IG is an FCA-regulated broker in Australia, offering a wide range of trading services across various financial markets, including forex, indices, commodities, and shares. Delve into our IG review for an in-depth understanding of the broker’s trading features and fees.

Official Website | |

Headquarters | UK |

Found in | 1974 |

Regulators | ASIC, JFSA, MAS, FINMA, FCA, & CFTC |

Products offered | ETF, Forex, Options, CFD, Stocks in some countries, Robo-advisory in UK, IPOs |

Minimum Initial Deposit | $300 |

MetaTrader 4 (MT4) | Yes |

MetaTrader 5 (MT5) | No |

Trading fees | Low |

Inactivity fee | $12 a month |

Withdrawal fee | £100 |

Supported currencies | Bitcoin, Ethereum, and several other blockchain-based cryptocurrencies |

Customer Support | Live Chat, Social Media, FAQ Section, and Email |

IG Markets Overview

Established in 1974 by investor Stuart Wheeler, IG Group initially operated under the name “IG Index,” focusing on trading gold indices. Its subsequent rebranding in 2000 marked its evolution into a prominent trading force, generating about $650 million in annual revenue.

Based in London, England, IG Group specialises in derivative trading, particularly CFDs. Globally recognised as a leading CFD provider, the company operates across more than seventeen countries, facilitating access to over 17,000 financial markets.

With a market cap exceeding $3 billion, IG caters to a client base of 239,600 individuals and employs over 1,900 staff members globally.

As with any investment platform, IG has its pros and cons and unique features. These features are briefly outlined below, with more insights provided throughout this IG review.

Pros

Cons

IG Share Markets

On a global scale, IG has curated a wide array of over 17,000 markets. The offerings include futures and options across various instruments, assuring clients of abundant trading opportunities. IG’s markets spectrum comprises Forex, Indices, Shares, Commodities, Cryptocurrencies, Bonds, ETFs, Options, Industry sectors, and Interest rates.

For those engaging in IG’s share trading account, a gateway to over 13,000 shares spanning Australian and international markets awaits. The breadth of stock exchanges accessible via the IG share trading account are:

- Australia: ASX 200, ASX 300, and a wide assortment of small-cap Australian stocks.

- US: S&P 500, DOW 30, Nasdaq-100, and an extensive array of small-cap US stocks.

- UK: FTSE 100, FTSE 250, and a diverse spectrum of small-cap UK stocks.

- Germany: DAX, HDAX, MDAX.

- Ireland: ISEQ.

Trade Experience

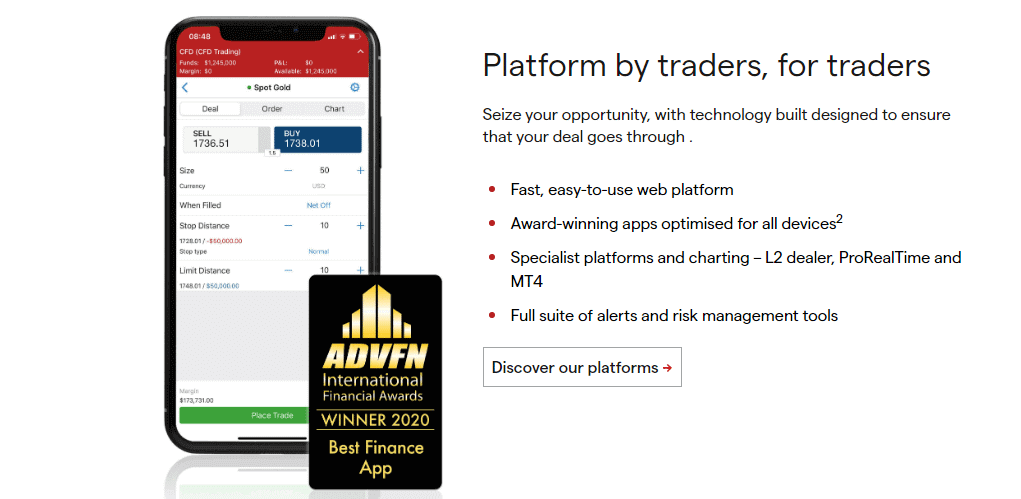

Globally, IG offers various platform options and API interfaces. Their proprietary web-based platform stands out for its customisation and user-friendly navigation, accessible across browsers with a preference for Google Chrome.

Despite its simplicity, particularly in the U.S. version, its functionality shines through. While it lacks some advanced features in competitor interfaces, its quality compensates for quantity. This, with the standard MT4 platform and mobile apps, constitutes IG’s U.S. online offering.

Clients enjoy similar privileges and can access the fee-based ProRealTime advanced charting platform, while tech-savvy users can integrate their software via API or Bloomberg terminal.

IG extends direct market access (DMA) through L2 Dealer for CFD shares and forex, with no added cost except exchange fees. The U.S. web-based platform features risk management tools, news streaming, and Autochartist integration, but lacks trailing and guaranteed stop-loss orders.

Basic order types include Market, Limit, and Stop, with the option to attach take profit and stop loss orders.

Portfolio Analysis

IG’s web-based platform, while simple and user-friendly, falls short of excellence. The order interface offers basic market and pending order options with stop-loss and take-profit orders but lacks guaranteed and trailing stop-loss options. Such essential trade information as pip value, trade size, margin requirements, and stop-loss/take-profit amounts, is displayed before execution.

Trade size is chosen in increments of 100,000 of the base currency, equivalent to a standard lot. In the U.S., the default currency is the dollar; the U.K. offers a choice of euro, pound, yen, and dollar. The U.K. version includes a guaranteed stop loss option but lacks a trailing stop loss, which is noteworthy.

For real-time client insights like balances, transaction history, and profit/loss breakdowns, the “My IG” page provides a basic overview. The U.S. platform is experimenting with “Trade Analytics” for in-depth analysis, exclusively for live accounts. This enhancement enables detailed scrutiny of trading beyond basic metrics. However, the platform lacks a trading journal and tax accounting tools.

Fee Structure

IG boasts globally competitive costs, extending the same benefit to Australian clients. The primary source of IG’s earnings is the spread, generated when customer trades traverse the bid/ask spread.

CFD trading introduces a commission charge, seamlessly incorporated into the market spread. Share-CFD trading entails an explicit commission. A premium applies upon triggering for guaranteed stop-loss orders on IG, a premium applies upon triggering, alongside additional documented extras and third-party fees.

Starting at 0.8 pips, IG’s platforms feature minimum spreads for major pairs, with average spreads ranging from 0.9 (EUR/USD, USD/JPY) to 5.4 (GBP/CAD).

In line with industry practice, swap fees linked to tom-next rates are applicable to overnight positions, possibly involving currency conversion charges for trades in a non-base currency. An inactivity fee of $12/month activates after 24 months without trading, and wire withdrawals attract a $15 charge. Detailed forex trading costs are transparently given on IG’s website.

Globally, a minimum account deposit of 250 units in the base currency applies, equivalent to $250. Clients are subject to a maximum leverage of 50:1 per CFTC regulations. Traders achieving specific volume thresholds qualify for rebates within three tiers, ranging from 5% for $100 million in monthly trading volume to 15% for $500+ million.

IG Security

In Australia, IG prioritises security measures to safeguard its clients’ interests. With authorised and regulated status from ASIC (Australian Securities and Investments Commission) under IG Markets Ltd (#220440), clients can trust in their compliance with stringent industry standards. This commitment extends to other regulatory bodies, including being a member of NFA (#0509630) and CFTC-regulated as an RFED in the U.S., as well as authorised and regulated by the FCA in the U.K.

IG adheres to FCA client money rules, ensuring that client funds remain separate from corporate funds, thereby providing asset protection. In the unlikely event of insolvency, client assets are held in segregated accounts at regulated banks. IG offers protection through the Financial Services Compensation Scheme (FSCS) and safeguards to mitigate potential risks. Negative balance protection is guaranteed, preventing clients from losing more than what’s available in their accounts.

IG upholds robust software security practices, including two-factor and biometric authentication. To ensure active security, both web-based and mobile apps log users out after periods of inactivity. It also operates a counterparty dealing desk, which is excellent for larger accounts seeking direct access to the interbank system through a dedicated platform. Dealing desks play a vital role in the stability and functionality of a broker’s platform.

Customer Service

IG provides robust customer service avenues to address clients’ needs effectively. Clients, whether potential or active, can engage with IG representatives through live chat during platform hours. The suite of contact options is further enriched by email, social media channels, and a comprehensive FAQ section, enhancing user convenience.

In cases where assistance is required, a transparent customer complaint procedure is in place to facilitate grievance resolution. The online customer support caters to diverse language preferences, appealing to a wide-ranging clientele. Satellite offices complement IG’s commitment, extending localised support to licensed regions.

Customer support spans 24/5 via telephone and email, alongside the website’s organised FAQs and support pages provide valuable information to users, streamlining their experience.

Research Amenities

IG stands out for its dedication to delivering timely and informative research to its clients, catering to various preferences – whether for reading, listening, or watching content. However, there’s a notable shortcoming wherein links on the U.S. site direct to the U.K. site, offering information that isn’t accurate for U.S. clients, like the mention of “guaranteed stop losses.”

IG’s DailyFX website encompasses comprehensive news, research, and an educational hub. This resource features internal analysts and covers various market topics, including intermediate technical and fundamental analysis. Real-time news is curated in-house, focusing on major currency pairs.

It further enrichs the knowledge through various live webinars to enhance trading skills, highlight crucial events, and identify news catalysts. The Trading Strategies section delivers concise short-term buy and sell signals, analyst recommendations, pivot points, and technical insights.

Education Resource

IG’s educational resources outshine those of other online brokers investigated by Investopedia. The expansive trader’s library, prominently featuring the impressive “IG Academy,” expedites beginners’ learning curves, while seasoned practitioners benefit from advanced trading strategy articles. An array of informative webinars covers topics ranging from platform navigation to upcoming trade opportunities.

The IG Academy’s courses adeptly cater to individuals at different stages of their trading journey. The user-friendly mobile app lets clients access courses and articles with great ease. While IG acquired DailyFX.com in 2016, integration with the broker site needs to be improved, except for the live seminar segment. This resource might be overlooked by potential clients. An efficient search function and comprehensive glossary increase the educational value IG offers its clients.

IG FAQs

Is my money safe with IG?

IG is regulated by diverse regulatory bodies, such as the Australian Securities and Investment Commission (ASIC). Its status as a publicly listed company reinforces its reliability, assuring traders of a secure trading environment. However, IG extends beyond shares, featuring riskier CFD and forex offerings suitable for sophisticated investors.

Does IG have a mobile app?

Yes. The IG app provides great dealing capabilities, enabling you to initiate, modify, and oversee your positions from anywhere. It grants access to risk management tools like trailing and guaranteed stops. The app goes further with advanced functionalities, including points through current, partial fills, and customised orders.

What account types can you open with IG?

IG offers a choice of three specialised accounts designed to meet your specific requirements.

- Corporate account: A comprehensive trading solution for corporate and institutional investors, providing access to diverse markets and financial products.

- Personal accounts: Designed for individual traders, it includes complimentary research, quick setup, competitive spreads, and a wide range of markets.

- SMSF account: Investors with an SMSF can trade through IG, requiring a minimum of $1 million in assets. Tailored accounts are provided to match your preferences.

How to open an IG share trading account?

To open an IG share trading account, complete a 5-10 minute online application. Specifically, you must provide personal data, including your name, contact info, address, username, password, and a photo/copy of your ID. After approval by IG, fund your account to start trading shares.

How to fund my IG share trading account?

You have several options: credit card, debit card, BPAY, bank transfer, and PayPal. Fees vary by method. In Australia, the minimum credit/debit card deposit is $450. Bank transfer, BPAY, and PayPal have no minimum deposit requirement. Below are funding methods based on your location.

IG Review: Final Verdict

In conclusion, IG is a one-stop solution for seasoned forex traders, delivering competitive spreads, an extensive selection of pairs, third-party platform choices, and dependable customer support. The implemented security measures reassure clients about fund protection. Yet, the inactivity fee might discourage less active traders from considering the platform.