What is Altcoin Season?

Altcoins are all non-Bitcoin cryptocurrencies. When referring to Altcoin Season, it is a crypto market phase where the prices of altcoins surge dramatically and tend to outperform Bitcoin.

The term ‘altcoin’ was created as a combination of ‘alternative’ and ‘coin’. It refers to any coin or token which is not Bitcoin. Many altcoins have been developed since the birth of Bitcoin, such as Ethereum (ETH), Solana (SOL), Toncoin (TON), and memecoins. Altcoins come with unique features and practical utilities more than mere digital medium of payment. These alternatives can offer faster throughput, lower fees, improved security, and recreational purposes and might draw significant attention from crypto investors, leading to what is called altcoin season.

During altcoin season, the aggregate market cap of all altcoins surpasses Bitcoin in a bull run in the crypto market. This surge in price and trading volume for altcoins gains traction among investors, fostering investments in emerging cryptocurrencies rather than Bitcoin.

Understanding Altcoin Season

Altcoin Season vs. Bitcoin Season

When it is Altcoin Season, the market’s focus shifts from Bitcoin to alternative cryptocurrencies. This move is attributed to a significant rise in the prices and trading activity of altcoins that could outperform Bitcoin. Several different elements could also be considered, such as speculative trading, the introduction of new projects, technological improvements, and increased utility that attracts investors.

Typically, altcoin season occurs after Bitcoin has experienced a prolonged price surge, making it less affordable for average investors. They will have no other choice but to turn to altcoins.

By contrast, Bitcoin Season is marked by the market’s heightened focus on Bitcoin. When this season occurs, Bitcoin’s dominance index – a measure of Bitcoin’s market cap relative to the total crypto market cap – rises, meaning that investors are in favour of the largest coin. This shift often happens when the market sentiments are pessimistic or amidst market volatility, and investors gravitate towards Bitcoin and stablecoins, seeking safer investments.

What Causes Altcoin Season?

Decreasing Interest in Bitcoin

Historically, after a remarkable ceiling trend, Bitcoin’s price tends to stabilise and stays high for extended periods. This can lead market participants seeking short term gains or looking to diversify their holdings to sell their BTC and shift to altcoins. Additionally, the high price of Bitcoin can deter new crypto investors, and they have no choice but to choose altcoins instead.

New Crypto Trends: DeFi, NFTs, and Web 3

The launch of new projects or updates to existing altcoins can create excitement in the market and drive up demand, especially when these altcoins are part of a broader trend or offer unique features or solutions to unresolved issues in the crypto space.

For instance, in 2020, the rise of decentralised finance (DeFi) fueled an altcoin season. In 2021, the rapid growth in popularity of nonfungible tokens (NFTs) triggered another altcoin surge. Similarly, in early 2022, the emergence of Web3 drove a new wave of altcoin adoption.

Bullish Sentiment in the Wider Economy

During bull markets, the increased appetite for risk and higher returns often benefits even small market cap altcoins thereby boosting the overall market cap of alternative coins.

Previous Altcoin Seasons Since the Birth of Bitcoin

Late 2017 – Early 2018

In this altcoin season, the Bitcoin dominance index started the year at 87% and plunged to an all-time low of 32% during the altcoin bubble peak in January 2018. Conversely, altcoins’ dominance rose dramatically, showing an appreciation in altcoin valuations.

The total cryptocurrency market cap experienced explosive growth, rising from around $30 billion in early 2017 to over $600 billion roughly a year later. Many altcoins reached all-time highs during this period, primarily due to the ICO boom, where numerous new tokens were launched, attracting significant investment and speculative interest.

Early 2021

In 2021, the introduction of DeFi projects, non-fungible tokens (NFTs), and memecoins has driven the boom of a new altcoin season. The Bitcoin dominance index quickly fell from 70% to 38%, while altcoins’ market share doubled from 30% to 62%.

Some of the best performers were Solana, Polygon, Dogecoin, Shiba Inu, PancakeSwap, and BNB. The total cryptocurrency market cap surged past $2 trillion for the first time, led mostly by altcoins. This period was the golden age of crypto, the largest bull run in the crypto market to date, with the total market cap soared to an all-time high (ATH) of over $3 trillion by the end of 2021.

Both periods highlight the cyclical nature of ‘altcoin seasons.’ However, the market has witnessed significant growth in complexity, with over 10,000 altcoins in 2021 and a notable presence of stablecoins in the market cap rankings.

Is 2024 the Altcoin Season?

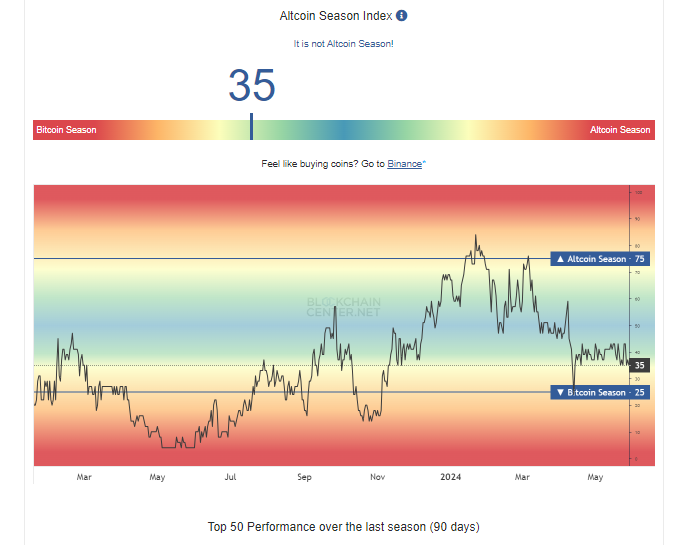

The current bullish trend in the crypto space is mostly attributed to the Bitcoin halving in April 2024 and spot Ethereum ETF approvals by the U.S. Securities and Exchange Commission (SEC) recently in May 2024. Usually, when Ethereum starts to rally, it can signal the beginning of an altcoin season. However, for the season to fully commence, other metrics must be clear. According to blockchaincenter.net, the altcoin season index now stands at 35. To indicate an altcoin season, 75% of the top 50 altcoins must outperform Bitcoin.

The future altcoin season could see rallies in remarkable sectors of the crypto market rather than ICOs, DeFi, and NFTs like previous ones. Networks and firms are focusing on Artificial Intelligence (AI), GameFi, metavers, DePIN, and web3 landscapes.

AI has been the leading narrative within crypto space. Notable performers such as Akash Network and Render, which have seen price surges of 1,170% and over 1,000%, respectively. In April 2024, Andreessen Horowitz raised $7.2 billion for new tech venture funds, with $1.25 billion allocated to AI infrastructure.

DePIN and GameFi subjects also gain significant investors’ traction. DePIN firm Roam has recently successfully received around $11 million in its series A funding. Meanwhile, the GameFi sector made a strong comeback, with companies entering the blockchain gaming arena and projects like Immutable X and Roin witnessing significant price increases of nearly 480% and 580%. Moreover, Pantera Capital continued to invest $8 million in GameFi platform InfiniGods, becoming the game’s exclusive investor in series A funding. At the time of writing, the GameFi sector boasts a market cap of over $25 billion.

How to Identify an When an Altcoin Season Begins

In fact, there is no exact formula to predict when an altcoin season happens. However, we have key indicators that signal the season’s potential arrival:

- Rising Altcoin Dominance: This metric tells how the market cap of all altcoins is compared to Bitcoin’s market cap. When altcoin dominance index rises significantly, it suggests that investors are shifting their focus towards altcoins.

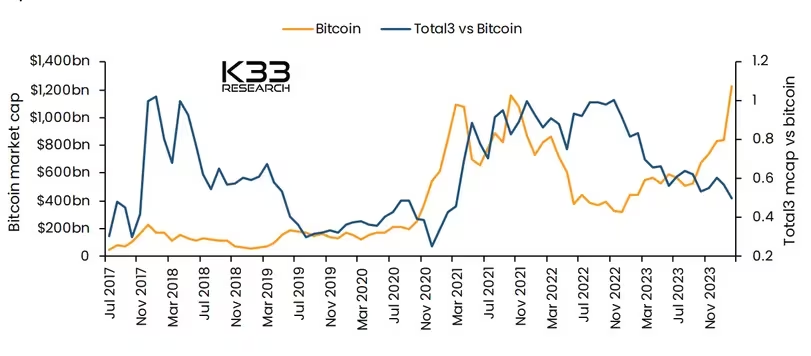

- Increased Trading Volume: A noticeable surge in trading volume across various altcoins can signal growing investor interest and potential price increases. Recent data from K33 Research indicates that meme coins such as DOGE, SHIB, BONK, PEPE, and WIF have experienced gains of at least 40%, suggesting that an altcoin season may be approaching in 2024.

- Positive Overall Market Sentiment: Bullish sentiment in the cryptocurrency market often extends to altcoins, driving up their prices. Analysts at Swissblock suggest that if Ethereum (ETH) breaks above $3,500, it could mark the beginning of a period where altcoins outperform Bitcoin during the current bull market cycle.

- Specific Events: The launch of a promising altcoin project or favourable regulatory developments for altcoins can act as catalysts for an altcoin season. These events can significantly boost investor confidence and lead to increased investment in altcoins.

How to Take Advantage of Altcoin Season?

As the next altcoin season approaches, here are some key strategies to consider for maximising your investment potential:

Research and Diversify Holdings

- Thorough Research: Deep dive into the fundamental and technical aspects of potential investments. Analyse the project’s use case, team, market position, and technological innovation to identify the best altcoins to buy.

- Diversification: Spread your investments across different altcoins to mitigate risk and enhance potential returns. Diversifying ensures that your portfolio is not overly dependent on the performance of a single asset, thus increasing your chances of overall success

Time Your Entries and Exits

- Technical Analysis: Utilise tools like support and resistance levels and the Relative Strength Index (RSI) to identify optimal entry and exit points. These indicators help monitor price trends and market sentiment, providing insights into when to buy or sell. However, keep in mind that you understand the coins thoroughly, so try to incorporate fundamental analysis.

- Strategic Timing: Establish clear entry and exit strategies to manage risk effectively. Experienced investors use these tools to make informed decisions and set profit-taking points, minimising losses and maximising gains during volatile periods.

Buy New Altcoins in Presale

Engage in presale events for new altcoins to gain early access to promising projects at discounted rates. Investigate upcoming initial coin offerings (ICOs) and presale opportunities to discover innovative projects with high growth potential. Early participation can provide substantial returns if the project succeeds.