Solana has gained significant popularity recently, in part due to its native token SOL witnessing significant value growth, as well as its fast transaction speeds, low fees, and broad ecosystem. It uses the PoS consensus mechanism to secure the network, meaning users can earn rewards by staking or delegating the native token SOL to validators. But is staking Solana risky? This article explores how to stake Solana to earn rewards, the best crypto wallets and exchange platforms for SOL staking.

What Is Solana Staking?

Solana staking involves delegating SOL coins to a validator in exchange for rewards paid in SOL. By staking SOL, participants contribute to the security and decentralisation of the Solana network. Validators operate full nodes that process transactions, validate blocks, and require powerful hardware, internet connectivity, and a significant SOL stake.

Individuals who cannot run their validator nodes can delegate their SOL to a validator. Delegating lowers the entry barriers and allows participants to be part of the Solana network. The more SOL staked with a validator, the greater its chances of participating in block validations and earning more rewards.

Validators may charge a fee from the delegator’s rewards for their services, and there is a risk of losing a portion or all of them if the validator behaves improperly or maliciously, known as slashing. Despite the flexibility to unstake coins anytime, Validators must wait for the Cooldown period to elapse before moving the SOL. The Cooldown period ensures that the network can penalise a validator for any misconduct even after they leave the network.

How Much Can You Earn From Staking SOL?

Earnings from staking SOL vary based on the staking method and the amount of SOL tokens staked. The Annual Percentage Yield (APY) for staking Solana typically ranges from 5% to 7%, although rates may differ on various platforms. For instance, staking 10,000 SOL at a 6% APY could yield 600 SOL at the end of the year.

Several factors influence the interest rate for staked tokens, including the number of participants already staking, the commission rate set by validators, and the inflation rate for SOL. Depositing SOL in DeFi protocols or staking them on centralised exchanges may offer higher returns than staking directly with the Solana network. However, these alternatives come with additional risks, such as impermanent losses, hacks, and third-party risks.

The time it takes to earn rewards from staking Solana depends on the chosen staking method and the network’s performance. Some crypto exchanges and wallets provide instant rewards, while others require validating a certain number of blockchain blocks before distributing rewards. Typically, staking rewards can accrue within a few hours to a few days.

How To Stake Solana & Earn Rewards

SOL can be done through a crypto exchange platform or a dedicated staking wallet. Leading exchanges like CoinSpot, Kraken, and Binance and staking wallets such as the official Solana Wallet and Exodus offer Solana staking programs, making the process straightforward.

Staking Solana via a Crypto Exchange

Step 1: Sign up for a supported crypto exchange, provide your personal information and complete the verification process if required.

Step 2: Obtain SOL tokens by purchasing them on the platform or transferring them from another wallet. Ensure you have the minimum required SOL for staking with your chosen validator.

Step 3: Visit the staking section on the exchange platform and follow the instructions to delegate your SOL tokens to a validator.

Step 4: Delegate your SOL tokens to the selected validator by following the instructions.

Step 5: Keep track of your staking rewards, regularly monitoring the performance and security of your chosen validator.

Staking Solana via a Crypto Wallet

Step 1: Choose a reputable and secure wallet that supports SOL staking, such as the official Solana Wallet or Exodus.

Step 2: Acquire SOL tokens by purchasing them on a crypto exchange or transferring them from another wallet.

Step 3: Transfer your SOL tokens to the staking wallet and navigate to the staking section. Follow the wallet’s specific instructions to delegate your SOL to a validator.

Step 4: After delegating your SOL to a validator, you will begin earning staking rewards, typically distributed every week.

Factors To Consider About Staking Methods

Before staking SOL, you should consider several factors: security, fees, network stability, wallet quality, customer service, validator uptime, and speed. These play a crucial role in determining the safety and profitability of your investment, ensuring a secure and satisfactory staking experience.

Security: As staking involves locking up a substantial amount of crypto for an extended period, selecting a platform with robust security measures is paramount to mitigate the risk of loss.

Fees: Different staking platforms impose varying fees, such as withdrawal fees, staking fees, and transaction fees. These charges can significantly impact staking profitability, so don’t forget to assess and compare fee structures.

Wallet Safety: It’s advisable to opt for a high-quality and secure staking wallet. A reliable wallet should offer user-friendly features while safeguarding your private keys and sensitive information.

Customer Service: Adequate customer service is vital in addressing concerns or issues with the staking platform. A responsive customer service team ensures timely assistance and support when needed.

Validator Uptime: The uptime and reliability of validators directly influence the profitability of staking. Validators that are frequently offline or encounter operational issues can result in lost or delayed staking rewards.

Speed: Transaction speed becomes crucial for those staking significant amounts of cryptocurrency. Some staking platforms may experience slower transaction times, leading to delays in receiving staking rewards.

Best Crypto Wallets To Stake Solana

After thoroughly assessing different crypto wallets, we have compiled a list of the top Solana wallets that offer secure and user-friendly experiences while supporting Solana-based tokens and applications across various operating systems.

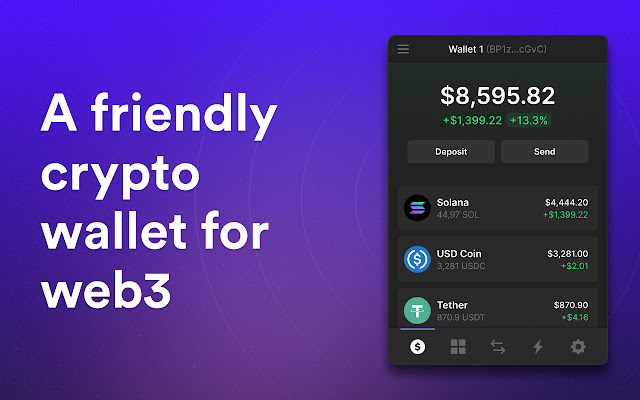

Phantom Wallet

Phantom Wallet is the best overall Solana wallet, offering a multi-chain solution that allows access to dApps on Solana, Ethereum, and Binance Smart Chain. Its intuitive user interface, similar to MetaMask, ensures seamless transactions such as buying, sending, receiving, and swapping tokens, including NFT transactions on the Solana blockchain. It is a browser extension, desktop, and mobile app compatible with iOS and Android.

Ledger Nano S Plus

The Ledger Nano S Plus is a hardware wallet that prioritises security by providing offline storage for multiple cryptocurrencies, including SOL. This compact device enhances protection against security threats like hacking or malware. While it may be less convenient for frequent on-chain activities, it is highly recommended for security-conscious users safeguarding assets of $10,000 or more.

Solflare

Solflare secures the third spot as a dedicated software wallet for Solana. It offers secure storage, management, and transfer of SOL and other Solana-based tokens. As a non-custodial wallet, it grants you complete control over your private keys and digital assets. With 22% of the total SOL supply staked through their service, Solflare is a trusted choice for staking assets in the Solana ecosystem.

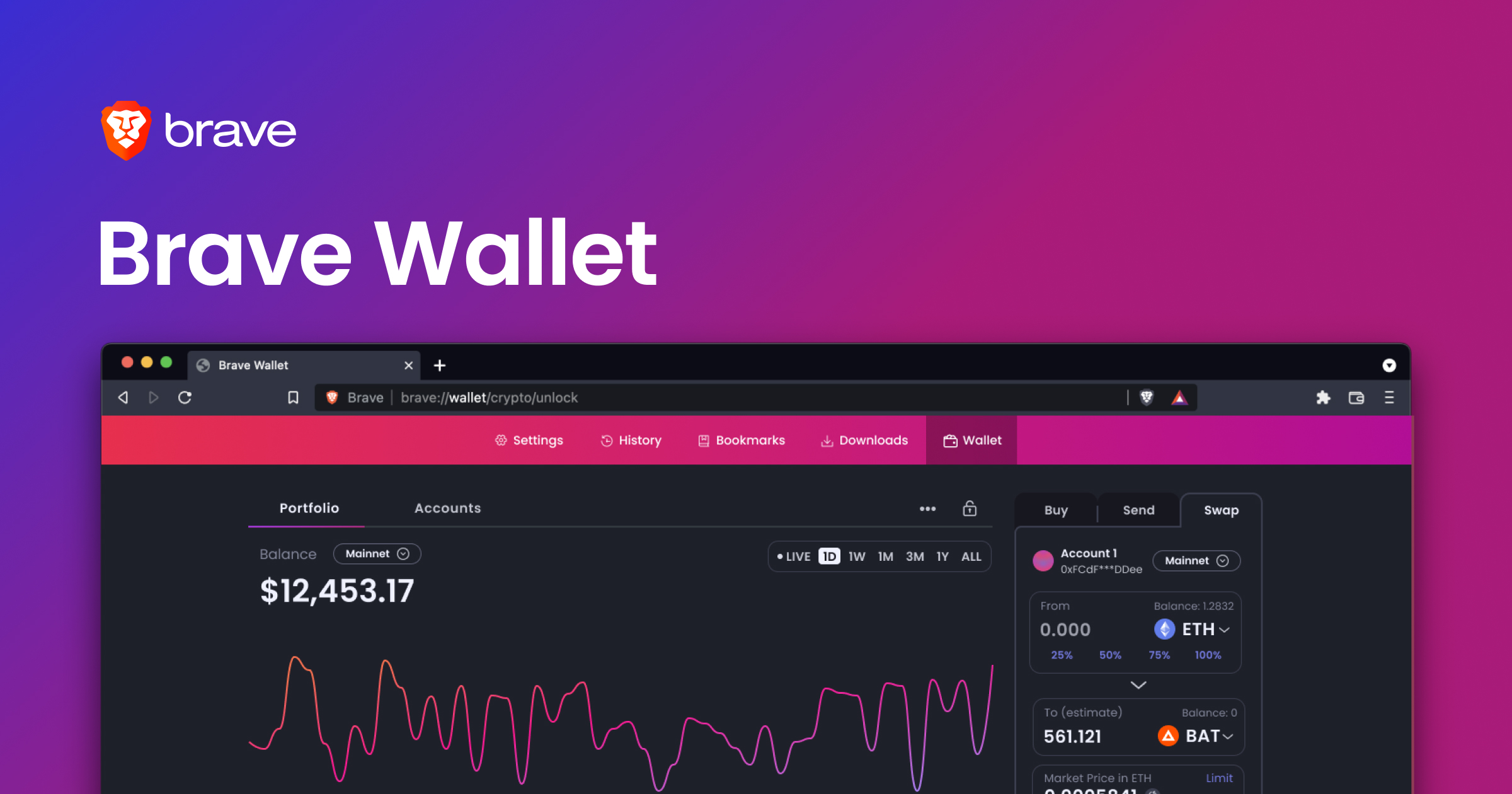

Brave Wallet

Rounding up the top five wallets is Brave Wallet, integrated within the privacy-centric Brave browser. It is compatible with various cryptocurrencies, including Solana. Users can manage their digital assets directly within the browser, ensuring secure management of Solana assets without relying on centralised third parties. Brave Wallet also supports DeFi and NFTs on the Solana blockchain.

MathWallet

MathWallet is a multi-chain mobile wallet supporting over 60 blockchains, including Solana. It offers users complete control over their private keys and digital assets. While it may not provide the same level of security as hardware wallets, it is user-friendly and accessible through a mobile app, making it a convenient option for Solana users.

Best Crypto Exchanges To Stake Solana

Several top crypto exchanges offer attractive options for staking Solana and earning rewards. Here are the recommended exchanges along with their unique features:

Binance

Binance is our top choice for staking cryptocurrencies, including Solana. As the largest crypto exchange globally, it offers high rewards and the flexibility to lock your crypto for different durations. You can purchase SOL using fiat currency on Binance and stake it on the same platform. The APY rates vary depending on the lock duration, ranging from 5.9% to 7.99% at the time of writing.

Crypto.com

Crypto.com is an easy-to-use mobile app that caters to US citizens and beginners in staking. It offers a wide range of coins for staking, including Solana. You can purchase SOL directly using a credit/debit card or deposit fiat currency into your Crypto.com account and then make the purchase. The staking options include flexible terms and fixed durations of 1 or 3 months, with APY rates ranging from 0.25% to 4.5%. By staking Crypto.com’s CRO coin, you can increase the rewards even further.

CoinSpot

CoinSpot is Australia’s premier cryptocurrency exchange, serving over 2.5 million users. It provides high yields for various tokens, including Solana, with staking rewards for SOL being 4.5% APY. CoinSpot’s tiered staking system allows users to earn higher yields by staking more tokens. Rewards are paid out weekly, and funds can be withdrawn anytime, making it a secure and hassle-free option for earning passive income on your Solana holdings.

Bybit

Bybit is an excellent choice for the flexible staking of Solana. It offers competitive APY rates of 3.3% for flexible staking and 6% for a 30-day lock. Bybit does not require KYC verification, allowing you to stake your SOL anonymously and earn interest on your crypto. Please note that Bybit is not accessible to US users, but a VPN can provide access.

Kraken

Kraken is a trusted and secure exchange popular among crypto investors and traders. It boasts Solana staking with flexible terms, allowing users to earn rewards and withdraw tokens anytime without penalties. The current APY ranges from 6% to 6.5%, similar to other exchanges. Kraken’s flexible staking is ideal for traders who want to earn rewards while waiting for trading opportunities.

FAQs About Staking Solana (SOL)

Is Staking Solana Risky?

Staking Solana is generally considered safe, but you must take precautions and follow security measures. Ensure that the platform or wallet you use for staking has a good reputation and implements security features like two-factor authentication and encryption. It’s also recommended you diversify your staking across multiple validators to mitigate the risk of potential validator issues or security breaches.

How Long Does it Take to Unstake Solana?

The timeframe for unstaking Solana depends on various factors, including the staking method and network conditions. Typically, the unstaking process can take a few hours to several days. Your staked tokens may be locked and inaccessible for trading or transfers during this period.

Where do Solana Staking Rewards Come From?

Solana staking rewards are sourced from the protocol’s inflation rate, incentivising validators to secure the network. In the early stages of Layer 1 platforms like Solana, incentivising staking is crucial to driving adoption. Solana (SOL) may have a higher inflation rate than established networks like Bitcoin or Ethereum. Staking and earning rewards help offset the effects of inflation for active participants.

What is the Minimum Amount to Stake Solana?

The minimum staking amount for SOL can vary depending on the exchange or wallet you use. For instance, crypto platforms like Kraken allow soft-staking of Solana tokens with minimum amounts as low as 0.00000001 SOL, while Binance requires minimum staking amounts of 0.0001 SOL. However, the Solana network does not impose a specific minimum token requirement.

Why is Solana Not Supported on EVM Wallets?

Solana is incompatible with EVM wallets such as MetaMask, TrustWallet, or Coinbase Wallet since the Solana blockchain uses Rust, a different programming language from Ethereum’s Solidity. EVM wallets are designed explicitly for Ethereum-based assets and do not natively support Solana-based assets. You must use wallets specifically developed for Solana to manage Solana-based assets, such as Solflare. These wallets are designed to work with Solana’s unique features, offering support for its fast transactions and low fees.