Bitcoin Cash experienced turbulence amidst its second-ever halving event on Wednesday. Following a three-month-long rally, the cryptocurrency faced a brief setback before quickly recovering as the blockchain underwent the halving process, wherein mining rewards are halved.

Bitcoin Cash, a proof-of-work blockchain network and cryptocurrency aimed at faster and cheaper transactions compared to Bitcoin, saw its first halving on April 8, 2020, reducing miner rewards from 12.5 BCH to 6.25 BCH.

Leading up to the halving, there was speculation, driving Bitcoin Cash’s price up by 147.85% over three months and 24% over the last 30 days.

However, on the day preceding the halving, Bitcoin Cash experienced a 9.94% drop in price, falling to $572.21 according to CoinMarketCap data. Nevertheless, post-halving, it swiftly rebounded to $604, marking a surge of approximately 5.5%.

The recent price dip caused liquidations totaling $3.9 million, predominantly affecting long positions at $3.3 million, with short positions at $569,540, as per CoinGlass data.

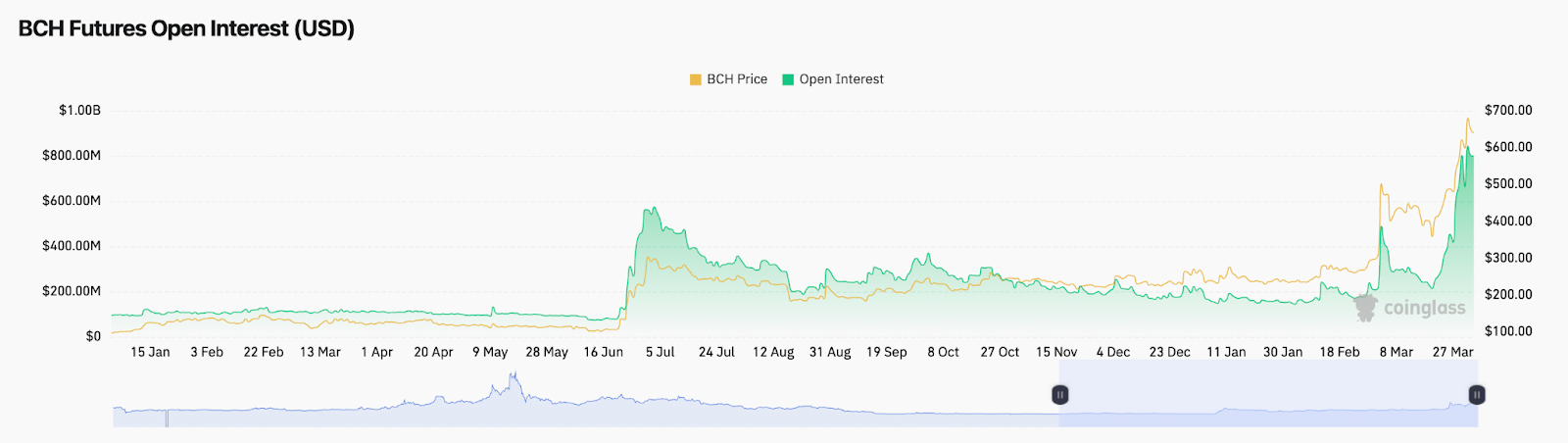

On March 29, the open interest (OI) in Bitcoin Cash futures perpetual contracts reached an all-time high of $708.75 million, which has since risen further to $799.23 million.

Meanwhile, one X user, “DavidShares,” with 17,500 followers, noted that many miners had switched to mining Bitcoin ahead of the halving. He also observed a decline in hash rates post-halving, with the network validating only four blocks since the event, according to Bitcoin Unlimited data.

Today Bitcoin Cash encountered extremely slow and intermittent blocks as it headed into the Halving event.

Due to the shared hashing algo between BTC and BCH, miners prior to the halving block 840000, had already switched over to mining BTC in anticipation of the halving and… pic.twitter.com/9v46R70Ngx

— DΛVID 🟢 (@DavidShares) April 3, 2024

Bitcoin Cash forked off from Bitcoin in 2017 due to disagreements within the community over scaling and reducing transaction fees. Two years later, it split again, causing controversy among miners as some had not upgraded to the new chain, resulting in resource wastage.

In November 2019, Cointelegraph reported that miners spent resources mining 14 empty blocks on the old chain, which the majority of the Bitcoin Cash network considered invalid and rejected.

The highly anticipated Bitcoin halving is scheduled for April 20, just 16 days from now.