Market cycles operate on the principle of positive and negative feedback, as they emerge from the behavior of investors and traders, and their psychology. Depending on the shifting context, markets can absorb or amplify losses. It is a natural occurrence found in every market, and the crypto market is no exception. The crypto market goes through similar phases of expansion and contraction due to crowding and panic, economic indicators and headlines, regulatory changes and technological advancement.

Despite the risks of crypto markets being highly volatile, there are underlying, predictable patterns known as “crypto market cycles”. All markets experience recurring cycles of growth and decline, and quite typically, the crypto markets do the same: periods of uptrend, downtrend, then back to uptrend. By getting a better grasp at these phases, investors can make more informed decisions, optimize their entry and exit points, and manage risks more effectively.

Understanding Crypto Market Cycles

Crypto market cycles are crucial for several reasons:

- Investment Timing: Understanding the right time to enter or exit the market is critical. Being able to determine the phase of the crypto cycle enables investors to make better decisions about when to buy or sell.

- Risk Management: Each cycle phase presents varying levels of risk. The identification of these phases allows the investors to minimize their exposure to risks depending on the market conditions at certain times.

- Strategic Planning: Having an understanding of the cycles in the market can help in long-term investment planning. It also helps investors to be ready for any change in the market and to be ready to act when the market turns either for good or bad.

- Market Sentiment Analysis: Cryptomarket cycles frequently correspond with swings in investor sentiment. Understanding these cycles gives investors insights into broader market emotions, which can be a useful tool to help foresee future movements.

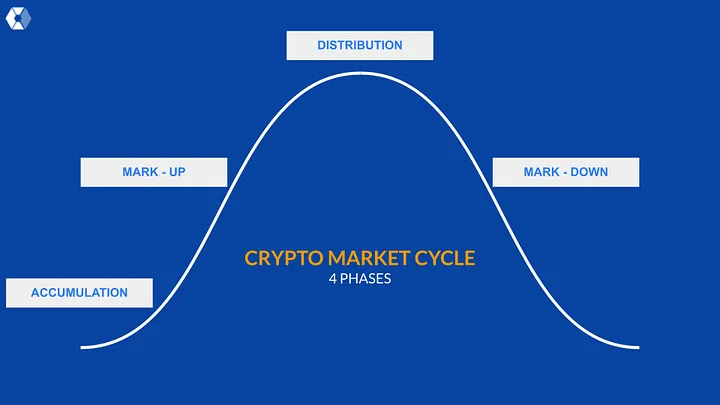

Although it is difficult to pinpoint the start or the end of a market cycle, most cryptocurrencies (excluding stablecoins) go through similar stages. The four primary phases of the crypto market cycle are Accumulation, Markup (Bull Market), Distribution, and Markdown (Bear Market).

1. Accumulation Phase

The Accumulation Phase is the first phase of every market cycle. This phase happens when the market has stabilized following a previous downturn that characterized a certain trend. New cycles typically start with longer periods where prices stop moving dramatically and are generally low, with the general public showing no interest in the market. This phase is characterized by uncertainties and fear from investors, many of which are still in the process of healing their losses as from the last bad phase.

This period is well suited for those who seek to invest for the long run with a view to a holding company. However, for short-term traders, it may require patience since this phase takes weeks, months, or even years to stabilize. During this period, favorable headlines about the general environment of the marketplace may enthrall the attention of the investors as well as stimulate the markup phase.

Characteristics and Indicators:

- Low Volatility: They generally fluctuate mildly within a given range as selling drive slows down while that of buyers begin to increase.

- Investor Behavior: Wise providers and producers invest in assets slowly, understanding that the prices are below the market value.

- Market Sentiment: Public perception and awareness remain fairly low overall, with very little news coverage and limited involvement from the public.

Traditionally, the accumulation phase can occur in the cryptocurrency market for more time if it experiences low, low-volatile price levels and low trading activity. For example, after the 2018 bearish, Bitcoin was trading sideways between $3,000 and $4,000 prices until the start of the 2019 bullish trend.

2. Markup Phase (Bull Market)

After the accumulation phase, the market moves to the Markup phase (also known as the bull market), which is the uptrend market condition. This is a period of rising prices, which sees increasing investor confidence, and growing public interest. A bull market is defined by the upward trending directory and the period can last from several months to even years.

During this phase, new groups of market participants enter the market, and with that there is often a sharp rise of volume at the start of this process. Supply dries up to average demand, and this leads to an increase of prices of an asset as people start competing to own the assets.

New investors may find it convenient for them to invest in the markup phase because it is easier for one to identify that prices are rising upwards. In this phase, dips or pullbacks are often seen as buying opportunities rather than warnings.

Nonetheless, not all assets would experience an increase in their price during the markup phase. Some may still be overrun by negative news pertaining to them, which leads to a movement in their prices in the opposite direction of the general trend in the market.

Characteristics and Indicators:

- Rising Prices: With each new period within the commodities chart, an increase of price as well as the higher highs and the higher lows.

- Investor Behavior: Higher frequency and quantity of purchases by many investors due to market buoyancy and FOMO.

- Market Sentiment: People are generally happy and the media attention and public interest up to the event is usually high.

The first example that is noteworthy as a bull market within the cryptocurrency space was in 2017, where Bitcoin prices started from under 1000$ at the beginning of the year and reached nearly 20000$ by the end of December. There was another big bull run in 2020-2021, when Bitcoin entered a new round of growth and passed the $60,000 mark.

3. Distribution Phase

The distribution phase comes after the bull market. It is characterized by less steep price increases and increased volatility.

During this phase, active traders continue to chip in their cash as they believe that the market still has more upside potential while other traders book their profits and sell their stocks. This results in a situation where those investors who have an optimistic view that the price of the commodity will go up in the future (bulls) are contradicting pessimistic investors who predict a fall in the price of the commodity in future times (bears). Despite high trading volumes, asset prices tend to fluctuate within a narrow range until one side prevails.

This phase usually alters the market outlook from an optimistic view to a very mixed one. This makes uncertainty deepens since both traders and investors cannot determine if it is still in the bull market or in bear market. Analysts frequently use the fear and greed index to measure this shift in market sentiment.

Characteristics and Indicators:

- Increased Volatility: Prices become more erratic, with sharp fluctuations as buying and selling pressures balance out.

- Investor Behavior: Experienced traders and investors start selling their holdings to lock in profits, while less experienced investors may continue to buy, driven by the previous bullish sentiment.

- Market Sentiment: Sentiment starts to shift from highly positive to mixed, with growing uncertainty and caution.

During the distribution phase in early 2018, the price was ranging between $15k — $20 and subsequently hit low before the bearish trend took over. This period was dominated by high turnovers, the more, the higher the risks of the market incase of handsome profit making.

4. Markdown Phase (Bear Market)

The markdown phase (also known as the bear market) entails low prices. During this phase, investors and traders view the market as bearish and market sentiment is negative. The more that participants begin fearing the upcoming state of the market, the more the selling pressure is created. In some situations, this cascading effect can propel prices of an asset to levels not predicted during the markup phase. This phase is usually more difficult for investors because they are likely to incur heavy losses and a form of market capitulation.

However, the markdown phase is long preferred by short sellers as it allows them to reap from a falling market. This usually occurs when even positive news fails to help an asset come out of the downtrend since investors are reluctant to add to their positions in a bid to minimize further losses due to difficult market conditions.

This phase is temporary and eventually gives way to a new cycle. After the markdown phase, the market often transitions into another markup phase, signaling the beginning of the next crypto market cycle.

Characteristics and Indicators:

- Declining Prices: Continuous downward price movement with lower highs and lower lows.

- Investor Behavior: Widespread selling as investors seek to minimize losses, leading to panic and market capitulation.

- Market Sentiment: Overwhelmingly negative sentiment, with media coverage focusing on market crashes and negative news.

The most recent bear market started in the fourth quarter of 2021 right after a bull market peak. The cryptocurrency market was volatile. For example, Bitcoin – which reached over $60,000 – fell to around $30,000 in a few months. There was also increased fear and uncertainty in the market during this period.

Conclusion

The crypto market cycle can be divided into four phases: Accumulation, Uptrend or Bull Market, Distribution, and Downtrend or Bear Market, and these concepts are crucial for every investor who wants to operate in the context of cryptocurrencies. Every phase has its advantages and limitations, and understanding patterns can help investors make better decisions, improve investment plans, and mitigate threats.As the crypto market continues to evolve, staying informed and adapting to these cycles will be crucial for long-term success. The ability to understand and adapt to these cycles, as well as proper investment management will continue to remain the key skills for investors in the ever-changing landscape of cryptocurrencies.