Amidst the crypto market bull run, SOL has risen as a top gainer, flipping BNB and USDT to rank as the 4th largest cryptocurrencies by market cap. The Solana token recently reached a new all-time high (ATH) of $263.83 on November 23, 2024, and a milestone monthly DEX volume of $100B for the first time.

Though the SOL token now consolidates its position as the 5th following USDT, the significant growth of Solana-based decentralised applications (dApps) & memecoin platforms, such as Pump.fun and Raydium contributes to continuing driving the surge of ETH’s rival entity.

Recent reports have shown that Solana network’s activities outperformed Ethereum in many aspects, from transaction volumes to the number of active addresses. With the expansion of the Solana ecosystem, more and more people are adopting the network token SOL, further pushing the SOL price.

Solana Technical Analysis

To forecast Solana’s future price trajectory, it is crucial to examine both its historical price movements and technical indicators. Solana’s journey from its modest beginnings to becoming a major player in the cryptocurrency space underscores its potential for growth, despite facing regulatory hurdles and market volatility.

Weekly basis

1. Moving Average

On the weekly chart, Solana shows a bullish momentum with the 50-day moving average currently climbing up and below solana’s current price. This indicates Buy and could act as support the next time it interacts with it. Similarly, the 200 weekly moving average stands below the price, meaning that if SOL’s price interacts with it again, it could be used as a support for the trend to continue.

2. Relative Strength Index

The Relative Strength Index currently lies in the neutral range of 30 – 70, hovering around 67, signalling a balanced market condition. This indicates that the price is maintaining a steady trend and may continue to hold the RSI in this range for some time.

3. MACD

The MACD histogram shows a bearish divergence, which could suggest a potential price reversal in the near future.

Solana Price History

Solana (SOL) has experienced a tumultuous price history since its inception. Initially priced at $0.22 in its final presale round in March 2020, SOL quickly gained traction upon its exchange launch, reaching an initial price of $0.9511. Throughout its early trading days, SOL remained below $10 until March 2021. In June 2021, the project garnered significant attention by raising over $300 million in a private sale, with investments from prominent firms like Almeda Research.

The Solana ecosystem saw unprecedented growth, reaching its all-time high (ATH) of $260.06 by November 2021. However, this peak was short-lived, and SOL’s price plummeted following the collapse of the FTX exchange, dropping by over 96% from its ATH to lows of $8.42.

By 2023, SOL had rebounded, boasting a 669% increase over the course of the year, reaching a price of $76.64, up from $9.961 at the beginning of the year.

However, challenges persist for Solana. FTX, once the largest holder of SOL, faced legal issues, with its founder Sam Bankman-Fried pleading guilty to fraud in December 2022. This event, coupled with regulatory scrutiny, led to increased volatility in SOL’s price. The SEC’s announcement in June 2023 that it considered SOL financial security caused a significant price drop, with major exchanges liquidating their SOL holdings.

Key Features:

- Solana (SOL) experienced rapid growth following its exchange launch, climbing from $0.9511 to $10 by March 2021. The project raised over $300 million in a private sale in June 2021.

- Solana reached its all-time high (ATH) of $260.06 in November 2021. However, the collapse of the FTX exchange triggered a sharp decline in SOL’s price, plummeting over 96% to a low of $8.42.

- By 2023, SOL had surged by 669% from its low point, reaching $76.64. However, SOL’s price remained volatile.

- Solana faced regulatory challenges, with the SEC announcing in June 2023 that it considered SOL financial security.

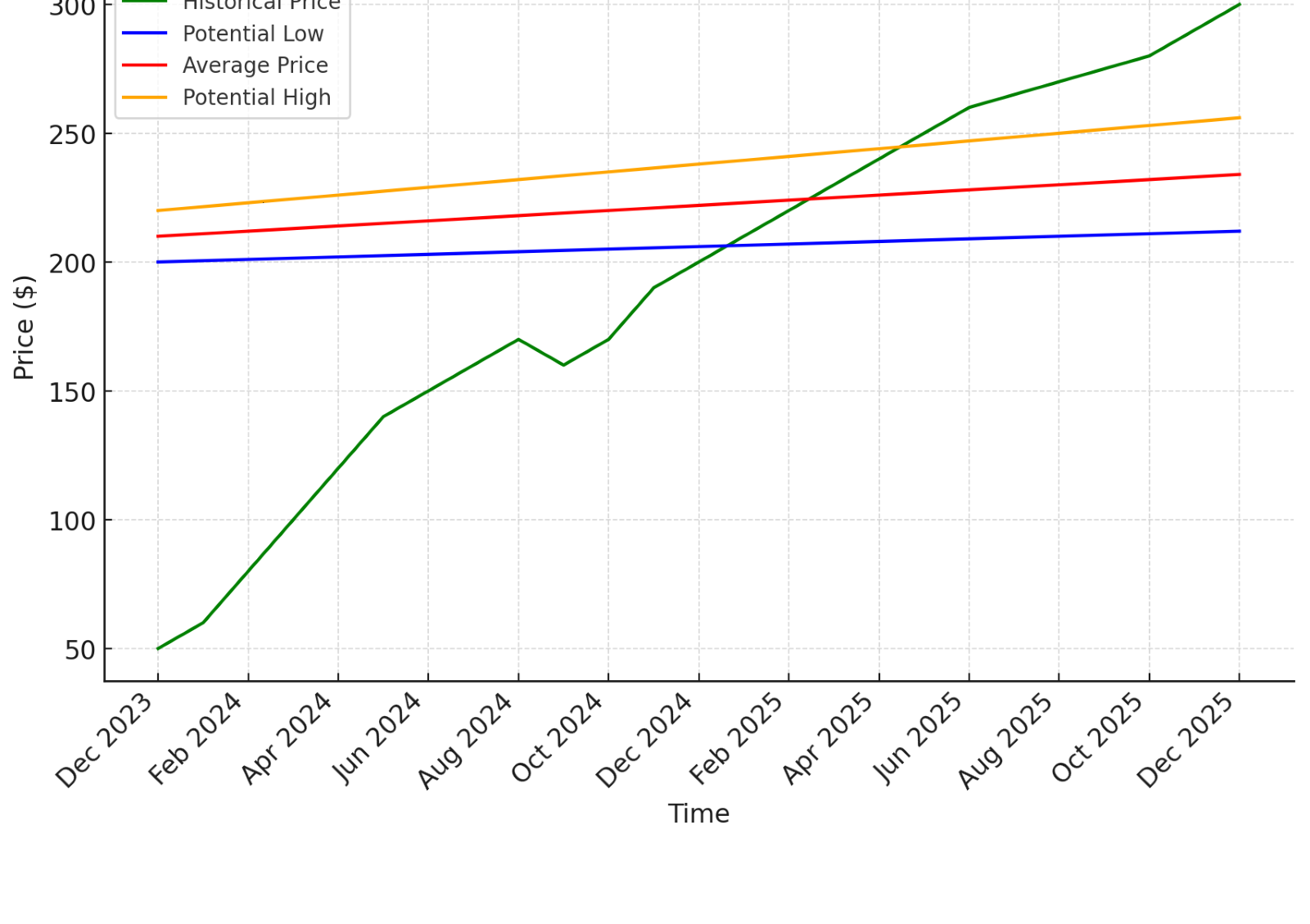

Solana (SOL) Price Predictions 2025 – 2034

After hitting a new all-time high (ATH) of $294.33, SOL is now trading around the $258 mark. If the current market sentiment stays Bullish, with the Fear & Greed Index showing 75 (Greed), Solana is predicted to finish this year within $340.39 and $356.93.

According to the current Solana price prediction, the SOL price is projected to rise by 7.56% and could reach $285.30 a month from now. All technical indicators imply a Bullish sentiment with strong Buy actions. The SOL’s price in the following years is expected to see the same patterns and is projected as below:

| Year | Potential Low (ROI) | Average Price (ROI) | Potential High (ROI) |

| 2025 | $233.12 (14.25%) | $302.69 (28.50%) | $336.25 (42.75%) |

| 2026 | $303.45 (28.82%) | $379.92 (61.29%) | $464.99 (97.40%) |

| 2027 | $337.63 (43.33%) | $465.61 (97.67%) | $622.42 (164.24%) |

| 2028 | $370.65 (57.35%) | $556.90 (136.42%) | $805.83 (242.10%) |

| 2029 | $401.41 (70.41%) | $649.79 (175.85%) | $1,008.23 (328.02%) |

| 2030 | $428.81 (82.04%) | $739.27 (213.84%) | $1,217.99 (417.08%) |

| 2031 | $451.77 (91.79%) | $819.72 (248.00%) | $1,419.40 (502.58%) |

| 2032 | $469.36 (99.26%) | $885.41 (275.89%) | $1,594.12 (576.75%) |

| 2033 | $480.77 (104.10%) | $931.16 (295.31%) | $1,723.67 (631.75%) |

| 2034 | $485.48 (106.10%) | $952.95 (304.56%) | $1,792.47 (660.96%) |

Solana Price Prediction 2025

The year 2024 has marked a significant breakthrough for the cryptocurrency market, with Solana as a major beneficiary. The Solana ecosystem experienced a surge in memecoin trading during the spring, followed by the approval of Bitcoin ETFs and the latest Bitcoin halving event. The recent Ethereum’s Dencun upgrade didn’t have a big impact on either Ethereum or Solana, which was good news for $SOL.

Following the approval of Ethereum ETFs, institutions have begun filing for a Solana ETF. With changes in the SEC’s composition, the possibility of such a fund being approved appears more likely. A future Solana ETF would likely create a significant surge in the price of $SOL 2025.

Solana’s ecosystem has also made considerable advancements in 2024, thanks to ongoing internal improvements. New token extensions have increased the utility of tokens within the network, while the development of multiple validator clients aims to address and prevent future network outages.

Recent months have again seen the Solana-based DApps rake in record fees as memecoin frenzy returns. Five of the top 10 crypto protocols by fee earnings in the last months were on Solana.

According to the Solana price prediction, Solana price 2025 would continue to follow historical patterns and hit a new all-time high (ATH) of $336.25. Analysts have predicted that Bitcoin could soon set a new milestone of above $110,000 and rocket as high as $200K. This could have a massive effect on the price of $SOL and other major altcoins.