Since its beginnings, blockchain technology has significantly developed and revolutionised numerous industries, including the financial and creative sectors. Alongside the widespread adoption of DeFi, GameFi, and NFTs, other blockchain technologies, particularly Decentralised Autonomous Organizations (DAOs), are gaining popularity in the digital arena. However, what a DAO is, how it works, and what the top DAO projects are in 2023. Keep reading to figure it out!

What is a DAO?

One of the common challenges in the digital world is how to organise people around the world who don’t personally know each other, establish rules and enforce them. For now, DAO is available to solve the challenge.

So, what does DAO mean? Wikipedia defines a Decentralised Autonomous Organisation (DAO) as an organisation represented by rules encoded as a computer program. These rules are transparent as they are member-controlled instead of single-control authority.

A DAO’s financial transactions records and programs are maintained on a blockchain. It provides a safe way for internet strangers to collaborate and a platform to commit funds for various causes.

DAOs are more like internet-based businesses without a single control organ. The members collectively own and manage the business. It has in-built treasuries that can only be accessed with the members’ authorisation. All the decisions in the organisation are made through member proposals and voting.

What makes DAO different?

DAO is becoming a popular organisational strategy due to its unique approach to finances and operations. The recording of the DAO’s financial transactions and rules on the blockchain leads to transparency.

Due to smart contracts, DAO eliminates the need for a third party in financial transactions. The DAO draws its firmness from smart contracts. Therefore, it is right to find out what DAO Ethereum is. Ethereum provides a platform for developing and deploying smart contracts that govern the DAOs.

The smart contracts contain all the organisation’s guidelines and storage. Given the decentralisation of blockchains, no one can edit the smart contracts without the other members’ consent. Transparency eliminates the need for legal status backing like other traditional firms.

Compared to traditional companies, DAO has democratised organisations. Instead of letting a few individuals make decisions on behalf of the company, DAO allows every member to vote to adopt proposals. The funding for most of the DAOs is through crowdfunding. Also, all the DAO activities are transparent and fully public. This is different from the traditional organisations, whose operations are predominantly private and with limited public access.

So far, DAOs are being used for many purposes, such as investment, charity, fundraising, borrowing, or buying NFTs, all without intermediaries. A DAO can accept donations from anyone around the world, and the members can decide how to spend donations.

How DAO works

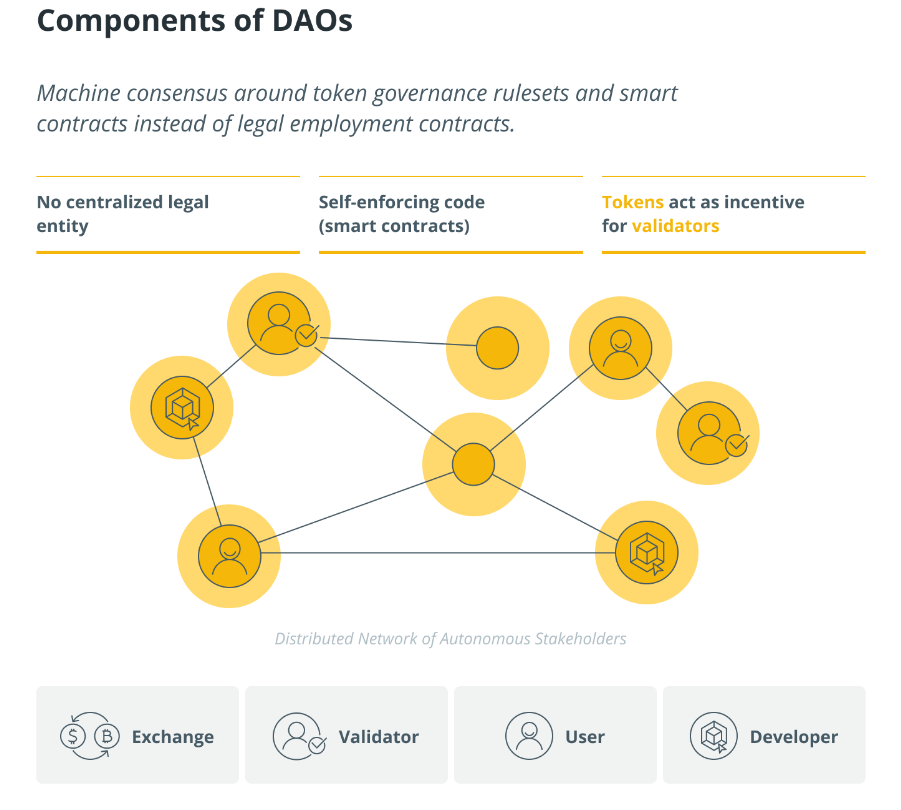

As stated previously, a DAO is an organisation in which decisions are made from the bottom up; a group of members collectively owns the organisation. There are numerous ways to engage in a DAO, the most common of which is token ownership.

DAOs operate via smart contracts distributed on various blockchains and Ethereum was the first blockchain to employ them. Those with a stake in a DAO are then granted voting rights and can affect the organisation’s operations by rejecting or proposing new governance proposals.

This strategy prohibits spamming DAOs with proposals; a proposal will only pass if most stakeholders support it. The smart contracts specify how this majority is chosen for each DAO.

For a DAO to launch, it must undergo various sustainability phases. Here is the process of creating a functional DAO.

- The smart contract setup – the first step in creating a DAO is to develop a set of rules governing the organisation. These rules are encrypted on the smart contracts and used for all operations. They determine the DAO’s workflow, finances, and governance system. The smart contract rules will only change through member proposals and voting.

- Funding – once the smart contract is in place, the DAO needs funding to start operating. The DAO smart contract details the funding through the creation of a native token. This token operates like any other crypto and can be used for voting rights and incentives. Anytime you interact with what is a DAO crypto, you are referring to the native token of the given organisation.

- Deployment – with the rules and funds in place, the last step is the DAO deployment. The organisation operates within the rules set by the smart contract.

Why do we need DAOs?

To trust the individuals you want to collaborate with to start a business is challenging, especially with someone you’ve only ever communicated with online. For DAOs, the only thing you need to trust is the DAO’s code, which is open and verifiable by anybody. This can pave the way for many new kinds of cooperation and coordination globally.

|

DAO |

A traditional organisation |

| Often flat, and entirely democratised. | Often hierarchical. |

| Members need to approve any modifications before they go into effect. | The structure determines whether a single party is given the option to make changes or whether voting is required. |

| Votes are tallied, and the result is implemented without a trusted middleman. | If voting is permitted, votes are tallied internally, and voting results must be handled manually. |

| Services are handled automatically in a decentralised manner (e.g. distribution of charity funds). | Requires human intervention or centralised automation and is susceptible to manipulation. |

| All activity is publicly available and transparent. | Activity is private and limited to the public. |

Below are some examples of how you can use a DAO:

- A charity: You can take donations from everyone worldwide and vote on which causes to finance through a charity.

- Collective ownership: Members can vote on how to use physical or digital assets acquired through collective ownership.

- Ventures and grants: You can build a venture fund that pools investment cash and votes on which firms to support. Later, repaid funds could be divided among DAO members.

Best DAO crypto projects 2023

RobotEra – Overall Best DAO Project in 2023

RobotEra, a metaverse-based ecosystem that intends to be a Sandbox-like metaverse gaming project, is our top-recommended best DAO project in 2023. RobotEra uses TARO as its native token, and the ERC-20 token grants investors access to the RobotEra DAO and other metaverse resources.

Robot NFTs are the 3D in-game avatars of users on the ‘Taro Planet’ – the virtual metaverse world of RobotEra. With NFTs, players can purchase Land on seven continents inside the Taro Planet.

According to the RobotEra whitepaper, the platform will ultimately deploy its DAO, which can be accessible by staking TARO tokens. The DAO will offer the ability to vote and make decisions on numerous aspects of the Taro Planet. Since Robots in the game are separated into diverse factions, DAO members can vote on and propose implementation tactics for their own factions.

Battle Infinity – Overall Best Crypto DAO Project

Battle Infinity intends to merge Play-to-Earn (P2E) gaming with Web 3.0 technology by establishing a metaverse-based game (Battle Arena). It provides users with a decentralised platform that gives them access to a virtual game ecosystem where they can play, earn, and create products.

The IBAT token serves as the platform’s utility token. IBAT tokens are generated on the Binance Smart Chain and are preparing for a mainnet deployment in phase 3 of the platform’s roadmap. To participate in the Battle Stake, users must stake IBAT, with the possibility to earn, build, and generate NFTs that can be turned into IBAT awards.

MakerDAO – Top DAO Project Built on Ethereum

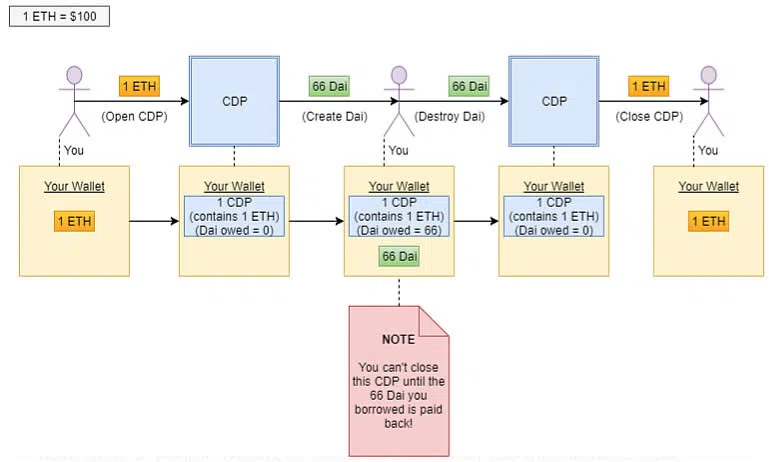

MakerDAO is a peer-to-peer decentralised autonomous organisation established on the Ethereum blockchain that enables individuals to lend and borrow cryptocurrencies. As with any other DeFi protocol, the borrowing and lending procedure on this platform is governed by smart contracts.

Due to the extreme volatility of cryptocurrencies, MakerDAO employs Dai, a stablecoin, to establish lending rates and repayment amounts. MakerDAO is a cryptocurrency lending credit facility that grants loans at predetermined interest rates. If a MakerDAO user wants to borrow a specified quantity of cryptocurrency, they must first deposit Ethereum into a Maker smart contract.

Future application-specific decentralised financial protocols will rely heavily on the Maker Protocol and Dai stablecoin as the foundational infrastructure layer.

Tamadoge – Upcoming Meme Token DAO project

Tamadoge, the native cryptocurrency of the Tamaverse, is a project launched amid massive hype as the latest Doge-themed meme coin with significant potential. Tamadoge provides a multi-utility token and play-to-earn (P2E) platform on the blockchain, whereas Dogecoin and other cryptocurrencies gained popularity owing to the social media support of notable celebrities.

On this P2E platform, players compete for possible earnings from a prize pool, which are awarded as TAMA tokens. Tamadoge pets are supposed to be created, bred, and traded by users. Each pet is issued as a non-fungible token (NFT) via smart contracts and possesses unique qualities, strengths, and limitations. The objective is to make these Doge pets competitive to gain points on the leaderboard each month.

Dash – Innovative ‘Privacy Coin’ Set for a Rebound

Dash is one of the top utility tokens for privacy and anonymity. Dash began as a fork of Litecoin and has since become a popular digital currency among those who value privacy about their personal information and transaction history. Over the past few years, businesses and online retailers have increasingly adopted Dash, which is now accepted at over 155,000 locations.

Dash functions similarly to Bitcoin, except that its InstantSend feature allows transactions to be completed in less than two seconds. In addition, Dash employs a valuable method that mixes transactions with others, making it nearly impossible to identify a specific transaction to a particular wallet.

While the project is a DAO insofar as all decisions are made collectively via a subset of master nodes, the degree to which the Dash network is decentralised remains debatable because the network’s governance tokens were distributed in a manner that concentrated wealth among a small group of stakeholders, granting them disproportionate voting power over the project.

Uniswap – Leading DeFi Protocol with $5.5B in TVL

Uniswap is a decentralised exchange (DEX) established on the Ethereum network that facilitates the easy exchange of ERC-20 tokens. This is the Ethereum token standard and contains some of the top altcoins, like Chainlink and Shiba Inu. Since the exchange is decentralised, an intermediary is unnecessary to facilitate transactions.

Uniswap employs liquidity pools, which eliminate the typical order book. Anyone can deposit unused ERC-20 tokens into Uniswap’s liquidity pools in exchange for a yield. Depending on the token, returns can be significantly higher than those granted by conventional savings accounts.

Due to its widespread adoption, Uniswap has become one of the most popular DeFi protocols worldwide. Numerous investors purchase UNI, the protocol’s native token, to gain exposure to its growth.

Consequently, Uniswap keeps the second position on our DAO crypto ranking list.

OlympusDAO – DAO Project for Stablecoins’ Liquidity

The objective of the OlympusDAO project was to create a new decentralised infrastructure for finance, which would be community-driven. At its core, OlympusDAO provided a solution to one of the most vexing issues in DeFi: the provision of sustainable liquidity for native tokens.

Instead of renting liquidity through token payouts, Olympus acquires it through its bonding mechanism. The mechanism provides a discount on the project’s OHM token in return for tokens, such as liquidity provider tokens (e.g. ones that represent deposits in OHM-DAI pool).

In addition, Olympus gave rise to the famed 3,3 meme, a slang for game-theoretic cooperation. This means the option to stake OHM tokens to get the six-digit APY offered at the project’s inception. When new bonds are issued, the protocol mints new OHM tokens, and the bulk of these tokens are distributed to stakers.

FAQs about DAOs

What is the purpose of a DAO?

A DAO’s purpose is to improve several organisations’ traditional management structures. A DAO attempts to provide every member with a voice, a vote, and the ability to suggest initiatives, as opposed to relying on a single individual or a small group of individuals to guide the organisation’s direction. A DAO also aspires to have governance by blockchain-based code.

What is an NFT DAO?

NFT DAOs are decentralised autonomous organisations that use NFTs as a membership and governance token in addition to a shared DAO treasury. By doing so, NFT initiatives can set up a formal structure that gives holders collective control over the project’s development. In laying the groundwork for collaborative, decentralised, and economically beneficial construction, NFT DAOs embody some of web3’s defining characteristics.

What is Lido DAO (LDO)?

For Ethereum 2.0 and other proof of stake (POS) blockchains like Polygon (MATIC), Solana (SOL), Polkadot (DOT), Lido is a decentralised autonomous organisation that offers a liquid staking service. Lido DAO token holders can stake them and reap profits without locking or managing the staking infrastructure. Also, they can stake Ethereum without making any initial investments or worrying about the upkeep of any underlying infrastructure; hence, joining on-chain operations like compound returns and lending.

How to create DAO on Ethereum?

There are a number of DAO startup templates and tools available to help startups save time and effort in developing their systems, or they can choose to develop their systems from scratch. Popular choices for the Ethereum blockchain include Aragon and Snapshot. Also, to make DAOs on Ethereum and Gnosis Chain, you can use a program called DAOstack Alchemy (formerly known as xDAI). If you want your DAO’s tokens, crowdfunding, and treasury tasks to go well, you’ll need to get the DAO treasury tools working properly after you set them up.

How does a DAO make money?

Typically, a DAO will exchange fiat currency for its token as its initial funding mechanism. A member’s share of voting power and ownership is reflected in the value of this native token. If a DAO is successful, there will be a rise in the price of the tokens used within it.

Tokens issued in the future by the DAO can be sold for higher prices. The members of a DAO have the power to authorise the organisation to make investments. Buying up businesses, NFTs, or other tokens is only one example of what a DAO can do with its funds. If the value of those assets goes up, so does the value of the DAO.

Final thoughts

The goal of DAOs is to create a collective organisation in which all members have an equal say in the running of the business. Many experts and insiders in the field agree that this form of organisation is gaining popularity and may even displace certain more conventional businesses.

Current trends can influence how customers connect with a company or brand. Thus, companies and brands need to keep tabs on these developments. While DAOs’ adoption isn’t widespread now, they’re gaining popularity amongst many developers and creators.