Liquidity mining in Ethereum Layer 2

In November 2021, Hop Protocol’s growth lead ‘Litecoen’ proposed an initial temperature check for Uniswap to consider launching a liquidity mining campaign on Ethereum Layer-2. His proposal seeks to achieve two goals: kickstart L2 adoption by incentivising users to bridge and shift their DeFi activity to L2s and offer deep liquidity for key pairs on L2.

Source: Uniswap

“Without direct on-ramps onto Layer-2 networks, users face high barriers before they can enjoy the benefits of these networks. These users have no other choice but to withdraw from a CEX to Ethereum to then bridge up from Ethereum to the promised land of Layer-2. On a day where fees on Ethereum mainnet are high, a user starting with $200 easily loses half of their portfolio.”

Overwhelmingly positive reception

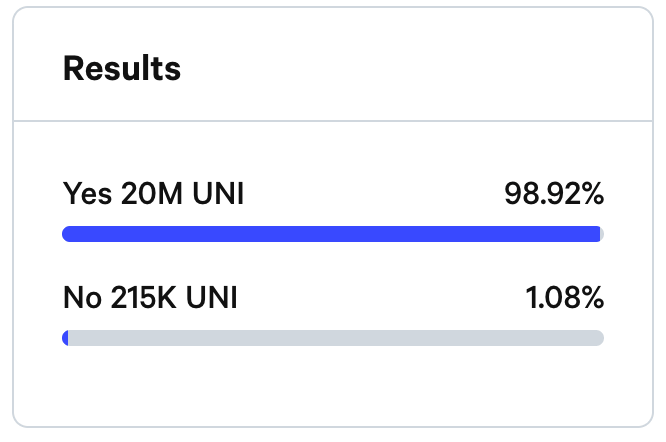

Litocoen’s temperature check was validated by over 25,000 UNI participants, a system where Uniswap users use their tokens (called UNI) to vote upon the protocol’s governance. This led to a Consensus Check, where users would decide if the proposal should go forward in a poll. The results were overwhelmingly positive, with 98.92% (or 20 million UNI) voting yes, and only 1.08% (or 215,000) UNI voting no.

Uniswap Consensus Results

Source: Uniswap

Suffice to say, this is something that the vast majority of the community agrees on, but what are the exact implications and benefits?

For starters, liquidity mining is a mechanism with an array of valuable benefits, including providing passive income. However, there’s a more specific benefit Litocoen has in mind, and that’s improving the distribution of rewards among users. Currently, large whales are seeing the most significant shares of rewards, given that liquidity mining programs incentivise LPs (liquidity providers) the closer their LP range is to the spot price. This means whales who provide liquidity on a single tick can re-balance their range every minute to get the most rewards.

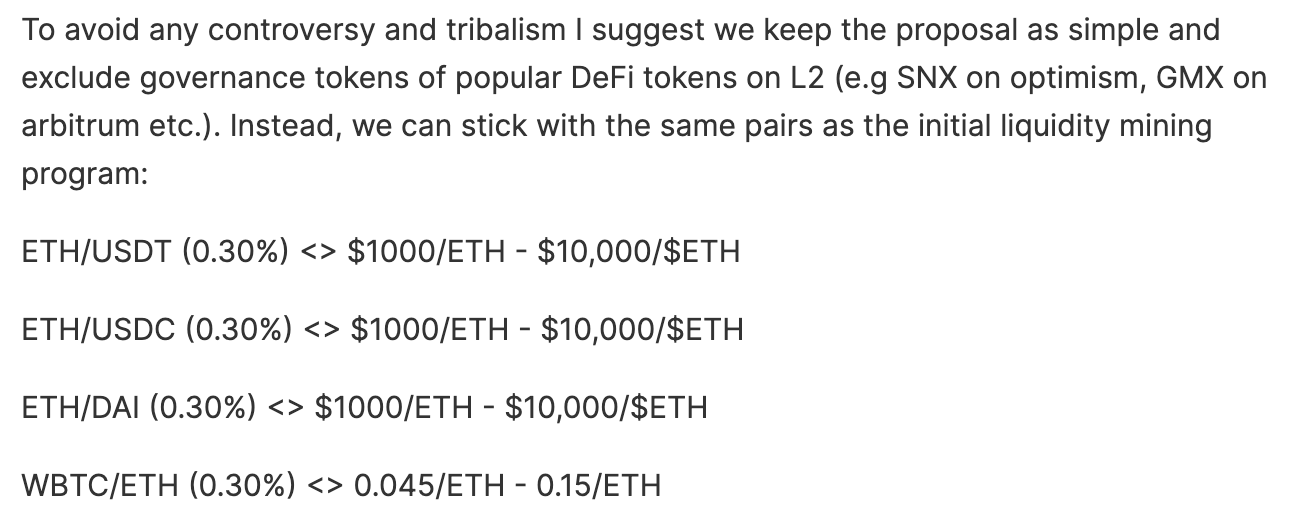

Litocoen’s proposal would shift the rewards to benefit a wider userbase. This is achieved by incentivising L2 liquidity providers to use wide fixed ranges where everyone receives the same pro-rata share of rewards. To get more technical, Litocoen proposes that Ethereum LPs within the scope of $1,000-$10,000 would reward passive LPs while active providers can still set narrow price ranges to accumulate additional benefits – which, as he puts it, is the best of both worlds.

Source: Uniswap

Concluding thoughts

While most were for the proposal, a few voters were less optimistic. During the initial Temperature Check, a user by the name of BOR4 voted to block the proposal, delegating over 200K UNI. Unfortunately, they didn’t participate in the discussion, leaving their thoughts a mystery. User Buckerino was more vocal, believing Litocoen’s idea to be a bad use of funds and that liquidity mining is parasitic in the long run. He continues, asking what do UNI token holders get in return, other than ‘getting utterly diluted’.

The Consensus Check that followed spurred on more interesting discussion, including input from Cornell University professor Guillaume Lambert (‘Guil-lambert’) on how to better the proposal: “I suggest that the staker contract only rewards LP positions that are in range AND above a specific width (i.e. upperTick – lowerTick > minWidth). In other words, allow users to choose the upper/lower bounds but limit the range to prevent 1-tickers.”

As of the time of writing, there haven’t been any new developments or news related to the proposal.