The ongoing debate in the crypto industry now revolves around how blockchains should expand, with advocates divided into favouring “modular” versus “monolithic” approaches.

Modular scaling involves diverting smaller transactions to layered solutions like layer-2 and even layer-3, which then settle back to a primary chain. This method, endorsed by Ethereum, often leads to network fragmentation and poor user experience.

By contrast, monolithic scaling, which is best exemplified by Solana, concentrates on keeping all transactions within a single chain and enhancing network efficiency through hardware, software, and consensus upgrades to boost throughput. Although this approach aims to improve user experience, it risks compromising vital blockchain features – decentralisation and resilience.

The core offering of permissionless chains extends beyond transaction processing, it provides secure blockspace—a scarce asset similar to fuel, but in a decentralised economy. The allocation of secure blockspace is governed by pricing, with higher prices promoting efficient use and reducing demand.

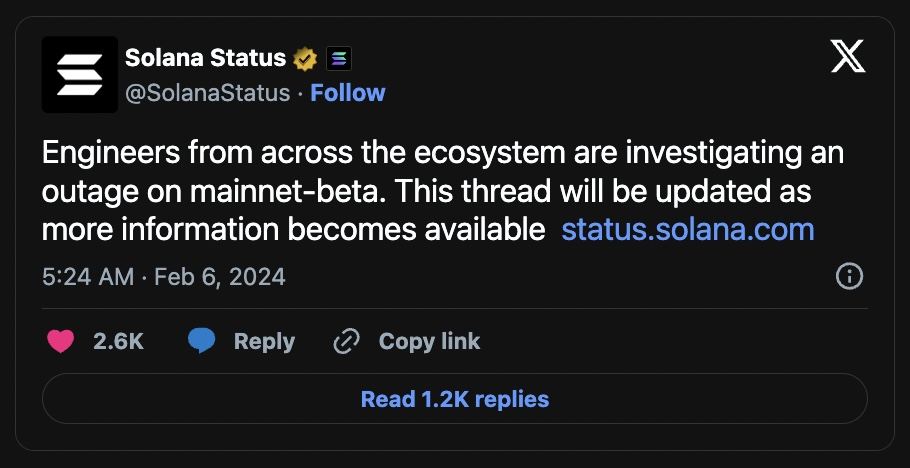

During the recent surge in memecoin activity, Solana encountered increased demand that led to high rates of transaction failures. Users exacerbated the situation by submitting transactions repeatedly. This situation reflects an underpricing of secure blockspace.

While Solana developers are enhancing fee markets to manage demand, successful upgrades might result in higher fees during peak periods, potentially excluding smaller traders. This contrasts with modular chains that offer various tiers of blockspace at different costs.

Scaling via hardware and software improvements could attract more small transactions but risks centralising the network infrastructure and jeopardising stability.