Wealth management firms are expected to increase their holdings in Bitcoin exchange-traded funds (ETFs), according to Bitwise CEO Hunter Horsley. This anticipation coincides with the growing interest in Bitcoin ETFs, particularly post-halving.

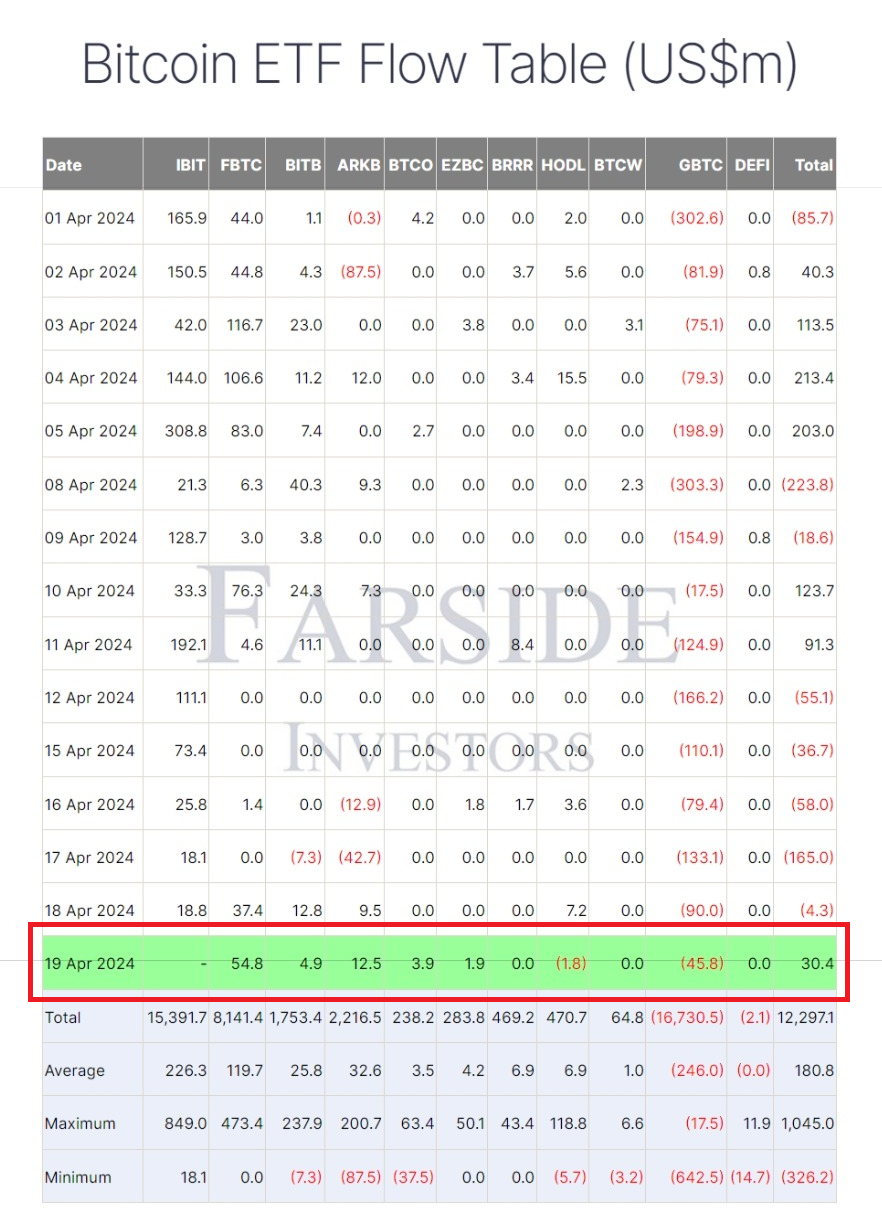

Horsley’s forecast reflects the general market sentiment that ETF demand is rising. Recent data shows a positive net inflow into Bitcoin ETFs in the U.S. market just before the halving, following a five-day streak of outflows.

BlackRock’s iShares Bitcoin Trust (IBIT) is closing in on Grayscale’s position, trailing by only $2 billion. This places BlackRock in a position to potentially overtake Grayscale as the largest Bitcoin fund globally. Meanwhile, Grayscale’s Bitcoin Trust (GBTC) has experienced a prolonged period of value decline, resulting in a substantial reduction of $16 billion in its assets, which is now $19.4 billion.

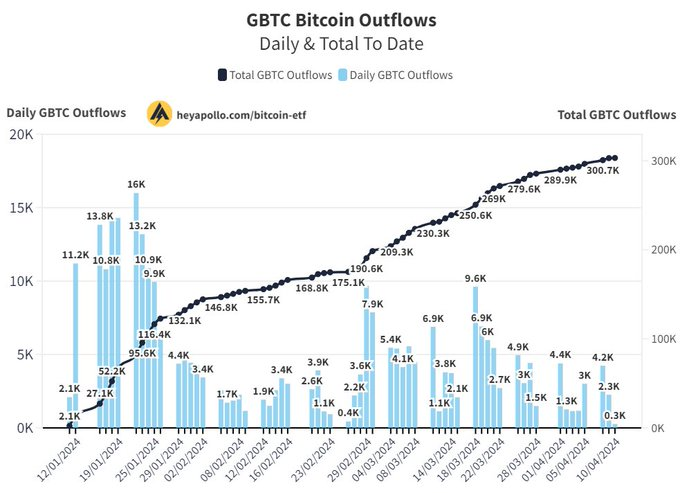

In contrast, IBIT has witnessed continuous asset growth, nearing a total of $17.3 billion. However, Grayscale’s spot Bitcoin ETF has faced significant capital outflows, with investors withdrawing $89.9 million in the past five days alone, contributing to a net outflow of $1.6 billion since January.

Despite Grayscale’s early dominance, its supremacy in the Bitcoin ETF market appears to be waning. Fidelity and BlackRock have swiftly gained considerable market shares since the beginning of trading. Both Fidelity and BlackRock Bitcoin ETFs saw notable net inflows in the same week, alleviating some liquidity concerns in the market.

Bitwise CEO highlights the discreet yet substantial adoption of Bitcoin ETFs by registered investment advisers (RIAs) and multifamily offices. Major financial institutions are quietly conducting comprehensive evaluations of the Bitcoin market.

According to Farside data, GBTC experienced a significant decrease in outflows on April 10 compared to the previous day. The daily outflow average since January stands at $257.8 million.

GBTC, which launched in 2015, converted to an ETF in January alongside the launch of nine other spot Bitcoin ETFs following Grayscale’s legal victory against the United States Securities and Exchange Commission. Recently, bankrupt crypto lending firm Genesis sold approximately 36 million GBTC shares to acquire 32,041 Bitcoin.