As mining has become less popular for earning rewards on blockchain networks, staking has taken its place. Many projects, including Ethereum, are shifting towards staking through upgrades, while others are launching with staking support from the start. Polkadot (DOT) is one such project that is gaining momentum. This article will provide a step-by-step guide on where and how to stake Polkadot (DOT) in Australia.

What is Polkadot Staking?

Polkadot staking involves locking up cryptocurrency to help validate transactions and secure the network, earning DOT rewards in return. There are two ways to stake Polkadot: as a validator or a nominator. Validators create blocks while nominators vote on who gets to be a validator, with the nominator receiving part of the validator’s bounty if their vote wins.

Staking Polkadot as a validator requires technical know-how and investment in a master node that runs 24/7 before profits can be realised. However, anyone can stake Polkadot as a nominator without technical expertise or significant investment by depositing funds on a cryptocurrency exchange or locking them in a wallet.

Another way to earn passive rewards is by transferring Polkadot to lending platforms such as Nexo or Crypto.com, which is lent to other investors, generating a variable interest over the deposit term. While this is not technically staking, it is still a way to earn rewards from holding Polkadot.

Pros & Cons of Polkadot Staking

Pros of staking Polkadot

One of the most significant benefits of staking Polkadot is the passive income it generates. Users can earn rewards by holding DOT assets in their wallets and staying connected to the network.

Stakers, whether validators or nominators, work towards securing and safeguarding the network. They can participate in the network’s overall efforts and receive rewards.

Staking DOT is an easy process that can be initiated by signing up for an exchange and buying some DOT. You can make the process as easy or complex as you prefer.

Cons of staking Polkadot

When you stake your funds in the Polkadot network, they are locked, and you may have to forfeit your interest rates if you want to withdraw them.

If you stake Polkadot, you need to stay connected to the network, or you risk facing slashing and losing your earnings. While participating in staking isn’t too complicated, it requires some effort and commitment.

If a validator you vote for behaves poorly, you may be subject to slashing, leading to loss of money. Hence, it is essential to conduct research before nominating a validator.

How to Stake Polkadot (DOT) in Australia

Now that you know the pros and cons of staking DOT, let’s explore how to do so in the first place.

Staking Polkadot (DOT) on a crypto exchange

Staking DOT on a crypto exchange is the easiest method. Exchanges typically have the necessary resources to manage wallet-level and node-level software at scale, allowing them to offer staking services to users through a simple dashboard with minimal setup required.

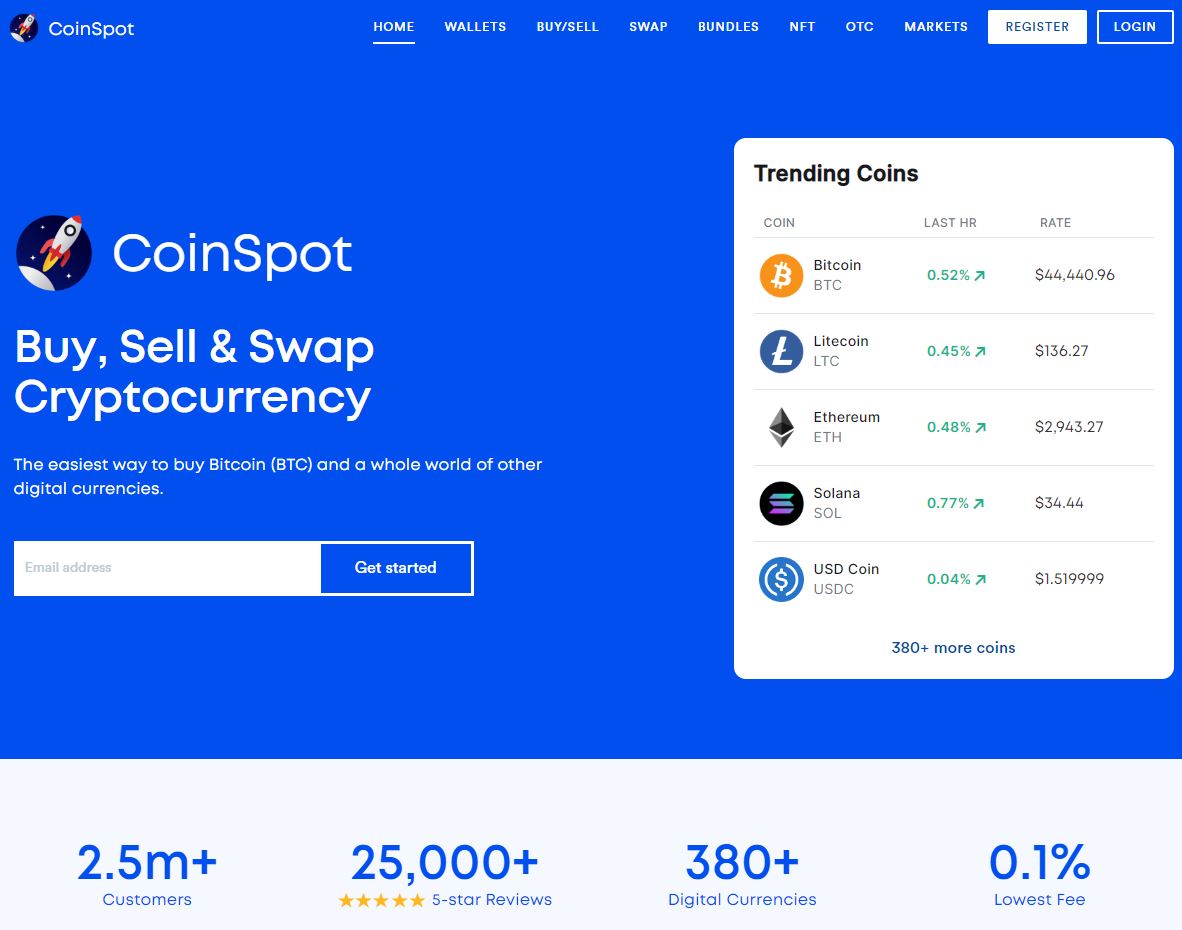

Leading exchanges for staking Polkadot include CoinSpot, Kraken, Binance, and Bitfinex. To stake DOT on these exchanges, you must first deposit fiat or crypto into your exchange account and purchase DOT tokens (or deposit DOT directly if you already have some).

Choose an exchange that you trust, and that provides a user-friendly experience. When comparing APYs, avoid selecting an exchange that frequently experiences downtime when you need to make transactions. Each exchange has a minimum staking requirement that should also be considered.

Here are the steps to stake Polkadot on CoinSpot:

- Sign up for a free account on CoinSpot and complete the verification process.

- Click “Deposit Funds,” choose a payment method, and deposit the AUD you want to invest.

- Go to the “Buy/Sell” tab and purchase the cryptocurrency you want to stake.

- On the “Wallets” tab, locate the token you want to stake, enter the amount you want to stake, and click “Confirm Earn Amount.”

Staking Polkadot (DOT) with a crypto wallet

Staking Polkadot with a wallet involves more steps and complexity than staking on a crypto exchange. This is because a staker must carefully choose up to 16 validators to participate in staking, and these validators act as the only intermediary between the staker and rewards.

When choosing a wallet staking method, stakers should consider the provider’s security, reliability, and reputation before selecting a validator or staking service. Popular wallet options for staking DOT include imToken, Ledger, Talisman, Fearless, Subwallet, Nova, and Polkawallet.

To begin staking with a wallet, a staker must first acquire DOT from a crypto exchange and deposit it into a DOT wallet. Once the DOT is deposited, the staker can select their preferred validators.

Staking Polkadot using a mobile wallet like imToken is a simple process that can be completed in just a few steps:

- Download the imToken app from either the App Store or Google Play.

- Create an account and save your password for the wallet.

- On the next screen, add your coin(s), select “DOT”, and click “Confirm”.

- Find your wallet address and deposit DOT tokens into the wallet.

- Once the DOT tokens are deposited, click “Staking” from within your DOT wallet and select your preferred validators.

- After selecting your validators, click “Confirm Validators” and enter the amount of DOT you want to bond.

Staking Polkadot (DOT) with a masternode

When staking with Polkadot-JS-UI, there are two options: nominator or validator. Nominators are stakers who can select up to 16 validators to receive rewards based on their performance. Validators run nodes to ensure the network’s security and stability. A minimum of 10 DOT is required to stake on Polkadot.

Validators must operate their nodes continuously to provide maximum stability to the Polkadot network. Nominators and validators earn higher rewards when the validators deliver better performance. According to the Polkadot whitepaper, Phragmen’s algorithm determines the validator selection.

Here are the steps to nominate a validator using the Polkadot.js UI or app:

- Create a Polkadot account.

- Navigate to the “Network > Staking > Accounts” page.

- Click “+ Nominator.”

- Choose a stash and controller account.

- Enter the amount to bond.

- Select a desired validator.

5 Best Crypto Exchanges for Staking DOT in 2023

CoinSpot

CoinSpot is our #1 recommendation for staking DOT in Australia. CoinSpot has over 380 cryptocurrencies, including BTC, ETH, and DOT, and is popular with 1M+ users worldwide. Deposit methods include Bank Transfer, OSKO, BPAY, POLI, PayID, Crypto, and cash. The platform offers two-factor authorisation and best practices to stop phishing attacks. You can read our CoinSpot review for further details.

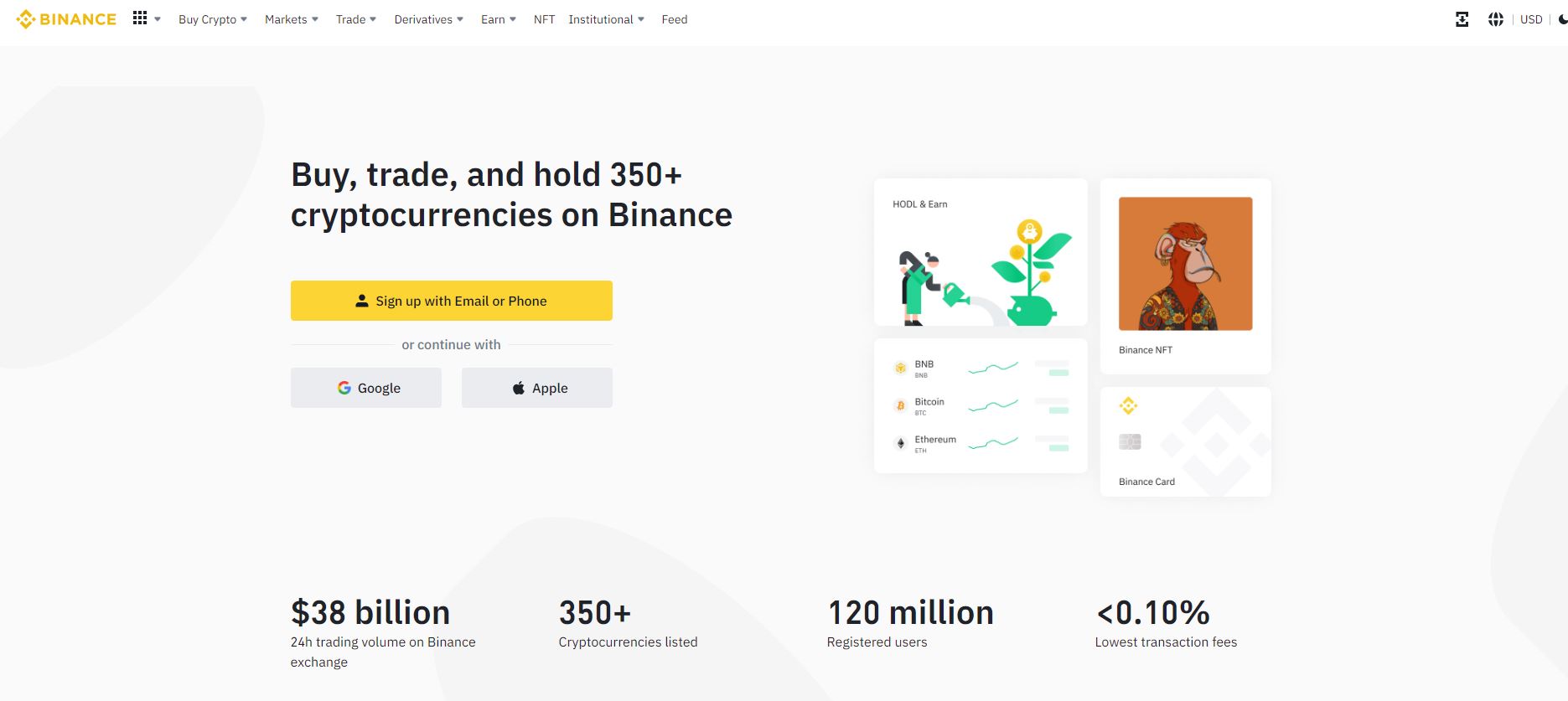

Binance

Binance is also a good place for earning interest on various cryptocurrencies, including DOT, which offers up to 16.9% APY when locked in for 120 days. You can have 13.9% APY locked for 90 days, 11.9% APY for 60 days, or 10.9% APY for 30 days. For those who prefer to keep their DOT flexible, you can earn 4.03% APY.

Bybit

Bybit is a good option for staking Polkadot, offering 1.77% APY for flexible staking. You can use the platform anonymously without submitting KYC documents and purchase DOT using fiat currency. Trading fees are low at 0.1%, and there’s a special offer of $10 BTC FREE when you deposit at least $100.

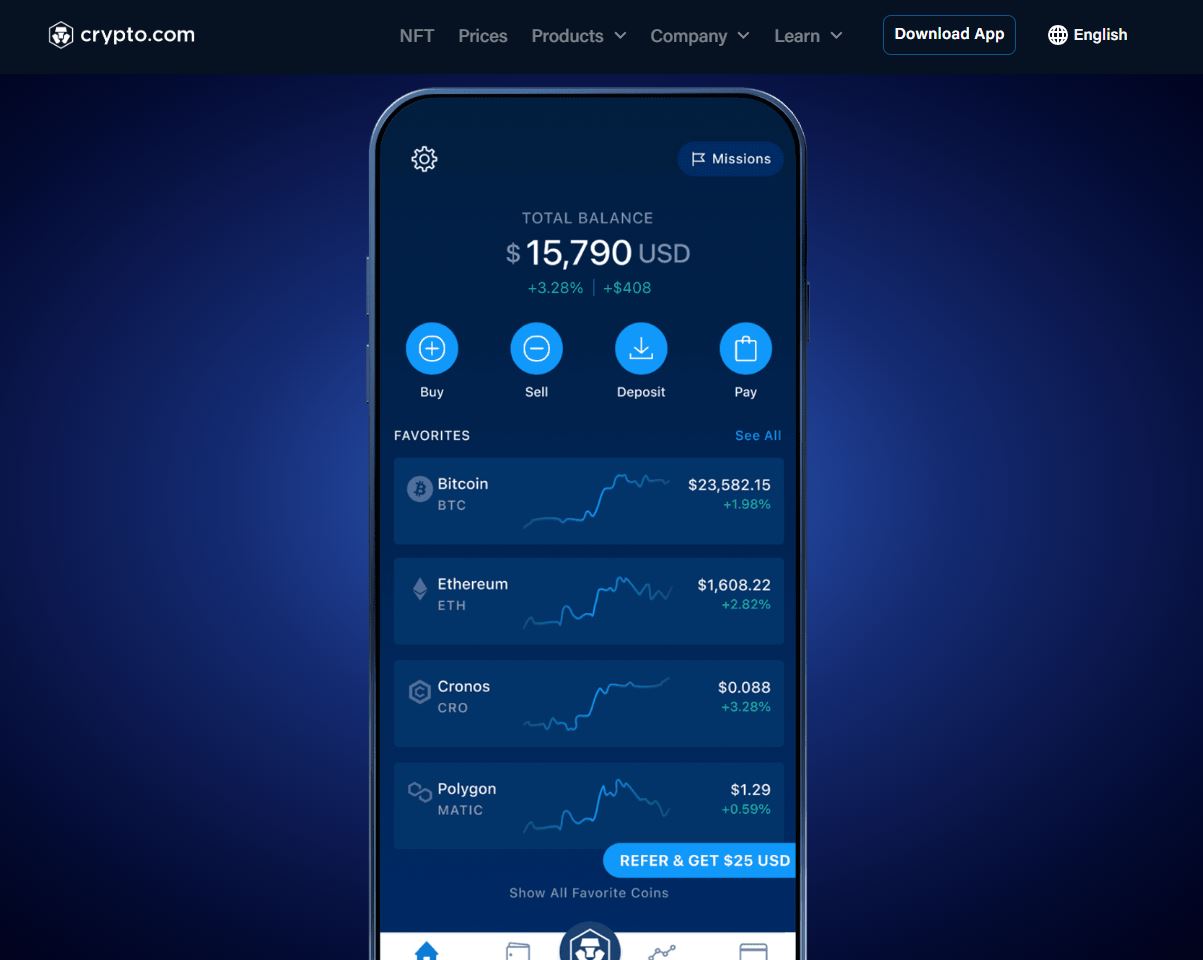

Crypto.com

Crypto.com is a convenient mobile app for staking, ideal for beginners. You can easily buy DOT using a credit/debit card or depositing fiat currency into the app. Once you’ve bought Polkadot, it only takes a few clicks to start staking and earn rewards. Staking options include flexible, 1 month, and 3 months, with rates of 1.15% APY, 8% APY, and 11% APY, respectively.

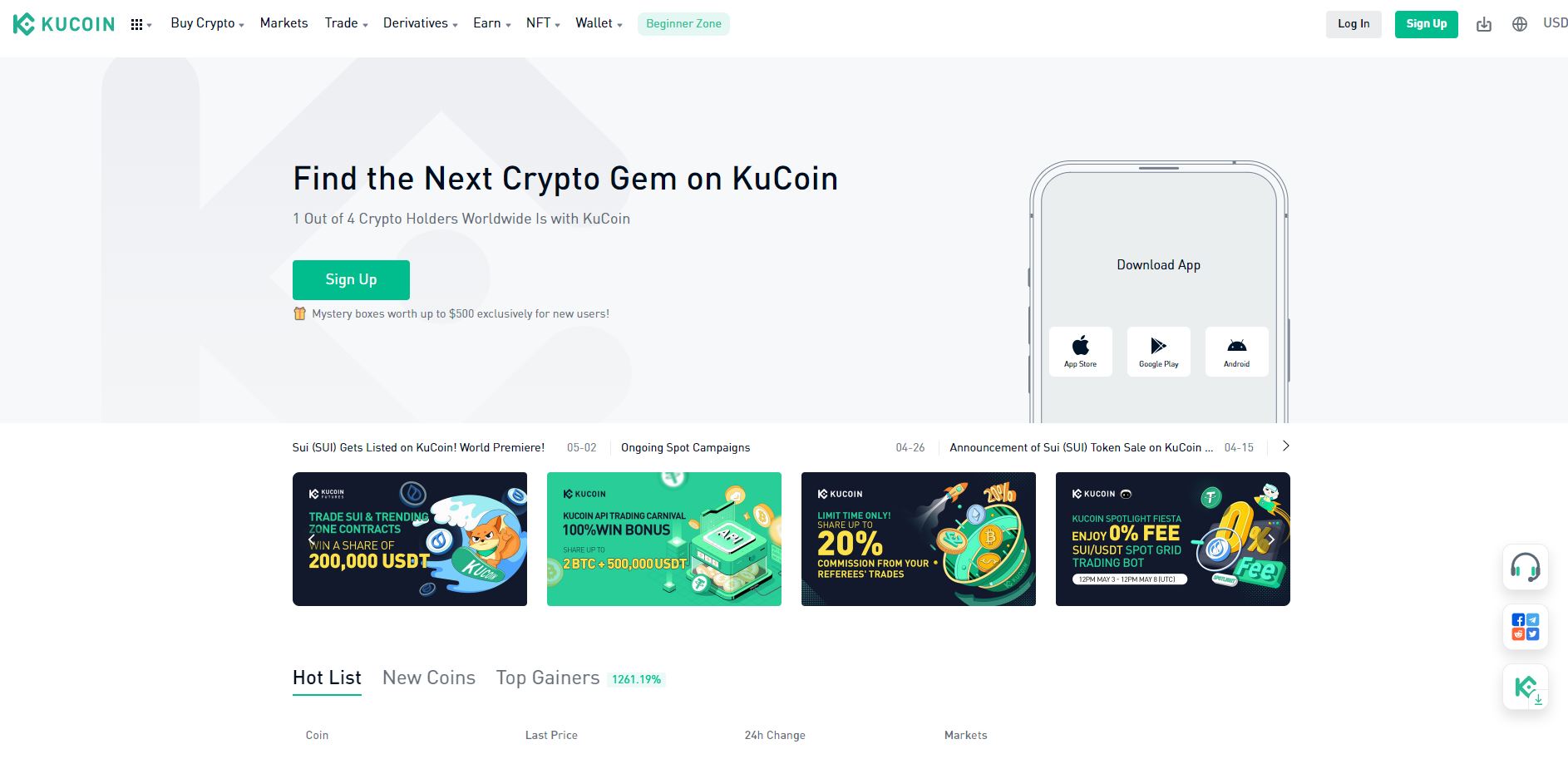

KuCoin

KuCoin is one of the largest crypto exchanges in the world, with more than 700 cryptocurrencies available. You can buy Polkadot on KuCoin with low fees and stake it in the Earn section. KuCoin offers flexible staking rates of 7.2% APY and 12.2% APY when locked for 30 days. Interest rates may fluctuate, so check our KuCoin review for current rewards.

Polkadot (DOT) Staking FAQs

Is staking Polkadot safe?

Earning passive income through staking Polkadot is a simple and relatively low-risk method. However, one significant downside is the possibility of being penalised and fined if any of the validators you nominate engage in misconduct or behave recklessly with the protocol. The concept of “slashing” enhances network security and emphasises the importance of nominating validators with a proven track record of solid performance.

Where to purchase DOT in Australia?

There are various ways to buy DOT, such as using centralised exchanges like CoinSpot, Coinbase, Kraken, and Binance. These exchanges are easy to set up and offer a wide range of coins and tokens, but they charge a fee for every purchase or sale. On the other hand, decentralised exchanges enable you to buy DOT directly from other users. Although this approach can be more complex, it typically incurs lower fees.

How much can I earn by staking DOT?

Staking Polkadot is an attractive option for earning passive income since it requires minimal effort. Once you deposit and lock your stake, the earnings start to accumulate. The amount you make depends on various factors, such as the commission rate of the validators you choose, the number of validators, and the number of tokens you initially staked. However, staking always generates more returns than letting your tokens sit idly in your wallet.

What are the best ways to buy Polkadot?

One can deposit local currency from a bank account or credit card or transfer cryptocurrency from another exchange or wallet. Here are some of the most popular methods:

- Bank account: Transferring funds from a local bank account is usually free, but don’t forget to check this with the chosen exchange.

- Credit or debit card: Linking a card to the account is a convenient way to top up, but it usually incurs an additional fee. The advantage is that you can use a card to make instant purchases or set up recurring purchases.

- Cryptocurrency: DOT can be purchased by trading it for another cryptocurrency, such as Bitcoin or a stablecoin. However, this varies between exchanges; hence, search for DOT on the spot market to see which cryptocurrencies can be traded for.

What are the best Polkadot wallets to store DOT?

It is possible to keep your DOT on the exchange where you bought it or transfer it to a personal wallet. Some individuals prefer to use their wallets to ensure complete control over their assets or to use them with other applications like DeFi services. Hardware wallets are generally considered the most secure type of cryptocurrency wallet, as they utilise a physical device to enhance security in several ways.

Final Thoughts

Polkadot is a blockchain initiative that enables you to earn rewards by staking DOT tokens on a cryptocurrency exchange or within a wallet. Validators utilise these tokens to facilitate network transactions, and they are locked in for some time. For those interested in holding cryptocurrency long-term, staking DOT tokens is a passive way to earn additional rewards without requiring a significant investment or effort.