With the volatile nature of the forex market, traders seek reliability and safety for their investments. IC Markets offers automated trading solutions, using intelligent algorithms to trade currencies based on user-defined parameters. Read our IC Markets review to know if IC Markets is the right choice for your online trading needs.

IC Markets Overview

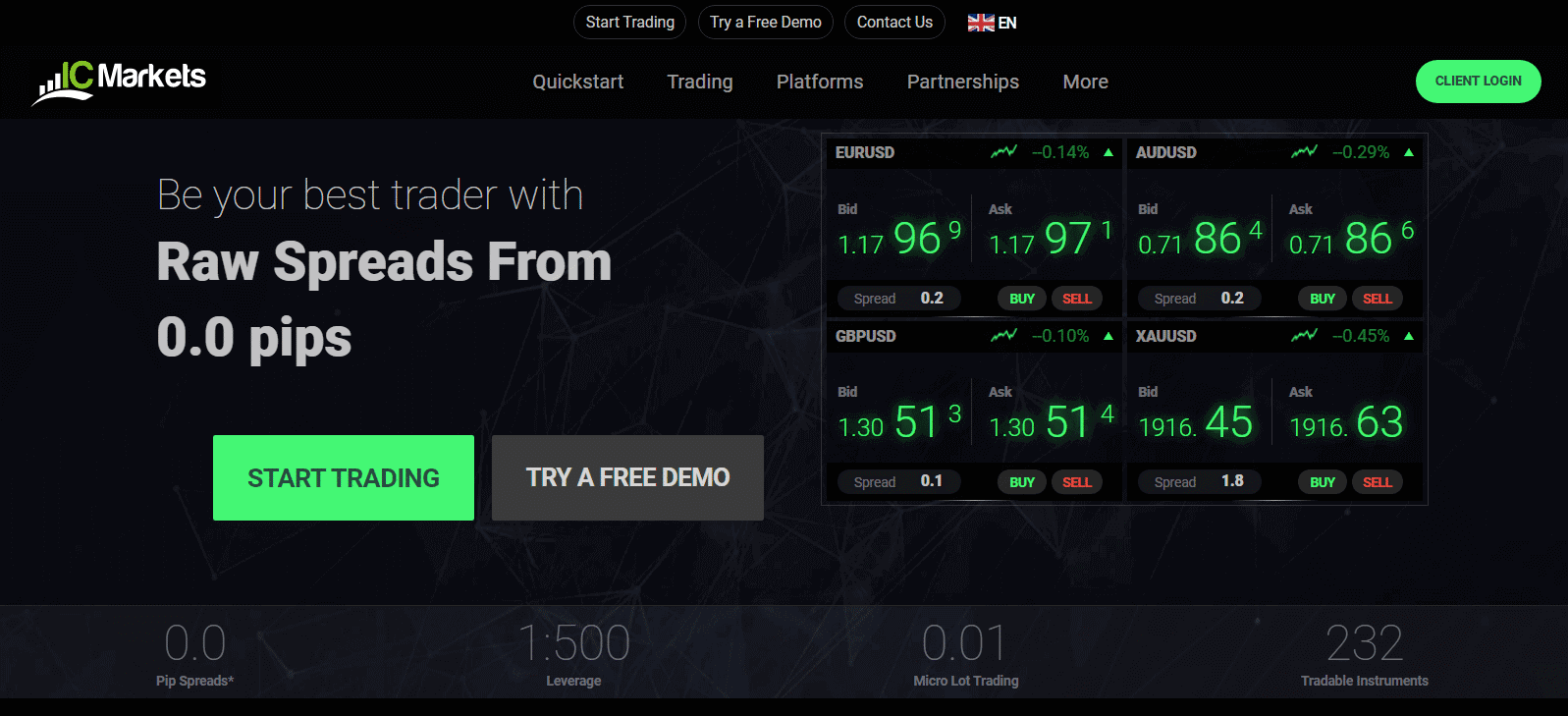

IC Markets is a regulated CFD broker headquartered in Australia. It is renowned for providing high-quality online trading solutions through its exceptional platforms, catering to traders of all stripes. Beyond its primary focus on forex trading, IC Markets extends its services to encompass futures, stock indices, and commodities. The appeal of IC Markets lies in its ability to draw traders with attractive features such as high leverage, minimal spreads, and competitive commission fees.

IC Markets stands out with its adherence to regulatory standards, being overseen by the Australian Securities and Investments Commission (ASIC), the Seychelles Financial Supervisory Authority (FSA), and the Cyprus Securities and Exchange Commission (CySEC). This trifecta of regulatory oversight ensures the utmost safety of online transactions conducted through the platform.

Pros

Cons

IC Markets Target Users

IC Markets caters to a broad spectrum of traders, from those who employ discretionary strategies to day traders and even those using automated trading approaches. The platform is well-suited for advanced traders and institutional investors seeking exceptional trading conditions characterised by lightning-fast order execution.

The broker ensures users can capitalise on price fluctuations and execute orders with minimal delays. With an average latency speed of under 40 milliseconds, traders can expect rapid order execution. IC Markets welcomes all trading strategies, including scalping, hedging, and high-frequency algorithms.

For newcomers, IC Markets offers a wealth of educational resources and valuable tools like AutoTrader and ZuluTrade, designed to assist individuals who prefer a more passive investment approach.

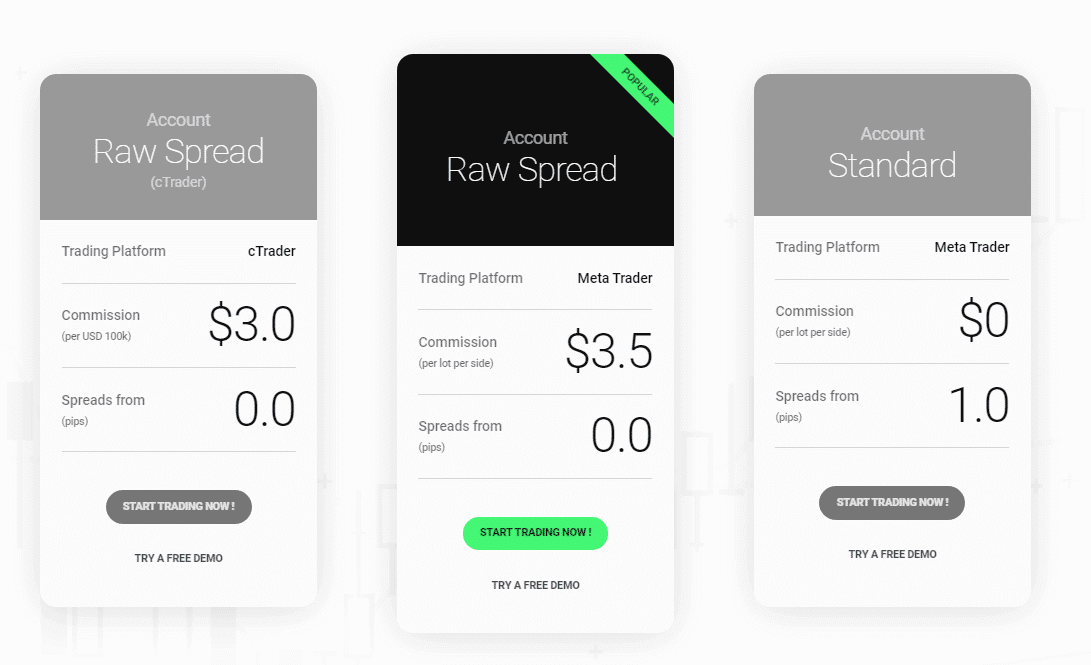

IC Markets Account Types

IC Markets presents three distinct account types tailored to suit your trading needs, allowing you to access the most popular assets 24/5. Besides, a demo account is helpful for you to familiarise yourself with the broker’s services without using real funds. Each account type comes with its unique fee structure and compatible trading platform:

cTrader Raw Spread Account

- Ideal for active day traders and scalpers

- Compatible with the cTrader platform

- A commission fee starting at $3

- A leverage of 1:500

- Trading fees commencing at 0 pips

- Low broker spreads

Raw Spread Account

- Suited for expert advisors, scalpers, and day traders

- Compatible with the MetaTrader 4 & 5 platforms

- A commission fee starting at $3.5

- A leverage of 1:500

- Trading fees commencing at 0 pips

- The lowest broker spreads

Standard Account

- Recommended for novice forex traders

- Compatible with the MetaTrader 4 & 5 platforms

- No commission fee

- A leverage of 1:500

- Trading fees at 1 pip

- Slightly higher broker spreads

Islamic Account (Swap-Free Account)

- Designed for Islamic traders

- Compatible with the MetaTrader 4 & 5 platforms

- A flat commission fee

- A leverage of 1:500

- No swap or interest payments on trades

- Lower broker spreads

When assessing these IC Markets account options, the Raw Spread Account stands out with its ability to offer the lowest spreads compared to the Standard Account or Islamic Account.

IC Markets Trading Platforms

IC Markets provides a selection of three versatile trading platforms suitable for web-based and mobile trading, accessible across all devices. While these platforms are not proprietary, traders can choose from third-party options.

MetaTrader 4 (MT4): It’s widely favoured by seasoned investors and traders for its user-friendly interface and robust algorithmic trading capabilities. This platform boasts a rich set of trading features, including automated trading, customisable trade settings, an array of technical indicators, and comprehensive charting tools.

MetaTrader 5 (MT5): As an industry standard for traders, MT5 represents the next generation of trading platforms designed to enhance your trading journey alongside your account. This platform integrates advanced order management and charting tools, enabling you to execute trades swiftly and efficiently while accommodating automated forex trading.

cTrader: cTrader stands out for its exceptional functionality and rapid order execution, making it an attractive choice for traders. The platform leverages automated trading software and incorporates robust back-testing features for precise order placement and execution. cTrader provides instant access to deep liquidity across various base currency pairs and equity indices.

These platforms collectively empower traders with diverse tools and features, ensuring you can find the ideal fit for your desktop and mobile trading needs.

IC Markets Trading Instruments

IC Markets provides an extensive array of financial instruments for trading, offering traders the advantage of enhanced liquidity. Here’s a summary of the various asset classes available for trading with IC Markets:

Forex CFDs: IC Markets offers trading opportunities across 60 currency pairs. Benefit from lower spreads, increased leverage options, and deep market liquidity to optimise your trading profits.

Indices CFDs: IC Markets grants access to indices from major stock exchanges, including the Australian Stock Exchange, NYSE, and Nasdaq. These assets feature tight spreads and leverage of up to 1:200, all without commission charges.

Commodities CFDs: Trade in major commodities such as energy, precious metals, agriculture, and futures with IC Markets. Enjoy competitive spreads and leverage of up to 1:500.

Bond CFDs: Diversify your investment portfolio by trading bond CFDs. IC Markets offers the opportunity to trade six bonds issued by the US, UK, Europe, and Japan, with leverage of up to 200:1 and zero commissions, allowing you to hedge against potential losses effectively.

Crypto CFDs: IC Markets stands out by providing CFDs for the world’s most popular cryptocurrencies. Enjoy leverage of up to 20:1 when investing in assets like Ethereum, Bitcoin, Litecoin, Dash, Ripple, NameCoin, EmerCoin, Eos, and PeerCoin.

Futures: Explore a variety of global futures, including the ICE Dollar Index and the CBOE VIX Index, with IC Markets. Trade futures CFDs with leverage of up to 200:1 and zero commission fees.

Stocks CFDs: IC Markets’ Stocks CFDs open doors to trading renowned companies like Facebook, Apple, and BHP Billiton. Access over 730 large-cap Stocks CFDs across the NASDAQ, ASX, and NYSE stock exchanges on the IC Markets MetaTrader 5 platform, featuring fast execution and competitive pricing.

IC Markets Pricing Plans

IC Markets boasts some of the industry’s most competitive spreads. The broker’s cTrader Account and Raw Spread Account offer spreads that commence at a remarkable 0.0 pips, while the Standard Account starts at 1.0 pips. Commission charges are applied depending on the chosen account type, with the cTrader Raw Spread Account and the Raw Spread Account incurring $3 and $3.5 per trade, respectively. Notably, the Standard Account does not involve any commission fees.

IC Markets presents a pricing and fee structure that ranks among the finest in the field. The spreads offered are impressively narrow, and the associated commissions are affordable, particularly in light of the remarkably tight raw spreads provided by the two account types.

Furthermore, IC Markets supports leverage up to 500:1, enabling users to amplify the capital they allocate to their accounts. The broker charges no fees for client deposits or withdrawals, and notably, there are no inactivity fees to be concerned about.

IC Markets Regulation

IC Markets operates under the regulation of three prominent authorities: the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investments Commission (ASIC), and the St. Vincent & the Grenadines Financial Services Authority (SVGFSA).

IC Markets complies fully with global regulations about Anti-Money Laundering (AML) and Counter Financial Terrorism.

The broker prioritises safeguarding client funds by maintaining segregated accounts and providing full insurance coverage. It also meets all requirements related to internal risk management and capital adequacy requirements, with regular external audits ensuring compliance.

Overall, the broker’s commitment to transparency and regulation protects client interests.

IC Markets Reliability & Security

IC Markets offers a selection of three major trading platforms: cTrader, MetaTrader 4, and MetaTrader 5, accessible via desktops, web browsers, and mobile devices running Android or iOS. The broker’s platforms are renowned for their ultra-low latency order execution.

IC Markets connects to two Equinix data centres in London and New York, guaranteeing exceptionally reliable and secure connectivity for traders. These data centres use dedicated fibre-optic networks to ensure instant order execution with minimal slippage.

The trading platforms are reliable and user-friendly, offering advanced features such as built-in spread monitoring, automated trade closure with custom order templates, and ladder trading. Real-time pricing updates are also available, and during our testing, we encountered no issues with these platforms.

IC Markets has received numerous accolades over the years for its commitment to providing outstanding trading conditions, including awards such as:

- ADVFN International Financial Awards Best ECN Broker 2019

- Forex Magnates Awards Best Retail Broker Execution 2013 Winner

- Asia-Pacific Financial Investment Association Financial Institution of the Year 2012

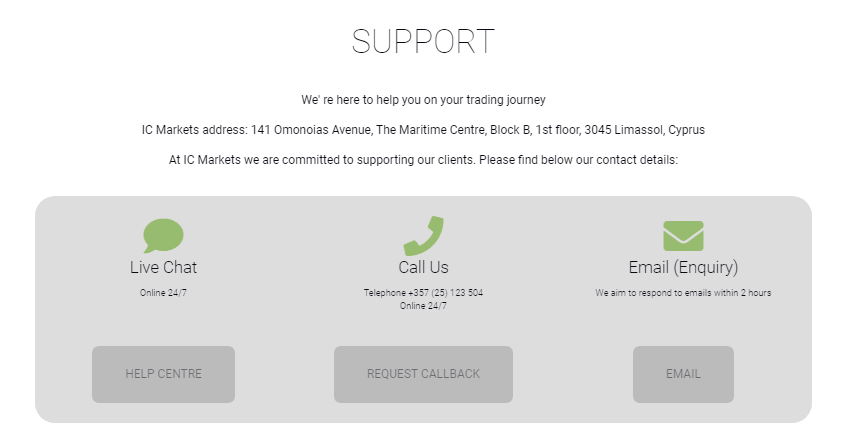

IC Markets Customer Support

IC Markets offers 24/7 multilingual customer support, catering to traders worldwide. Support can be accessed through live chat, email, or phone, with a FAQ feature available on the website’s ‘Help Center’ section.

However, live chat support is rated negatively for slow response times and frequent offline periods. Email support proved more reliable, with responses to queries within 24 hours. Notably, the phone support option impressed us with its swift and professional response system, delivering a high level of service.

IC Markets FAQs

Can I create a demo account?

IC Markets users can easily register for a demo account by providing basic details such as their country of residence, first name, last name, email, and phone number. This demo account is accessible across all three account types, allowing users to test each trading platform’s features thoroughly.

Does IC Markets support mobile trading?

Yes, IC Markets clients can engage in mobile trading using their smartphones and other internet-connected mobile devices. The broker’s platforms are fully compatible with Android and iOS operating systems, and browser-based versions are available for enhanced accessibility.

Are my funds secure with IC Markets?

IC Markets prioritises the security of customer funds by holding them in segregated accounts. Besides, all customer funds are fully insured, providing another layer of financial security.

How to make a deposit?

IC Markets offers traders a range of deposit options in 10 different base currencies. The minimum deposit requirement is $200, which can be transferred via credit card, debit card, wire transfer, or other payment methods such as PayPal, Skrill, Neteller, Bpay, FasaPay, Klarna, POLI, Rapidpay, Bitcoin Wallet, and many more. IC Markets does not impose any fees on deposits.

How to make withdrawals?

IC Markets allows traders to make withdrawals using their preferred payment method, free of charge. During the platform review, you must submit a ‘withdrawal request’ from our Secure Client Area. Subsequently, your profits are transferred to our bank account within 48 hours. Similar to deposits, the processing time for withdrawals varies depending on the chosen transaction method and the trader’s jurisdiction.

Final Thoughts

IC Markets is dominant in order execution and foreign exchange trading volumes. With a compelling array of advantages, such as quick order execution, narrow spreads, substantial liquidity, value-enhancing tools, and a diverse asset selection, the platform is incredibly appealing to investors, particularly seasoned professionals seeking top-tier trading conditions.

In addition to its steadfast and secure trading environment, IC Markets boasts full regulation across three jurisdictions, reaffirming its dedication to transparency and prioritising client welfare. IC Markets also significantly emphasises customer service, delivering round-the-clock support to its users.