Fraudsters are constantly searching for new ways to steal their funds, and the exponential surge of cryptocurrency recently has spawned numerous avenues for deceit. The year 2021 witnessed an unprecedented upsurge in cryptocurrency crime, as per a report from Chainalysis, with a staggering $14 billion worth of crypto stolen by swindlers. If you’re interested in crypto, you must know the potential dangers. Keep reading to learn how to detect and prevent prevalent crypto scams.

What Are Crypto Scams?

Crypto scams pertain to deception aimed at convincing unsuspecting individuals to transfer funds, divulge login credentials, or invest in fraudulent startups. The main goal of these scams is to induce victims into transferring digital assets to the swindler’s account or providing confidential information. As such, it is crucial to steer clear of these scams to safeguard one’s coins and NFTs.

Crypto scams are similar to other financial frauds, the only difference being that crypto scammers target individuals’ crypto assets instead of cash. As blockchain technology lacks a central authority, scammers can easily deceive hopeful investors. Some telltale signs of these scams include exaggerated marketing, promises of substantial returns in a short time frame, and flawed white papers.

It is worth noting that cryptocurrency transactions are pseudonymous, meaning users interact via encoded addresses instead of legal names, and they are irrevocable. Thus, it is highly improbable for individuals to recover funds lost to scammers.

Popular Crypto Scams to Watch For

Scammers exhibit exceptional creativity when it comes to enticing you into a trap or eliciting your personal information. Consequently, several crypto scams feature impersonation tactics alongside a repertoire of artfully crafted falsehoods, often tailored to suit the intended victim. Presently, the most prevalent types of crypto scams include:

Fake Apps/Websites

Fraudsters frequently fabricate counterfeit cryptocurrency exchange platforms or wallets to dupe unwary victims. These websites often possess domain names strikingly similar to those they intend to replicate, making it arduous to distinguish between them. Fake crypto sites usually operate in one of two ways: phishing or theft.

Phishing sites typically prompt you to provide information such as your wallet’s password, recovery phrase, and other financial data to access your cryptos, which ultimately end up in the hands of scammers. Other sites steal your funds by allowing you to withdraw a meagre sum of money initially. You may deposit more funds into these sites, but when you attempt to remove your money later, they either cease operation or decline your withdrawal request.

Another widely used tactic by scammers to deceive investors is creating bogus apps on Google Play and the Apple App Store. Even though these phony apps are swiftly discovered and removed, they can still adversely affect the finances of several users.

Phishing Scams

Phishing scams within the crypto industry focus on obtaining information about online wallets, particularly crypto wallet private keys necessary to access your assets. Scammers use a familiar tactic, sending an email containing links that direct wallet holders to a fraudulent website where they are prompted to enter their private keys. Once the scammers acquire this information, they can abscond with the cryptocurrency.

Social Engineering Scams

Social engineering scams involve duping individuals and using psychological techniques to obtain confidential information from user accounts. Scammers can pose as trustworthy sources such as government agencies, corporations, technical support, colleagues, or acquaintances to gain the victim’s confidence.

After gaining the trust of potential victims, scammers solicit sensitive information or urge the victims to transfer funds to their digital wallets. If a supposedly “reliable” entity requests cryptocurrency for any reason, it is likely a scam.

In February 2023, Trust Wallet, owned by Binance, reported losing $4 million worth of USD to a social engineering attack conducted by an organised crime syndicate in Rome. The in-person social engineering scam successfully depleted the crypto from a Trust Wallet owned by the metaverse startup Webaverse.

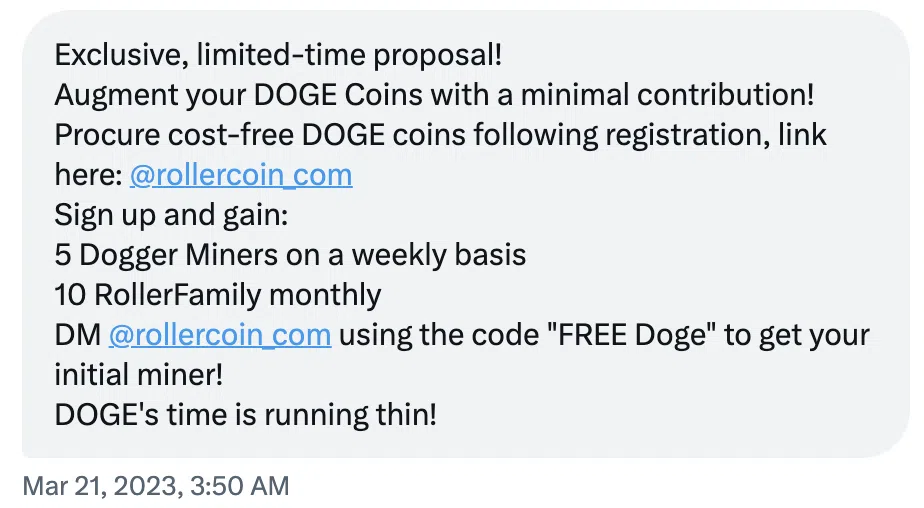

Pump and Dump Schemes

Pump-and-dump schemes are a form of investment fraud in which a scammer convinces individuals to buy a lesser-known crypto at a low price, claiming its value will rapidly increase shortly. As soon as the price rises, the scammer sells their holdings at the inflated price, causing the value to plummet and resulting in losses for the unsuspecting buyers.

These scams appeal to investors seeking quick profits, often through false reports of extraordinary gains in a short time frame. They typically originate on social media platforms, so be wary of unsolicited messages from unknown people regarding your crypto assets. Be cautious of individuals promoting specific crypto assets on platforms like Reddit or Twitter, as these are often socially-engineered scams.

Investment Opportunity Scams

The well-known saying “If something sounds too good to be true, it probably is” is still relevant, particularly for those interested in investing, including cryptocurrencies. Many investors looking for profits fall prey to deceitful websites that offer guaranteed returns or investment opportunities that require significant sums of money for even more substantial guaranteed returns. Unfortunately, these false promises often result in financial ruin when investors attempt to withdraw their funds and discover they cannot.

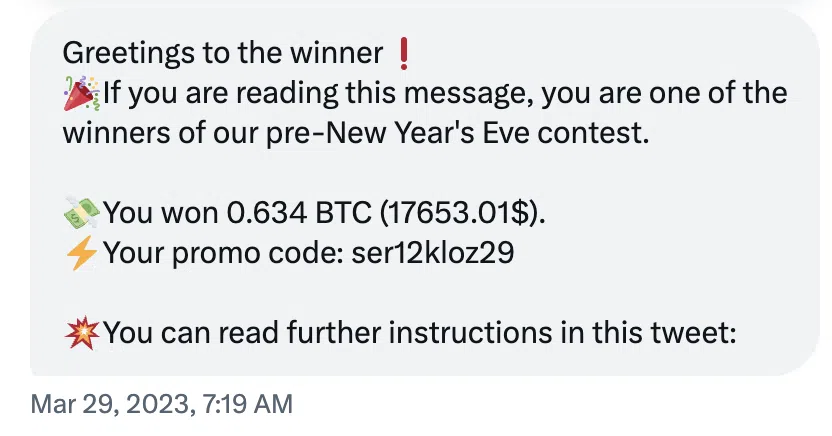

Giveaway Scams

Using social media and phishing campaigns, scammers use crypto giveaway schemes to deceive crypto enthusiasts into trusting them with promises of high-yield rewards. They often impersonate famous individuals with substantial financial resources, such as Elon Musk, who has a massive following and is known in the crypto community.

These scams appear legitimate by considering the coin’s popularity at the time, utilising well-known names and brands without authorisation, hijacking YouTube accounts, creating fake coins, and even conducting in-person meetings.

Fraudulent ICOs/NFTs

Scammers have found new avenues to trick people out of their money through cryptocurrency-based investments, such as initial coin offerings (ICOs) and non-fungible tokens (NFTs). Startup companies use ICOs to raise funds by offering discounts on new coins in exchange for established cryptocurrencies like Bitcoin. However, many ICOs have turned out to be fraudulent.

Scammers may create counterfeit websites for ICOs and ask users to transfer their cryptocurrencies into a compromised wallet. In other cases, the ICO itself may be misleading. Founders may distribute unregulated tokens or misrepresent their products through false advertising. It is crucial to recognise that although crypto-based investments or business opportunities may seem profitable, they are only sometimes legitimate.

Rug Pulls

Rug pulls refer to a developer enticing investors to put their money into a new crypto project, often related to DeFi or NFTs, and then abandoning it before its completion, leading to investors holding worthless currency. In 2021, NFTs became a prime target for this type of scam. Scammers promoted PFP projects, claiming to deliver value and utility with unrealistic, never fulfilled roadmaps.

In May 2022, Zagabond, the founder of the renowned Azuki NFT collection, admitted to orchestrating multi-million dollar rug pulls by creating and abandoning three NFT collections, namely CryptoPhunks, Tendies, and CryptoZunks. Rug pulls can also be a variation of a Ponzi scheme, where investors attract other users with false financial promises. Even proof-of-stake projects can fall victim to different versions of rug pulls, such as those that convince you to stake tokens in master nodes.

Cloud Mining Scams

Cloud mining is a service that enables users to rent mining hardware from companies for a fixed fee and a share of the revenue. This eliminates the need for users to purchase expensive mining hardware and allows them to mine remotely. However, several cloud mining companies are either fraudulent or ineffective, resulting in users losing money or earning less than promised.

Also, scammers are posing as cloud-mining providers and claiming to offer users tens of thousands of dollars in their automated cloud-mining platform accounts. Despite some volatility in the cryptocurrency market in the last six months, many people still consider it a way to get rich quickly.

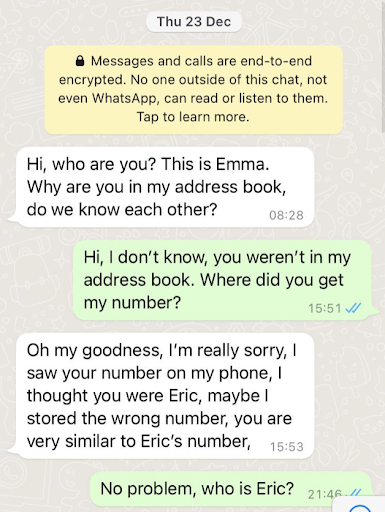

Romance Scams

A type of cryptocurrency scam that has been increasing in prevalence this year is known as pig butchering or romance scam. In these scams, fraudsters create fake personas and pretend to be interested in a romantic relationship with the victim. Using false information and an elaborate web of deceit, scammers can spend months building trust and emotional connection with their victims before requesting crypto payments or enticing them to invest in crypto together for a shared future. Unfortunately, these romantic encounters are entirely fabricated, and the individual on the other end of the conversation is not who they pretended to be.

How to Spot Cryptocurrency Scams

Crypto scams are increasingly common on the internet. These scams often share common characteristics and can be identified and avoided with proper knowledge.

Promises of Guaranteed Returns

If you’re presented with a vague or incomplete investment opportunity, it’s likely a scam. First, evaluate the offer’s feasibility and determine if it’s realistic. While earning a 1,000% return on your investment in 18 months would be phenomenal, is it probable with this new offer? Scammers often use false promises of returns to lure investors into their schemes. If an ICO lacks a solid strategy or information for its rapid growth, it’s best to avoid it altogether.

Excessive Marketing Campaigns

Cryptocurrencies are not typically a way to make money. Instead, they are projects with specific purposes, and their tokens are meant to facilitate the blockchain’s operation. Legitimate projects won’t promote themselves as the “next big thing” on social media, nor will they prioritise discussing fundraising efforts over technological advancements and security measures.

While some businesses use blockchain technology to provide services and may use tokens for transaction fees, advertising and marketing will appear more formal and professional. They may even have the resources to invest in celebrity endorsements and will advertise their blockchain-based services rather than push for everyone to buy their tokens.

Poor/Non-existent Whitepaper

Cryptocurrencies undergo a development phase preceded by publishing a white paper. It details the protocols and blockchain, presents formulas and illustrates the network’s operation. Scam cryptocurrencies, on the other hand, fail to follow this protocol. The creators publish subpar “white papers” with inaccurate figures, poor grammar, no explanation of the intended use of funds, or a lack of essential information that makes it evident that the white paper is not genuine.

Ghost Team Members

White papers need to include information about the members and developers involved in the cryptocurrency project. While open-source crypto projects may not consistently have named developers, this is common for such projects. You can typically view most of the coding, comments, and discussions related to the project on platforms like GitHub or GitLab or forums and apps like Discord. However, it’s likely a scam if you cannot find such information and the white paper is riddled with errors.

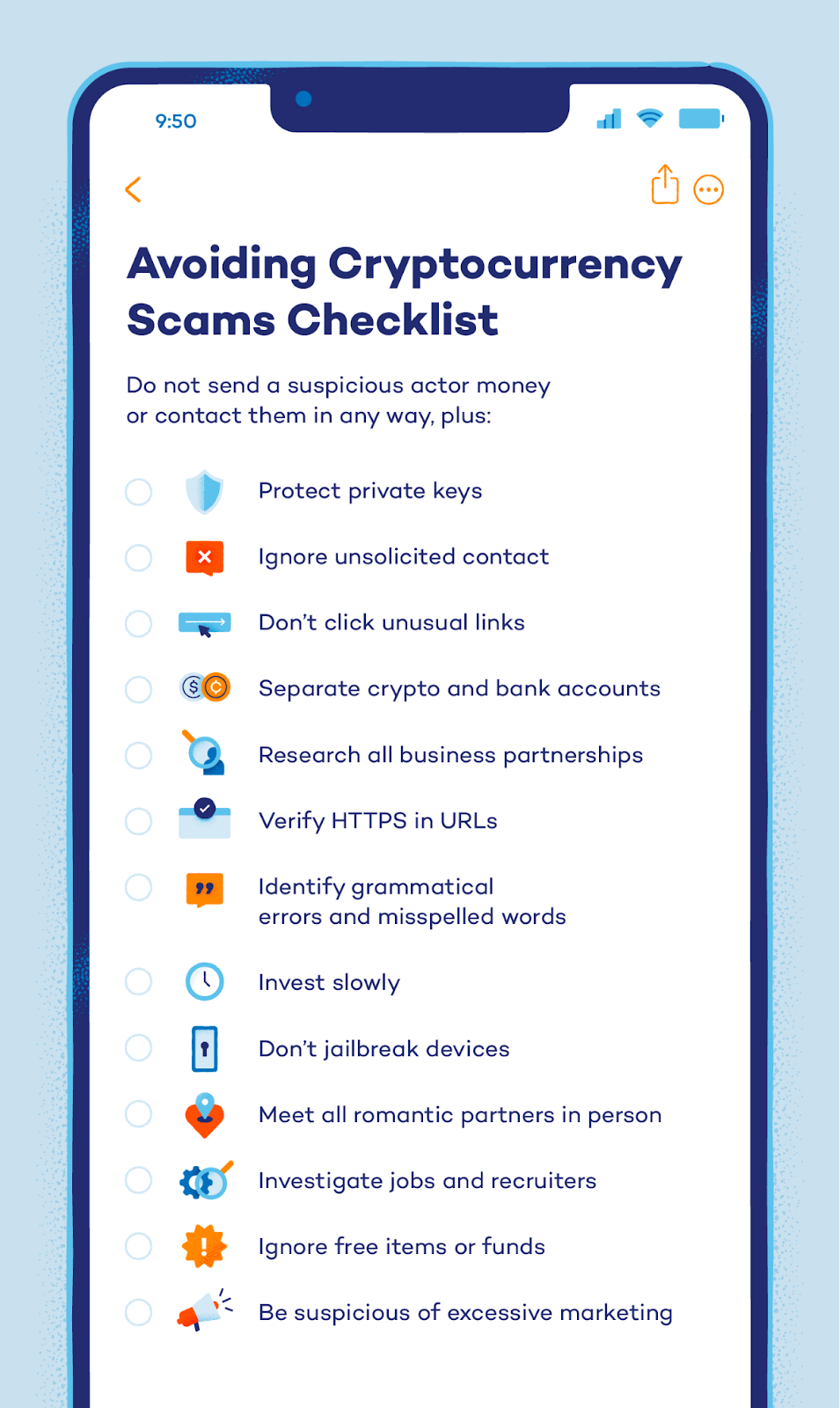

How to Avoid Cryptocurrency Scams

To avoid falling for cryptocurrency scams, follow these tips:

- Secure your wallet. Keep your cryptocurrency in a self-hosted wallet, not on an exchange, and don’t share your private keys with anyone.

- Be wary of too-good-to-be-true offers. Scammers often promise unrealistic investment returns, so don’t fall for get-rich-quick schemes.

- Beware of unsolicited messages and calls. Don’t give out personal information or send money in response to unexpected cryptocurrency investment opportunities.

- Be cautious of social media hype. Scammers use social media to advertise their scams, often using images of celebrities or high-profile individuals to make them seem legitimate.

- Don’t make hasty investment decisions. Take the time to research thoroughly and make informed choices.

How to Report Cryptocurrency Scams

Reporting procedures may vary depending on your location. Still, all complaints should include essential information such as your name, address, telephone, and email, any information about the scammers or the person who received the funds, and transaction IDs.

Investigators will need all transaction IDs related to the funds you sent to the scammers to track your stolen funds. Authorities can use these IDs to trace the stolen coins’ transfer history and location electronically.

You should also provide specific details on how you were victimised, proof of ownership of the stolen funds, and any other relevant information you believe is necessary to support your complaint. It’s essential to use your real digital signature and not a pseudonym.

Suppose you are based in the United States. In that case, you can file a complaint with your local police station or choose to report your case to several authorities, including the Federal Trade Commission (FTC), the Commodity Futures Trading Commission, the U.S. Securities and Exchange Commission (SEC), and the Internet Crime Complaint Center (IC3).

For European-based businesses, Europol can assist in finding the appropriate authorities to report crypto fraud. If your Member State does not have a dedicated online option, Europol recommends visiting your local police station to file a complaint.

Crypto Scams FAQs

What are the biggest crypto scams?

The Mt. Gox hack in 2014 resulted in the loss of over 850,000 bitcoins, while the Bitconnect Ponzi scheme led to the defrauding of investors of $4 billion. Other scams like the OneCoin Ponzi scheme ($25 billion in losses), the PlusToken scam, and various DeFi hacks have been recorded.

What to do if you have been scammed?

If you become a victim of a crypto scam and lose your digital assets, recovering your funds can be challenging. Transactions in the crypto world are irreversible, and fraudsters frequently operate under pseudonyms, making it difficult to trace them. But if you’ve been defrauded, you must act promptly by notifying your bank or financial institution. Report the scam to the relevant authorities and update your security information and passwords to avoid additional fraudulent activities.

Can a crypto scammer be traced?

If you’ve experienced cryptocurrency theft or fraud, one practical approach to identifying and recovering assets is through crypto tracing. Blockchain transactions are publicly recorded on a distributed ledger, allowing all transactions to be traceable. As a result, interested government agencies and the public can track these transactions.

Can I get scammed if someone sends me crypto?

To prevent cryptocurrency theft, avoid accepting transactions from unknown sources. The only possible ways that someone can steal your crypto are through a carefully orchestrated scam in which you voluntarily hand over your funds or by obtaining access to your private keys by hacking your wallet. Therefore, keep your private keys secure and not to share them with anyone.

The Bottom Line

As the crypto market grows in scale and complexity, some people see it as reminiscent of the Wild West, which has attracted scammers’ attention. Crypto scams can be categorised into two types: socially engineered attempts to acquire security or account information and persuading the target to send cryptocurrency to a compromised digital wallet. Knowing the common methods scammers use to obtain your information (and ultimately your funds) can help you identify and avoid crypto-related scams early.