As a cryptocurrency miner, you can use your computer to earn extra cash. Depending on the capacity of your computer, it can be a decent secondary hustle to generate passive income. Mining is the lifeblood of the cryptocurrency universe.

Miners use their systems to validate ongoing transactions by solving intricate mathematical problems. In this procedure, miners exchange computing power and electricity for a block reward. A block reward is an inducement to maintain the blockchain technology underlying cryptocurrencies.

If you are interested in cryptocurrency mining, we have compiled a list of the most reputable and lucrative mining pools. Let’s get into it.

What Is A Bitcoin Mining Pool?

Bitcoin mining pools are networks of dispersed miners who collaborate to mine blocks and disseminate the rewards proportionally to their respective contributions. Through pool coordinator fees, miners balance their income at a minor discount.

Contribution to a mining pool is quantified by hash rate, which is the number of hashes—attempts to locate a new block—per second. When miners in a mining pool discover a block, they pay the block reward to the mining pool coordinator. After deducting a modest fee, the coordinator pays each participant based on their contribution to the pool’s hash rate.

A minor miner with impossibly low odds of discovering a block alone will generate a consistent income by joining a mining pool. This revenue will be proportional to the miner’s capacity, so it will still be modest. However, the miner can continue covering operating expenses and making a profit due to its consistency.

Mining pools may be viewed as a centralising force, but because they comprise numerous decentralised entities, they are much more difficult to coerce. They must constantly compete to offer their members higher profits than other mining pools. If a mining pool acts in poor faith, charges excessive fees or begins censoring transactions, causing members to lose profits, they can quickly join a different pool with best practices.

However, efforts are being made to ensure that mining pools are decentralised. Stratum v2 is a case in point. This new protocol control over which transactions are included in blocks by placing more authority in the hands of mining pool members rather than the coordinator.

10 Best Bitcoin Mining Pools in 2023

F2Pool

F2Pool is among the earliest established in 2013. With a hash rate of approximately 14%, it is currently the world’s third-largest mining pool. F2Pool’s comparatively low payout fee of 2.5% and exceptional dependability make it a reliable choice for most Bitcoin miners, but that is not why it is so high on our list.

F2Pool’s ability to permit merged mining makes it stand out to us. You can mine other cryptocurrencies concurrently with Bitcoin without influencing your BTC hash rate. For instance, earning up to 120 Hathor (HTR) for each Bitcoin mined is possible.

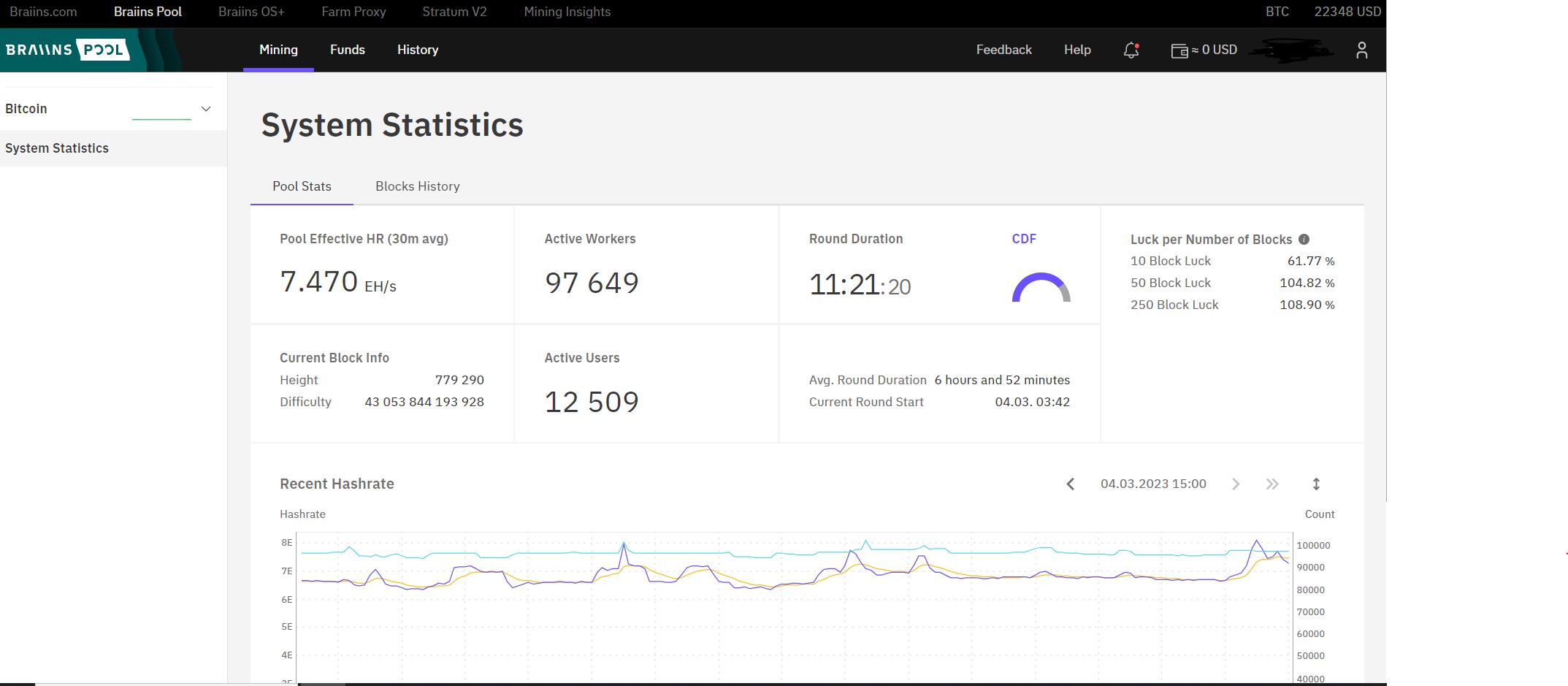

Slush Pool

Slush Pool (now Braiins Pool) is the first Bitcoin pool launched in 2010 during Bitcoin’s early years. Today, it embodies the idiom “Old is gold” with its low 2% charge and 0.001 BTC minimum payout threshold, allowing miners to generate more profit.

However, the most remarkable aspect of Slush Pool is that its commission fees can be reduced to nil. All you need to do is install the Braiins OS+ on your Bitcoin ASICs, which we found very simple.

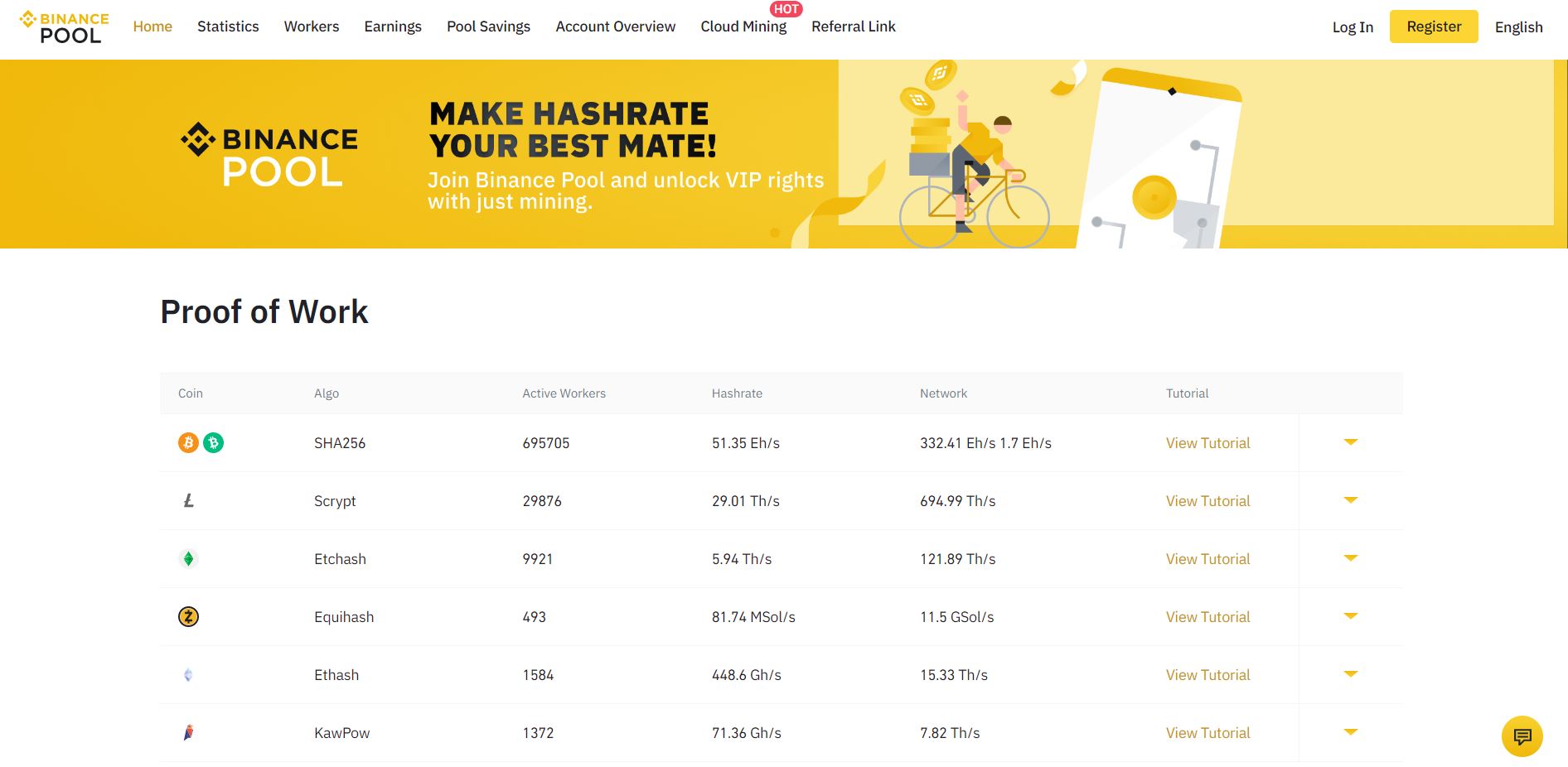

Binance Pool

Binance Pool employs an auto-switching algorithm that enables the mining of various cryptocurrencies, including BTC, BCH, and BSV, using a variety of mining algorithms. Additionally, it is possible to mine Ethereum, Cardano, Binance USD, Solana, Polkadot, Ripple, Filecoin, and Binance Coin, among others. With auto-switching, you generate greater profits than would otherwise be conceivable.

Additionally, users can sell their hash rates. With pool savings, users can increase their income by depositing the pool’s earnings to earn between 4% and 30% annual interest.

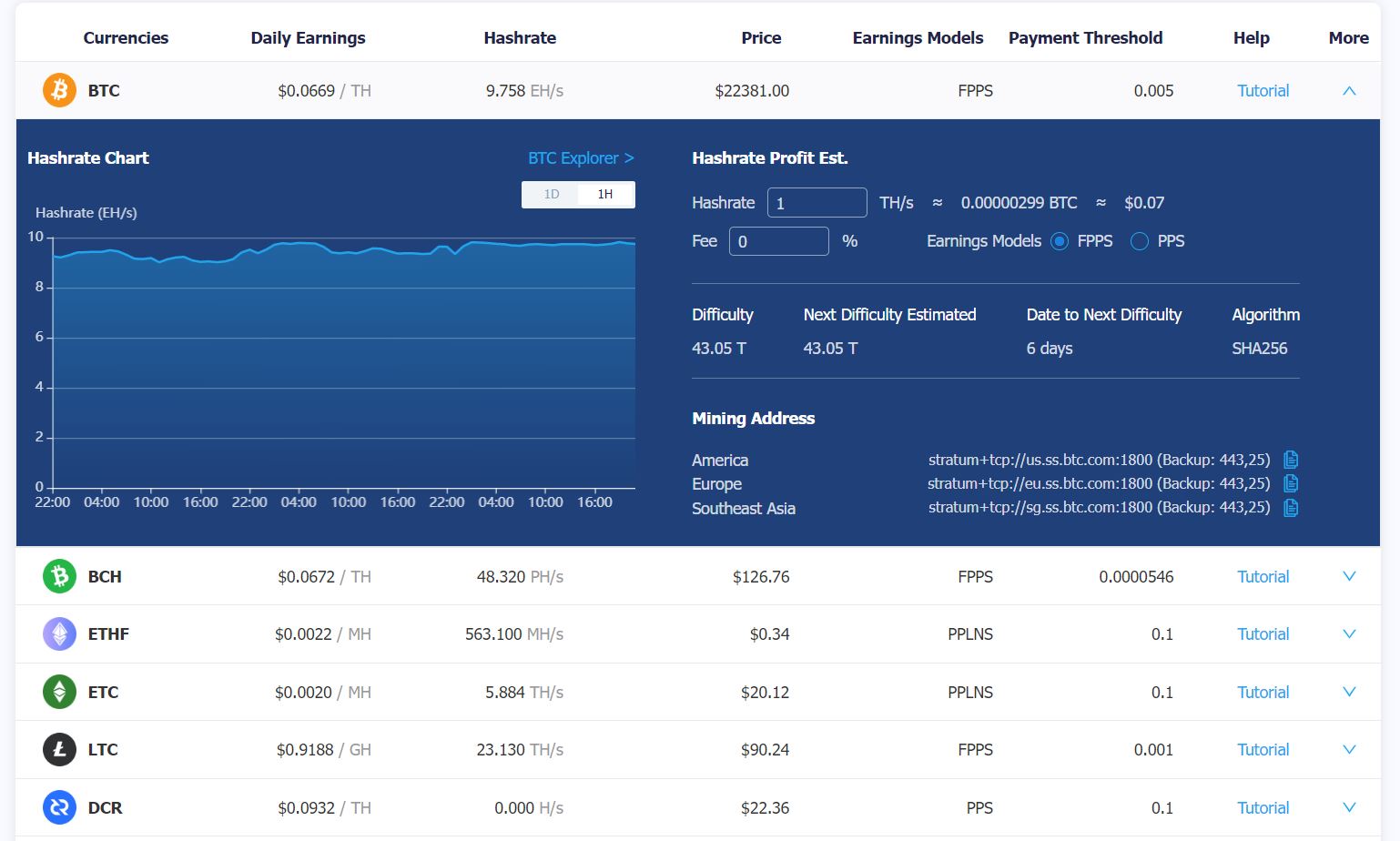

BTC.com

BTC.com captured our attention due to its superior security and transparency. It displays each user’s hash rates, fee ratio, power consumption, daily profit, and 24-hour returns, allowing you to make profitable decisions quickly.

BTC.com’s security is supported by an entirely open-source code and Cloudflare DDoS protection. In addition, the $4 commission fee is quite reasonable for most miners.

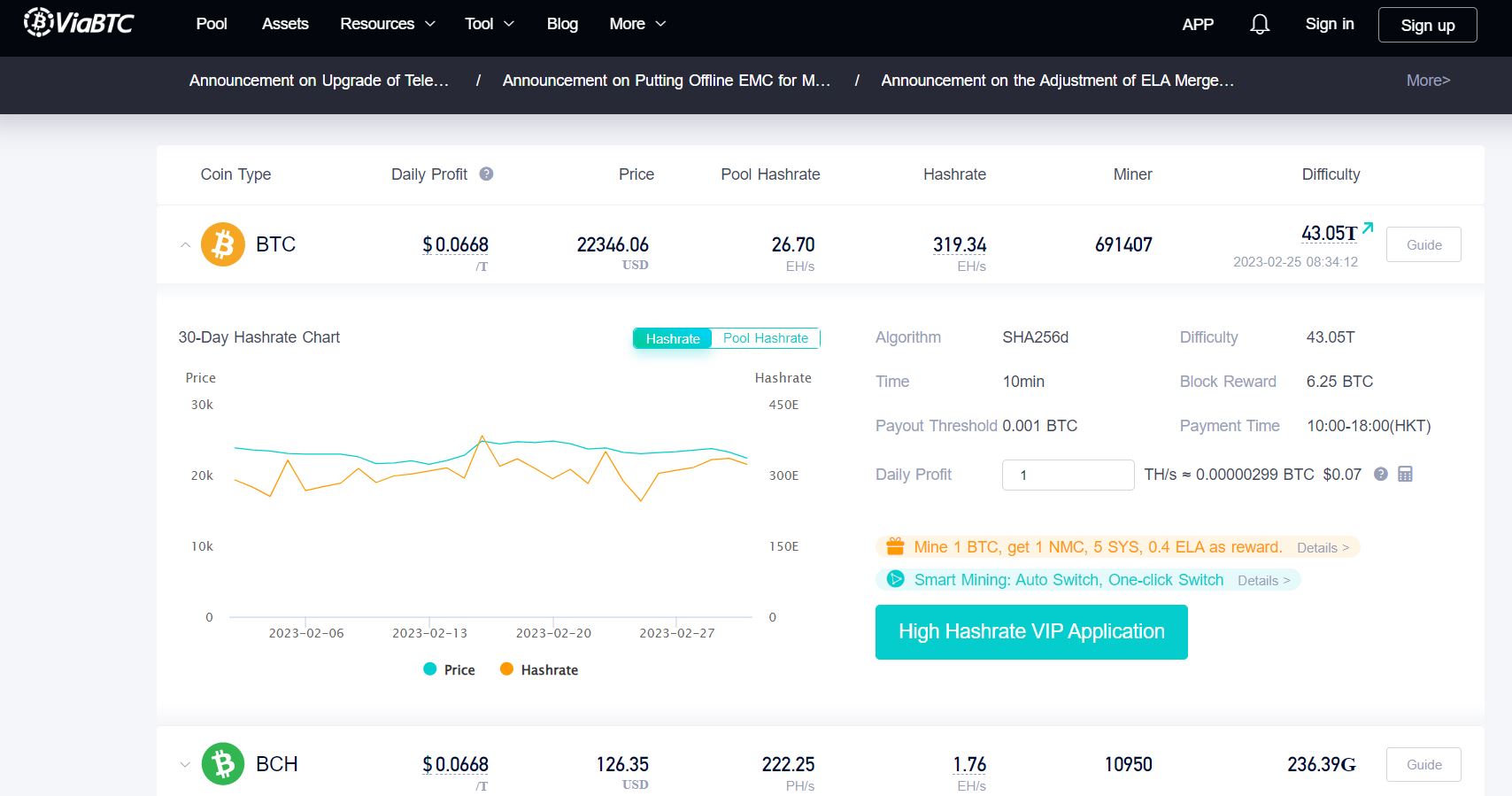

ViaBTC

ViaBTC is one of the top five mining pools, accounting for 8.094% of the total hash rate. Its high ranking on the global BTC leaderboard makes sense, given that its average pool hash rate is a blistering 22 EH/s.

During our time using this pool, its hashing performance and BTC output were remarkably consistent and comparable to the market’s top participants.

Not to mention that the PPLNS payout system has a modest 2% commission fee. However, ViaBTC will charge a 4% fee for PPS payments.

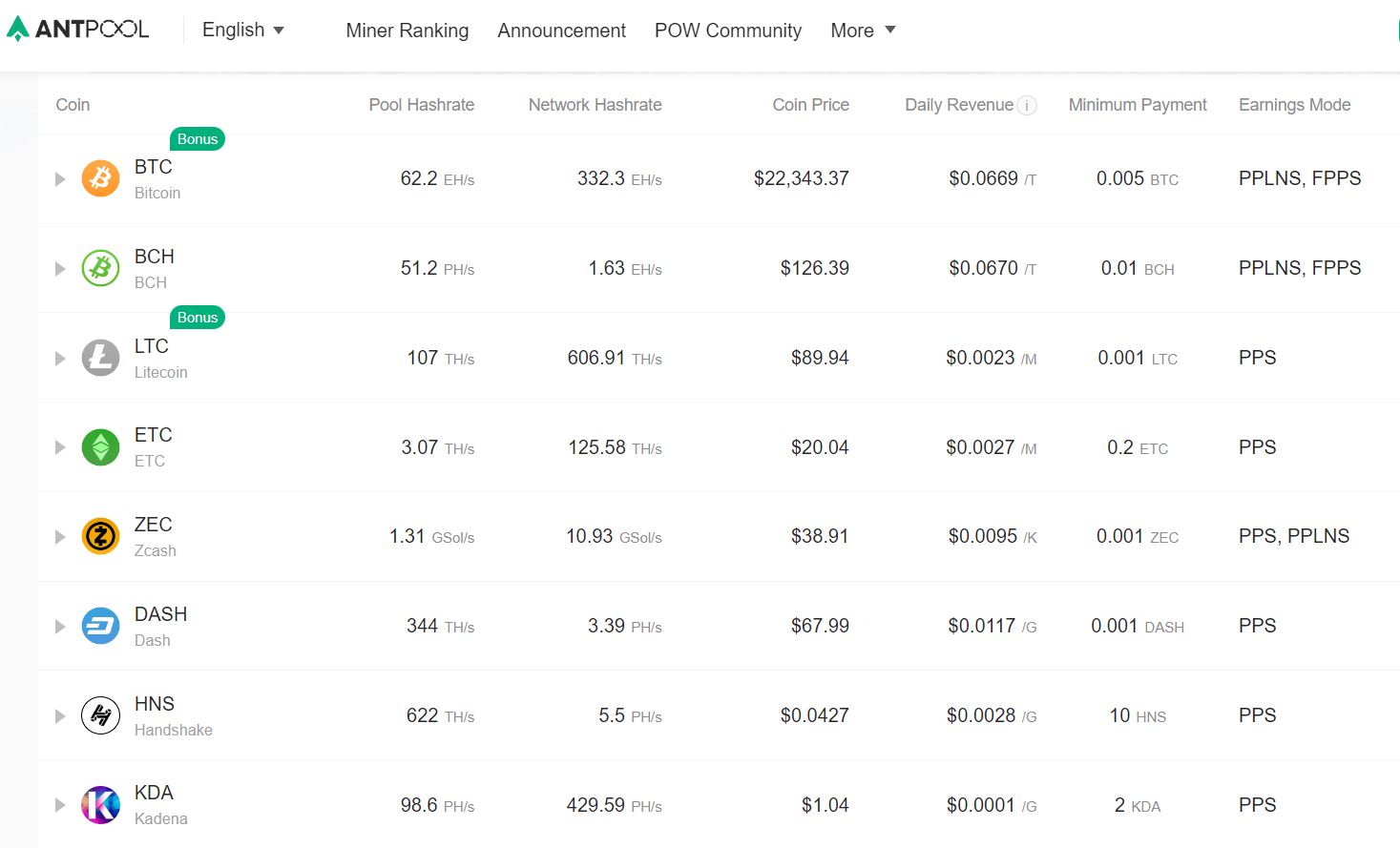

Antpool

Antpool holds over 21.043% of the total hash rate distribution, making it the second-largest Bitcoin mining pool globally. It is also one of the most efficient mining platforms, with an average pool hash rate of 56 EH/s, allowing astute miners to earn substantial profits.

With the PPLNS payout mechanism, Antpool’s 0% commission fee is our favourite feature. However, this fee increases to 4% if you choose PPS+.

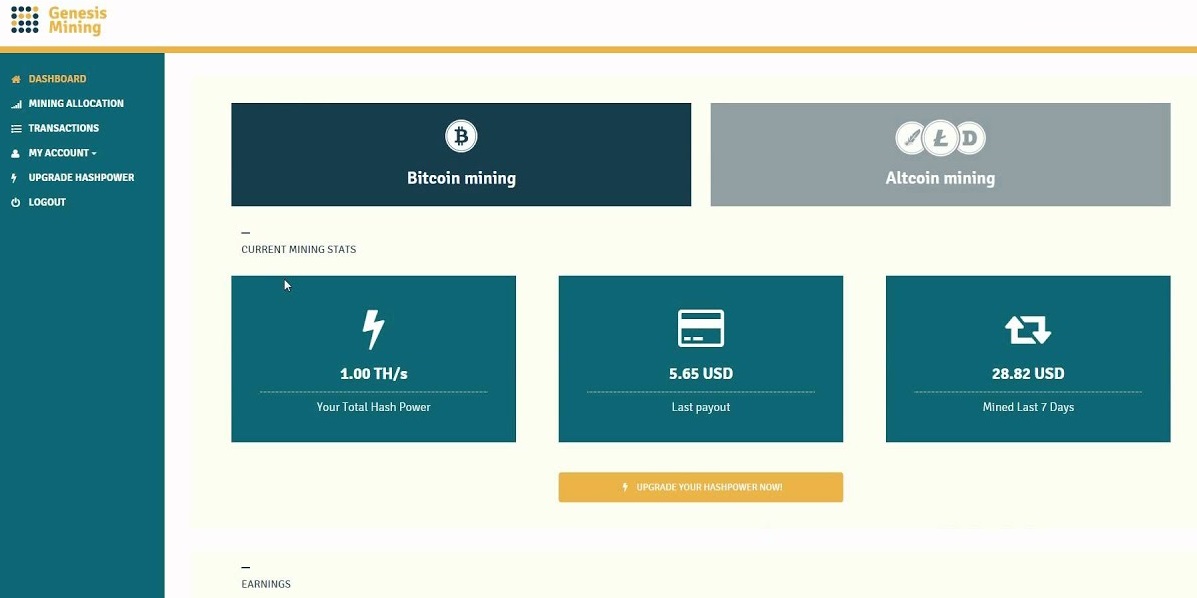

Genesis Mining

Genesis Mining is a cloud mining service that enables the extraction of altcoins and Bitcoin. It hosts its mining devices in the cloud and, as a result, sells mining bundles for each supported cryptocurrency at a predetermined price.

Visit the website, register, select and purchase a bundle, and mining will commence. Benefits include not having to deal with deafening noises, excessive machine heating, intricate installations and machine and software maintenance, a guarantee of 100% uptime, and the lowest possible electricity rates to boost profitability.

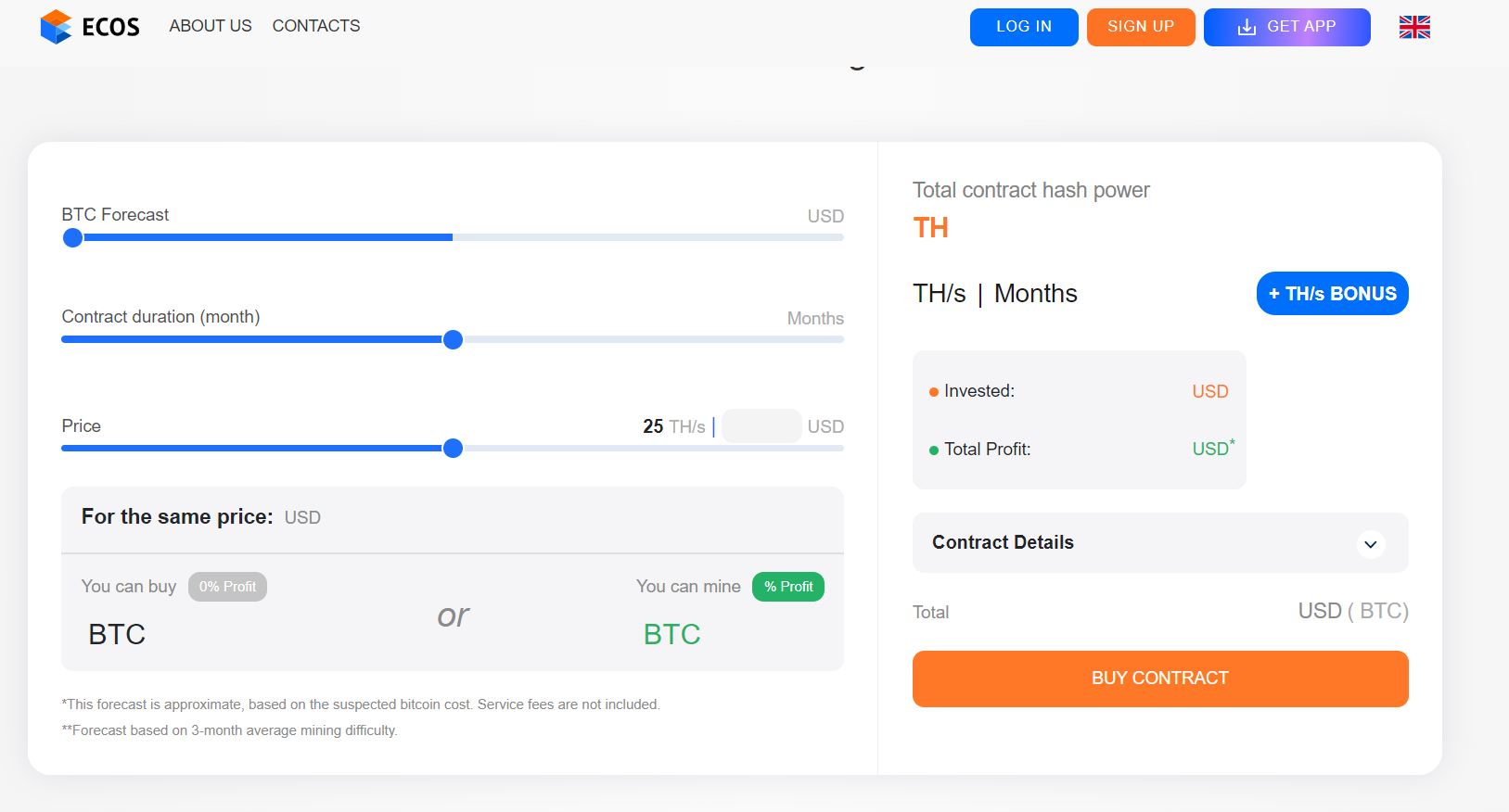

ECOS

ECOS is among the most cost-effective mining pools we’ve evaluated. This is because it is a remote mining service that enables you to mine Bitcoin without your hardware.

The ease of setup distinguishes ECOS from other cloud mining services. Use three sliders to select your desired BTC forecast, contract duration, and price, and the site will automatically generate the optimal contract for you.

In addition, once you begin mining, the 1 TH/s per day commission fee of ECOS enables you to increase your profits even further.

Poolin

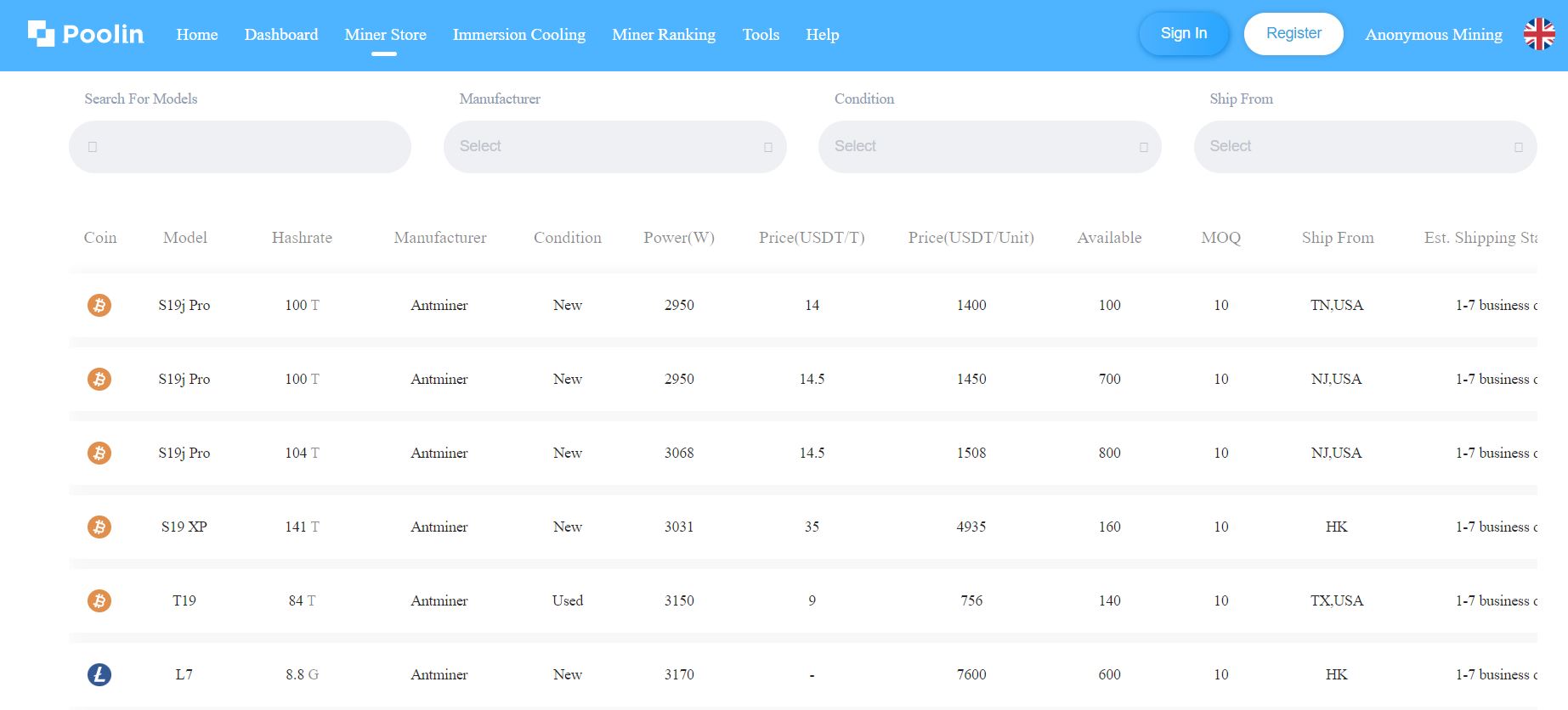

Poolin is an all-around trustworthy Bitcoin mining pool with no significant drawbacks. It offers complete transparency regarding each miner’s hash rate, price, power consumption, and profitability ranking. During our assessment of Poolin, this transparency enabled us to optimise our profits from this mining platform by making informed decisions.

Poolin offers multiple payout options, including PPS, PPS+, Solo, PPLNS, and FPPS. However, it is essential to note that its commission fees range from 2.5% to 4%, depending on the distribution option, with FPPS having the lowest commission fees at 2.5%.

Bitfury

Bitfury also operates crypto mining data centres chilled by immersion cooling. The Bitfury Tardis Server is designed for small, medium, and large businesses that wish to mine Bitcoin efficiently. Once ordered, the mining rigs can be connected to the Internet and electricity, set up with the mining pool, and then BTC can be mined.

BlockBox AC is a full-size, portable Bitcoin mining data centre with remote browser or mobile device monitoring.

How to Select a Cryptocurrency Mining Pool

There are numerous factors to consider before selecting a Bitcoin mining pool. Examples include task assignment methods, reward distributions, total hash rate, and hardware and software compatibility.

Each of these factors will affect the profitability and revenue of your mining operation. Consequently, selecting the finest pool will largely hinge on your priorities. What do you consider to be the most crucial aspect of your mining operation? What do you feel the most at ease with?

It is only possible to join a mining pool with higher rewards if, for instance, you are continually concerned about transparency. It is a matter of personal preference. In light of this, let’s consider the most critical mining pool factors when choosing.

Hardware & Software Compatibility

The cryptocurrency industry is dynamic, and mining networks are no exception.

As mining hardware evolves, pools may cease supporting older devices. Additionally, consider each pool’s recommendation and hash rate in general.

Your earnings will likely be negligible if you wish to join a network predominantly comprised of new ASIC miners while using an older, less potent model.

Similarly, certain pools may be inaccessible without specialized mining software. Occasionally, they may even require their custom-built program to function.

Compatibility with your mining setup should be your top priority, as this feature or characteristic will only matter if the mining pool supports your hardware.

Mining Pool Payment System

Not all pools compensate their miners for the same amount of labour or for the same amount of time. Pool administrators utilize different systems to calculate, distribute, and execute payments.

Some of the most commonly used are:

Proportional payments: Payments are based on a division into rounds, where a round is an interval between blocks discovered by the pool. After each round, when the pool finds a block and receives the reward, the operator retains a charge and payments are distributed to miners in direct proportion to the number of shares they submitted during this round.

Pay-per-share: When a participant submits a share, they are promptly rewarded the expected value of this share’s contribution, less applicable fees, regardless of whether the pool discovers a block. The operator retains all rewards for successfully solved blocks. The payment per share is, therefore, a predetermined amount that is known in advance.

Pay per last N shares (PPLNS): Instead of paying per round, pool operators define a specific period of time (N). The miners are compensated for the submitted shares within the specified time frame.

In addition, some Bitcoin mining pools may require miners to attain a minimum threshold before receiving payment. This is particularly essential for miners with limited output, as it may take them longer to reach the threshold. In contrast, administrators may also limit how much each miner can withdraw from the pool during specified time periods. Again, your setup and computing capacity will determine which payment system is ideal for you.

Task Assignment Methods

Mining pools use different mechanisms to assign work to their miners and determine their share earnings.

Individual Bitcoin miners are granted complete freedom to select their difficulty targets and work ranges by some Bitcoin mining pools. This allows them to complete as much work as they desire without requiring assignments from the pool.

Other pools assign labour units — particular nonce ranges — to miners according to their relative hash rate. Most powerful miners may get a larger quantity of labour while their less powerful counterpart receives fewer tasks.

The reward pool adjusts accordingly. Operators do so to ensure optimum output and efficacy, thus optimizing revenue for every miner.

Mining Pool Size & Total Hashrate

Pool size is yet another factor that can impact your mining revenue, although proportionally, it tends to remain relatively constant over time.

Larger pools have a greater possibility of resolving obstacles. As a result of having to disseminate rewards to a more significant number of miners, however, these rewards are frequently diminished.

In contrast, tiny pools offer greater profits when a block is solved, but this occurs less frequently.

It boils down to whether you prefer a high probability with lesser rewards or a low probability with more significant revenue.

Pool Transparency & Fees

Each mining pool has its operator, the entity or organization that administers it, determines the method of task assignment and reward distribution, etc.

Individual miners who connect to mining pools can examine the data of other mining pools to ensure that their administrators are trustworthy and disseminating rewards equitably.

For greater transparency, some mining networks make this information accessible to everyone online and in real-time.

Each Bitcoin mining network has a unique business model on the same level. Some pools charge a participation fee based on a variety of formulas.

Other pools may require additional costs, such as entry commissions, the acquisition of specialised mining software, or the retention of transaction fees and distribution of only block rewards.

Verify that the pool operators are well-intentioned, provide transparent information about pool performance and charge calculations, and act equitably by evaluating these factors.

Best Mining Pool FAQs

Is it better to mine solo or in a pool?

Pool mining can generate a steady income of lesser value. Solo mining, on the other hand, needs to be more consistent and takes years to mine a single block. Pooled mining can generate 1% to 2% more revenue through the pools’ extended polling. Solo mining is inefficient due to the availability of only network draw.

Do you need Bitcoin wallets?

Undoubtedly, Bitcoin mining requires a Bitcoin wallet. The mining pools will request your Bitcoin address to deliver rewards and payments. Other mining pools that assist you in mining additional cryptocurrencies, such as Litecoin or Ethereum, will require their respective wallet addresses.

Why are miners important?

The miner adds transaction records to the blockchain as part of the Bitcoin mining procedure. This process requires a tremendous amount of computing power to execute. Each Bitcoin miner contributes to the decentralized peer-to-peer network to guarantee the integrity and security of the blockchain network. The miner’s network records, processes, and validates the transactions; no central authority exists.

These transactions are entirely transparent, but personal information is anonymized. Miners are responsible for validating blocks of transactions to earn rewards. A new BTC is added to the blockchain when a new transaction block is added to the network. So, not only do miners protect the blockchain network, but they also validate transactions. To ensure the correct functioning of the blockchain network, miners are continuously engaged in network maintenance.

What are Mining Pools vs. Cloud Mining differences?

Bitcoin Mining Pools are third-party-operated and -organized organizations that oversee the hashing power of Bitcoin miners worldwide. They divide the resulting Bitcoin proportionately by the amount of hashing power contributed to the pool.

In contrast, Cloud Mining is a viable alternative if you are interested in mining but are willing to purchase expensive apparatus. It enables you to buy time duration on the mining equipment of others. Typically, this mining operation utilizes cloud computing so that software, servers, and storage can be accessed from anywhere.

Is the Bitcoin mining pool profitable?

Mining Bitcoin on your own can be costly due to the hardware required, but joining a mining network can earn respectable profits. Participating in a mining pool increases the likelihood of a reward because the mining difficulty increases with each coin awarded. You should join a Bitcoin mining pool unless you have a cutting-edge ASIC miner.

Can I mine Bitcoin but not join a pool?

Indeed, you can. However, joining a mining pool is the most profitable method to mine Bitcoin, as the difficulty of the process increases with each coin awarded. To be competitive, it is recommended to join a mining pool unless you have the resources to construct your own or purchase multiple ASIC miners with the latest technology.

How to mine Bitcoin at home?

Certainly, it is possible to mine Bitcoin at home. Given the complexity of Bitcoin mining, you can invest in the proper hardware. If you are mining Bitcoin at home, you must consider the electricity consumption of your hardware. The rate of achievement will be low. Because cryptocurrencies are so prevalent today that even kindergarteners mine Bitcoins. You require specialised mining hardware to achieve any level of success.

Final Thoughts

The mining of cryptocurrencies is one of the best methods to generate passive income. Not only does it keep the blockchain network operational, but it also facilitates the circulation of cryptocurrencies. While some mining pools require significant computational capacity, the finest mining pools do not require costly hardware to mine Bitcoin and other digital currencies.