Koinly is designed to streamline the typically intricate task of monitoring, computing, and disclosing taxes related to your crypto transactions. This Koinly review delves into the features of this tool and assesses its pricing and safety features.

What Is Koinly?

Koinly is a crypto tax software that facilitates tax reporting based on crypto activities such as trading, mining, staking, and airdrops. It benefits individual traders, investors, and corporate or professional accountants serving crypto investors.

Koinly adopts a hands-off approach, simplifying the process for users. The platform takes charge of the remaining tasks by linking their exchanges, wallets, or other relevant services through API keys.

Automated importation of transactions occurs seamlessly, including calculating market prices during trading, matching transfers within wallets, and determining gains and losses from crypto investments. Ultimately, Koinly generates comprehensive cryptocurrency tax reports to fulfil your tax obligations.

Pros

Cons

Koinly’s Prominent Features

By enabling automatic import and organisation of crypto transactions, Koinly eliminates the burden of manual entry and ensures accurate records. Below are some of the prominent features of this tool.

Portfolio Tracking

Koinly empowers users to monitor their crypto assets effectively and evaluate performance across various platforms. Given the widespread distribution of digital assets among different wallets and exchanges, tracking the overall portfolio’s performance can be daunting.

However, Koinly offers a comprehensive solution by presenting an all-in-one dashboard that displays the aggregated position of your crypto assets. This portfolio tracking feature proves invaluable as it calculates your actual return on investment (ROI) across all holdings, tracks growth over time, and provides a holistic overview of additional income sources like mining, staking, lending, and more.

Data Import

The utility of Koinly lies in its robust support for automation and mass data import. Without these features, the platform’s usefulness would be severely limited. Users can bypass the tedious process of manually entering data from every crypto platform they use. Instead, it allows for seamless data synchronisation and mass file uploads to cover any information that cannot be automatically synced.

Koinly’s extensive capabilities encompass support for over 20,000 tokens, 170 chains, and 400+ exchanges, wallets, and services. Some notable features include:

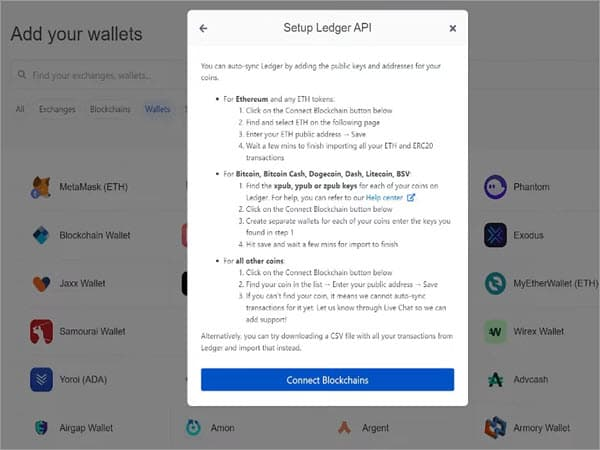

- API integration, wallet linkage using x/y/zpubs, and Ethereum (ETH) token tracking through public addresses.

- Comprehensive tracking of margin trading on centralised exchanges.

- Automatic tagging of “income” from imported sources, such as platforms like Nexo, Compound, Aave, and more.

- Smart Transfer Matching: Koinly employs AI-powered detection tools to identify transfers between your wallets, excluding them from tax reports.

- Automated data input captures crucial transaction details, including the transaction date, token quantity, and transaction price, reducing the need for manual input.

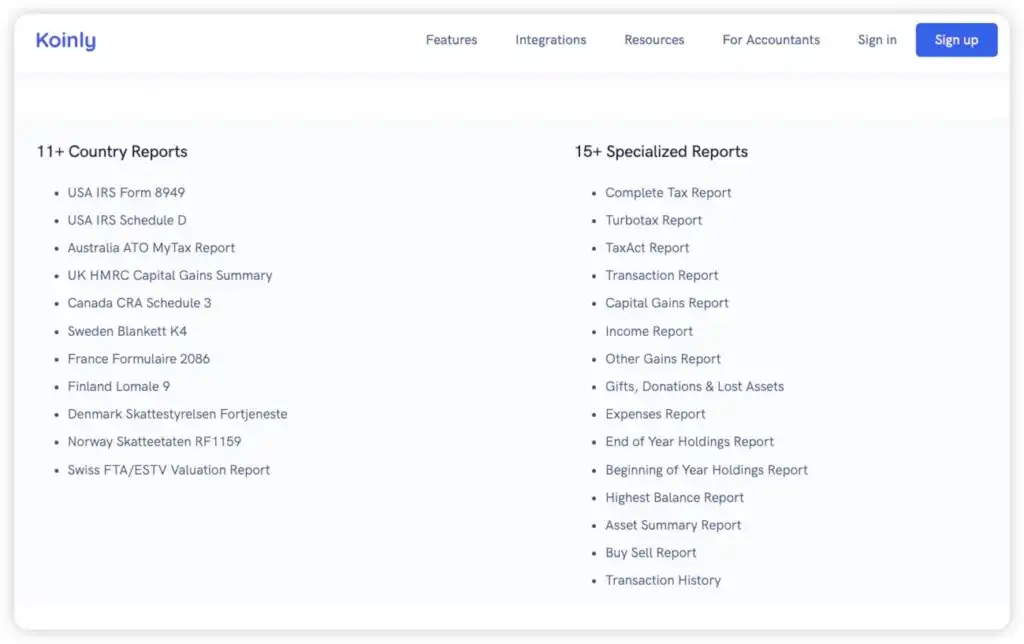

Crypto Tax Reports

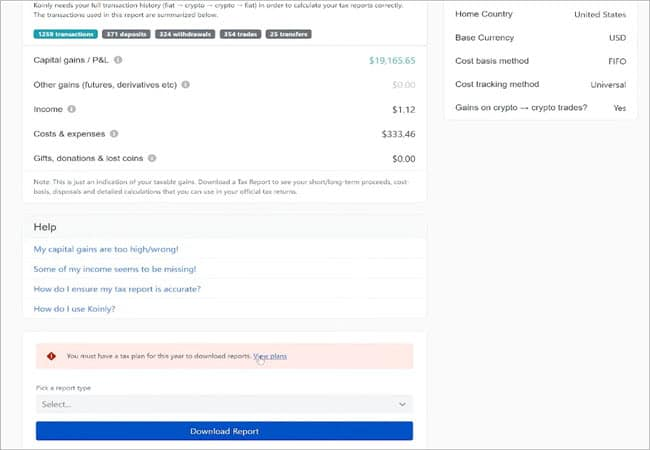

After gathering all the necessary data, Koinly offers users a complimentary preview of their capital gains, losses, and other tax reports. When ready, users can generate the required tax documents conveniently. Here are some of the available tax reports:

- Form 8949, Schedule D: For users in the United States, Koinly can generate pre-filled IRS tax forms on their behalf.

- International tax reports: Koinly provides localised tax reports for over 20 countries, including the USA, Canada, the UK, Germany, Sweden, Brazil, and more. These reports cater to the specific tax requirements of each country.

- Comprehensive tax reports for various accounting methods: Koinly accommodates users who need to declare taxes in countries employing different accounting methods such as First In First Out (FIFO), Last In First Out (LIFO), Highest Cost, Average Cost Basis, Shared Pool, or PFU.

Koinly Pricing And Plans

Koinly offers a range of options, including one free and three paid plans.

- Free Plan: This plan offers essential features such as portfolio value tracking, unlimited wallets and exchange accounts, capital gains preview, support for DeFi, margin trades, futures, avalanche trades, and the ability to calculate up to 10,000 transactions.

- Newbie Plan: Priced at $49 per year, this plan includes additional features like overseas tax reports, Form 8949, Schedule D, a comprehensive audit report, and the ability to file and include up to 100 transactions in your account.

- Hodler Plan: For an annual fee of $99, the Hodler Plan builds upon the features of the Newbie Plan and allows up to 1,000 transactions to be processed.

- Trader Plan: Designed for experienced traders, this plan is priced at $179 per year. It encompasses all the features of the previous plans and provides the capacity to process up to 3,000 transactions. It also includes expert email assistance. If more transactions are required, an option to process over 10,000 transactions is available for $279.

Is Koinly Reliable & Secure?

Koinly has garnered a high rating on Trustpilot, with an average of 4.8 stars out of 5 based on over 1,208 reviews as of June 1, 2023. This establishes Koinly as a trusted and legitimate crypto software to track their crypto activities and generate reliable tax reports. The platform also provides detailed information about transactions, allowing for efficient management.

Koinly employs advanced security systems to ensure user data safety and privacy. Here are some key points regarding the safety of using Koinly, as indicated by search results:

- Data encryption: Koinly encrypts data during transmission and does not store payment details.

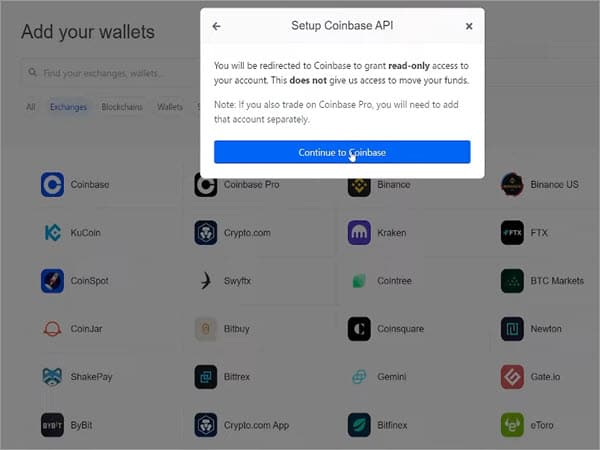

- Secure API integration: Koinly only requires read-only API access to function, making connecting with exchanges like Coinbase or other platforms safe.

- Strong SSL security: All data transmitted to Koinly is encrypted during transit, and both its API and application endpoints receive an “A+” rating on SSL Labs’ tests.

- Bank-grade security: Koinly employs security measures of the highest standard to protect user data.

However, some users have reported inaccuracies and errors requiring manual adjustments. Besides, there have been reports of compatibility challenges with certain exchanges. For instance, some customers have encountered difficulties accurately reporting transactions from DeFi exchanges like Maker and Compound.

How to Use Koinly?

Koinly is a user-friendly platform that is easy to set up and use. It doesn’t require any prior accounting knowledge or tax expertise to benefit from its features. Here’s a breakdown of the setup process:

Step 1: Sign up on Koinly

Register via either your Google or Coinbase account or by providing your name, email, and password in the sign-up form. Choose your country and base currency, and select a plan. The account is set up as a read-only account to prevent unauthorised money transfers.

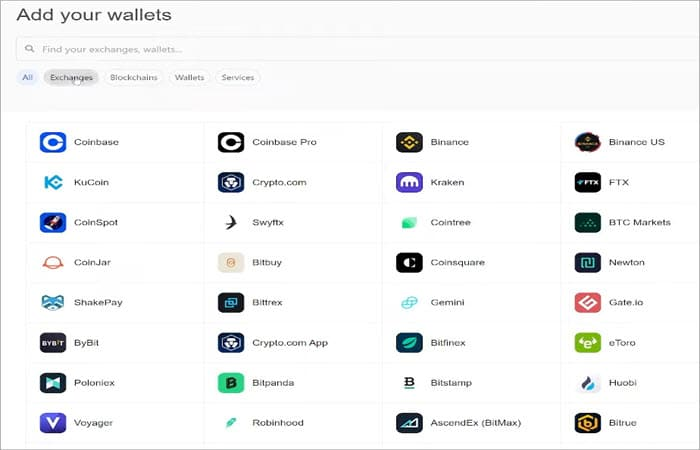

Step 2: Sync your crypto accounts and import data

Koinly requires users to import data regarding their crypto transactions. To add a wallet, exchange, blockchain, or service, log in to Koinly and navigate to the respective tabs.

For syncing crypto exchanges, choose the Exchange tab, select your exchange from the list, log in to your wallet, and authorise the API connection. Some exchanges, like Coinbase, sync automatically without manual API setup, while others, such as Binance or Kraken, require manually entering the API keys.

For blockchain wallet syncing, use the Blockchain tab, click “Connect Blockchain,” enter your wallet address, specify the starting time for data import, and click “Import.”

The same process can be repeated for syncing wallets and other services. Paste your wallet address, choose the starting time for importing data, and click “Import.”

Alternatively, you can download CSV files from your wallets or exchanges and manually upload them to Koinly.

Step 3: Review the data and wait for gains to update

Once the data sync is complete, ensure that all the information has been added accurately. This step does not require purchasing a plan and can be used as a portfolio tracker to monitor crypto investments across various platforms and services.

Based on the transaction history, Koinly will calculate cost basis, fair market value, capital gains, and income. A tax summary will be available for free. Navigate to the crypto tax report section on Koinly.

Step 4: Export tax reports to tax apps or download

To file taxes, you can manually or automatically export tax reports from Koinly to tax software such as TurboTax. Please note that a paid plan is required for this functionality.

Koinly generates a PDF report with a capital gains summary, a list of transactions, end-of-year balances, an asset summary, and income transactions. For users in the United States, Koinly can generate filled IRS tax reports that can be uploaded to tax apps, sent by post, or shared with an accountant.

Frequently Asked Questions

How accurate is Koinly?

Since its establishment in 2018, Koinly has assisted individuals with their crypto taxes. The tool proudly asserts a remarkable accuracy rate of over 98% when matching wallet transfers. It also ensures that tax calculations are precise and compliant with tax authorities’ regulations and requirements.

Who is the best fit for Koinly?

Koinly is a versatile tool suitable for all crypto users, from casual holders to advanced traders, businesses, and accountancy firms. If you find crypto taxes overwhelming, Koinly offers expert guidance to help you navigate the process and ensure you confidently meet your tax obligations.

Is it safe to give an API key to Koinly?

Koinly is safe to use. When you grant Koinly API access, it only allows read-only privileges to import your transactions and track the interest you’ve earned from lending, staking, or holding crypto assets. Importantly, it does not give Koinly the capability to make trades or move funds on your behalf, ensuring the security of your assets.

Does Koinly Report to the IRS?

No. Koinly doesn’t directly report to the IRS. However, users can use the platform to file their taxes and generate capital gains and losses calculations for Schedule D. Koinly can also generate Form 8949, commonly used for IRS reporting purposes.

How long does Koinly take to sync?

Syncing an account on an exchange or wallet service typically takes around 15 minutes. Users can manually trigger the sync instead of relying on auto-syncing. Alternatively, they can download a CSV file from their exchange or wallet account and manually upload it to Koinly, eliminating the need to sync the exchange directly.

Does Koinly offer promo codes?

Koinly provides some promo codes or referral bonuses. You can use our unique referral link COINSPOT23 to enjoy a 30% discount on all plans. To avail yourself of the promo code, read our detailed guide on using Koinly promo codes.

Final Thought

Koinly stands out favourably compared to other crypto tax software options, often earning high ratings from users. This tax software simplifies the process of crypto tax reporting and calculation, particularly for small businesses with fewer transactions. It seamlessly retrieves transaction records from numerous crypto exchanges, wallets, blockchains, and services.