Basic concept of Staking

As its nature, there is no centralised entity responsible for functioning a blockchain. Whenever a transaction is pushed into the queue, it must receive approvals from all nodes of that blockchain to be executed. But how do these nodes know when to approve a request? The answer is that they depend on a consensus mechanism.

Different blockchains employ different consensus mechanisms. In Ethereum’s case, this network uses the Proof-of-Stake (PoS) algorithm.

Ethereum’s method of consensus revolves around a process called ‘staking’. In decentralised finance (DeFi), staking means locking up assets to get rewards over time. The PoS mechanism will ask users to lock up their native assets in a smart contract to participate in the validation process. If selected as a validator, you’ll be responsible for storing data, processing transactions, and adding new blocks to the chain. In return, validators receive new ETH in the process.

How staking works on Ethereum

Unlike the Proof-of-Work (PoW) model where miners solve complex puzzles to validate transactions, PoS selects validators based on the amount of cryptocurrency they commit to “stake” or lock up. With Ethereum, there’s specific steps in staking:

- To become a validator, a participant must stake at least 32 ETH, Ethereum’s native currency.

- Once staked, validators propose new blocks and validate transactions.

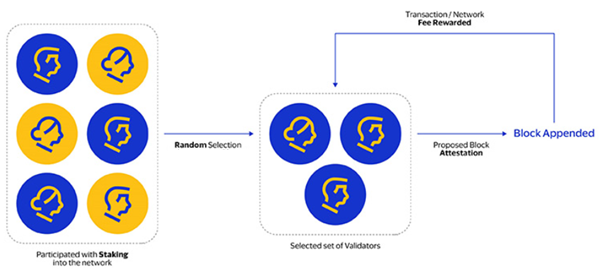

- The protocol randomly chooses a validator to propose a block, which is then verified by others. If the majority agrees on its validity, the block is added to the blockchain.

- Validators have a strong incentive to uphold honesty and network integrity since they risk losing a portion or all their staked ETH through a process known as slashing if they validate fraudulent transactions or act maliciously.

- In exchange for staking and validating, validators receive additional ETH rewards. These rewards consist of newly generated ETH from network inflation and transaction fees from validated blocks.

However, not everyone possesses enough ETH to stake or wants to manage their validating node due to technical complexities. Consequently, staking pools and services have emerged, enabling users to pool their ETH together, meet the staking threshold, and collectively share in the rewards.

How to Stake Ethereum

Solo home staking

Solo staking is the gold standard for staking. Validators can receive full participation rewards, improve the decentralisation of the network, and never have to trust anyone else with your funds.

In return, you will be running an Ethereum node connected to the Internet and depositing at least 32 ETH to act as a validator. Solo stakers are responsible for operating the hardware needed to run the node and are required to comprehend integral technical knowledge and skills such as secure key management, reliable uptime, maintenance, or slashing risk. All these documents are available on Ethereum’s tutorial site.

Basically, becoming a solo staker follows 5 essential steps:

- Get some hardware

- Sync an execution layer client

- Sync a consensus layer client

- Generate your keys and load them into your validator client

- Monitor and maintain your node

Ethereum suggests miners get started on the Staking Launchpad, an open-source application that will guide you through choosing your clients, generating your keys, and depositing your ETH to the staking deposit contract. A checklist is provided to make sure you’ve covered everything to get your validator set up safely.

Staking as a service (SaaS)

If you are not tech-savvy or simply don’t feel comfortable dealing with hardware, staking-as-a-service options allow you to delegate the hard part while earning native block rewards.

SaaS represents a category of staking services where you deposit your own 32 ETH for a validator, but delegate node operations to a third-party operator. Usually, SaaS requires some basic steps:

- Initial setup with service provider (including key generation and deposit).

- Upload your signing keys to the operator to allow the service to operate your validator on your behalf.

- Receive your rewards and pay fees for the provider.

There are a growing number of SaaS providers to help you stake your ETH, but they all have their own benefits and risks. Keep in mind that all SaaS options require trust in a third-party, so due diligence is essentially important when choosing a provider. To help with, you can use those attribute indicators below to decide which provider best fits your staking expectation.

- Open source/Closed source: Essential code is 100% open source and available to the public to fork and use

- Audited: Essential code has undergone formal auditing with results published and available publicly

- Bug bounty: A public bug bounty has been performed on any essential code to rewards users for safely reporting and/or fixing vulnerabilities

- Battle tested: Service has been available and used by the public for the indicated period of time

- Permissionless: Users do not require any special permission, account sign up, or KYC to participate with the service

- Execution diversity: Service should not run more than 50% of their aggregate validators with a majority execution client

- Consensus diversity: Service should not run more than 50% of their aggregate validators with a majority consensus client

- Self custody: User maintains custody of any validator credentials, including signing and withdrawal keys

Notably, to minimise counterparty risk, the keys to withdrawal should be kept securely in your possession.

Pool Staking

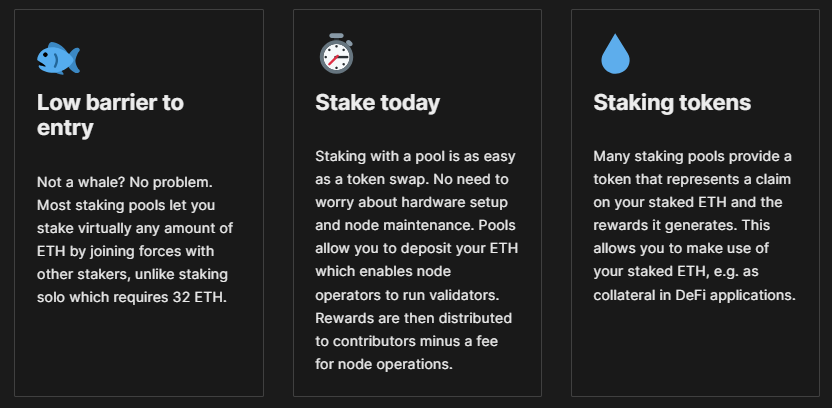

For some miners, the 32 ETH threshold can be a deterrent. Therefore, pooling solutions now exist to allow many with smaller amounts of ETH to obtain the 32 ETH required to activate a set of validator keys.

To start pool staking, users need to swap their ETH for a token (usually an ERC-20 token) representing staked ETH. The token allows users to swap any amount of ETH to an equivalent amount of a yield-bearing token that generates a return from the staking rewards applied to the underlying staked ETH (and vice versa) on decentralised exchanges even though the actual ETH stays staked on the consensus layer. This means swaps back and forth from a yield-bearing staked-ETH product and “raw ETH” is quick, easy and not only available in multiples of 32 ETH.

Similar to SaaS, pooled staking is not native to the Ethereum network and is built under third parties, so they carry their own risks. To identify the strengths and weaknesses a staking pool may have, you can use those attribute indicators listed below:

- Open Source: Essential code is 100% open source and available to the public to fork and use

- Audited: Essential code has undergone formal auditing with results published and available publicly

- Bug Bounty: A public bug bounty has been performed on any essential code to rewards users for safely reporting and/or fixing vulnerabilities

- Battle tested: Service has been available and used by the public for the indicated period of time

- Trustless: Service does not require trusting any humans to custody your keys or distribute rewards

- Permissionless nodes: Service allows anyone to join as a node operator for the pool, without permission

- Execution diversity: Service should not run more than 50% of their aggregate validators with a majority execution client

- Consensus diversity: Service should not run more than 50% of their aggregate validators with a majority consensus client

- Liquidity token: Offers tradable liquidity token representing your staked ETH, held in your own wallet

Stake through Centralised Exchanges

This might seem a little bit the custodial and non-custodial wallet story, but if you are not yet comfortable holding ETH in your own wallet, there are several centralised exchanges that offer staking services. This solution allows you to earn some yield on your ETH holdings with minimal oversight or effort.

The trade-off here is that you must trust the exchange you choose and accept the risk of cyber breaches or exploits happening on that exchange.

Why Stake your ETH?

Earn rewards

Each time new blocks are added to the chain, rewards are given to validators of these blocks as a sort of incentive for helping the network reach consensus. The more transactions processed, and more verification tasks achieved, the more rewards you get because that’s what keeps the chain running securely.

Better security

The network gets stronger against attacks as more ETH is staked, as it then requires more ETH to control a majority of the network. To become a threat or create an exploit, you would need to hold the majority of validators, which means you’d need to control the majority of ETH in the system – which is practically impossible!

More sustainable

Ethereum has successfully adopted PoS since 2022 and stopped using Proof-of-Work as an endeavour to protect the environment. Stakers don’t need to do energy-intensive PoW computations to participate in securing the network. Instead, they stake to secure nodes running on relatively modest hardware using very little energy.

FAQs

Is staking live now?

Yes. Staking has been live since December 1, 2020. Users can now deposit their ETH, run a validator client, and start earning rewards.

When can I withdraw my staked ETH?

Stakers are free to withdraw their rewards and/or principal deposit Ether from their validator balance at any time they want.

Stakers will also earn rewards in the form of fees and MEV when proposing blocks, which are made available immediately via the set fee recipient address.

What is a validator?

A validator is a virtual entity that lives on Ethereum and participates in the consensus of the Ethereum protocol. Validators are represented by a balance, public key, and additional attributes. A validator client is the software that acts on behalf of the validator by holding and using its private key. One validator client can hold many key pairs, thus overseeing numerous validators.

A validator is responsible for storing data, processing transactions, and adding new blocks to the chain.

Why do I need to have funds at stake?

A validator has the ability to propose and attest to blocks for the network. To prevent dishonest behaviour, users must stake their funds as collateral. This allows the protocol to penalise malicious actors. Once a validator chooses to act dishonestly and goes against the majority of validators, they can risk losing a large portion or all of their staked funds.