According to Bloomberg ETF analyst Eric Balchunas, US Solana ETFs are not likely to be approved under the current administration.

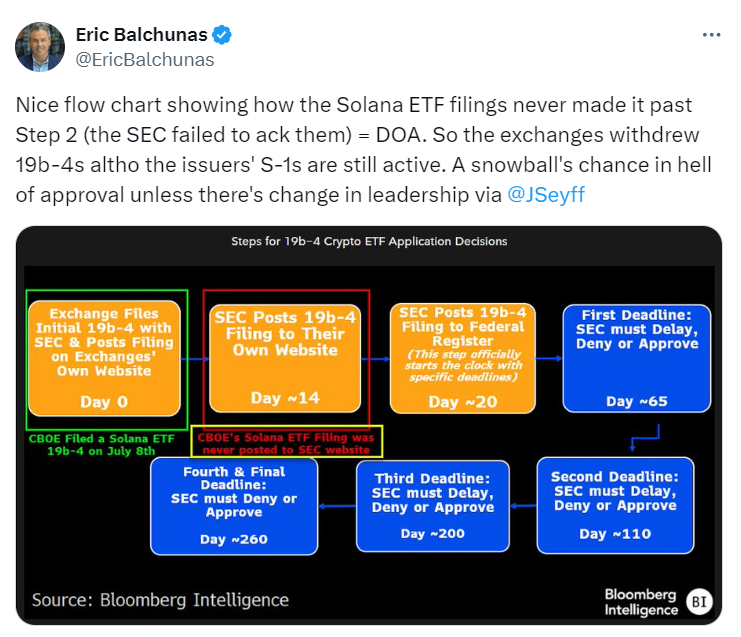

Eric said their chances of being approved was just like a “snowball’s chance in hell,” and approval would only be possible with a change in leadership. This comment follows reports that Cboe had removed the necessary filings for two Solana ETFs from its website, leading to speculation that the U.S. Securities and Exchange Commission (SEC) had rejected the filings due to concerns over Solana’s classification as a security.

“Yes, near-zero chance in 2024, and if Harris wins, there’s prob near-zero chance in 2025 too. Only hope IMO is if Trump wins,” said Balchunas in response to a comment on his original post.

ETFStore president Nate Geraci echoed these sentiments: “Solana ETF not happening anytime soon under the current administration.”

VanEck’s head of digital asset research, Matthew Sigel, pointed to a 2018 case involving a fraudulent cryptocurrency firm, which he believes could be a pivotal legal precedent. He argued that, like Bitcoin and Ethereum, Solana could be considered a commodity based on evolving legal interpretations. The case involved the Commodity Futures Trading Commission (CFTC) and the “My Big Coin Pay” token, which was classified as a commodity despite the absence of futures contracts.

Despite setbacks, Sigel noted that VanEck’s filing for a Solana ETF is still active, even though Cboe removed the related filings. He clarified that exchanges like Cboe file rule changes, while issuers such as VanEck are responsible for the prospectus, which remains in play.