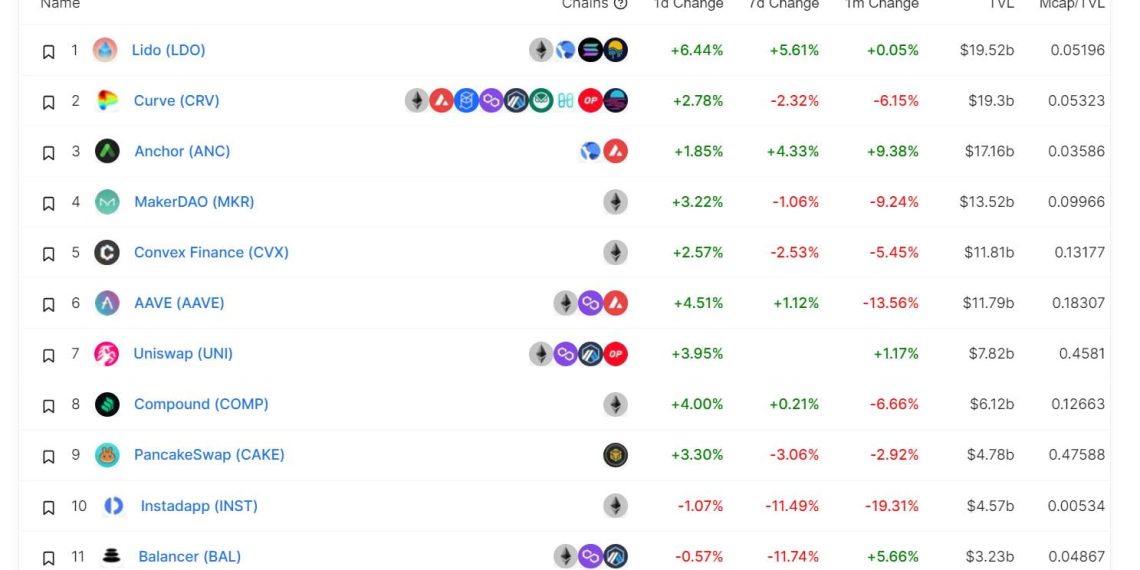

Lido Finance became the most significant Defi protocol in terms of total value locked (TVL), a metric used to monitor the number of assets invested in different Defi projects. At the time of writing, it held $19.4 billion in cryptocurrency.

Curve, a decentralised exchange specialising in stablecoins, previously held the top spot in this metric for approximately six months. Curve currently controls around $19.28 billion and trails Lido by just $120 million, indicating that the two rivals are now close competitors.

Other prominent Defi projects, like Anchor Protocol, Convex Finance, and MakerDAO have TVs ranging from $11 billion to $17 billion.

Understand Lido’s Upsurge

Today’s lead demonstrates Lido’s increasing popularity as a top platform for liquid staking on blockchains like Ethereum, Terra, and Solana. Liquid staking is a procedure in which users delegate tokens to a staking service while maintaining ownership of the underlying value through derivative tokens.

Lido supports blockchains like Ethereum, Terra, and Solana. Image: CoinCulture

This kind of system is popular since it frees up users’ liquidity, which users can then utilise to generate further yield in other Defi protocols. For instance, Lido users on Ethereum exchange their ETH for Staked ETH (stETH), a derivative token representing staked assets with a similar value.

According to Andrew Thurman, content lead at blockchain analytics platform Nansen, how popular stETH has become as collateral and for yield farming tactics is the most impressive. Investors are flocking to staked ether and its derivatives because of the earning potential and fungibility of the asset.

Ethereum is just one of the blockchains used by Lido Finance. The company provides a liquid staking option for LUNA, the Terra blockchain’s native asset. stLUNA is a token that represents staked Luna in Lido and adds almost $7 billion to the protocol’s value.