Solana’s recent surge in activity has outpaced Ethereum, fueled by a frenzy for Solana-based memecoins. This surge led to significant strain on the Solana network, resulting in transaction failures and delays.

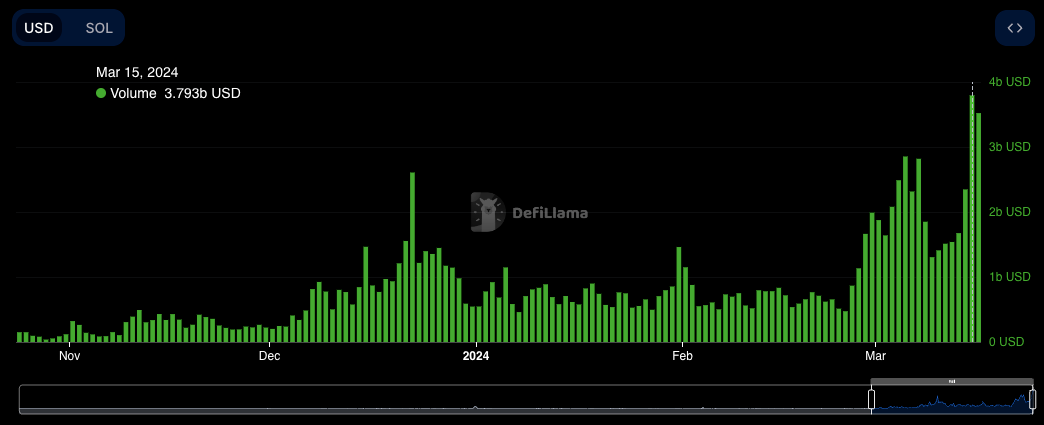

On March 16, Solana’s trading volume surpassed Ethereum’s by $1.1 billion, reaching $3.52 billion, as reported by DefiLlama. However, the network struggled to cope with the increased demand, leading to numerous reports of failed transactions.

Solana Validator data, referenced by the pseudonymous user “Dagnum,” indicated that on March 16 at 8 pm UTC, the ping time ranged from 20 to 40 seconds, causing around 50% of transactions to fail for approximately 20 minutes.

🚨#Solana is currently congested with an Average Ping Time of 20-40s, 30-50% Ping loss, up to 50-80% failed transactions. $SOL

Solana’s TPS isn’t 50k due to vote transactions; it’s just marketing. In reality, under full network conditions with 30-50s wait times, Solana maxes out… pic.twitter.com/NJJfZGDBgo

— Dagnum P.I. (@Dagnum_PI) March 17, 2024

The surge in Solana network activity was primarily driven by a heightened interest in new memecoins. Notably, on March 14, investors flocked to a new memecoin named Book of Meme (BOME), which rapidly rose from insignificance to a market capitalization of $1.45 billion within 56 hours. Another memecoin, “$NAP” (NAP), experienced a similar surge, increasing from a market cap of around $20 million to over $330 million in less than 18 hours.

As Solana’s network activity soared, so did its price, with SOL currently trading at $200, marking a 7.6% increase over the past week and a 38.4% increase over the last month, according to CoinGecko data. This surge propelled Solana to surpass Binance Coin and become the fourth-largest cryptocurrency by market cap, valued at $88.5 billion.

Additionally, due to an increase in the total supply of Solana tokens, the network’s market cap now exceeds its previous peak of $76.5 billion reached on November 7, 2021.