Solana (SOL) recently surged to a 26-week peak of $141, mirroring Bitcoin’s historic surge past its previous all-time high. This propelled Solana to temporarily overtake Binance Coin (BNB) as the fourth-largest cryptocurrency by market capitalization.

However, this ascent was short-lived as a sharp correction in Bitcoin’s price triggered a broader downturn in the altcoin market. Within hours, SOL plummeted by 18% from its peak, only to rebound to $130 due to dip-buying activity.

Consequently, SOL has retreated to the fifth position in cryptocurrency market cap rankings as of the latest update. Despite this volatility, SOL recorded trading volumes of $9.5 billion in a 24-hour period, more than double the previous day’s volume.

Despite the recent downturn, many traders remain optimistic about SOL. While the Open Interest (OI) in SOL futures dropped by 13% following the correction, the positive funding rate on Binance indicates continued bullish sentiment among traders.

Data from Hyblock Capital suggests that SOL whales, or large investors, currently have a higher long exposure compared to retail investors. Interestingly, these whales were not particularly bullish on SOL in the days leading up to the recent market movements, likely due to its stagnant price trajectory. However, the increased volatility in the past 24 hours prompted these large investors to increase their long positions.

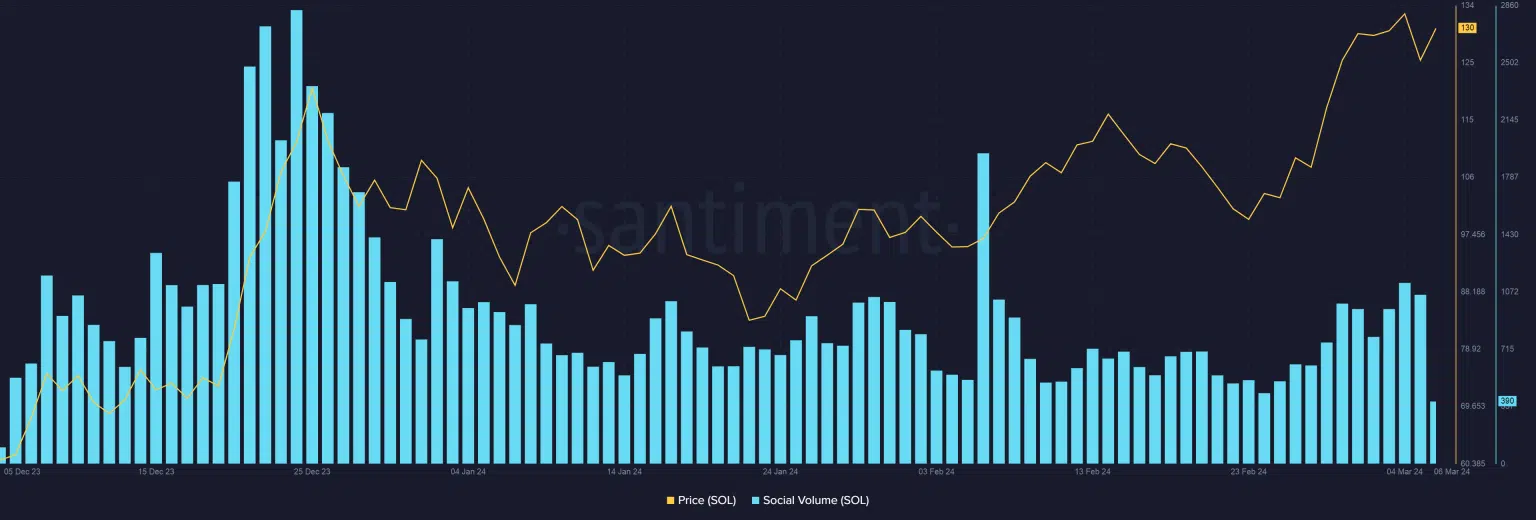

Following the correction, market sentiment shifted from “Extreme Greed” to “Greed,” indicating a potential cooling off period and the possibility of further gains in the coming days. Moreover, there hasn’t been a notable surge in mentions of SOL in top crypto-focused social channels, suggesting subdued interest from retail investors.