Those closely monitoring the crypto industry in 2022 are confident that cryptocurrency is here to stay. The digital assets market was a highly volatile year, with crypto war relief, multimillion-dollar hacks, and industry-shaking explosions.

Canada Freezes Freedom Convoy Funds

The Canadian province of Ontario has petitioned a court to suspend access to over $24 million in cryptocurrencies and fundraising platforms donated to the convoy protesting COVID-19 restrictions in Ottawa and at multiple border crossings.

The province got an order from the Superior Court of Justice prohibiting the distribution of donations made through the “Freedom Convoy 2022” and “Adopt-a-Trucker” campaign sites on the website.

Ukraine Starts Accepting Crypto Donations

During the Russia-Ukraine conflict, the Ukrainian government has reached out to the crypto community on Twitter to raise funds for its civilians and forces. In February, Ukraine began accepting cryptocurrency donations in bitcoin, ether, and tether.

Since Moscow’s invasion on February 24, more than 102,000 crypto asset payments worth $54.7 million have been made to the Ukrainian government and Come Back Alive, a military-supporting NGO, according to blockchain analytics company Elliptic.

Stand with the people of Ukraine. Now accepting cryptocurrency donations. Bitcoin, Ethereum and USDT.

BTC – 357a3So9CbsNfBBgFYACGvxxS6tMaDoa1P

ETH and USDT (ERC-20) – 0x165CD37b4C644C2921454429E7F9358d18A45e14

— Ukraine / Україна (@Ukraine) February 26, 2022

Biden Signs Executive Order on Crypto Regulation

After 13 years and three administrations since Bitcoin’s genesis block was mined, President Biden signed an executive order instructing nearly all federal agencies to develop detailed plans for U.S. crypto regulation and enforcement. Biden’s order amounted to little more than a research mandate requiring each department to finalise a strategy and submit it to the White House.

While there is widespread consensus that comprehensive crypto regulation is necessary, the legislative body with authority to create one, namely Congress, is not signalling that it will rush to do so. Currently, crypto can only be controlled within the boundaries of the laws as they are written, which is the president’s responsibility. It is time for a president to at least get the ball moving.

Yuga Labs Introduced Otherside

Acquiring the CryptoPunks and Meebits collections from Larva Labs cemented Yuga’s position as the world’s leading NFT firm. Yuga started its Metaverse chapter with an NFT sale for virtual land plots, allowing community members to buy a piece of a magical planet named “Otherside.”

The introduction of The Otherside was the most anticipated NFT drop of the year, and Bored Apes were surging. The sale netted the firm over $310 million, making it the most significant NFT drop in history. On the secondary market, prices rose quickly and have since fallen due to general market weakness.

Hackers Stole $500 Million From Ronin Network

Several high-profile crypto attacks occurred in 2022, but the nine-figure breach of Axie Infinity’s Ronin bridge in March was by far the largest.

Using phishing emails, a gang of attackers ultimately identified by U.S. law enforcement as the North Korean government-backed Lazarus Group gained access to five of nine Ronin chain validators. This allowed the criminal organisation to steal about $551,8 million worth of Ethereum and USDC from the bridge that connected the network to Ethereum’s mainnet.

Terra Collapsed Spectacularly

In late 2021 and early 2022, Terra’s value skyrocketed due primarily to the popularity of its native stablecoin, UST. The Terra ecosystem was worth over $40 billion at its peak, but the network’s dual token method was its undoing. On May 7, a series of massive sell-offs threatened UST’s position, setting up alarm bells before a brief rebound.

The fall of Terra precipitated a severe liquidity crisis for participants such as Celsius, Three Arrows Capital, Genesis Trading, and Alameda Research. Legislators from throughout the globe have also condemned the dangers posed by stablecoins, particularly algorithmic ones. In many ways, Terra was the greatest failure of decentralised finance, and the effects of its implosion are still unfolding.

Celsius, 3AC Major Crypto Liquidity Crisis

On the evening of June 12, Celsius notified its customers that withdrawals would be temporarily suspended permanently. Celsius had invested in Terra, and when that project failed, it fanned a fire ignited by CEO Alex Mashinsky’s illegal trading on the company’s accounts, as was later disclosed.

Worse still, this borrowing and lending occurred within a small network of companies. Celsius extended credit to decentralised platforms such as Maker, Compound, and Aave and centralised businesses like Genesis, Galaxy Digital, and Three Arrows Capital. Those individuals, except for Galaxy, were lending it out again and again.

Within a few days of Celsius’s announcement, reports about 3AC’s insolvency began to surface, and the company’s co-founders, Su Zhu and Kyle Davies, remained silent. They are reportedly on the run after defaulting on a series of loans and owing over $3.5 billion.

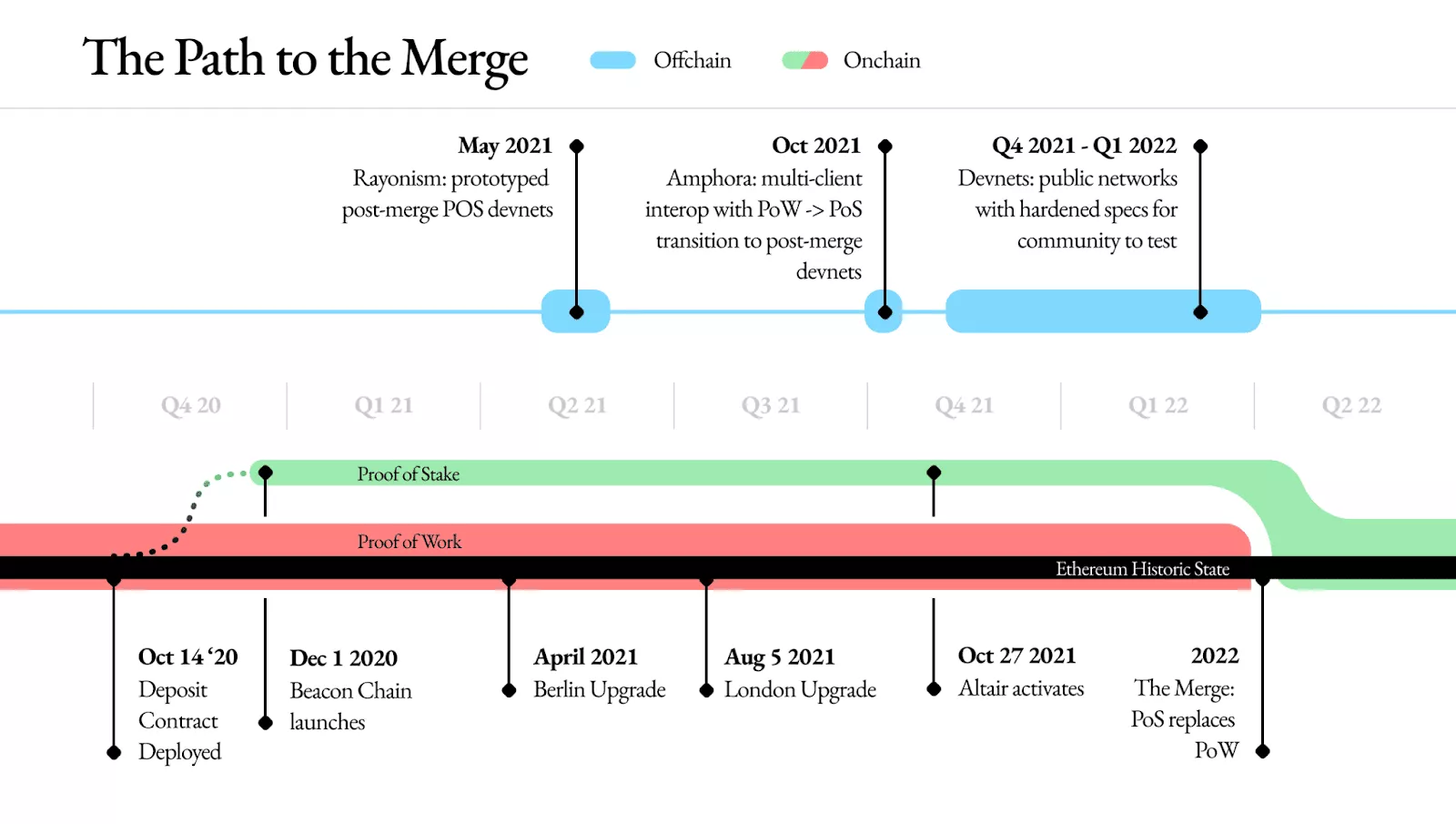

Ethereum’s Proof-of-Stake Upgrade Completed

The Proof-of-Stake upgrade for Ethereum has been discussed for as long as the blockchain has existed; thus, the September rollout was met with much anticipation. ETH climbed more than 100% from its June low, increasing optimism that the Merge’s benefits — a 99.95% improvement in energy efficiency and a 90% reduction in ETH emissions — could help the crypto market turn bullish.

In the end, the upgrade was successfully released on September 15. As several astute traders had predicted, the Merge was a “sell the news” event, and EthereumPOW failed, but the Ethereum community remained undeterred by the lacklustre price action. The Merge was heralded as crypto’s technological improvement since Bitcoin’s inception, and Ethereum engineers were warmly congratulated for its achievement. It was frequently compared to an aeroplane switching engines mid-flight.

U.S. Treasury Sanctioned Tornado Cash

The Office of Foreign Assets Control of the U.S. Treasury said on August 8 that it added the Tornado Cash protocol to its sanctions list. In a statement, the CIA stated that cybercriminals used Tornado Cash to launder money.

The prohibition angered the cryptocurrency sector. Circle and Infura responded swiftly to comply with the sanctions by blocklisting Ethereum addresses associated with Tornado Cash transactions. Some DeFi protocols imitated this behaviour by prohibiting wallets on their frontends.

Crypto Giant FTX Collapsed into Bankruptcy

A month ago, FTX dominated the global market. The crypto exchange in the Bahamas was renowned for spending a great deal of money promoting its image, and as a result, it has become a household name.

In early November, allegations of illiquidity at FTX’s unofficially-official sister firm, Alameda Research, also created by Sam Bankman-Fried (SBF), threatened to pressure FTX. This resulted in a bank run on the platform, revealing that most of the exchange’s assets had already been depleted.

As additional information emerges through witness interviews and court filings, it has become brutally evident that FTX was not only not a good firm but an awful one. FTX seized $10 billion from customer deposits to cover Alameda’s failed transactions but made no effort to track the money. FTX filed for bankruptcy, and SBF resigned as the company’s CEO.