What is Bitcoin Dominance?

Bitcoin dominance is the ratio between the total market cap of Bitcoin to the total market cap of the entire cryptocurrency market. It is a dynamic ratio that reflects Bitcoin’s relative value to other cryptocurrencies and its influence within the crypto space.

The Bitcoin dominance index can be calculated by simply dividing the market cap of Bitcoin by the market cap of all cryptocurrencies. The index is illustrated as below:

Pay attention that the total market cap (the total value) of a cryptocurrency can vary over time as it is based on the total number of coins mined and the price of a single coin. This means that the Bitcoin dominance index is also temporary and changeable.

Market cap indicates how stable a coin or token is likely to be. Keep in mind that all cryptocurrencies boast volatility, even the biggest coin Bitcoin, as it is part of its nature. However, the same way a bigger ship can better navigate heavy weather, a cryptocurrency with a much larger market cap is likely to be a more stable investment compared to one with a smaller market cap.

Key Factors Affecting Bitcoin Dominance

-

- Investors’ Sentiments: When investors are bullish on Bitcoin, they are more likely to buy and hold the asset, boosting the coin’s market cap and its dominance. Conversely, when traders turn to altcoins or try to escape the market, Bitcoin’s market cap could decrease and, thus, its dominance.

- Regulation Concerns: The regulatory environment significantly influences Bitcoin’s dominance. Ambiguous regulations and policies could hinder the growth and communities’ support for Bitcoin. However, if regulators endure conducive legislation for the crypto industry, this can encourage more investors to enter the market, allowing Bitcoin to maintain its dominance.

- Adoption: As a commodity, the more people adopt Bitcoin, the more its market can increase, so as its dominance. On the other hand, if the coin could not gain adoption, its dominance decreases.

- Supply and Demand : Supply and demand are two of the most important factors driving Bitcoin dominance. As the Bitcoin’s supply is capped at 21 million BTC, the coin becomes scarcer over time as no more BTC could be mined. Moreover, if there is a time that the demand for Bitcoin rises, this can increase the coin’s price and so as its market cap, allowing it to maintain dominance.

- Emergence of New Revolutionary Coins:

Since the birth of Bitcoin, there have been over 13,000 crypto coins and tokens which were created and around 10,000 cryptocurrencies alive as of June 2024. Each cryptocurrency offers unique features and utilities, and the number of cryptocurrencies has not yet shown signs of stopping. Bitcoin must compete against prominent players now in the crypto space as well as upcoming projects in the future. If a coin successfully outperforms Bitcoin, BTC’s dominance will obviously go down.

Bitcoin Season vs. Altcoin Season

When it is Altcoin Season, the market’s focus shifts from Bitcoin to alternative cryptocurrencies (called altcoins). This move is attributed to a significant rise in the prices and trading activity of altcoins that could outperform Bitcoin. Several different elements could also be considered, such as speculative trading, the introduction of new projects, technological improvements, and increased utility that attracts investors.

Typically, altcoin season occurs after Bitcoin has experienced a prolonged price surge, making it less affordable for average investors. They will have no other choice but to turn to altcoins.

By contrast, Bitcoin Season is marked by the market’s heightened focus on Bitcoin. When this season occurs, Bitcoin’s dominance index – a measure of Bitcoin’s market cap relative to the total crypto market cap – rises, meaning that investors are in favour of the largest coin. This shift often happens when the market sentiments are pessimistic or amidst market volatility, and investors gravitate towards Bitcoin and stablecoins, seeking safer investments.

Bitcoin Dominance over time

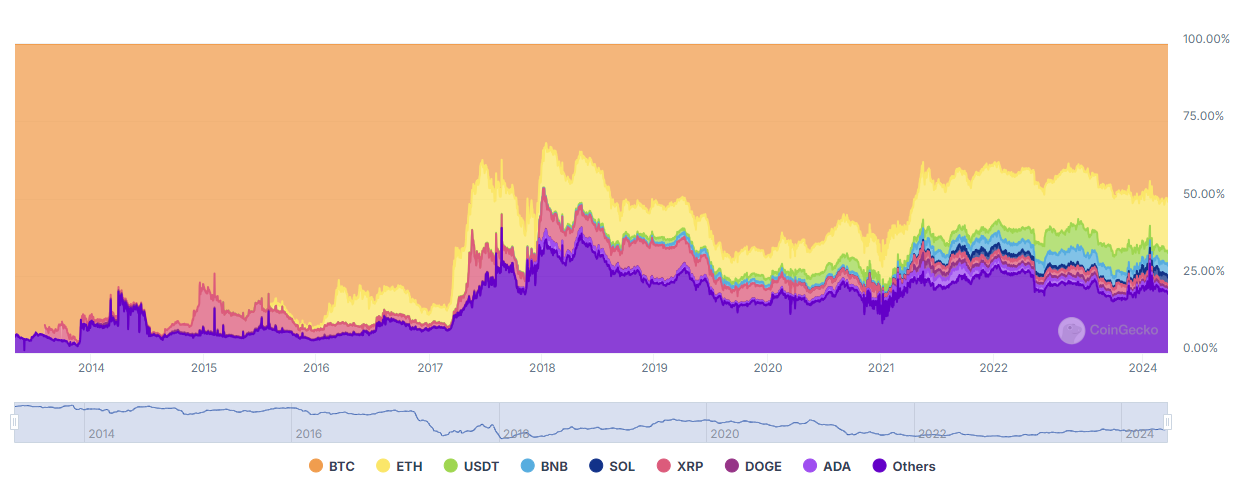

While Bitcoin’s dominance has fluctuated over time, we can see that BTC overall dominance has been in decline ever since. Back in 2013-2014, Bitcoin had a market dominance of around 94% because almost no alternative coins existed. This dramatically changed in 2017, when Ethereum’s gradual price increase kicked off the so-called ICO boom that led to the rise of thousands of crypto coins and tokens (the 2017 Altcoin Season). In March of 2017, Bitcoin’s dominance stood around 85% before it plunged to as low as 38% in just less than four months.

After a brief recovery to over 62% by mid-December, Bitcoin’s dominance plummeted to its all-time low of 32.8%, marking the onset of the 2018 crypto bear market. During this bear market that lasted more than two years, Bitcoin’s dominance began to recover, reaching a temporary peak of just over 71% at the beginning of January 2021.

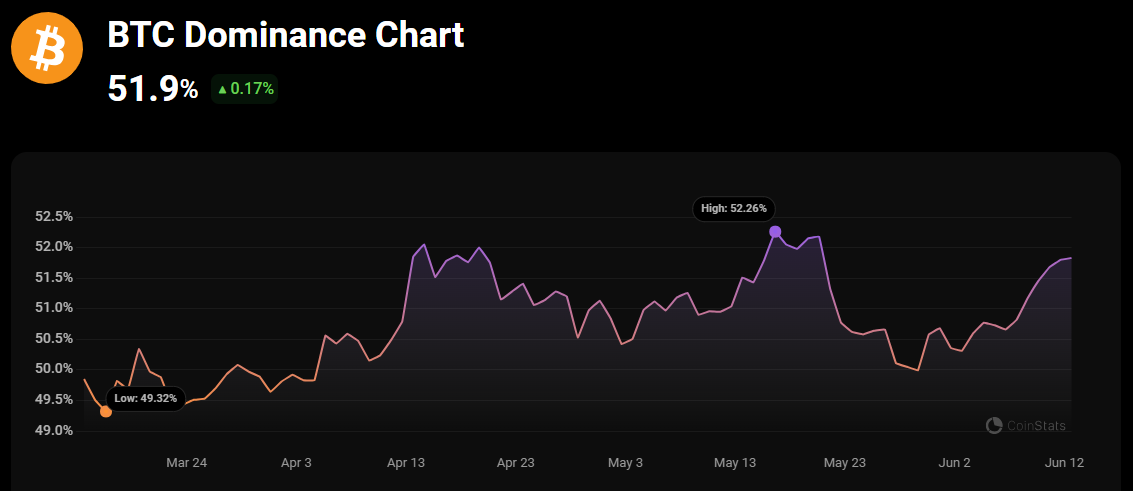

Since the beginning of 2022, Bitcoin’s dominance has again seen a sharp decline, hovering around 40-48% for the whole year. This trend has continued until now, even after the Bitcoin halving event in April 2024, though the BTC dominance index does show a slight increase.

How to Take Advantage of Bitcoin dominance

Bitcoin dominance could be a useful metric for evaluating the health of the overall cryptocurrency market. This is, however, not the only utility it offers. Investors can gain better profits through methods such as shorting, given that they truly understand the practical uses of this measure. We can help with that.

Consideration in managing risk

Investors can use BTC dominance to help manage their overall risk exposure to the cryptocurrency market.

A rising Bitcoin dominance often indicates that investors are flocking to Bitcoin. This movement could signal a bearish sentiment in the broader crypto market because Bitcoin is considered as the “digital gold” of the crypto world. Similar to the traditional economic system, whenever the market goes down, investors turn to gold.

Conversely, a decreasing Bitcoin dominance might suggest a bullish sentiment. In a bullish market, investors will try to diversify their portfolios and explore alternative cryptocurrencies, thus reducing the Bitcoin dominance.

Portfolio Diversification

Investors use Bitcoin dominance as a barometer to help gauge the overall market sentiment and make decisions about whether and how they should diversify your crypto portfolio. When Bitcoin dominance is high, investors may consider diversifying into altcoins to spread their risk. Conversely, during periods of low Bitcoin dominance, some investors might opt to consolidate their holdings into Bitcoin.

Bitcoin dominance cycle

The rise and fall of cryptocurrencies is cyclical and can generally be observed in the following order:

- BTC rises

- Large-market-cap altcoins rise

- Medium-market-cap altcoins rise

- Small-market-cap altcoins rise

- BTC begins to fall (Altcoins keep rising)

- Large-market-cap altcoins begin to fall (med and small continue as they have momentum)

- Medium-market-cap altcoins start to fall (small cap keep pushing)

- Small-market-cap altcoins also crash