Due to the historically low base interest rate established by the RBA, it’s sluggish to use bank savings accounts for investment growth. However, an option exists for regular investors who aim to optimise their returns without delving into intricate financial market understanding. This alternative involves the utilisation of a micro-investing platform Raiz. But is it safe to invest with Raiz? What are Raiz fee structures? Is Raiz suitable for beginners? Read this Raiz review to figure it out!

Raiz Overview

Previously recognised as Acorns, Raiz started as an Australian micro-investing platform in 2016. This application empowers individuals in Australia to conveniently construct their investment portfolios even with modest sums of money. By harnessing automation and advanced technology capabilities, Raiz’s primary objective is to dismantle conventional barriers associated with investing, ensuring inclusivity regardless of one’s financial expertise.

Pros

Cons

How Raiz Works

If you’ve ever engaged with an app-based service, getting started with Raiz will feel instantly recognisable. Just follow these straightforward steps:

- Download the App: Raiz is accessible for both iOS and Android platforms.

- Create & Configure Your Account: Provide your email address and set up a password. Then, configure your bank account for deposits and withdrawals to and from your Raiz account. While the round-up amounts are from your card expenditures, they are debited from your bank account, not the card account. Raiz employs bank-level security measures and encryption, with no data stored on your phone.

- Specify Round-Up Spending Sources: Connect a single credit or debit card – or multiple cards – as your round-up spending sources. This is used to calculate the rounded-up amounts.

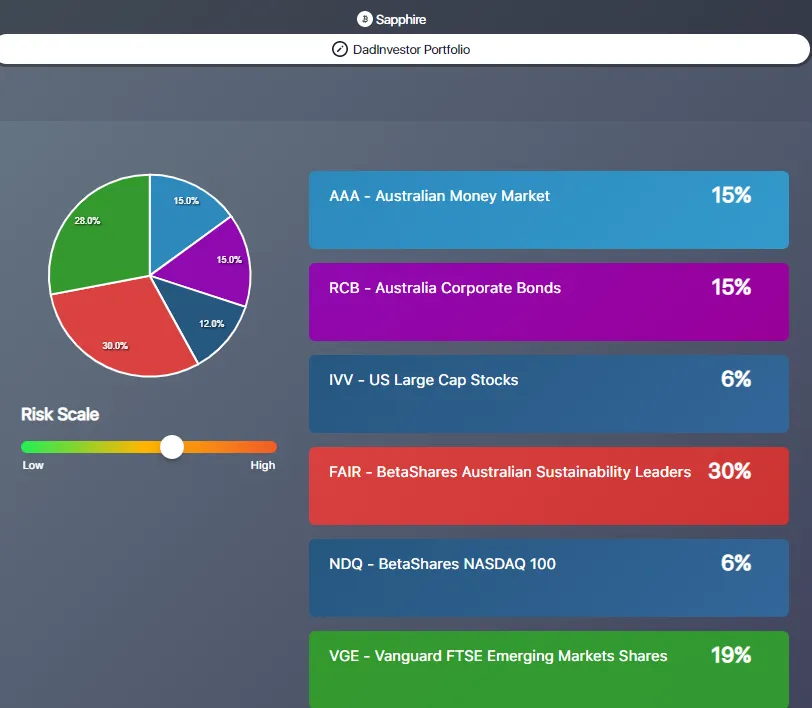

- Choose Your Investment Mix: Select one of the seven investment portfolios. The selection depends on your desired risk level. The portfolios range from Conservative (minimal risk) to Aggressive (high risk), with options like Moderately Conservative, Moderate, Moderately Aggressive, Emerald (socially responsible), and Sapphire. Changing your portfolio is fee-free and can be done at any time.

Investing with Raiz

Raiz stands as a potent investment platform engineered to accelerate wealth growth beyond the pace of a typical bank account. This is attributed to the superior returns the stock market generates, which Raiz employs to allocate your funds. Notably, two exceptional attributes render Raiz an accessible and uncomplicated means of engaging in share investments.

ETFs

Your Raiz account is dedicated to a collection of established ETFs recognised for their great historical performance. Although these ETFs can be individually purchased through online brokers, Raiz’s portfolios offer the advantage of investing in multiple options through a single account. When constructing a customised portfolio within the Raiz framework, you now have the flexibility to choose from a selection of 23 distinct ASX-listed ETFs alongside Bitcoin and a property fund.

Global ETFs

- IOO – Global 100

- IAA – Asia Large Cap Stocks

- IEU – Europe Large Cap Stocks

- IVV – US Large Cap Stocks

- ETHI – Global Socially Responsible

- NDQ – Nasdaq 100

- VGE – Emerging Markets

Australian ETFs

- STW – Aus Large Cap Stocks

- RARI – Aus Socially Responsible

- FAIR – Aus Sustainable Leaders

- VSO – Australian Small Companies

- VETH – Ethically Conscious Australian Shares

Fixed interest & cash ETFs

- AAA – Cash ETF

- IAF – Aus Bonds

- RCB – Aus Corporate Bonds

- VEFI – Ethically Conscious Global Bonds

- VCAF – Aus Corporate Bonds

Trend, themed and sector focused ETFs

- IXJ – Global Healthcare

- Bitcoin (but no more than 5% of overall portfolio)

- IFRA – Global Infrastructure

- ERTH – Climate Change innovation

- HACK – Global Cybersecurity

- ACDC – Battery Tech & Lithium

- QAU – iShares Gold Bullion

Property

- RPF – Raiz Property Fund

Fractionally

The attractiveness of opting for Raiz for your investments lies in its ability to put any amount of cash to work. This entails purchasing fractions of shares on your behalf, eliminating the need to wait until you have the precise share price before making a purchase. This convenience enables you to begin investing promptly, even with a starting amount as low as $5.

In contrast, online brokers typically require a minimum investment of $500. Consequently, you need this minimum sum to initiate an investment, and the resulting investment value might not precisely match the share price due to the requirement of aligning your investment with the units you intend to acquire.

Raiz Smart Portfolios

One of the initial steps upon creating your new Raiz investment account involves selecting the portfolio in which to invest. Raiz provides a choice between seven preconfigured portfolios and the option to craft a customised portfolio.

The key distinction among these portfolios lies in their risk levels. Risk denotes the potential variance between your actual returns and your anticipated outcomes. A higher risk level corresponds to an increased possibility of such discrepancies occurring.

The portfolio options are as follows:

- Conservative (low risk)

- Moderately Conservative

- Moderate

- Moderately Aggressive

- Aggressive

- Emerald Portfolio

- Sapphire Portfolio (highest risk)

These preset portfolios consist of established ETFs, which represent a combination of local and global stocks, bonds, and cash. Each portfolio features a distinct blend of stocks and bonds, ranging from the conservative choice (22% stocks) to the aggressive growth alternative (90% stocks). These labels mirror the categorisations often encountered in superannuation contexts.

Custom Portfolios

In 2021, Raiz introduced custom portfolios, revolutionising the investment landscape. This innovation empowers you to construct your personalised, diversified portfolio. Instead of individually acquiring multiple ETFs, Raiz allows you to amalgamate them into a single investment.

The process involves selecting the desired ETFs and determining their respective portions within your portfolio. While the options are limited to 16 ETFs (along with up to 5% Bitcoin), these choices encompass robust and well-established ETFs that are well-suited to your requirements.

Upon making your ETF selections, you’ll allocate percentages to each within your overall portfolio. Raiz also offers uniquely tailored portfolios, permitting multiple investments and fine-tuning the allocations to match your preferences. The only stipulation is that Bitcoin cannot exceed 5% of the portfolio.

This feature proves invaluable for those seeking asset allocation flexibility without delving into individual stock selection. Nonetheless, it’s important to note that this portfolio variant comes with higher fees than other platform options. Therefore, it is advisable to assess the Raiz portfolio offerings and compare them against your intended investment goals and risk appetite.

During the selection process, Raiz provides risk assessments that gauge the risk associated with your choices. A higher proportion of stocks or cryptocurrency translates to elevated risk within the portfolio.

Raiz Fee Schedule

Raiz maintains full transparency in its pricing structure, and though occasional fee adjustments may occur, it remains a cost-effective choice. The absence of trading fees (for deposits and withdrawals) and the consistent portfolio balancing further contribute to its affordability.

The fee structure on Raiz varies depending on your account balance and the chosen portfolio. For instance, individuals holding less than $15,000 encounter a $3.5 monthly charge for a standard portfolio, whereas those over $15,000 are subject to a 0.275% monthly fee. Raiz’s fees are listed below:

Standard Portfolios:

- Under $15,000: $3.5 per month

- $15,000 and above: 0.275% per year

Custom Portfolios:

- Under $20,000: $4.5 per month

- $20,000 and above: 0.275% per year

Sapphire Portfolios:

- $3.5 per month or 0.275% per year.

Raiz Security

Raiz is a reasonably secure micro-investment tool. Several factors contribute to my view that Raiz stands out as a safe micro-investing platform:

- Regulatory Oversight: Raiz operates under the umbrella of an Australian Financial Services Licence and functions as a managed investment scheme, overseen by ASIC.

- Public Listing and Transparency: As a publicly listed entity on the Australian Securities Exchange, Raiz is obligated to provide comprehensive company documentation, ensuring a level of transparency and accountability.

- Limited Initial Investments: The platform primarily deals with smaller sums of money. Once your portfolio gains momentum, it’s generally more advisable to explore investment options outside of Raiz.

- Robust Security Measures: Raiz employs stringent security protocols, storing data on secure cloud servers with bank-level security standards. The utilisation of secure 256-bit SSL encryption and multi-factor account authentication further safeguards your personal identity, bank account, and investments.

- Insurance Against Fraud: Your funds receive insurance coverage against instances of fraud and criminal activity, enhancing the overall protection of your investments.

Other Features

- Round-Up Investments: A distinctive Raiz feature, the round-up investment mechanism, empowers users to transform spare change into investments. By rounding up everyday purchases to the nearest dollar, the difference is automatically channelled into the chosen portfolio, facilitating gradual wealth accumulation.

- Automated Investments: Raiz offers users the ability to establish recurring investments daily, weekly, or monthly. This approach eliminates the complexities of market timing and encourages a disciplined, long-term investment strategy.

- Raiz Mobile App: The Raiz mobile app boasts exceptional user-friendliness, enabling seamless purchasing, selling, and trading of available portfolios on the move. The app presents your investment portfolio through an intuitive interface. Compatible with iOS and Android devices, the Raiz app holds a remarkable rating of 4.7 stars from 29,000 reviews on the Apple App Store, and 4.6 stars based on 100,000 reviews on Google Play.

- Raiz Rewards: Through the Raiz Rewards program, users can earn cashback when purchasing from participating retailers. This cashback can be directly invested into their Raiz account, enhancing their investment potential.

- Financial Education: Raiz strongly emphasises financial literacy by providing an extensive array of educational resources. These resources cover diverse topics, including budgeting, debt management, and fundamental investment concepts.

- Customer Support: Distinguishing itself in customer support, Raiz offers 24/7 live assistance through email ([email protected]) and phone (1300 75 47 48). Moreover, the team is accessible via various social media platforms, including Facebook, Instagram, Twitter, LinkedIn, and YouTube.

Raiz FAQs

What is Raiz designed for?

Raiz is a forward-thinking and user-centric micro-investing application created for individuals seeking to venture into the investment realm without substantial financial obligations. Everyone can discover the inventive functionalities within the Raiz app, crafted to assist users in constructing a robust investment portfolio, even with modest sums of money.

Can I invest in property through Raiz?

You now have the option to include Australian residential property in your Raiz portfolio using the Custom Portfolio feature. This avenue exposes a diverse property portfolio encompassing residential houses, apartments, and new developments, all within a single investing app. The fund predominantly invests in million-dollar properties across Australia, with the objectives of capital growth and stable rental income.

Is Raiz suitable for beginners?

Yes, it is well-suited for beginners due to its low minimum investment requirement of $5. Raiz offers informative resources to educate investors and ensures convenient deposits and withdrawals. The user-friendly Raiz App simplifies the investment process with its intuitive interface.

Is investing with Raiz secure?

Investing with Raiz is secure as it possesses an Australian Financial Services Licence and operates under ASIC’s oversight. It is also listed on the Australian Stock Exchange. The ETFs purchased by Raiz on your behalf are held by an independent custodian, not by Raiz or you. If Raiz encounters financial difficulties, the custodian will transfer the holdings back to you.

Is Raiz or Spaceship the better choice?

Spaceship holds an advantage due to its significantly lower fees than Raiz (currently 0.05% for portfolios exceeding $5000 in Spaceship versus 0.275% for portfolios over $10,000 with Raiz). Spaceship doesn’t impose fees for balances below $5000. However, Raiz provides the option to construct custom portfolios and offers features like round-ups, which Spaceship doesn’t currently provide.

What’s the potential return on Raiz?

The potential returns on Raiz are influenced by variables such as your investment contributions, the performance of your selected portfolio, and prevailing market conditions. While Raiz aims to foster growth in your investments over time, it’s essential to recognise that returns are not guaranteed, and investing carries risks.

Raiz Review: Conclusion

Overall, Raiz is a comprehensive wealth management solution that provides a remarkable introduction to saving and investment practices. Tailored for novice investors, it is a gateway to diversified, premium investment offerings at minimal expenses. The platform integrates automated “round-up” technology and investment functionalities that bolster your investments.