It’s not hard to buy crypto using a credit card to expand your investment portfolios. Credit cards offer easy accessibility, enabling people to respond to market movements even if they don’t have immediate capital. This guide delves into the process of buying crypto with a credit card, highlights any associated risks, and recommends the top exchanges in Australia for crypto purchases.

What are Crypto Credit Cards?

Unlike crypto debit cards, crypto credit cards are credit cards that offer cryptocurrency rewards instead of cash back or points. The rewards earned are deposited as cryptocurrency into your associated account. Co-branded by banks and crypto-related brands, these cards, such as the BlockFi Rewards Visa® Signature Credit Card, allow you to earn cryptocurrencies like Bitcoin, Ethereum, Dogecoin, Litecoin, and Gemini Dollar.

The amount of crypto you receive as rewards depends on the rewards rate and the coin’s market value at the time of the transaction. Like traditional rewards cards, many crypto cards offer a flat rate of rewards on purchases and bonus rewards for specific categories.

How To Buy Crypto With Credit Card In Australia?

Here’s a step-by-step guide on how to buy crypto with a credit card in Australia:

Find a credit card-supported exchange: Research and choose a platform that accepts credit card payments for purchasing cryptocurrencies. Ensure the platform supports your credit card and offers a reliable and secure service.

Create an account: Sign up for an account on the chosen platform. Provide the required information, such as your email address and password. Be prepared to go through a Know Your Customer (KYC) process, which often involves providing a photo ID for verification.

Initiate the purchase: Once your account is set up, proceed to make your purchase using your credit card. Enter your credit card details, including the full card information and associated billing address. Select the amount of Bitcoin or other cryptocurrencies you wish to buy, considering that fractional amounts are possible.

Choose a storage solution: The trading platform typically provides an in-built wallet to store your purchased crypto. However, consider transferring most of your funds to a personal crypto wallet for enhanced security, especially if you don’t plan on frequent trading.

Conduct thorough research on fees, security measures, and the platform’s reputation before proceeding with any transactions.

Where To Buy Crypto With Credit Card In Australia?

Here are some options for buying crypto with a credit card in Australia:

Bitcoin ATMs: Some Bitcoin ATMs allow credit card payments, enabling in-person Bitcoin purchases.

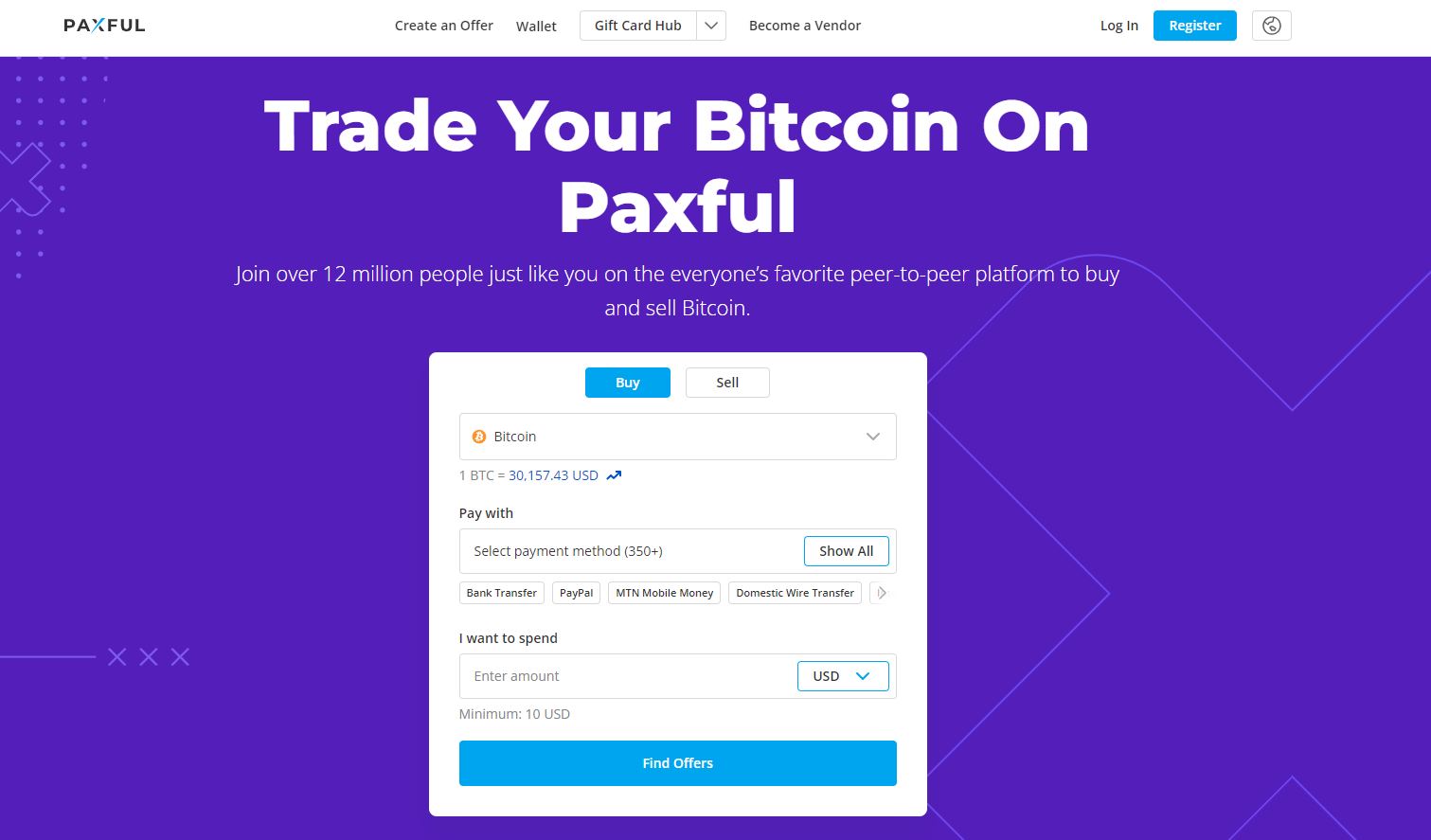

Peer-to-peer marketplaces: Platforms like Paxful connect buyers and sellers, some of whom accept credit card payments.

Cryptocurrency trading platforms:

- Binance: Binance supports credit card purchases, offers zero-fee trading, and has high liquidity. It provides its crypto card and prioritizes security.

- KuCoin: KuCoin allows buying BTC with a credit card and supports USD and EUR. It offers low fees, spot and margin trading, and a variety of cryptocurrencies.

- Bitfinex: Bitfinex has facilitated crypto purchases with credit cards since 2012. It supports Visa/Mastercard and offers a mobile app and web platform.

- OKX: OKX enables quick BTC purchases with Mastercard/Visa and offers various cryptocurrencies. It has good client support and a user-friendly interface.

- Bittrex: Bittrex is a reliable platform with low fees for credit card deposits. It provides high-level security and offers a spot market for trading.

When choosing a platform, consider fees, security measures, user experience, and available support. It’s essential to conduct thorough research and ensure the platform aligns with your requirements.

What are the Fees to Buy Crypto With Credit Cards?

When purchasing crypto with a credit card, consider the associated fees, which can significantly impact the overall cost of the transaction. These fees include:

Cash advance fee: Some card issuers treat crypto purchases as cash advances, adding additional fees. Typically, this fee is $5 or 10% of the transaction amount, whichever is greater.

Exchange/broker fee: The platform used to buy crypto will impose its transaction fee, usually ranging from 4 to 5%, but potentially higher.

Credit card surcharge: A surcharge may be applied to credit card transactions besides other fees.

Currency exchange fee: Foreign currency conversion fees might apply if a local credit card is used on an overseas exchange.

Higher interest rates: Credit card providers often charge high-interest rates, typically over 10% p.a., on credit loans. It’s crucial to review the loan terms and repayment details with your card provider and account for the impact of interest rates on your repayments.

Considering these fees is essential to understand the cost of buying crypto with a credit card and making informed financial decisions.

Is it Safe To Buy Crypto with Credit Cards?

When purchasing cryptocurrency with a credit card, prioritise safety by taking necessary precautions. In this context, you must also know the potential risks associated with credit card transactions. Unlike other methods, credit card transactions for cryptocurrency purchases are generally irreversible, making you more susceptible to fraud or potential losses.

To protect yourself when buying cryptocurrency with a credit card, follow these guidelines:

- Use a credit card issued by a reputable financial institution and ensure the security of your credit card information.

- Purchase cryptocurrency only from trustworthy exchanges or brokers with a solid reputation and are regulated by AUSTRAC and ASIC in Australia.

- Thoroughly review the terms and conditions of any cryptocurrency purchase, including applicable fees or charges.

- Safeguard your credit card and personal financial information using strong passwords and enable two-factor authentication whenever possible.

- Regularly monitor your credit card statements and account balances to identify any unauthorised transactions or potential issues promptly.

By following these precautions, you can enhance the safety of buying cryptocurrency with a credit card and reduce the associated risks.

Crypto Purchase With Credit Card FAQs

Is it a good idea to buy crypto with a credit card?

One advantage of using a credit card for purchasing crypto is convenience, as it offers an easy payment method. However, using a credit card to buy cryptocurrency has several drawbacks. It is not advisable to take on debt for investing in the volatile and risky crypto market. Besides, it can be costly, with platforms often imposing extra fees for credit card transactions. Credit card companies treat cryptocurrency purchases as cash advances, resulting in higher interest rates and immediate interest accrual, further increasing expenses.

Can I use a credit card to buy any coin?

If the exchange you select allows credit card deposits, you can buy any cryptocurrency available on their platform. For instance, Swyftx offers over 320+ coins that can be purchased using a credit card.

What credit cards are supported for crypto purchases in Australia?

Westpac, Macquarie, and ANZ are Australian banks that purchase crypto using credit cards. However, certain Australian banks do not allow such transactions, with the Commonwealth Bank of Australia being a notable example. It’s important to stay informed about the latest regulations and updates as this information is subject to change.

Is it legal in Australia to use credit cards to buy crypto?

Purchasing crypto with a credit card is legal for Australians. However, it’s important to note that crypto regulations undergo regular reviews by government officials and financial institutions, and updates can occur anytime.

Can I buy crypto anonymously with a credit card?

Purchasing crypto with a credit card without ID verification can pose challenges since most exchanges mandate personal information and KYC verification for transactions. While it might be feasible to find a platform for anonymous purchases, like a peer-to-peer exchange, the credit card used will still be associated with your identity, leaving a traceable transaction record.

How long does it take for a crypto credit card purchase to clear?

Transactions with credit cards are completed within seconds, unlike bank and wire transfers, which can take several days. This swift process allows users to promptly move their cryptocurrency off the exchange and take advantage of market opportunities, especially during bear markets when investors aim to capitalise on price dips. Therefore, credit cards offer an ideal choice for those seeking instant speed and the ability to buy crypto quickly.

Bottom Line

For most people, using a credit card to buy crypto may not be the most practical option. However, consider the significant drawbacks before opting for this method. Purchasing crypto is often more advisable through direct deposits, debit cards, or wire transfers.

One major disadvantage of using a credit card for crypto purchases is the high fees involved. These fees can significantly reduce the value of your investment or minimise potential returns. Additionally, a considerable risk of accumulating substantial debt can be challenging.

Suppose you still choose to proceed with a credit card. In that case, we recommend contacting a credit card representative to understand the specific repercussions of your issuer and searching for a crypto exchange platform that offers the best credit card rates.