BTC Markets was founded in 2013 and is among the oldest trading platforms in Australia, with a reputation for reliability. New crypto brokerage platforms and exchanges have flooded the Australian market recently. Is BTC Markets still up to the task? If you’re considering opening an account on BTC Markets, this review will provide you with all the necessary information.

BTC Markets Overview

Martin Bajalan, a Bitcoin enthusiast, created the Melbourne, Australia-based cryptocurrency exchange BTC Markets in September 2013. The exchange is led by a management team with substantial expertise in both the IT and financial services areas.

BTCMarkets will appeal to anybody seeking a low-cost, user-friendly crypto exchange. More advanced cryptocurrency traders who require a greater breadth of supported cryptocurrencies may look elsewhere, but due to its highly competitive fee structure, many use BTCMarkets to trade the larger cap cryptocurrencies and use other exchanges for trading a greater selection.

Website | btcmarkets.net |

Headquarters | Melbourne, Australia |

Listed Cryptos | 25+ |

Trading Pairs | 19 |

Supported Fiat | AUD |

Minimum Deposit | $200 |

Deposit/Withdrawal | Free Deposit; Withdrawal fees vary |

Transaction Fees | Maker-> -0.05% Taker-> 0.2% |

Mobile App | Yes (both IOS & Android) |

Advanced features | Advanced trading and charts, SMSF, OTC Desk, staking, etc. |

BTC Markets Pros & Cons

Based on multiple reviews on Trustpilot, BTC Markets has some pros and cons below:

Pros

Cons

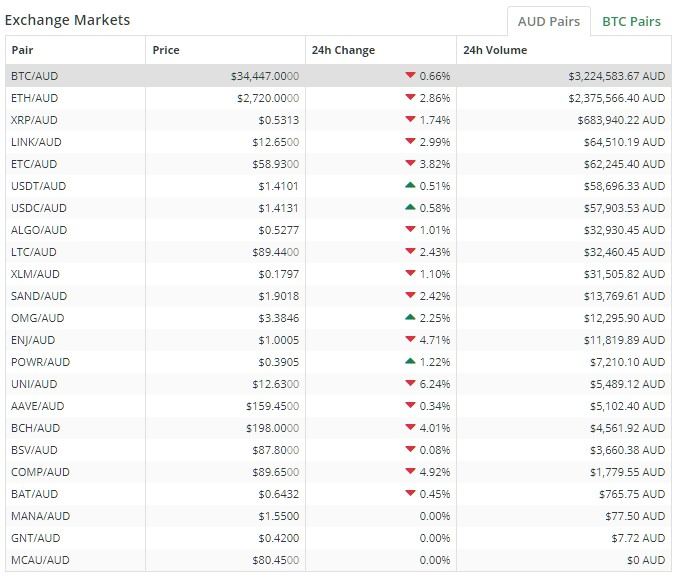

Supported Cryptocurrencies

In addition to Bitcoin trading, BTC Markets offers about 25 cryptocurrencies to its consumers, which is quite limited and unsuitable for altcoin investors compared to other exchanges. Using advanced charting features, it picks the available cryptocurrencies based on a real-time study of market trends.

You can also acquire digital currencies in some crypto-to-crypto trading pairs and trade cryptocurrency pairs against the AUD, the sole accessible fiat currency on BTC Markets.

Deposit Methods

BTC Markets’ deposit options include Electronic Funds Transfer, OSKO, BPay, wire transfer, and cryptocurrencies. Users can choose between the BPay and OSKO deposit options to deposit funds. All BPay cash deposits are subject to the BPAYS terms and conditions. Similarly, you are advised to review the applicable terms and conditions for other deposit methods.

However, it’s worth noting that BTC Markets doesn’t currently support deposits via credit/debit cards. This is a drawback compared to other major exchanges that provide more flexibility. Swyftx and Binance, for instance, permit using credit/debit cards for purchases, while Coinspot enables the purchase of cryptocurrencies with a cash deposit. (You can read our CoinSpot review or Swyftx review to learn more about their features)

Fee Structures

BTC Markets distinguishes itself from the competition by not charging any hidden fees or requiring a minimum margin. Here is a breakdown of the trading fees charged by the platform.

Deposit & Withdrawal Fees

If you fund your BTC Markets account via an Australian bank or financial institution, there are no deposit fees. In this way, you have more financial flexibility and the freedom to select your preferred bank at no additional expense. When you withdraw your digital assets in Australian dollars (AUD), BTC Markets does not charge you any transaction fees.

However, depending on which blockchain is used to execute the transaction, the fees for withdrawing funds from other networks may vary significantly. The fees for cryptocurrency withdrawals are as follows: Bitcoin = 0.0005 BTC, Litecoin = 0.001 LTC, Ethereum = 0.001 ETH, Ethereum Classic = 0.001 ETC, Ripple = 0.15 XRP, BCH = 0.001 BCH.

Trading Fees

Takers and makers pay separate trading fees on BTC Markets, which is standard in the industry. This exchange’s trading fee for takers is around typical for the industry, which is 0.20% of the order total. Meanwhile, the trading fee for makers is -0.05%, which means you are rewarded for making a deal.

It should also be noted that many exchanges feature trading costs that decrease as volume increases, giving you the incentive to trade in larger quantities. BTC Markets offers a similar discount scheme, but solely for trading cryptocurrencies against the AUD. The fees for these currency pairs range from 0.85% (when you trade small volume) to 0.10% (when you trade over AUD 5,000,000 in a 30-day period).

BTC Markets Features

BTC Markets provides a secure and stable platform for buying, trading, and selling cryptocurrencies. The trading platform offers the following features.

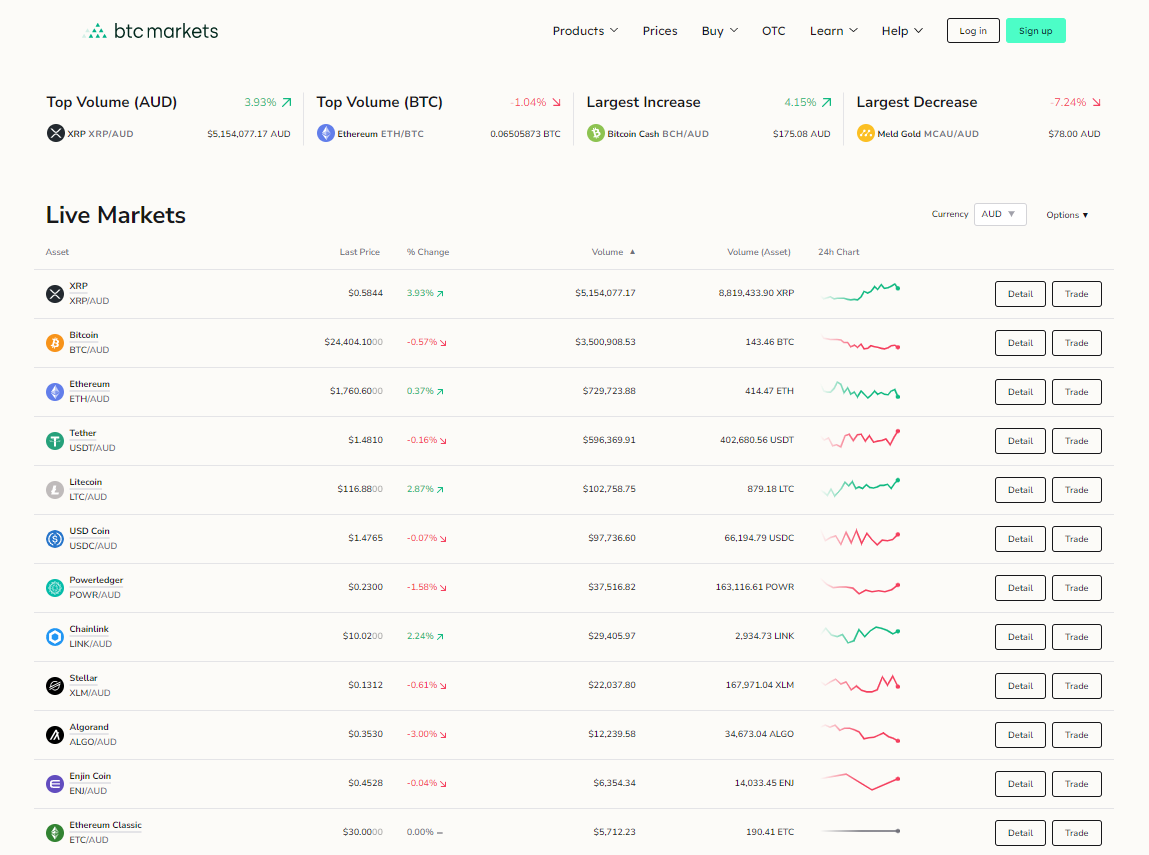

User Interface

BTC Markets’ trading system includes high-volume transaction processing and automated trading features. It provides an advanced crypto trading platform that lets users buy and sell crypto assets for AUD and profit from daily price swings.

Traders might go long or short to hedge against price volatility, thereby managing their investment risk. In addition to TradingView-powered charts, the exchange platform has buying and selling panels and order books for traders to evaluate the spread and volume of a trading pair.

Advanced Trading Tools

BTC Markets is geared towards seasoned, high-volume crypto traders in Australia by eliminating Instant Buy/Sell and featuring an advanced trading interface. The TradingView-powered real-time charts provide access to a set of advanced analytical tools and indicators.

Traders and investors can switch between the 25 crypto/AUD trading pairs by clicking the Change Market button above the charts, despite only being able to trade some popular coins against Bitcoin. Traders can also make multiple advanced orders for greater control and flexibility while buying and selling digital currencies, such as:

- Market Order: Crypto sell or buy at the best market price.

- Stop Order: A market order is placed when the ‘stop’ price condition is met.

- Limit Order: If the indicated price for an asset is higher than its market price, the asset will be bought at its market price.

- Stop Limit Order: A limit order is placed when the ‘stop’ condition is met.

- Advanced: Time in Force (TIF) and Post Only orders.

- Take profit: A market order is placed when the ‘take’ price condition is met.

Personalised OTC Desk

OTC trading is a common method for executing high-volume trades with lower spreads on BTC Markets. This function delivers large orders to the site’s trading desk so they can facilitate your transaction immediately. This limits your exposure to market volatility and the effect of such a trade on the asset price. Regarding this trading option, BTC Markets is discrete and gives personalised help for orders above AUD 100,000.

OTC trading enables access to a vast network of liquidity providers and the execution of large trades outside the BTC Markets public exchange. BTC Markets offers personalised support for high-net traders undertaking high-volume transactions, allowing you to negotiate and lock in prices amid market instability and receive more competitive interest rates.

SMSF Investments

BTC Markets permits investors to invest a portion of their Self-Managed Super Funds (SMSF) in digital currencies, including Bitcoin and Ether. The website does not indicate whether BTC Markets has collaborated with a super fund specialist to provide these services or whether they are provided in-house. Still, consumers can take advantage of the following:

- BTC Market’s reputation as a provider of crypto services

- An Over-The-Counter (OTC) desk for high-volume traders

- Suitable trading fees for Bitcoin trading pairs on the exchange.

- Easy to generate tax reports to file your return

If you are seeking further information about crypto SMSFs in Australia, our Australian Super Funds to invest in cryptocurrencies guide may pique your interest.

BTC Market’s SMSF support appears modest compared to other Australian exchanges offering the same service. Buying cryptocurrencies like Bitcoin and Ethereum, popular investments for SMSFs, is not as cost-effective on other platforms unless the 30-day trading volume is substantial enough to earn fee discounts.

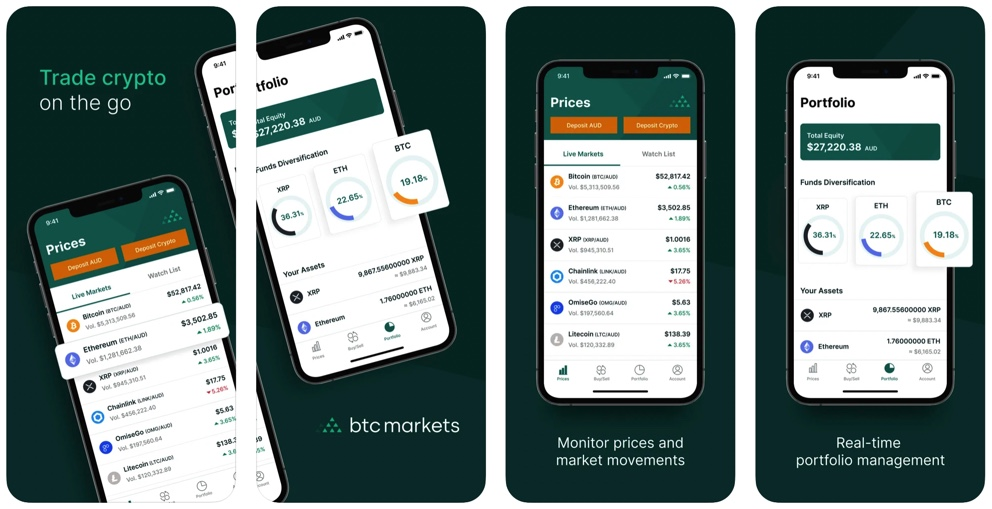

BTC Markets App

BTC Markets has recently developed mobile applications for iOS and Android. Due to its recent release, consumer feedback has been limited; however, based on a few customer reviews, the app has a rating of 3.5/5.0. Despite the small sample size used to determine how customers have received the app, most reviews were positive. The app’s simplicity was largely praised, but some users experienced withdrawal difficulties.

Our testing shows that the app includes conventional security measures such as two-factor authentication, setting a unique PIN, and biometric login. Accessible features include account funding, detailed charting, and placing market orders to purchase cryptocurrency.

BTC Markets Security

BTC Markets is one of Australia’s most secure cryptocurrency exchanges, certified by Blockchain Australia and registered with AUSTRAC. Its security measures include the Know-Your-Customer (KYC) procedure, 2-Factor Authentication (2FA) and storing 98% of digital assets offline. Additionally, BTC Markets does hourly reconciliations to guarantee that the funds in their cold wallets and bank account match those in their customers’ accounts. Both fiat and Bitcoin funds are subject to a 100% reserve policy.

Since its inception, BTC Markets have established robust security mechanisms and have never reported significant hacks. In 2020, however, a marketing email sent by the BTC Markets exchange in December disclosed all its users’ complete identities and email addresses. These emails were sent in batches of 10,000 without detection by the corporation, and BTC Markets could not stop these emails from being sent in rapid succession. Later, the exchange apologised to its consumers and said that this incident affected everyone involved.

BTC Markets’ users were quick to express concern that this exposure could lead to account compromises for individuals with weak login credentials. In response, BTC markets urged their users to use robust login credentials and assured them of an internal audit of their security measures. However, the platform has remained unaffected since then.

Customer Support

The customer service structure of BTC Markets consists of a Frequently Asked Questions area and an email help system. However, their website’s content is substantial and can be used to address the most prevalent concerns. You can use the online ticketing system for account-specific problems, and their support team will respond to your inquiries.

Given the delicate nature of cryptocurrency trading, BTC Markets should broaden their customer service choices to include phone help. Due to security concerns, even though this website has media-specific pages on the most prominent platforms, they do not reply to client inquiries regarding account issues. Support is primarily offered through support tickets and vast online resources.

If the response you received from customer service did not meet your expectations, you have the opportunity to file a formal complaint by emailing [email protected]. Please note that BTC Markets requires written notification of any complaints to process them.

Frequently Asked Questions

Are BTC Markets insured?

There is currently no insurance coverage for BTC Markets funds. However, your funds are still protected with BTC Markets. Via both a cold wallet and a hot wallet, the exchange maintains a total reserve and processes frequent reconciliation reports. Thus, you are sure that your BTC Market account’s funds correspond to the amounts in the exchange’s bank account and cold wallets.

Is BTC Markets secure?

Yes, trading on BTC Markets is entirely secure. BTC Markets conducts daily Reconciliation of Funds checks to ensure everything is in order. Crypto assets are stored offline in cold wallets to prevent hacks, while a tiny portion is kept in hot wallets to preserve liquidity.

Is BTC Markets legal in Australia?

Yes, BTC Markets is authorised to operate in Australia. It adheres to all Australian Financial Regulations and is registered with the Australian Transaction Reports and Analysis Centre (AUSTRAC) and the Digital Currency Exchange. The Anti-Money Laundering and Counter-Terrorism Financing Act (AML/CTF) is adhered to by BTC Markets.

How to deposit into my BTC Market?

Adding funds to your BTC Markets account is straightforward. Begin by logging into the system, then select your deposit type by clicking on the Account icon. If you’re funding your account with a digital asset, pick the digital asset and click Generate Address. Finally, click the Deposit option to finalise the transaction.

Conclusion

Since 2013, BTC Markets has provided Australians with access to digital currencies. It has a solid reputation as a trustworthy place to exchange cash for cryptocurrency. Despite its well-established reliability in the Australian crypto market, BTC Markets’ features and fees have not kept pace with other popular platforms such as Coinspot vs Swyftx. First, its trading fees of 0.85% are relatively high, and there are cheaper places to purchase cryptocurrency. Also, seasoned individuals who aspire to trade a broader selection of digital assets may seek other exchanges.

The following review is for informational purposes only and should not be construed as financial or investment advice. It is important to note that cryptocurrency is a highly volatile and speculative market, and there is no guarantee of profit or loss. This review is based on the author’s personal experience and research, and individual results may vary. The author is not affiliated with any of the exchanges mentioned in this review and does not receive compensation for their mention. It is recommended that readers conduct their own due diligence and consult with a financial advisor before making any investment decisions.

The information regarding performance may be different from the time of publication. Past performance does not guarantee future results. While we believe that all content was accurate at the time of posting, it is possible that some offers included in the content may no longer be valid.