In a significant step towards innovation, Australia’s central bank has successfully concluded its trial of a central bank digital currency (CBDC), uncovering promising use cases for a potential digital dollar.

The Reserve Bank of Australia, in collaboration with the Digital Finance Cooperative Research Centre, recently unveiled their discoveries through a 44-page report on August 23. The study spotlighted areas where a CBDC could be advantageous and identified instances where it might not be the exclusive solution.

We’ve released a report with the Digital Finance CRC @DigiFinanceCRC today on the findings from an Australian central bank digital currency pilot.https://t.co/bTT84yBp02#RBA #CBDC #Payments #DigitalPayments #Blockchain #FinTech pic.twitter.com/WXfe7lchHj

— Reserve Bank of Australia (@RBAInfo) August 23, 2023

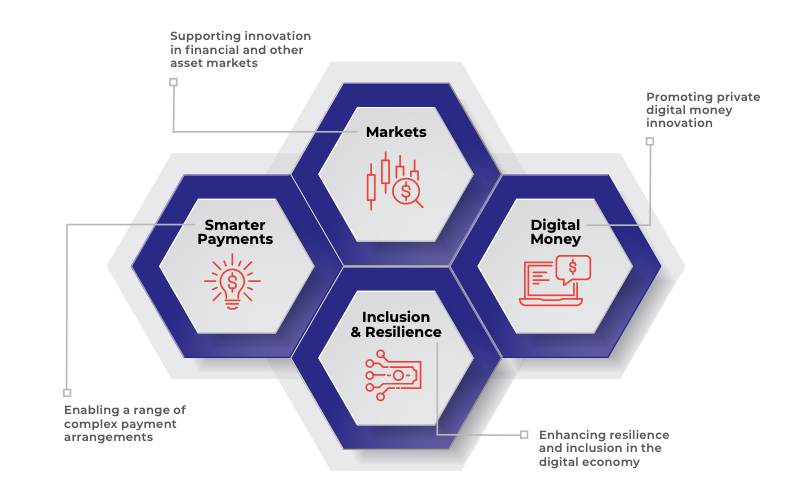

The pilot program yielded noteworthy insights, highlighting four primary domains where a CBDC could deliver significant improvements. First, a tokenised CBDC exhibited potential in facilitating more intricate payment arrangements, enabling more sophisticated payment scenarios. This “smarter” payments approach showcased how a CBDC could streamline complex financial transactions.

The report also delved into the potential role of a CBDC in fostering financial innovation. It identified its potential impact on debt securities markets, its capacity to drive innovation in emerging private digital currency sectors, and its potential to enhance the overall resilience and inclusivity of the digital economy.

Participating firms, numbering sixteen in total, offered diverse perspectives on the merits of a CBDC. They highlighted its ability to facilitate “atomic settlements,” where transactions can be executed instantly. Programmability emerged as another advantage, with the ability to improve efficiency and mitigate risk in intricate business processes.

The unique structure of the CBDC pilot program, representing a real legal claim on the Reserve Bank of Australia, brought forth uncertainties about its legal standing and regulatory implications for participants. According to the report, participants faced uncertainties regarding their roles in custody services or regulated financial product dealings due to their involvement with the pilot CBDC.

While the report underscored the potential benefits of a CBDC, it also acknowledged that alternative solutions might achieve similar outcomes. Privately issued tokenized bank deposits and asset-backed stablecoins were cited as viable alternatives to achieve similar goals.

In summation, the report emphasised that while introducing a CBDC could enhance efficiency and resilience in certain aspects of Australia’s payment ecosystem, deeper research is necessary to fully comprehend the potential benefits. The findings bring to light the multifaceted nature of CBDC implementation and its implications for Australia’s financial landscape.