Falling prices for physical assets may contribute to rising digital asset values. Both bitcoin (BTC) and ether (ETH) saw above-average trading and opened the week with gains of 1.5% and 4%, respectively.

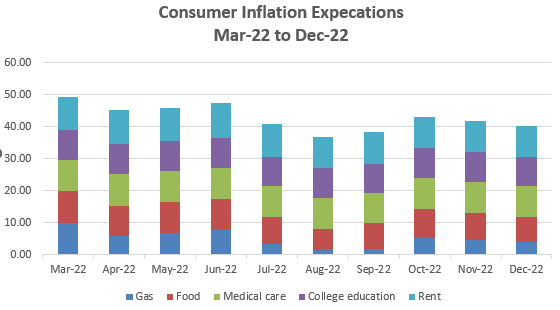

The price hikes came on the same day that the Federal Reserve Bank of New York reported that December consumer inflation expectations in the United States were 5%, down from 5.2%. The 5% level is the lowest since July 2021 and is the second consecutive monthly fall. The Federal Reserve’s efforts to reduce inflation continue to affect the values of bitcoin and ether.

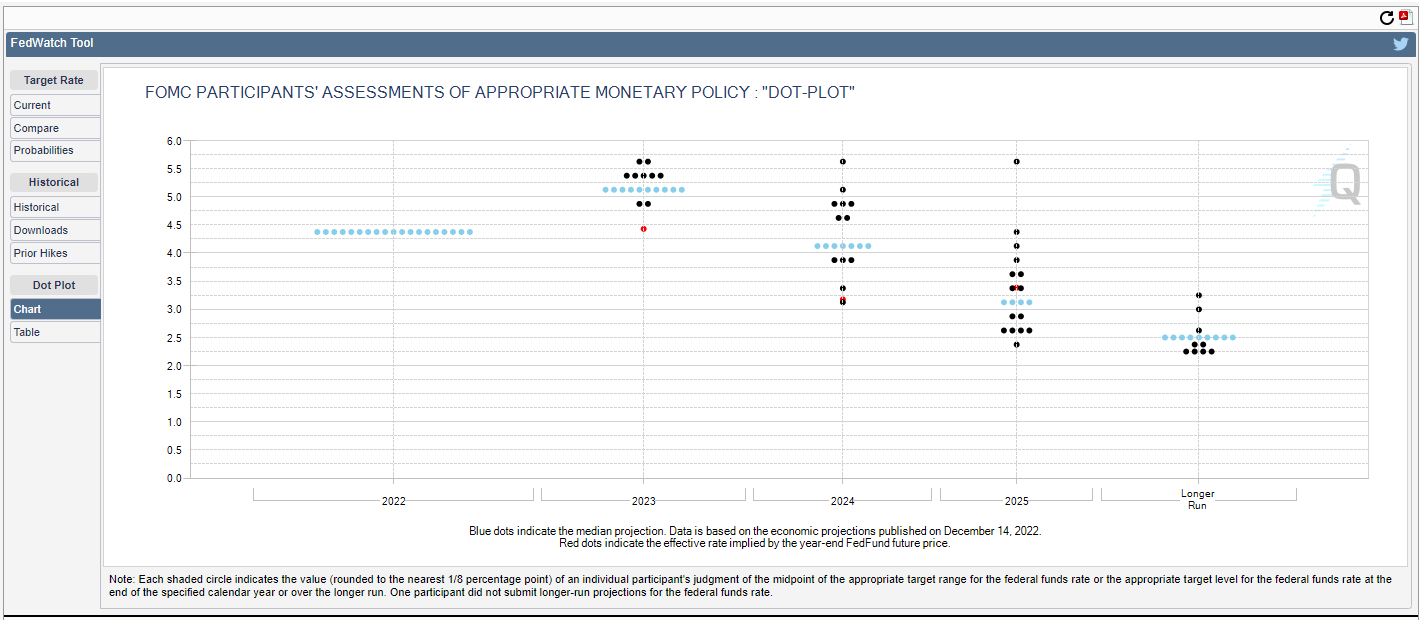

When inflation expectations fall, it’s good news for those who have made long bets on cryptocurrencies or other long-term investments. Top Fed officials’ predictions for interest rates in 2023 are consistent with the 5% inflation forecast.

The reduced gap between price growth and rate levels will be crucial in containing inflation. In March of 2022, while the federal funds target rate was between 0.25% and 0.50%, the inflation rate was 8.50%. More price momentum for bitcoin and ether is generated if the gap between inflation and the federal funds rate shrinks sooner rather than later.

As a result of the news, the prices of bitcoin and ether rose by 0.39% and 0.74%, respectively. Each asset had been trading at a little premium before, but then its price appreciation was accelerated.

The data results for the Dow Jones Industrial Average and the Standard & Poor’s 500 were negative, while those for the Nasdaq composite were positive.

Lisa Cook, the governor of the Federal Reserve System, spoke about the importance of inflation expectations on January 6. He said with concerns about a self-fulfilling prophecy: “If cost shocks and supply disruptions keep inflation elevated for a long enough period, households’ and firms’ inflation expectations could move higher – a development that could put additional upward pressure on inflation.”

Consumers’ inflation expectations have steadily declined since the Fed tightening began in March 2022. Gas has been the primary contributor to lowered expectations, down 5.9% throughout the study period. The third most significant factor was a 2.2% drop in expected food prices.

Customers’ hopes for reduced costs can cause them to put off making purchases, which can cause prices to fall. This can raise consumers’ purchasing power, increasing the funds available to invest in high-risk assets like bitcoin and ether.

Ether price trends

In the past week, ether has gained a lot of momentum. The RSI, a relative strength measure, is now in the upper 70s. The Relative Strength Index (RSI) is a momentum indicator that detects trends and warnings of overbought/oversold territory.

A reading of 30 suggests an asset may be oversold, while a reading of 70 means it may be overbought. Over the past six days, ether’s price has moved beyond its Bollinger Bands’ upper limit four times. When an asset enters Bollinger Bands’ upper range, it is frequently seen as a positive indication.

Ether has gained 5.4% this year, whereas bitcoin has only gained 4%.