The Downfall

Just weeks ago, Dani Sesta was heralded as one of the brightest in the crypto industry. However, following recent events, criticisms have been levelled at the disgraced DeFi founder – questioning both his morality and integrity.

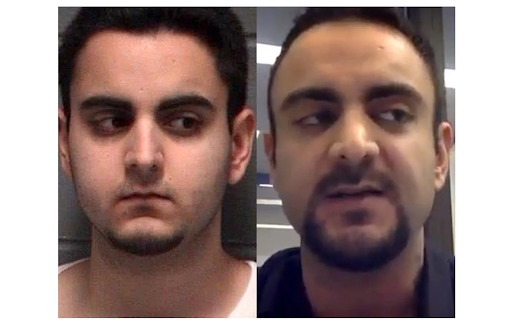

Here’s the elevator breakdown: Dani Sesta, full name Daniele Sestagalli, is the founder of several popular DeFi protocols, including the popular Olympus DAO fork Wonderland (TIME). The community (users known as ‘frogs’) was shaken to the core after it was revealed that Sestagalli’s right-hand 0xSifu was Michael Patryn, a convicted criminal and co-founder of the QuadrigaCX scam exchange. This revelation was just the first part of a two-for-one since soon after, Sestagalli admitted that he had known about Patryn’s background for a while. This was already problematic but was exacerbated in the days following when Sestagalli would attempt to act against a community poll (regarding the future of Wonderland).

No doubt a drama-filled week for the so-called ‘Frog Nation’, but it doesn’t stop there. Read on as we cover the entire debacle.

An introductory about Wonderland & Sestagalli

Wonderland, or Wonderland Money, is “a decentralised reserve currency protocol” built on the Avalanche blockchain network by Sestagalli. The network’s token is called TIME. In a nutshell, it is an attempt to create an independent monetary system – with one of the most significant selling points being an advertised 80,000% API.

As mentioned earlier, the community of Wonderland refer to themselves as ‘frogs’ (collectively ‘Frog Nation’) and actively support Sestagalli’s other projects: Popsicle Finance and Abracadabra Money. Before 2022, the sentiment towards Sestagalli was overwhelmingly positive among ‘frogs’, given that he was responsible for three successful and popular DeFi protocols.

Source: Medium @Brinc.fi

Sestagalli was generally regarded as ‘the golden boy’, given his passion (spawning three successful DeFi protocols) and his crusade against centralisation (dubbed OccupyDeFi). This crusade was a driving factor in his rise to prominence. He led his Frog Nation on a charge to ‘bring decentralisation back to the DeFi space’ by targeting centralised stablecoins (a divisive subject within the crypto space). He was undoubtedly influential, enough to comfortably answer ‘Is TIME a Ponzi?’ with ‘I guess’ [0:40] without anybody giving it a second thought (there is a certain irony to this, but we’ll touch on this more later). Though this was the beginning of Daniele Sesta’s legacy, the remainder of this article will be covering the downfall.

The Sifu Controversy

On January 27th, pseudonymous DeFi investigator ‘zachxbt’ posted a series of tweets unveiling the identity of 0xSifu, as none other than Michael Patryn, to which Dani Sesta confirmed, and admitted to not disclosing. For those unfamiliar, Michael Patryn is the co-founder of QuadrigaCX, a Canadian scam exchange that disappeared with $238 million AUD of investor funds. This exchange was officially labelled as a ‘fraud’ and ‘Ponzi scheme’ by the Ontario Securities Commission.

Now it wouldn’t be too problematic if Patryn was simply a smaller developer, but the issue was that Sestagalli had made him the manager of Wonderland’s billion-dollar (AUD) treasury. On top of this, Patryn is also a convicted criminal, possessing a rather comprehensive rap sheet:

- Pleaded guilty to operating shadowcrew.com in 2002. Though now defunct, this was a website that peddled 1.5 million stolen credit and bank card numbers.

- He once again pleaded guilty to conspiracy to commit credit and bank card fraud in 2005.

- Graduated from credit and bank card fraud, to burglary, grand larceny, and computer fraud in 2007.

Source: Davidgerard.co.uk

Patryn was also documented as having changed his name several times. The first time would be in March 2003 when he changed his name from Omar Dhanani to Omar Patryn with the British Columbia government. This was followed by the change to his current name Michael Patryn in 2008. According to Bloomberg, he has also attempted to distance himself from his alleged criminal record, including hiring a company to remove negative digital footprints that may tarnish his reputation. There’s nothing wrong with wanting a fresh start, but not when it involves founding a Ponzi scheme, and omitting critical bits of information to garner approval to manage a billion-dollar treasury.

With all of this in context, it’s no surprise that critics and investors alike have slammed Sestagalli’s decision to keep Patryn’s identity a secret. Exacerbating this is an old interview from December 2020, in which Sestagalli talks about QuadrigaCX, albeit very briefly: “The Quadriga story will come back guys, I’m telling you. Sooner or later, something will reappear on Quadriga.” Though likely nothing more than coincidence, it certainly didn’t do Sestagalli any favours. It only gets worse as the Wonderland founder goes to Twitter to defend Patryn.

1/ Today allegations about our team member @0xSifu will circulate. I want everyone to know that I was aware of this and decided that the past of an individual doesn’t determine their future. I choose to value the time we spent together without knowing his past more than anything.

— Daniele never asks to DM (@danielesesta) January 27, 2022

This tweet was met with outrage from users, and Sestagalli quickly backpedalled, issuing another tweet afterwards stating that Patryn would step down pending a vote – with the implication being that Patryn wouldn’t remain Wonderland’s treasury manager if enough people wanted it.

He was ousted at a 9:1 margin.

Investors ignored, community confused

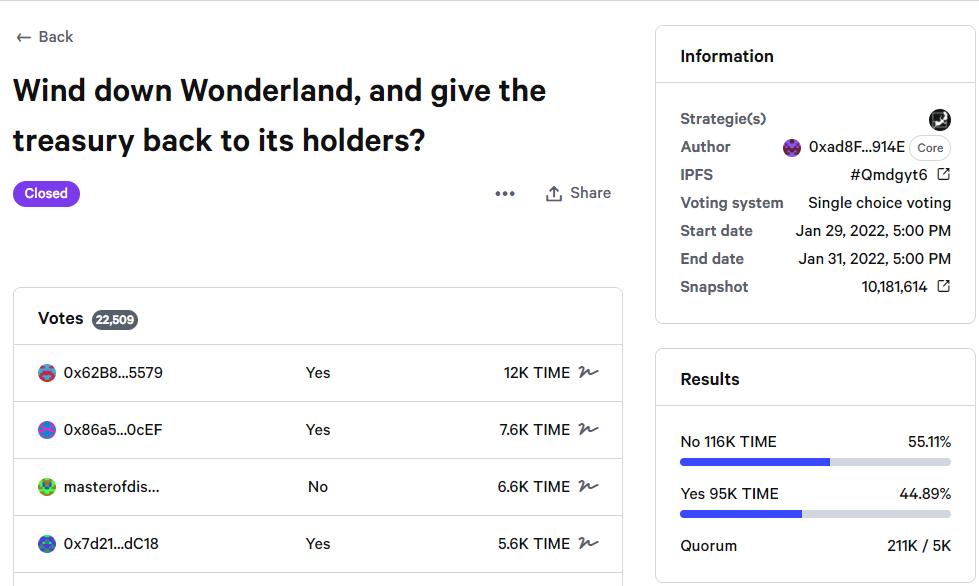

After the Sifu controversy, Sestagalli published a poll asking for the Frog Nation’s consensus on whether they wanted to wind down the project and return the treasury to TIME holders. This announcement wasn’t surprising given all the backlash and anger he had received in the past few days – taking a step back and halting the project wasn’t the worst idea the former golden boy had come up with that week.

Fortunately for the protocol, others were still willing to keep fighting; the poll concluded with 55.11% of votes against the proposal, showing that the majority of ‘frogs’ were still optimistic about the project itself despite all the drama.

Source: snapshot.org

Despite this, Sestagalli decided to do something very questionable, tweeting that the sentiment was too divided in the community and that the Wonderland experiment would shut down – even when it wasn’t.

This simply added further fuel to the already drama-filled fire. Tweets ranged from general anger, like: “He [Sestagalli] is a scam, you vote no, he still wants to liquidate. Wonder why?” to concern, with some worrying that the Wonderland founders were planning to pillage the treasury, which would leave everybody that voted against the wind-down, with “an empty DAO with no treasury”.

In a single week, Sestagalli contributed to one of the largest controversies in DeFi, showed morally questionable decision-making, and then immediately after, went on to throw the very principles of Decentralized Autonomous Organizations (DAOs) out a window with an executive decision to override community consensus. However, things began even before the revelation of Sifu’s identity – with one of the biggest rug pulls of recent times.

Rugpull to top it all off – or rather, begin

For starters, TIME is down almost 97.5% from where it was a few months ago. The sentiment regarding Wonderland was a far cry from where it was back in November, where people were laughing at Sestagalli’s joke regarding TIME being a Ponzi. Following the recurring theme of this article: things get worse.

Source: coingecko

A leverage strategy referred to as (9,9) is particularly popular among TIME holders, as they can leverage their staked tokens using Abracadabra (another project owned by Sestagalli) to increase exposure and yield. However, it comes at the risk of liquidation, in which the collateral used to borrow is consumed to pay for the loan. In this case, we’ll be talking about cascading liquidations, a vicious cycle in which traders are forced to sell their positions as they get liquidated, causing further liquidations and further intensifying selling pressure – not just for the individual but for all investors.

This is what transpired on January 17th, causing the price of TIME to fall from $2780 AUD down to $1,300 AUD. This led to many being liquidated by the sudden 50% drop, but the Wonderland team assured users that the treasury would be used to defend the ‘backing price’. Unfortunately, on January 25, TIME saw another 50% drop whereby the price ended up far below the ‘backing price’. As such, further liquidations ensued – including the founders themselves (in which Sestagalli lost $15 million).

This led to the first wave of resentment and protests against the Wonderland team. It also didn’t help that Sestagalli decided to private his Twitter right after. This lasted only for a day, but it certainly wasn’t the response that these users wanted to see from their trusted ‘leader’ after losing all their investments in arguably the biggest rugpull in recent months.

Though the Sifu drama was the incident that drew the most headlines, the downfall of Daniele Sesta began long before that.

Going Forward: Daniele and Wonderland

This series of unfortunate events have left a bitter taste in the mouths of many. Be it the people who lost all their money during the rugpull, those who felt cheated by Sestagalli’s lack of transparency, or those that felt perturbed by his attempt to override a community vote.

Without question, these events have given cause for users to question the integrity of Dani Sesta. The clip at the beginning of Sesta’s comment regarding TIME being a Ponzi certainly feels like a foreshadowing more than a joke, with countless having nothing to show for all their money invested and time dedicated. But more to the point, it calls into question one simple thought: Assuming zachxbt didn’t bring this case to light, Sesta would have never acknowledged the true identity of his partner; which isn’t good, to say the least, when said partner is a professional criminal that’s highly adept with technology.

Taking Sestagalli’s actions into account, some in the community have even run a poll on Twitter on whether somebody else should take over Wonderland – with netizens responding with an overwhelming ‘Yes’.

Would you back a proposal to let @harryyeh take over Wonderland $TIME?

— Ran NeuNer (@cryptomanran) January 31, 2022

Others have taken more extreme (and inappropriate) measures, going as far as to send death threats to the Wonderland founder.

Sestagalli’s has made recent attempts to remedy the situation (i.e. a 45-minute session on Discord to answer questions from Wonderland users); however, he – along with all of us – will come to learn a valuable lesson from these recent events; trust is the hardest thing to win back in this world.