Japan’s ruling Liberal Democratic Party is advocating for “immediate” reforms to the country’s crypto tax regulations. According to an official party release and a report from the Japanese-language media outlet CoinPost, the party’s web3 project team introduced a “White Paper” on April 12, outlining proposed crypto tax policy changes.

The proposed reform suggests separating crypto asset transaction profits and losses for self-assessment taxation, as opposed to the current system, which requires crypto traders to include profits and losses in their annual income declarations. The team emphasised the need for immediate action on this issue, and the report has been submitted to the party’s Digital Society Promotion unit.

Currently, Japanese taxpayers must declare all crypto-related earnings as “other income.” This tax structure leads to low-earning individuals paying as little as 11% on crypto trading profits, while those in higher tax brackets could face rates of over 50%. In most other countries, crypto trading profits are taxed as capital gains, similar to assets like stocks and shares.

The Bank of Japan ended its eight years of negative interest rates during its March meeting, matching market forecasts.https://t.co/BjzD4RRMeI pic.twitter.com/j57T8OyqTK

— TRADING ECONOMICS (@tEconomics) March 19, 2024

Campaigners have long called for Tokyo to adjust its approach, and Prime Minister Fumio Kishida has demonstrated a pro-web3 stance, supporting NFT-powered economic growth and indicating a willingness to reform tax laws.

Kishida’s stance led to tax reform for corporations, allowing them to forego taxes on “unrealized” gains—referring to crypto assets that appreciate in value over a financial year but are not sold for fiat currency during the same period.

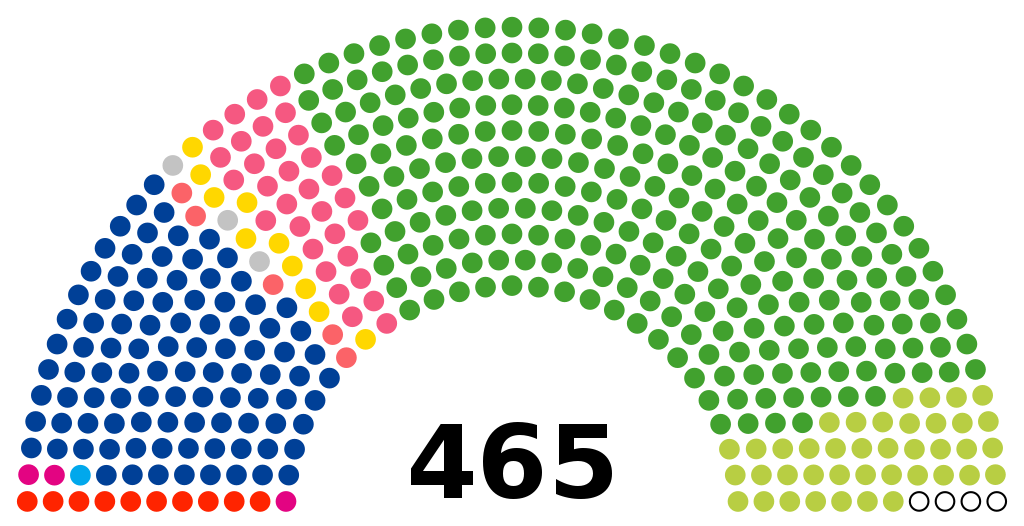

If the Digital Society Promotion unit approves the individual trader tax reform, it will progress to the Political Affairs Research Council. If the council approves, the tax reform will become official party policy, enabling lawmakers to present a bill to the National Diet.

Though these steps may take time, they should not pose significant obstacles to the web3 project team’s proposed changes. Given the ruling party’s long-standing dominance in Japanese politics, it appears to be a matter of “when,” not “if,” for Japanese crypto traders hoping for tax reform.

The white paper’s authors aim to place Japan at the forefront of the web3 revolution, advocating for the development of blockchain technology in social infrastructure projects. In addition to separating crypto profits taxation from income tax, the proposed changes would allow traders to defer losses for up to three years.

The white paper’s authors also proposed revisiting Japan’s strict crypto leverage trading rules, which have challenged Japanese exchanges for some time. Japanese crypto industry insiders have responded positively, noting that the white paper addresses many of their requests and sets the stage for future reforms.