Tether’s USDT stablecoin has been on a rally, with its market cap nearing $120 billion, consolidating its position as the largest stablecoin in the crypto market. Despite this significant growth, Tether continues to face criticism over its reserves and potential risks for users.

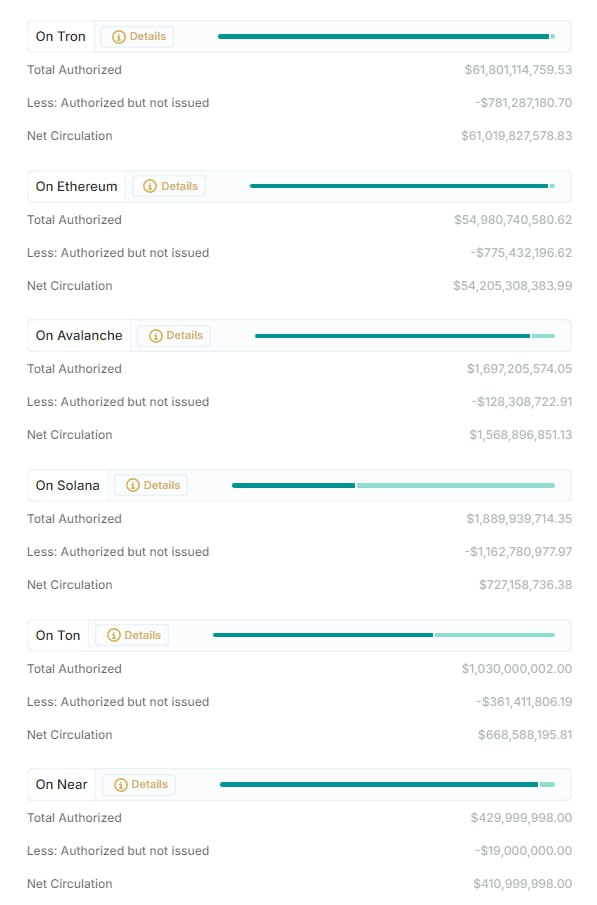

Recently, Tether minted $1 billion USDT on the Ethereum blockchain, raising its market cap to $119 billion. According to SpotOnChain, the company has issued $35B worth of USDT over the past year. With such progress, Tether continues to dominate the stablecoin market and keeps USDT far ahead of its main competitor, Circle’s USDC.

By Q2 2024, Tether stands as the 18th largest holder of US government bonds globally by holding over $97B in US Treasuries, surpassing even Germany and Australia. Stablecoins like USDT offer a practical solution for daily use, serving as a stable alternative to the volatility of other cryptocurrencies. They are becoming increasingly popular in emerging markets for savings, payments, and cross-border transactions.

Tether’s user base has surpassed 350 million globally, contributing to significant profits. In the past month alone, Tether generated over $400 million in earnings, as reported by Token Terminal. The company’s growth has spurred its expansion into new sectors such as agriculture and led to a restructuring focused on finance, data, education, and power.

However, Tether faces criticism regarding its business model, with concerns raised about the transparency of its reserves and potential risks. Organisations like Consumers’ Research have flagged vulnerabilities tied to Tether’s financial exposure.

As Tether maintains its leadership in the stablecoin market, these concerns continue to present challenges for the company moving forward