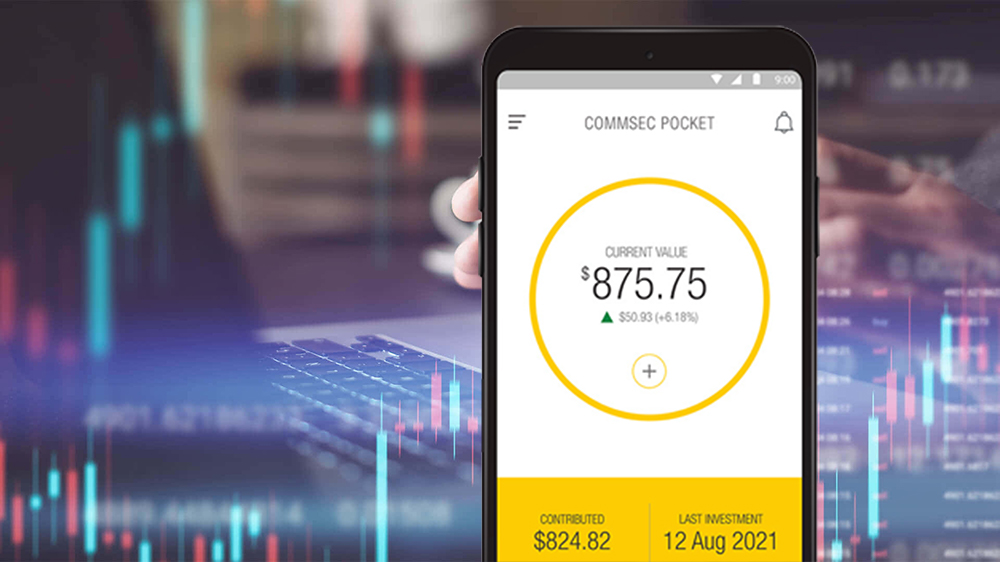

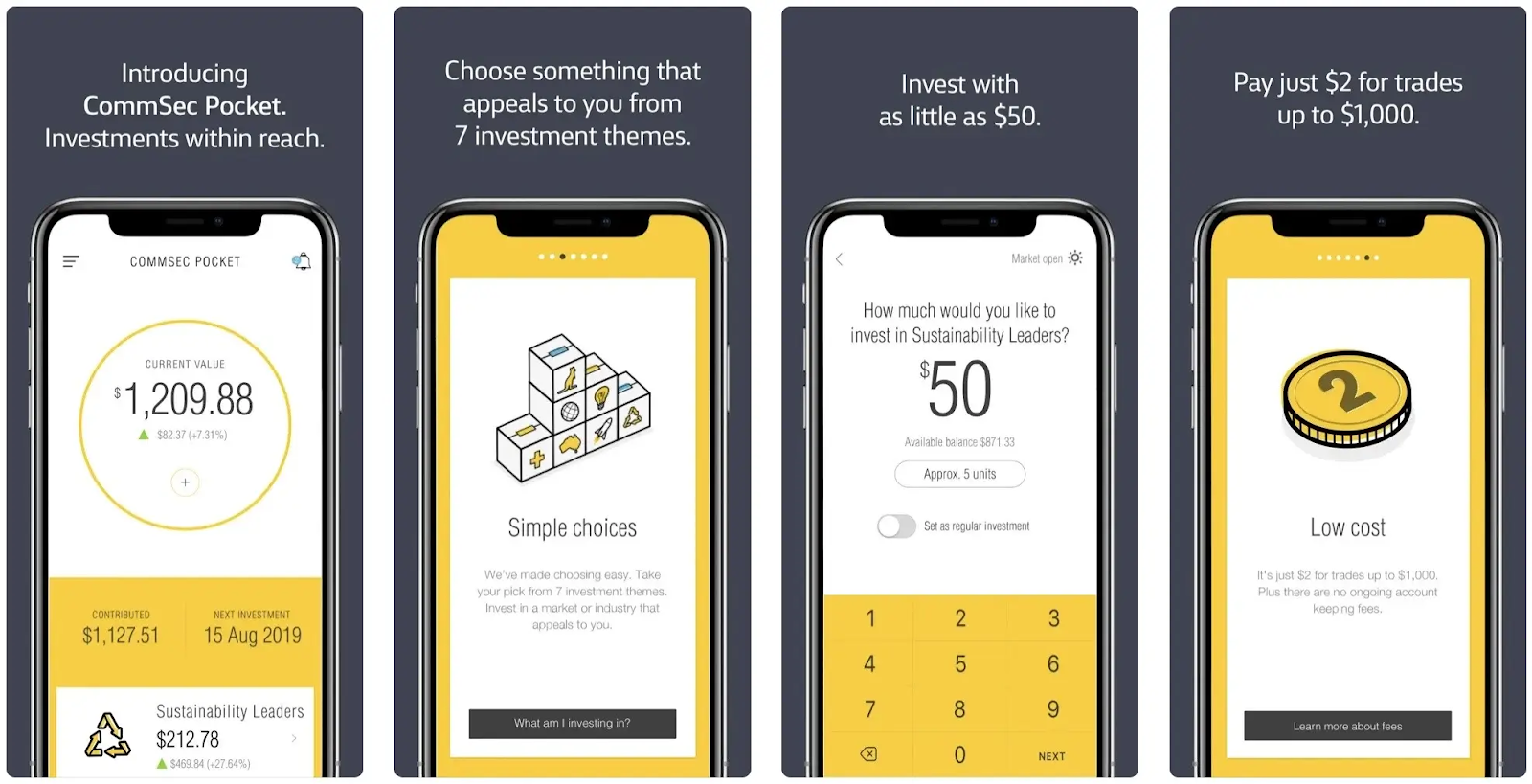

CommSec Pocket, created by CommSec, is a user-friendly alternative for new investors needing help with the traditional CommSec platform. The app allows users to invest in ETFs with a minimum starting amount of just $50. Unlike the CommSec platform, CommSec Pocket focuses solely on ETFs, offering a curated list of these investment funds, representing a compilation of shares on an exchange.

What is CommSec Pocket?

CommSec Pocket, a user-friendly investment platform offered by Commonwealth Securities, simplifies the process for new investors. It presents several investment options, each comprising a range of diverse Exchange Traded Funds (ETFs). With seven different ETFs, users can quickly start small or keep their investing straightforward, thanks to low-cost buying and selling.

The app provides ample support and guidance, explaining investment concepts at a basic level to alleviate any feelings of overwhelm for those new to investing. Please note that CommSec Pocket is exclusively available as a mobile app, with no desktop or browser version.

CommSec Pocket Pros & Cons

Pros

Cons

CommSec Pocket ETFs

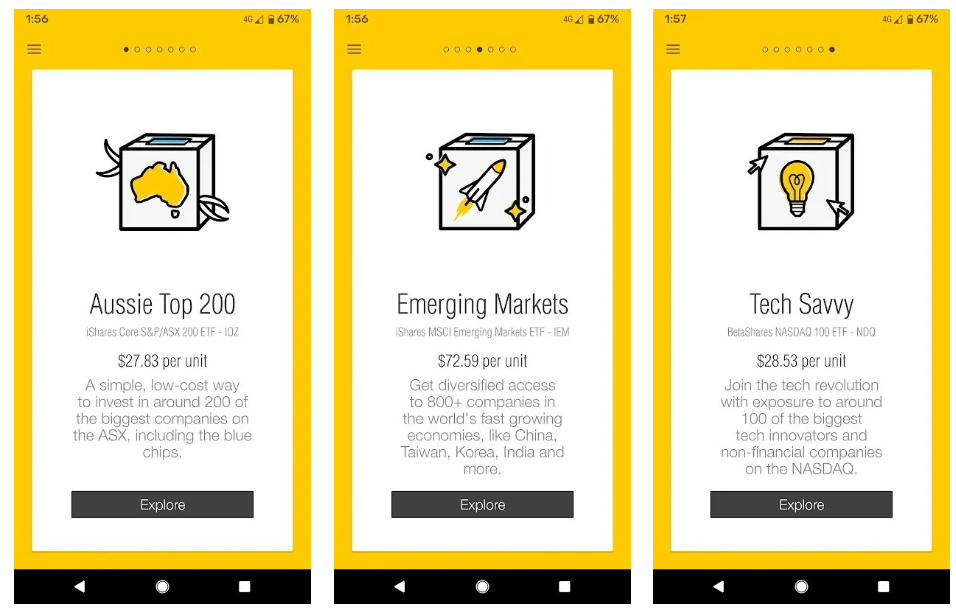

CommSec Pocket offers investors 7 ETF options, each with clear and comprehensible themes, encompassing various industries, markets, and global sectors. Take a look at the following list for a high-level overview of the available choices:

- Aussie Top 200 (IOZ): Tracking the performance of the 200 largest Australian companies on the ASX, offering stability and regular dividends. Average yield: 8% per annum.

- Aussie Dividends (SYI): Focusing on Australian companies known for generous dividends, ideal for income-focused investors. Average yield: 6.73% per annum.

- Global 100 (IOO): Exposure to 100 large-cap global companies allows investors to diversify across international firms and economies. Average yield: 3.26% per annum.

- Health Wise (IXJ): Providing exposure to global healthcare companies, tapping into the growing healthcare sector driven by medical advancements and an ageing global population. Average yield: 5.57% per annum.

- Emerging Markets (IEM): Offering exposure to companies from emerging economies like India, China, Brazil, and Russia, with potential for high growth. Average yield: 9.49% per annum.

- Sustainability Leaders (ETHI): Selecting companies based on strict ethical standards, emphasising sustainability and responsible practices. Ideal for ESG-conscious investors. Average yield: 22.20% per annum.

- Tech Savvy (NDQ): Tracking the NASDAQ-100 Index, offering exposure to leading tech companies with fast-paced growth potential. Average yield: 21.75% per annum.

Investors using CommSec Pocket can diversify their portfolios across different sectors and regions through these ETF options. Whether you prioritise income, are passionate about technology, or care about ESG (Environmental, Social, and Governance) issues, CommSec Pocket offers ETFs tailored to suit your specific investment goals.

CommSec Pocket Fees

CommSec Pocket’s main attraction lies in its accessibility to investors, allowing them to start with as little as $50 and offering brokerage fees of just $2. For CommBank customers, there are no additional fees if they already bank with CBA or meet specific account requirements, making it a cost-effective option.

One of the app’s key strengths is its competitive brokerage fees, charging a flat rate of $2 for transactions up to $1,000 and 0.2% for transactions exceeding that amount. Its user-friendly mobile interface further enhances the investing experience by providing real-time insights and a seamless interface, empowering users to make informed decisions.

Trading Guide & Customer Support

For those new to investing, having access to trading guidance through an online stock broker is highly valuable. Many platforms, including CommSec, offer research on stocks conducted by certified fund managers like Goldman Sachs and Morningstar.

CommSec Pocket provides users with an in-house learning centre featuring videos, tutorials, and webinars to help investors gain knowledge and confidence. A demo platform is also available for practice trading, allowing users to make more informed decisions.

In addition to its trading guidance, CommSec Pocket provides customer support through in-app live chat, email, and phone support during specific hours. However, note that contacting the help centre during market hours may result in some delays.

If you have questions about the CommSec Pocket app, email them at [email protected].

CommSec Pocket Security

The CommSec Pocket app is considered 99% safe due to its CHESS sponsorship, ensuring that investors who use the app and purchase ETFs are legal shareholders of the respective companies.

However, there is still a 1% risk associated with market volatility, which can sometimes cause panic among new investors when they witness fluctuations in the share market. It’s important to remember that ups and downs are common in investing, and selling at a loss due to limited knowledge and experience can result in losses.

While investing in shares may carry risks in the long run, micro-investing apps like CommSec Pocket offer a high level of safety and can provide attractive returns over time.

How to Use CommSec Pockets

Using CommSec Pocket requires having either a pre-existing CommBank or CommSec account, which can be inconvenient for some users.

To start with CommSec Pocket, open the app and click “Explore” to view the list of investment options. The list displays each fund’s theme, the price per unit, and the ETF name for easy understanding.

The minimum investment is $50, but available options may vary based on market fluctuations. Currently, the Sustainability Leaders fund offers the lowest minimum at $49.

If you opt for automatic monthly or fortnightly investments, the minimum cost per unit and brokerage fee remains the same.

For example, investing monthly in the Aussie Top 200 ETF over a year would accumulate around $730 with around $24 in fees. However, considering the costs, investing in one lump sum or using the main CommSec app might be more beneficial, which allows trading up to $1,000 for $10 in fees and offers a broader range of choices.

Frequently Asked Questions (FAQs)

What is the CommSec brokerage fee?

When trading ASX shares through CommSec, the brokerage fee is calculated as 0.1% of the transaction value, with a minimum fee of $19.95 and a maximum fee of $29.95 per trade.

Who does CommSec Pocket cater to?

CommSec Pocket is well-suited for investors seeking access to international markets and those new to investing. Its global trade market accessibility and comprehensive educational tools make it an ideal choice for novice investors.

Does CommSec Pocket charge an account fee?

No, no account or subscription fees are associated with CommSec Pocket. Having a CommSec account incurs no costs unless you engage in active trading.

What is the best CommSec Pocket ETF?

If we consider past performance, the TechSavvy ETF stands out with an impressive 34.78% growth in the past year. Another option is the Sustainability Leaders (ETHI) ETF, which gained popularity with a 22.20% return and a growing focus on ‘Sustainable Projects’ in the market.

Do Commsec Pocket pay dividend on investment?

Indeed, dividends are paid to investors based on their ETF holdings in the CommSec Pocket app. Like any other company, ETFs have their schedules for dividend payouts. Investors receive dividends according to the number of ETFs and the scheduled payout times for each ETF.

What is Commsec Pocket Reddit?

CommSec Pocket Reddit is an active Reddit group where members discuss the CommSec Pocket app. They frequently discuss CommSec Pocket fees and dividends and share valuable insights on their investing journeys with the app. It is a platform for users to learn from each other and stay updated on all things related to CommSec Pocket.

Conclusion

The CommSec Pocket app offers numerous benefits as a micro-investing platform, providing investors with diverse ETF options. It is an ideal entry point for beginners venturing into the financial markets, allowing easy automation of investments with as little as $10 or $20 for specific stocks. With its low brokerage fees and a minimum investment of $50, CommSec Pocket is particularly attractive. However, for experienced investors seeking to trade over $2,500, the standard CommSec Trading App is recommended.