CoinSpot stands out as a more user-friendly and versatile platform compared to Coinbase Australia. Supporting over 480 cryptocurrencies, it offers broader access to digital assets, including an in-platform NFT marketplace and seamless integration with OpenSea.

CoinSpot’s fee structure is more transparent and simpler, with a 0.1% fee for market trades and 1% for instant buys, unlike Coinbase’s complex spread-based fees. Moreover, Coinbase’s history of security breaches makes CoinSpot the more reliable option for Australian traders.

CoinSpot & Coinbase Australia: At a Glance

The table below provide a comprehensive comparison between CoinSpot vs Coinbase.

|

|

|

| Website | www.coinspot.com.au | https://www.coinbase.com/en-au |

| Trading Options | Spot Trading, Instant Buy, Swap, In-place NFTs Marketplace, OTC | Spot Trading, NFTs, Advanced Trade, Derivatives, USD Coin |

| Supported Tokens | Over 480+ cryptocurrencies27/30 top highest market cap tokens | 247 Cryptocurrencies |

| Deposit Fees | POLi, PayID, Direct deposit: 0%Debit cards: 1.88%Credit cards: 0.9% | Bank transfer, PayID:0%Cryptocurrencies: 0%Debit and Credit Cards: Vary |

| Withdrawal Fees | Free for AUD | Free for AUD |

| Transaction Fees | 0.1% for Market Trades1% for Instant Buy/Sell0.1% for OTC Trades1% for CoinSwap | “Spread fees” structure influenced by multiple factors. |

| Payment options | POLi, PayID, OSKO, Debit/credit Cards, Cash | Bank transfer, OSKO, PayID, Credit and Debit Cards |

| Security | 2FA, Biometric security, KYC, Offline cold storage, AUSTRAC registered, ISO 27001 certified | 2FA, Cold storage, AUSTRAC registered, KYC |

| Customer Support | 24/7 Live Chat customer support New request-a-call feature for users to organise a call with support staffResponsive and available specialist Support Team via Help Desk | 24/7 live chat and email support for urgent concerns It’s hard to reach a support team via email or live chat. You cannot chat with support staff unless signed in. |

CoinSpot Overview

Founded in 2013, CoinSpot is one of Australia’s oldest and most reliable crypto exchanges in Australia with robust & verified security and a firm customer base of over 2.5 million users. The platform is acclaimed as one the most user-friendly and transparent exchanges, catering to the needs of both novice and advanced traders.

The exchange has consistently strived to provide supporters with a wide selection of digital assets, boasting over 480+ cryptocurrencies available for trading.

Pros

Cons

Coinbase Australia Overview

Coinbase Australia features easy-to-use trading tools for both beginners and advanced traders, allowing Australian users to buy, sell, and hold various cryptocurrencies like Bitcoin, Ethereum, and more, with seamless integration of AUD support.

Coinbase also places a strong emphasis on security, with features like two-factor authentication (2FA), cold storage for funds, and regular audits to protect user assets. However, Coinbase has undergone some significant hacks and exploits affecting both its customers and employees.

Investors who prefer a transparent fee policy may find Coinbase’s fee policies complicated as they vary based upon payment methods, sorts of trading, and the “spread”.

Pros

Cons

CoinSpot vs. Coinbase Australia: Unique Features

CoinSpot’s Features

CoinSpot is known as the most user-friendly exchange in Australia with easy-to-use interface and a variety of trading options that cater to the needs of both novice and experienced investors.

- Spot Trading: CoinSpot offers an intuitive trading interface. Users can easily browse and buy any of over 480 digital currencies. The cryptos list is also regularly updated each month, depending on customer requests.

- Bundles: Bundles are a carefully selected assortment of various digital currencies. Using bundles can help you cut down the fees by just paying one time for the whole bundle instead of paying the fee for each coin.

- In-platform NFT Marketplace: CoinSpot is the first platform in Australia to enable users to make purchases directly through its in-platform NFT Marketplace. It allows users to purchase NFTs using their choice of cryptocurrency with no need to convert currency or set up an external wallet.

- OTC Trading: CoinSpot’s specialised OTC Trading Desk allows members to perform high-volume transactions without the need of traditional public order books.

Coinbase Australia’s Features

Coinbase goes beyond crypto trading by offering a range of services within the cryptocurrency ecosystem, including Coinbase Card and Staking option.

- Staking and Rewards: On Coinbase, users can stake and earn rewards with attractive yields (e.g., 5.00% APY on USDC). Please note that though staking incurs no gas fees, Coinbase does take a commision of 25% for ETH and 35% for other cryptocurrencies staking options.

- Coinbase Card: The card supports several popular cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC). It offers up to 4% cashback on purchases, with no annual or foreign transaction fees. However, a 1% conversion fee and a 3% fee for international purchases apply.

- Web3 Portal: This is a strength of Coinbase. Coinbase facilitates access to decentralised applications (dApps) via its Web3 portal, which features over 500 dApps across various blockchains, including Ethereum, Solana, and Polygon.

- Trading Platforms: Coinbase offers two trading platforms: a basic “Simple Trade” for new users and an advanced platform with more sophisticated tools. While Simple Trade is easy to use and supports various payment options, it carries higher fees. Advanced trading, on the other hand, offers significantly lower fees and advanced charting features.

CoinSpot vs. Coinbase Australia: Fee Structures

CoinSpot Fee Policies

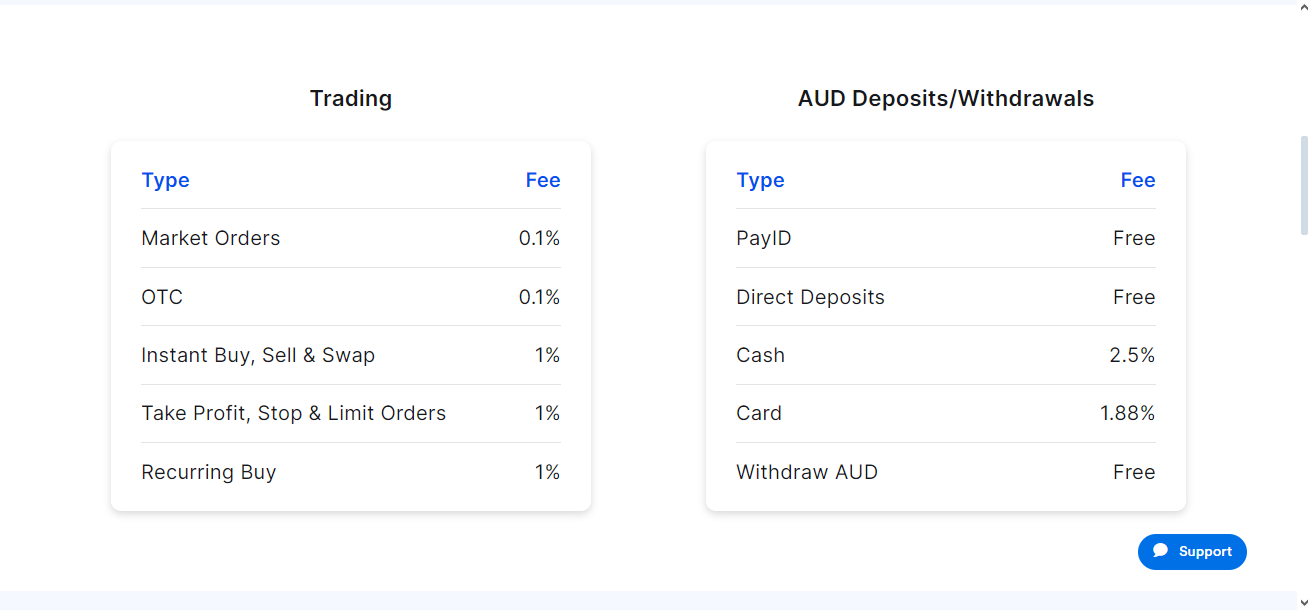

Fees are how crypto exchanges and platforms earn money in the end, so investors need to understand “What are CoinSpot fees?”

Deposit Fees

The exchange accepts a wide variety of deposit methods. On CoinSpot, you don’t need to pay any fee when you make instant deposits via POLi, PayID, or Direct Deposit (via OSKO). If you use Bpay or cards, you will have to pay 0.9% fee (for credit cards) or a 1.88% fee (for debit cards). Otherwise, for physical cash deposits at Blueshyft newsagents, the deposit fee is up to 2.5%

Withdrawal Fees

You can withdraw money from CoinSpot using bank transfers like POLi or PayID without paying any charges. It offers free AUD withdrawals. However, you must pay a small mining fee (blockchain network fee), depending on the token and the network traffic. For example, Bitcoin withdrawals have a fee of 0.0002 BTC, Ethereum withdrawals have a fee of 0.0018 ETH, and Solana withdrawals have a fee of 0.02 SOL.

Transaction Fees

The exchange lays trading fees out simply, so you only pay one transparent fee and avoid any hidden costs as on other platforms.

- Market Trades (0.1% fee): When you set a price at which you want to buy or sell a cryptocurrency, your order will be filled when another trader places an order at that same price. At the time of writing, CoinSpot includes 15 popular options, including BTC, ETH, BNB, XRP, and ADA.

- Instant Buy/Sell (1% fee): CoinSpot sets a fixed price for your desired coins. You don’t have to wait for traders to buy from you or sell to you. Trade happens instantly. The advantage of “Instant” purchasing is that you don’t have to worry about price fluctuations while waiting for your order to be filled. All 410+ crypto assets available on CoinSpot can be purchased instantly.

- OTC Trades (0.1% fee): Users who conduct high-volume transactions can take advantage of CoinSpot’s OTC Trading Desk, which offers instant liquidity and settlement into your account. For transactions of $50,000 AUD or more, this is usually the best option. The best part is that it settles instantly with only a 0.1% fee per trade.

- Advanced Trading Tools (1% fee): If you are a seasoned trader, you can use tools like Recurring Buy, Take Profit, Stop Loss, and Limit Orders with a 1% fee.

- CoinSwap (1% fee): When you swap on Swyftx (exchange any crypto for any other one they offer), you make two trades: sell & buy. Each of these trades has a 0.6% fee, so the total is 1.2%. CoinSpot’s swap feature, in contrast, allows customers to swap between currencies in one simple trade for a low 1% fee.

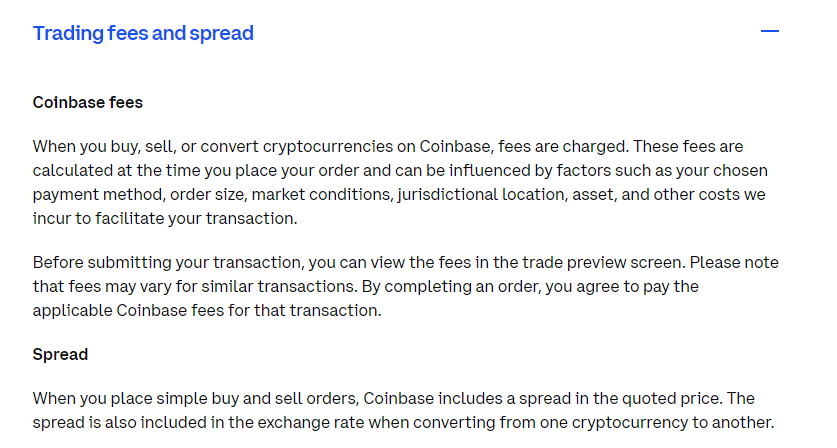

Coinbase Australia Fee Structure

Deposit and Withdrawal Fees

Aussies can deposit and withdraw AUD directly from their accounts through bank transfer and PayID with no fees charged. However, if you opt for credit or debit cards, fees may vary based on the volume of your transactions and the card providers’ fees.

Transaction Fees

Coinbase’s fee structure is very complicated. There is no specific rate for any trading activity, except for the staking option (which takes 25% commission based on your rewards if you go with ETH).

The “spread and Coinbase fees” make the exchange not as transparent as it states. Fees can vary dramatically depending on how much you trade, market conditions, jurisdictional location, asset, payment method, and other costs. When you place simple buy and sell orders, Coinbase includes a spread in the quoted price. The spread is also included in the exchange rate when converting from one cryptocurrency to another.

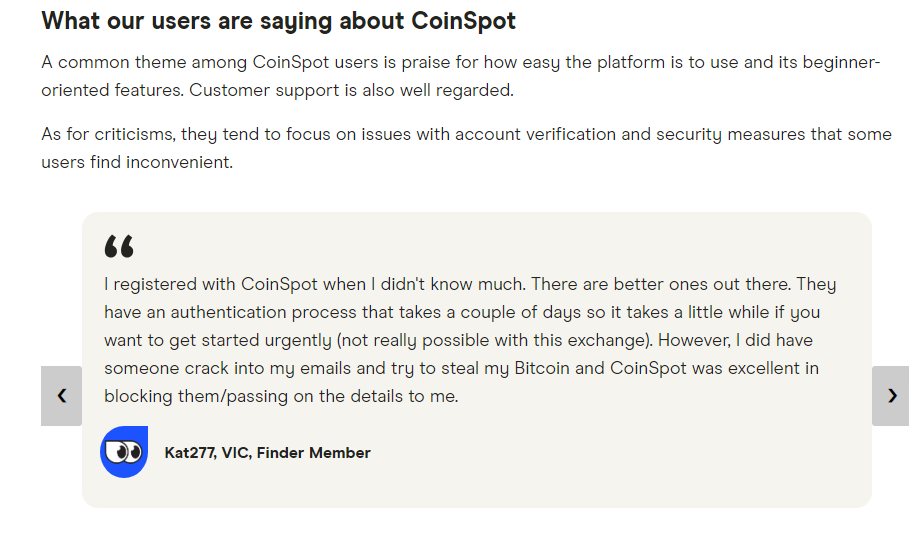

CoinSpot vs. Coinbase Australia: Customer Experience

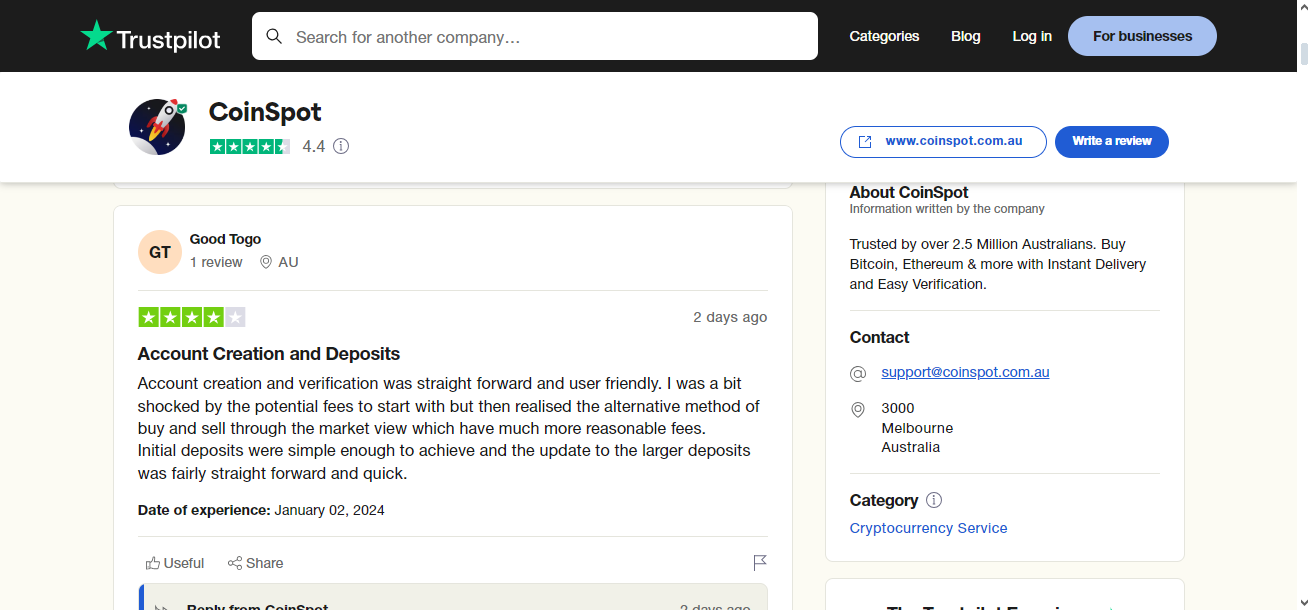

CoinSpot’s Customer Feedback

For those first entering the crypto space, it is effortless to buy, sell or swap various crypto assets with CoinSpot. This exchange has been recognised as one of the top solid choices for both beginners and experienced traders due to its straightforward and user-friendly interface. There are no complex pages so that users can feel like they know the platform very well.

CoinSpot constantly checks and assists its users with any issues they encounter. If you want help, CoinSpot also has a Live Chat option that enables you to reach out for assistance immediately, 24/7. Otherwise, if the team notices a suspicious activity, they will attempt to address the problem and contact you even before you recognise it.

If you cannot converse over live chat, CoinSpot provides alternative measures through their help desk, where you can respond whenever you are ready. The support staff will contact and help you address your problems within 24 hours.

The customer service team is also active on various platforms to answer any queries from their users. For instance, you can feel free to discuss everything about crypto and receive timely support from the official CoinSpot Reddit.

Coinbase Australia’s Help Center

With a 1.5 (out of 5) Trustpilot rating, Coinbase reviews on Trustpilot rank the exchange similarly to Binance (2.1 out of 5-star rating) and Kraken (2.5 out of 5-star rating).

Coinbase offers a comprehensive Help Center that offers instruction articles, FAQs, and an educational site that assists you in discovering the crypto sphere. The platform does have a 24/7 live chat, but you cannot reach anyone if you do not have a Coinbase account.

This makes it hard and inconvenient for Australian individuals considering chosing the exchange since not everything about Coinbase (e.g., fee structure) is clearified on the website.

Coinspot v.s. Coinbase Australia: Security

When choosing an exchange, security is one of the most integral factors. Literally, both Coinbase and CoinSpot emphasise strong security measures against crypto frauds, scams, or cyber breaches.

CoinSpot’s Security

CoinSpot is registered with AUSTRAC and is one of a few that has received the Blockchain Australia certification since 2014.

It is also the first Australian crypto exchange to be awarded the international recognised ISO 27001 certification for information security. The examination process requires the platform to fully adhere to the International Organisation for Standardisation’s requirements and pass an external audit conducted by SCI Qual International (an accredited JAS-ANZ certification body). Therefore, CoinSpot has proved stringently unrivalled in terms of security.

Specifically, the exchange keeps most assets in highly secure offline locations with customisable options for you to prevent unauthorised account access.

- Two-Factor Authentication: Even if your password is compromised, hackers won’t be able to access your account without the 6-digit Authenticator code that is renewed every 30 seconds.

- Anti-phishing phrase: You can customise the phrase that appears each time you sign in with Two-Factor Authentication, ensuring that you are on the actual CoinSpot website and not a phoney one attempting to steal your information and password.

- Geo-lock logins: You can use this option to restrict logins to Australian IP addresses only, thus preventing hacking from outside Australia.

- Disable withdrawals: This feature prevents anyone from withdrawing cryptocurrency or AUD from your account. You must contact support to re-enable withdrawals.

- Session timeout: You can specify the time between when you first log in to CoinSpot and the next time when you are required to log in again. This safeguards against unauthorised access if you forget to log out of your account.

It’s important to note that CoinSpot has never been hacked or exploited before.

Coinbase Australia’s Security

We are curious about the security measures that Coinbase employs as we cannot find a special method stated on the exchange’s website or any reviews from trusted publishers. Coinbase does have Two-factor authentication (2FA), password protection, multi-approval withdrawals, and a bug bounty programme.

However, in recent years, Coinbase has been hit by three notable security incidents:

- Early 2021: Hackers exploited an MFA flaw in Coinbase’s 2FA security feature and stole cryptocurrency from over 6,000 customers

- Feb 2023: Coinbase disclosed a cyberattack targeting employees, involving phishing via SMS and impersonation of IT staff. Although one employee was compromised, multi-factor authentication prevented deeper access. No customer funds or data were affected.

- July 2023: When an attack on Curve Finance triggered volatile price swings in the entire DeFi market, Coinbase inadvertently earned $1 million during the chaos. Coinbase has yet to return the funds.

Article Sources

At CoinCulture, we value content that is authenticated and helpful. All information is supported with white papers, government data, authorised organisations reports, and interviews with industry experts. We also reference original research and articles from other trusted publishers.

- CoinSpot. “CoinSpot Fee Structure, https://www.coinspot.com.au/fees”

- Yellow Card. “What is Crypto OTC Trading and How Does it Work?, https://yellowcard.io/blog/what-is-crypto-otc-how-does-it-work/”

- Trustpilot.com. “CoinSpot review, https://www.trustpilot.com/review/www.coinspot.com.au”

- Digital Economy Council of Australia. “Certified exchanges, https://deca.org.au/#certified-exchanges”

- International Organisation for Standardization. “ISO certification, https://www.iso.org/standard/27001”

- Coinbase Australia. “Coinbase pricing and fees disclosures, https://help.coinbase.com/en-au/coinbase/trading-and-funding/pricing-and-fees/fees”

- Finder. “CoinSpot review, https://www.finder.com.au/cryptocurrency/exchanges?utm_source=blue&utm_medium=cpc&utm_campaign=AUFCY_Exchanges_PF_Display_99Degrees#coinspot”

- Trustpilot. “Coinbase Australia review, https://www.trustpilot.com/review/coinbase.com”

- Cointelegraph. “Hackers exploit MFA flaw to steal from 6,000 Coinbase customers — Report, https://cointelegraph.com/news/hackers-exploit-mfa-flaw-to-steal-from-6-000-coinbase-customers-report”

- Cointelegraph. “Coinbase discloses recent cyberattack targeting employees, https://cointelegraph.com/news/coinbase-discloses-recent-cyberattack-targeting-employees”

- CoinDesk. “Coinbase Earned $1M Amid Hack, but Hasn’t Reimbursed Victims, https://www.coindesk.com/tech/2023/09/15/coinbase-inadvertently-earned-1m-due-to-hack-but-hasnt-reimbursed-victims/”