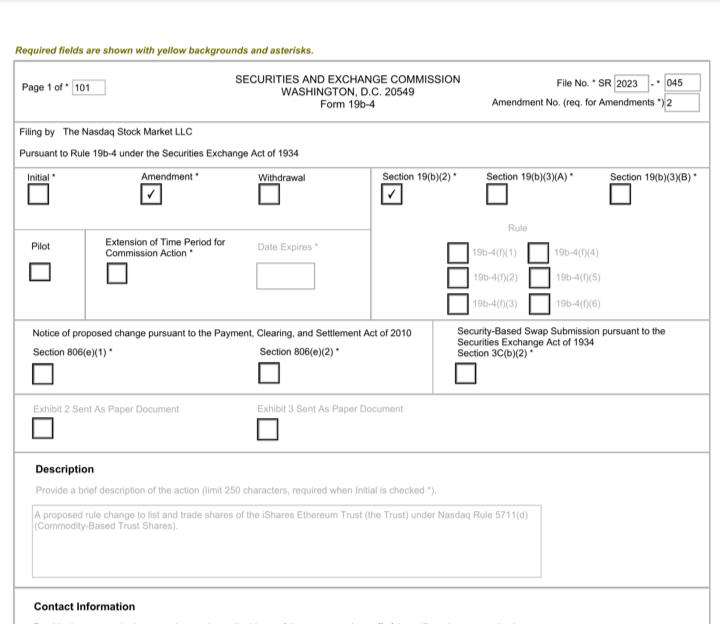

BlackRock has filed a new application for a spot Ethereum ETF following the success of BlackRock’s Bitcoin ETF, the market’s second largest ETF. Specifically, the 19b-4 document excludes all Ethereum staking services.

The filing also outlines that BlackRock’s iShares Ethereum Trust will operate under Nasdaq Rule 5711(d), which governs Commodity-Based Trust Shares. This amendment entirely replaces the previous filing and has been approved by senior Nasdaq management, with necessary communications to the Board.

BlackRock Drops Staking From Spot Ethereum ETF

The iShares Ethereum Trust, sponsored by iShares Delaware Trust Sponsor LLC (a BlackRock subsidiary), will issue shares representing fractional interests in its net assets, consisting mainly of ETH and cash held by a custodian. The trust will not engage in Ethereum staking or any activities to earn additional ETH. The filing specifies:

“The Shares have been designed to remove the obstacles represented by the complexities and operational burdens involved in a direct investment in ether, while at the same time having an intrinsic value that reflects, at any given time, the investment exposure to the ether owned by the Trust at such time, less the Trust’s expenses and liabilities.”

BlackRock Fund Advisors will serve as trustee, with Wilmington Trust, National Association, as the Delaware Trustee. Coinbase Custody Trust Company will manage the trust’s assets in a cold storage custody account, and Coinbase Inc., an affiliate of the Ether Custodian, will act as the prime broker handling trading activities.

Simplified Investment in Ethereum

The iShares Ethereum Trust aims to mirror ETH price performance by holding ETH without engaging in staking. This approach offers an alternative to directly buying and holding ETH, which can be complex and stressful for investors.

The Bank of New York Mellon will be the custodian and administrator of the trust’s cash holdings. The trust agreement permits the trustee to delegate duties to agents, with significant responsibilities assigned to the trust administrator and other affiliates.

Exclusion of Incidental Rights and IR Virtual Currency

The trust may acquire rights to other virtual currencies or assets related to its ETH holdings from events like forks or airdrops. However, the trust’s sponsor will ensure these incidental rights and virtual currencies are permanently abandoned and not included in the trust’s net asset value (NAV).

The iShares Ethereum Trust is not registered under the Investment Company Act of 1940. Instead, it operates under a regulatory framework set by the SEC and Nasdaq, ensuring compliance with all required rules and guidelines. The trust’s shares will be registered with the SEC through a Form S-1 registration statement detailing the trust’s structure, operations, and objectives.