Cardano is a blockchain-based infrastructure designed to process transactions with the ADA cryptocurrency. The Cardano platform can handle all types of transactions. Still, its ultimate objective is to become the “Internet of Blockchains” by establishing an ecosystem that enables the interoperability of different blockchains. As it’s a potential digital asset, many are considering investing in Cardano (ADA). But is it a good investment? How to buy ADA in Australia? What are the best crypto exchanges to buy Cardano? Keep reading this article to figure it out!

What is Cardano?

Charles Hoskinson, a co-founder of Ethereum (ETH), founded Cardano in 2015 and, two years later, launched it with a $62.2 million initial coin offering (ICO). Cardano was one of the first blockchains to use a proof-of-stake (PoS) consensus mechanism.

According to its website, it “combines pioneering technologies to provide unparalleled security and sustainability to decentralised applications, systems, and societies”.

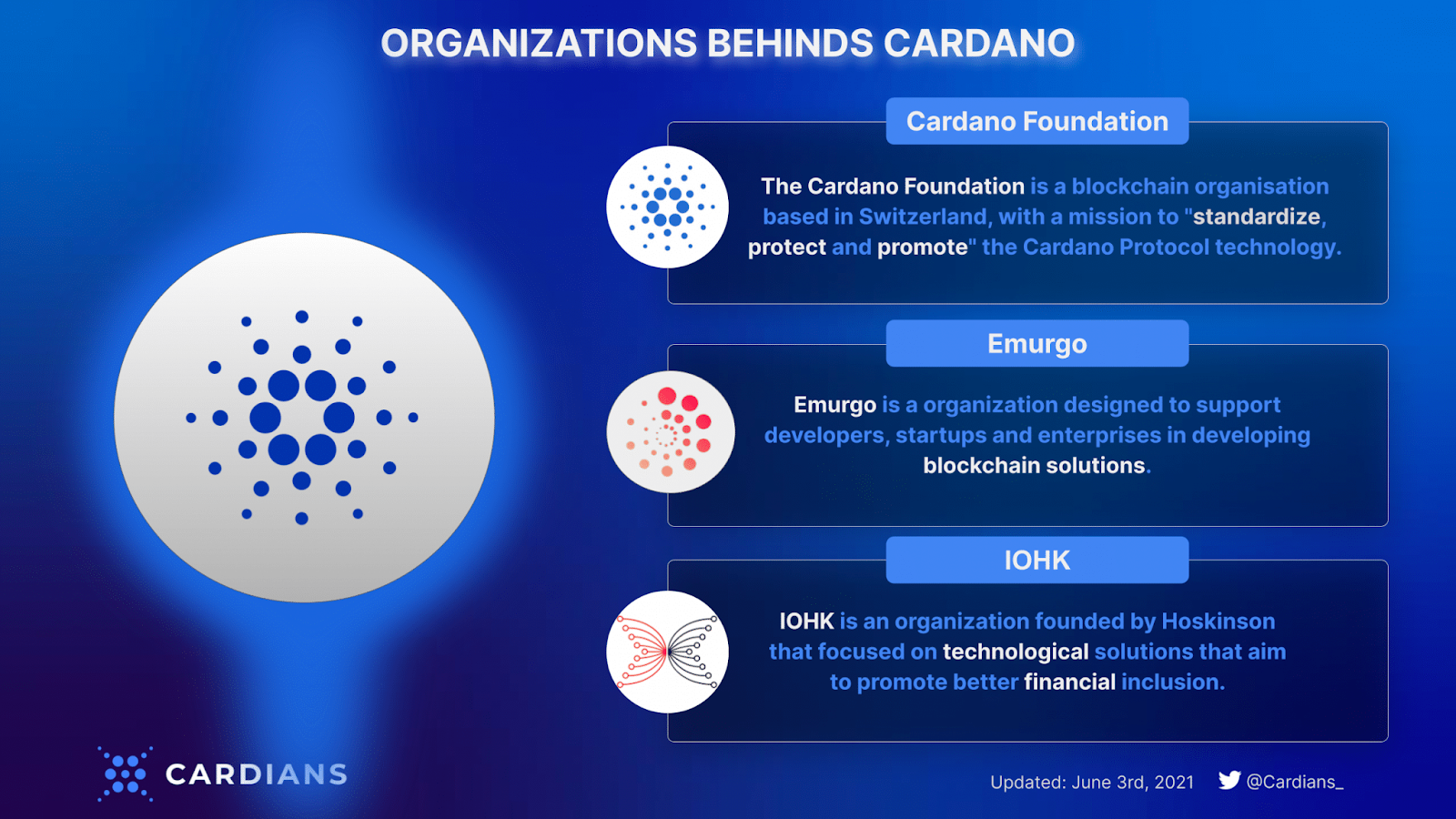

Hoskinson co-founded the Hong Kong-based blockchain research and engineering firm Input Output Hong Kong (IOHK), which collaborates with the Cardano Foundation and the Japanese software company Emurgo to develop the Cardano project.

The Cardano blockchain is named after Gerolamo Cardano, an Italian polymath from the 16th century. The network’s native currency, ADA, is named after Ada Lovelace, a British mathematician from the 19th century who is widely regarded as the first computer programmer.

The blockchain employs the Ouroboros protocol, facilitating decentralisation and scalability while maintaining network security.

Similar to Ethereum, which is undergoing a series of enhancements, Cardano is instituting a series of hard forks to increase its functionality. The Mary hard fork in March 2021 allowed the network to become a multi-asset platform.

How does Cardano work?

It is feasible to send and receive ADA through Cardano’s platform without a central authority. Cardano also facilitates the creation of decentralised applications by developers.

Bitcoin and Ethereum use proof of Work as a consensus mechanism, which is the mechanism that causes network participants to reach a consensus on information stored on the blockchain. This transaction verification mechanism can be very energy-intensive, relying on computing power and electricity.

Unlike Bitcoin and Ethereum, Cardano has developed its consensus mechanism, Ouroboros, based on Proof of Stake and is reportedly environmentally sustainable.

In September 2022, Ethereum switched from Proof of Work (PoW) to Proof of Stake (PoS) as part of The Ethereum 2.0 Merge, requiring the network to rely on validators rather than miners to operate.

Since the debut of Ethereum’s Beacon Chain, validators have staked ETH and accumulated rewards for validating transactions. This was the initial step in a lengthy sequence of events that culminated in September 2022 with the transition from PoW to PoS.

With the Shanghai Upgrade in March 2023, validators will be able to redeem their rewards at last.

Pros & Cons of Cardano

Pros

- Environmentally friendly. Cardano is among the most eco-friendly blockchain technologies. Hoskinson stated in a 2021 interview with Forbes that Cardano is 1.6 million times more energy-efficient than bitcoin.

- Faster transactions. Cardano also processes transactions significantly faster than Bitcoin or Ethereum 1.0, also known as Classic Ethereum. Cardano can execute more than 250 transactions per second (TPS), compared to between 15 and 45 TPS for Ethereum 1.0. Thus, the Cardano network is highly scalable. Ethereum 2.0 is the upgrade to the Ethereum network that addresses previous security and scalability issues.

- Peer-reviewed network. The Cardano team collaborates closely with academics to produce research that has been peer-reviewed to inform blockchain development. Its character as an open-source, peer-reviewed blockchain ensures its survival and evolution beyond its parent organisation.

- Earn through staking: ADA holders can “stake” their assets to verify transactions on the underlying blockchain network. This allows proprietors to generate cryptocurrency without purchasing more.

Cons

- Still in development: One of Cardano’s disadvantages is that its blockchain is still under development. Numerous essential features like scalability have yet to be released. Ethereum is also developing scalability enhancements via sharding, a significant threat to Cardano.

- Little developer interest: Based on Electric capital’s developer report, Cardano was one of the slower-growing developer ecosystems with a growth of just 90% compared to Solana and Near, which both grew over 4x in developers despite having a lesser market cap than Cardano. This dearth of developer interest may be due to the complexity of the Haskell programming language, as evidenced by their low TVL since launching decentralised applications (dApps).

- Double-spend: Another concern is the possibility of double-spending, also known as a 51% attack, as there is still a risk that input endorsers will authorise the same set of transactions from two separate slot leaders.

Is Cardano a good investment?

Like other cryptocurrencies, Cardano has been highly volatile in terms of prices. Cardano is down from its recent highs, but those staying with it have likely made significant profits, mainly if they bought and held since its 2017 debut. Rather than focusing on recent gains or losses, it is essential to comprehend what you’re purchasing.

From this perspective, Cardano is not supported by any assets or financial flow of an underlying business, a critical distinction between virtually all cryptocurrencies and stocks. A share of stock represents a fractional ownership interest in a company, so if the company develops, the stock will likely appreciate as well. Shareholders possess a legal claim to the company’s assets and financial flow, as they own its equity. Additionally, the stock may pay monetary dividends to its shareholders.

Cardano dealers do not have such claims or guarantees for their investments. The coin fluctuates in value as traders’ optimism surges and wanes. Traders believe they can transfer the coin to someone else for a higher price.

In such situations, the market frequently runs out of ever more optimistic traders, causing the price to plummet as speculators flee. This arrangement – the absence of a growing, cash-generating company underlying the investment – prevents many prominent investors, including the legendary Warren Buffett, from investing in cryptocurrencies.

Cardano (ADA) price history

The ADA coin’s value has tended to mirror that of the cryptocurrency market, increasing during rallies in late 2017 and early 2021 and falling during market-wide declines.

When the ADA price reached its all-time peak of $3.10 on 2 September 2021, just before the Alonzo hard fork introduced smart contracts to the blockchain, expectations were high.

Following the launch, developers deployed over 100 smart contracts. Still, the ADA token failed to participate in the November 2021 crypto rally that propelled bitcoin (BTC) and ether, the two largest cryptocurrencies, to all-time highs.

ADA began 2022 at $1.36 and increased to $1.63 on 18 January. On 24 February, it fell to $0.7528 as investors sold assets at the onset of the Russia-Ukraine conflict. Late in March, the price recovered to $1.24 but could not sustain the upward trend, declining to $0.7424 by the end of April 2022.

The coin fell to a low of $0.4065 on 12 May 2022 as crypto markets reacted to the de-pegging of the UST stablecoin and the collapse of the associated LUNA cryptocurrency, and the Dollar Index reached its highest level in 20 years against a basket of other currencies. (DXY).

ADA rose to $0.6823 as the price of cryptocurrencies rose before falling to $0.4234 by mid-June. The price rose to $0.546 on 20 July 2022 before falling to $0.4521 and then traded near $0.50 through the beginning of August. On 14 August, it attained a monthly high of $0.5939 before falling to approximately $0.4575 by 31 August 2022.

The price initially recovered in September as investors anticipated the launch of Vasil, with ADA reaching a high of $0.5235 on 10 September 2022. After that, however, market factors caused the price to decrease. Despite the news about Vasil, ADA’s price fell to a low of $0.331 on 21 October before rebounding to a high of $0.4362 on 5 November.

Despite the announcement that the DJED algorithmic stablecoin would launch on the Cardano blockchain, the FTX exchange collapsed. The market fell again, leaving ADA at a low of $0.2973 on 21 November.

At the end of the year, the token was worth $0.2465, representing an annual loss of more than 80%. Since then, however, the price of ADA has increased due to a market recovery, and on 16 February, it was worth $0.4192, its highest price since before the collapse of FTX. After that, its value decreased somewhat, and on 3 March 2023, it was worth approximately $0.339.

There was 34.67 billion ADA in circulation at the time. This gave the coin a market capitalisation of approximately $117 billion, making it the seventh-largest cryptocurrency by this metric.

Where can you buy Cardano?

You can purchase Cardano almost anywhere in the world via a broker or cryptocurrency exchange. You can exchange another cryptocurrency for Cardano or deposit fiat currency and convert it to ADA.

Several stock brokers offer clients a limited selection of cryptocurrencies. This option may be viable if you already have a Cardano trading broker account. It is especially true if you must add a modest quantity of Cardano to your portfolio but wish to refrain from actively trading cryptocurrencies or managing a separate investment account.

Setting up an account with a cryptocurrency exchange is relatively simple. You must likely submit a photo ID and address confirmation to verify your account. Many crypto platforms typically offer a greater variety of coinage and more functionality than brokers. However, unlike brokerages, exchanges are unlikely to be registered so they may provide less protection for investors.

Most top crypto brokers and exchanges have mobile trading applications, making buying Cardano from your mobile device simple. Cardano is not supported by popular payment applications such as PayPal, Venmo, and CashApp.

How To Buy Cardano (ADA) in Australia

There are two options available for purchasing Cardano in Australia. You can buy Cardano with a fiat currency (Australian Dollars) or cryptocurrencies such as Bitcoin or Ethereum.

Buying Cardano with Cryptocurrency

Buying Cardano with cryptocurrency is optimal if you already have another cryptocurrency in your wallet, such as Bitcoin (BTC) or Ethereum (ETH).

Cardano will be simpler to acquire with Bitcoin or Ethereum, as most exchanges offer Cardano combinations with the two leading cryptocurrencies.

For instance, if you have Ethereum (ETH) in a wallet, you can register with an exchange and transmit your ETH tokens to the exchange account you created. You can then proceed to the ETH/ADA pair to purchase Cardano with your Ethereum balance.

Buying Cardano with Fiat Currency

If you are new to cryptocurrencies, you can buy Cardano with fiat currency (AUD). However, your options for cryptocurrency exchanges will be limited because some do not support direct deposits with fiat currency. If you have located a crypto platform that accepts deposits in fiat currency, you can follow the steps below to register and purchase Cardano.

Choose crypto exchange

To purchase Cardano on a crypto exchange in Australia, you must first register with a crypto exchange that accepts fiat currency deposits. However, most exchanges require personal information such as your complete name, identity proof, residential address, and employment information.

While some are designed for novice crypto traders, others are best left to seasoned crypto traders. Find the ideal fit for an exchange with low account minimums and trade fees. Check out our curated list of the best cryptocurrency exchanges to discover your perfect companion.

A few things to consider when selecting a crypto exchange include:

- Payment methods: Most crypto exchanges accept credit card and debit card deposits and bank transfers. Crypto exchanges such as CoinSpot and eToro accept PayPal payments for Australian users.

- Fee structures: Certain payment methods incur fees. For example, credit card deposits typically incur a substantial fee. Are there expenses for outbound transfers? Where withdrawals are allowed, fees may be assessed.

- Crypto wallets: Crypto wallets are used to store cryptocurrencies. Some exchanges provide built-in purses. Some others permit the transfer of assets to third-party wallets or so-called “cold” offline storage devices.

- Supported assets: Some exchanges allow trading in over 650 cryptocurrencies, whereas others offer less than 100. To purchase Cardano ADA, determine if it is available on your preferred exchange.

Decide payment method

Once your account has been created and verified, you can deposit funds via credit card, debit card, PayPal, bank transfer, or any other method the exchange provides.

Check to see if any fees are associated with the payment method you intend to use. For instance, Coinbase does not charge any fees for bank transfers, but debit card payments incur a 3.99% fee. Typically, fees for credit card transactions on other exchanges are at least this high.

Credit card payments on these exchanges are typically classified as cash advances, attracting interest much higher than normal purchases. This interest is charged when the transaction is made, regardless of whether the balance is paid in full by the due date.

Buy Cardano (ADA)

Now, you can purchase Cardano using your AUD balance on the exchange. Navigate to the “markets” section where crypto-to-crypto pairs are listed. Identify the ADA/AUD pair and complete the order form.

Choose a market order or limit order based on your preferences. The limit strategy is optimal if you anticipate a decline in Cardano and wish to purchase at a predetermined price level.

When you select this option, the exchange will only implement your order if the price of Cardano declines to your specified level.

When your order is executed, you will receive an email notification.

Store Your ADA

You must store your crypto tokens in a cryptocurrency wallet. You have numerous wallet options, including:

- Hardware wallets: The hardware wallet is a flash drive-like tangible device. They are not connected to a network or the internet, so they are considered “cold storage” and are generally more secure than other storage options.

- Paper wallets: As its name suggests, a paper wallet stores your private credentials on paper or with a QR code. If you use a paper wallet, you must plan where to keep it; if you misplace it, you will lose access to your cryptocurrency.

- Software wallets: If you desire more convenient methods to access your cryptocurrency and purchase and sell your holdings, you may prefer a software wallet. This option lets you use a software program or application to store your digital assets. Because the software connects to the internet, it is less secure than hardware or paper wallets, providing easier access to your cryptocurrency holdings.

- Crypto exchanges: Some cryptocurrency exchanges will retain your cryptocurrency assets. However, relying on a crypto exchange to manage storage can be risky, and it is generally advisable only for small quantities and short periods.

Best crypto exchanges in Australia to buy Cardano

To discover the best place to buy Cardano, consider fees and commissions in addition to the regulatory status of your preferred provider. Below are the top crypto platforms in Australia to purchase ADA or any other popular cryptocurrency asset.

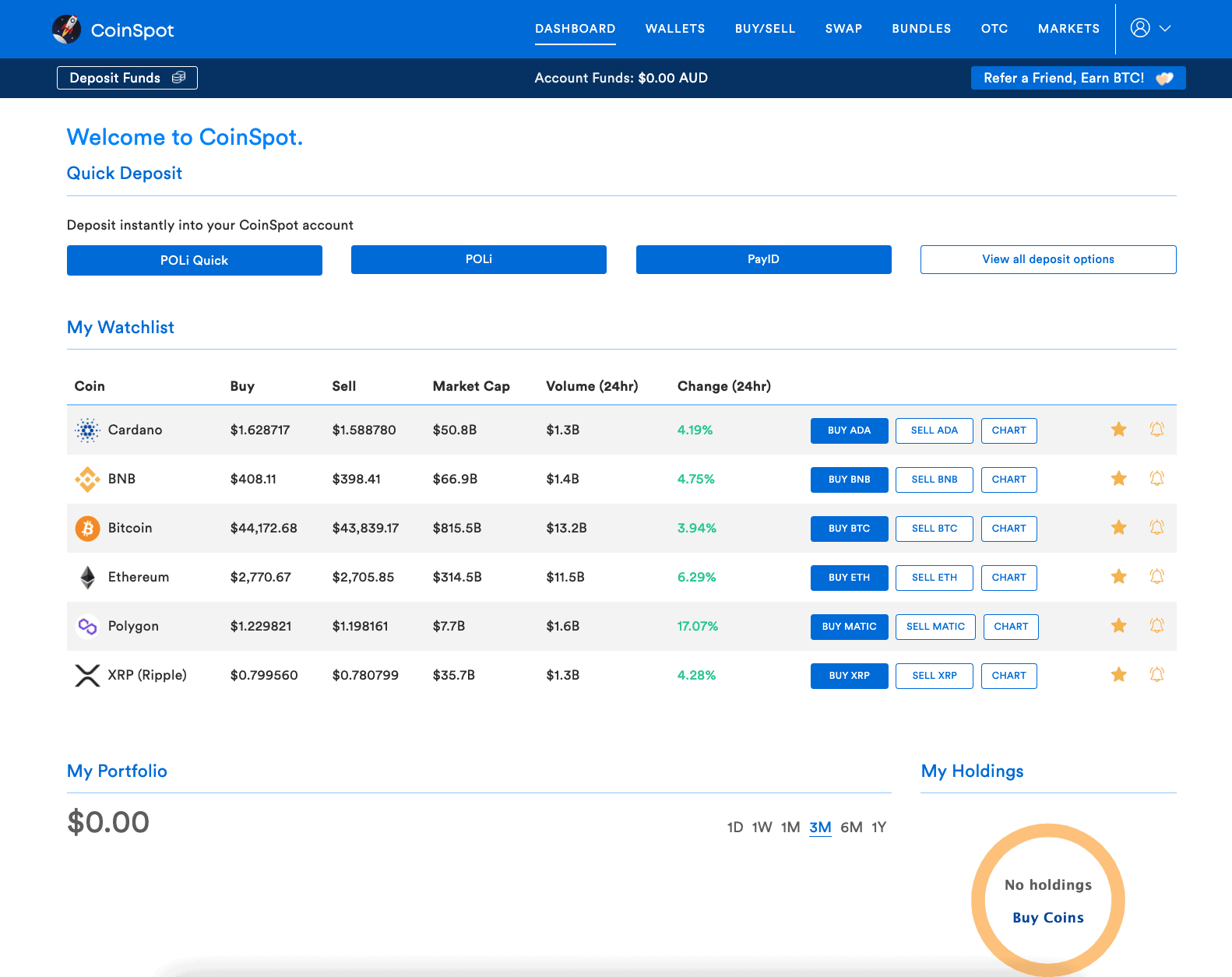

CoinSpot – Overall best crypto exchange to buy Cardano in Australia

CoinSpot is the highest-rated cryptocurrency exchange in Australia. It has the greatest security certifications in Australia and is Blockchain Australia-certified, providing advanced and multilayered support. Besides being AUSTRAC-registered, CoinSpot is the only Australian platform with ISO 27001 certification, a globally recognised standard for information security management systems (ISMS).

In addition, CoinSpot features more than 380 cryptocurrencies, such as Bitcoin, Ethereum, Cardano, Dogecoin, Solano, and Shiba Inu, as well as smaller-cap altcoins with the potential for more significant gains. The exchange is always quick to provide customers with the cryptocurrencies they request via social media, demonstrating that they prioritise their customers when making business decisions.

Moreover, many reviews on Reddit and Trustpilot show that the exchange prioritises customer support to assist its users with any questions or problems. This is a crucial aspect of a cryptocurrency exchange, especially if you are a beginner. When buying and selling cryptocurrencies on CoinSpot, novice investors may be unfamiliar with several of the exchange’s features. Here, CoinSpot’s helpful customer service staff comes in conveniently.

CoinSpot possesses a well-designed user interface and an intuitive trading platform. This is a compelling argument for why we believe CoinSpot is an excellent option for investors, particularly those new to the crypto sphere. CoinSpot’s fees are highly competitive, and placing buy and sell orders for the crypto assets listed on the exchange or using their immediate transaction feature is a breeze.

To learn more about CoinSpot, you can read our detailed CoinSpot Review.

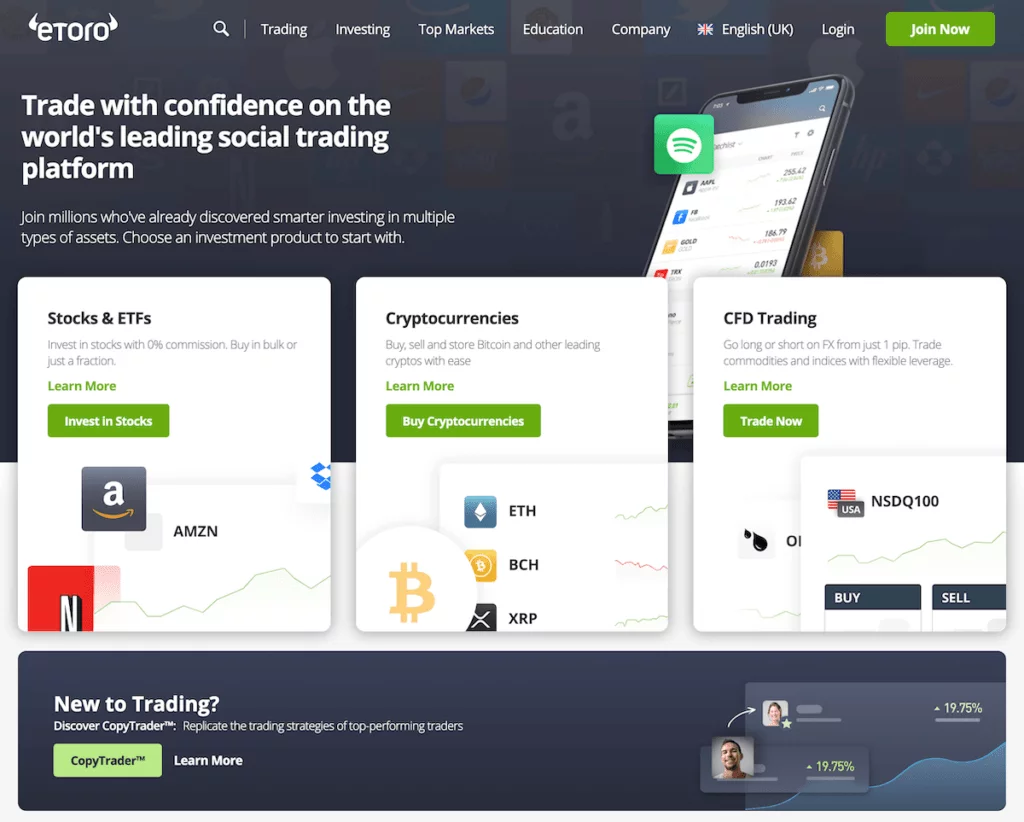

eToro – Best forex broker for trading Cardano in Australia

eToro is the best crypto broker to buy Cardano in Australia. It allows you to purchase Cardano using a spread-only model, meaning that you only need to pay the difference between the purchase and sale price of the ADA token. Additionally, you can make free deposits if your chosen payment method is AUD.

This includes PayPal, debit and credit cards, ACH, and bank transfers. Withdrawals are also free of charge. eToro is one of the lowest exchanges to purchase Cardano and one of the most secure.

It possesses licences from many regulatory bodies, including the SEC, FCA, ASIC, and CySEC. We also appreciate eToro’s extensive selection of supported digital currencies. In addition to Cardano, this includes over 70 other undervalued cryptocurrencies, including Bitcoin, Ethereum, XRP, Decentraland, BNB, and others.

EToro has a $10 minimum transaction quantity regardless of the cryptocurrency you wish to purchase. This suits those buying Cardano and other digital tokens on a budget. Consider an eToro smart portfolio if you want to diversify without devoting innumerable hours of research to the process.

This will enable you to invest in a diversified portfolio of digital currencies managed by eToro. Copy trading, which allows you to mirror the investments of a seasoned trader, is another alternative. eToro is accessible via an Android and iOS mobile app that links to your primary account.

If you are a complete novice, consider opening an eToro demo account with $100,000 in paper trading funds. This provides access to live trading conditions, but without risk. In addition, eToro offers a vast selection of commission-free equities and ETFs.

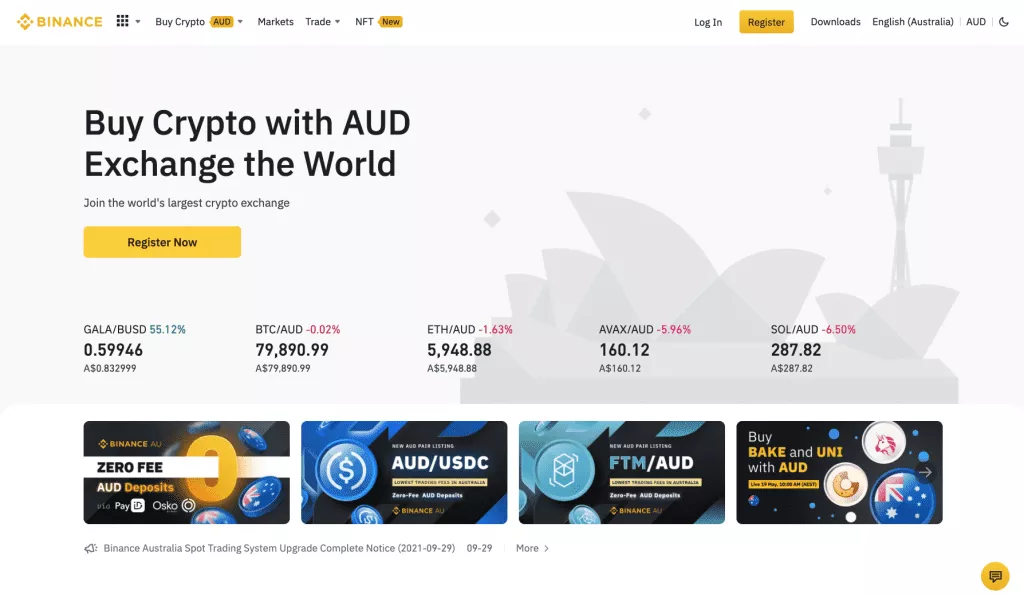

Binance – Most popular crypto exchange to buy Cardano

Binance is reportedly a cryptocurrency exchange with over 100 million customers. The platform is especially well-liked by crypto day traders, not least because Binance provides access to more than 60 markets at industry-leading fees.

For example, if you trade Cardano against another digital currency, such as Bitcoin, BNB, or Tether, you will pay a commission of 0.10% per slide. You will only be charged $0.50 for every $500 you trade.

In addition, Binance employs a variable pricing structure that rewards greater trading volume. By holding BNB tokens, you can minimise your trading fees by 25%. Besides, US users can deposit funds for free via domestic wire transfer or ACH.

However, if you desire to purchase Cardano with a debit or credit card, Binance will charge you a staggering 4.5% plus a 0.5% commission. Therefore, you must pay a premium if you want to invest as quickly as feasible. You can store your Cardano tokens conveniently in your Binance web wallet.

You will gain access to various security protocols, such as cold storage and two-factor authentication, by doing so. The latter entails email and mobile confirmation for each withdrawal and login request. Cardano tokens can also be withdrawn to Trust Wallet, a non-custodial wallet sponsored by Binance.

Binance offers cryptocurrency interest accounts in addition to trading and exchange services. This enables you to generate a return on your cryptocurrency investments, with the exact APY depending on the token. Binance’s iOS and Android apps allow you to connect to your primary account.

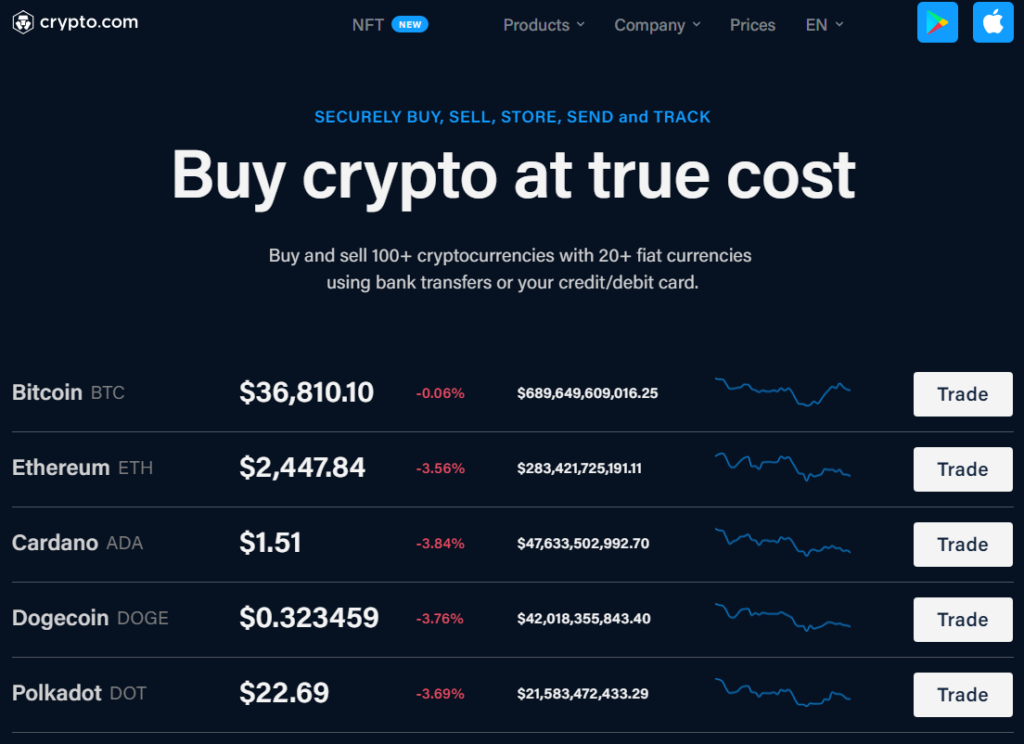

Crypto.com – Most user-friendly crypto exchange to Buy Cardano

Crypto.com is another online broker suitable for novices who want to purchase Cardano easily. This brokerage has highly competitive fees, as Crypto.com only charges 0.4% in trading commissions.

The platform offers lower fees if you trade larger quantities or stake CRO tokens. When purchasing Cardano with a debit or credit card, Crypto.com levies a 2.99% fee. Although this is more costly than eToro, it is still less expensive than most competitors.

After purchasing Cardano, you can diversify across additional digital tokens. Choose from over 250 distinct digital currencies of all shapes and sizes on Crypto.com. This exchange stands out in particular for its crypto savings accounts.

As the name suggests, you will receive interest when you deposit digital tokens into your Crypto.com account. The APRs will differ based on the cryptocurrency you wish to deposit and your willingness to seal away your tokens. When you stake CRO tokens, you also receive a higher return.

Consider obtaining a digital asset loan to expand your exposure to the digital currency industry. The maximum LTV at Crypto.com is 50%, equivalent to leverage of 1.5x. Crypto.com can be used to purchase and sell non-fungible tokens (NFTs). Thousands of NFTs are listed on Crypto.com, and there are no transaction fees for purchasers.

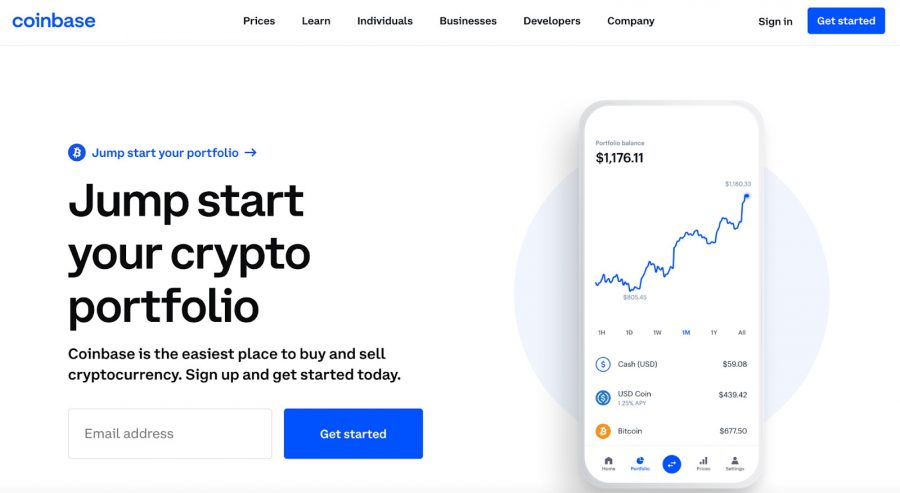

Coinbase – Best exchange to buy Cardano with debit/credit cards

Coinbase is the largest cryptocurrency exchange in the United States, with millions of consumers. Coinbase accounts can be created within minutes if you’re searching for a simple and quick method to purchase Cardano.

Once you have uploaded your government-issued ID via the KYC process, you can immediately invest in cryptocurrencies using your debit or credit card. For Cardano investments over $200, a debit/credit card fee of 3.99% will apply. Depending on the quantity of the transaction, a flat fee is incurred for investments below this threshold.

You must deposit funds via domestic wire transfer or ACH if you desire lower fees. Note, however, that it will take 1-3 business days for the funds to arrive, and a standard fee of 1.49% will apply when you purchase Cardano. Coinbase provides a convenient method to invest in cryptocurrencies, but the platform is expensive.

The platform also offers a highly user-friendly iOS and Android mobile app. This will attach to your primary Coinbase account, allowing you to trade Cardano from anywhere. In addition, both the Coinbase website and mobile app serve as cryptocurrency wallets.

Coinbase is regulated in the United States to offer cryptocurrency brokerage services. In addition, the platform is now a publicly traded corporation, with Coinbase securities trading on the NASDAQ. Coinbase implements cold storage systems for 98% of users’ digital assets.

In addition to Cardano, Coinbase enables purchasing and selling over 100 other cryptocurrencies. This includes cryptocurrencies such as Stellar, Dogecoin, Ethereum, Bitcoin, Shiba Inu, and Decentraland. Lastly, if you are an experienced investor, consider Coinbase Pro, which provides sophisticated trading tools and charting indicators.

FAQs

Can I purchase Cardano in Australia?

Yes, you can. Ensure that it is available on your preferred exchange. Cardano is popular and ranked highly by CoinMarketCap regarding market capitalisation, so finding a suitable exchange should be easy.

How do I buy and use Cardano?

Follow our detailed instructions above to purchase ADA on a trading platform like CoinSpot or Binance Australia. You must transmit your ADA from the exchange where you bought it to a non-custodial Cardano wallet before you can use it. From there, you can, among other things, stake your ADA, interact with Cardano’s DeFi ecosystem, and purchase and sell NFTs.

How do I buy Cardano instantly?

If you already have a funded account with an exchange like CoinSpot or Binance Australia, you can instantly buy ADA. Many crypto exchanges also offer a “buy instantly” option using a credit card, but be aware that this option comes with higher fees and additional risks.

How do I sell my Cardano?

How you sell Cardano depends on whether you wish to exchange it for another cryptocurrency or convert it back to Australian dollars. Using a platform with ADA trading pairs, such as one of the options listed in the best crypto exchanges in Australia review.

What is the best way to buy Cardano?

Ultimately, it is up to you to determine the best means to purchase Cardano, but our top choices are a good place to start your investigation.

If you intend to speculate on ADA’s price in the short term, you can purchase it on CoinSpot or another exchange or app that holds the asset on your behalf.

Meanwhile, if you intend to retain your ADA for an extended period, you can transmit it to a cold storage hardware wallet to keep its private keys offline and secure.

The final thought

To buy Cardano, compare Australian crypto brokers and exchanges based on their features, fees, security, and overall reputation before deciding on a platform. It’s advisable to select an AUSTRAC-registered exchange for added security.

Keep in mind that possessing and using Cardano is not risk-free. Consider investing in ADA as part of a larger strategy, and if you have any concerns, consult a financial advisor.

After purchasing ADA, consider your short- and long-term objectives. This will help you determine whether to retain the cryptocurrency on the exchange or transfer it to your wallet.