MicroStrategy and Tether are the two most recent companies to deny having any ties to Silvergate Bank publicly.

The news comes after Silvergate said that it would delay filing its annual 10-K financial report, making many people worry that the cryptocurrency bank might be about to go bankrupt. This prompted MicroStrategy, which holds over 130,000 Bitcoin, to affirm that Silvergate does not retain its BTC collateral.

The company, founded by Michael Saylor, added that it will not be required to repay a loan to Silvergate until the first quarter of 2025 and that a bankruptcy or insolvency event would not “accelerate” the loan repayment.

We have a loan from Silvergate not due until Q1 ‘25. There are mkt concerns re SI’s fin. condition. For anyone wondering, the loan wouldn’t accelerate b/c of SI insolvency or bankruptcy. Our BTC collateral isn’t custodied w/ SI & we have no other financial relationship w/ SI.

— MicroStrategy (@MicroStrategy) March 2, 2023

Paolo Ardoino, who is in charge of technology at Tether, confirmed on March 2 that Silvergate does not affect Tether.

#Tether does not have any exposure to Silvergate.

— Paolo Ardoino 🍐 (@paoloardoino) March 2, 2023

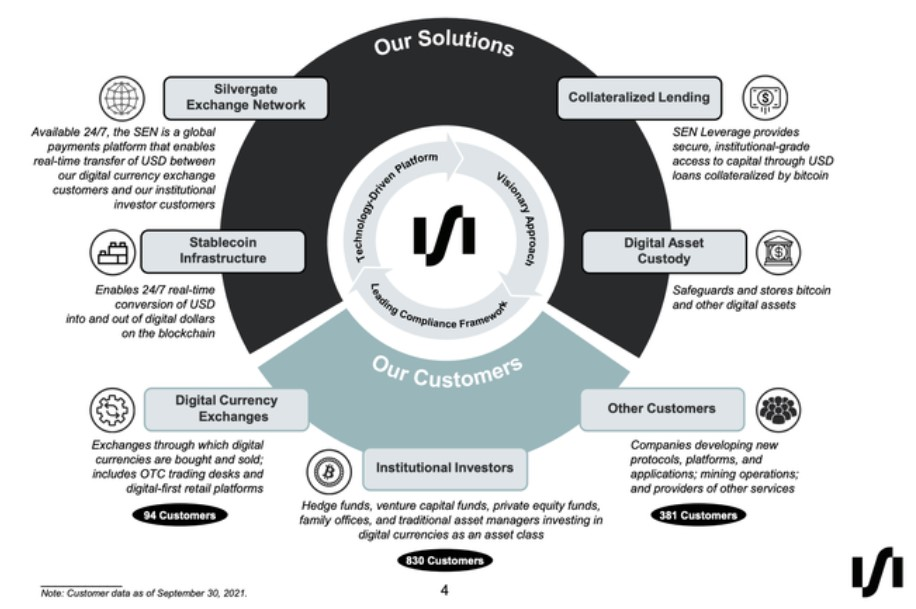

A cryptocurrency bank’s failure could be detrimental to the industry. Silvergate is a fintech company that helps some of the world’s largest crypto exchanges, institutional investors, and mining companies with their financial infrastructure.

Silvergate Exchange Network’s payments platform, open 24/7, has reportedly processed over $1 trillion in transactions since 2017. It also offers several institutional participants in the crypto industry a stablecoin infrastructure platform, digital asset custody management, and collateralised lending services.

Though network effects are essential, the late 10-K filing has hurt the company’s partnerships in a big way.

Bitstamp, Coinbase, Circle, Galaxy Digital, and Paxos verified within 24 hours of the late 10-K filing that they would reduce their partnerships with the cryptocurrency bank.

Gemini has stopped taking customer deposits and letting them take money out through Silvergate ACH and wire transfers.

Reports say that Crypto.com, Blockchain.com, Wintermute, GSR, and Cboe Digital have also cut or reduced ties.

In the meantime, a Binance spokesperson confirmed to Cointelegraph that the exchange has no partnership with Silvergate and does not use the bank’s services.

Silvergate failed to file their annual report citing regulatory investigations. Possibly not solvent.

They already lost majority of their partners. pic.twitter.com/LKdQtNfRRe

— Quinten | 048.eth (@QuintenFrancois) March 2, 2023

Concerns about Silvergate’s prospective financial difficulties surfaced for the first time in the fourth quarter of 2022 when it reported a $1 billion net loss due to the November collapse of FTX.

The United States Department of Justice looks into how Silvergate and FTX did business, but no wrongdoing has been claimed.

In the fourth quarter of 2022, the bank still processed over $3.8 billion in customer deposits, despite many companies recently stating they had no exposure to Silvergate. Silvergate said this significantly declined from the $11.9 billion in Q3 2022.

Since the late 10-K filing news broke on March 1, Silvergate’s stock price has plummeted 58.7% to $5.57. Since the stock’s all-time high of $219.7 on November 14, 2021, it has declined by more than 97%.