Bitcoin fees have sharply declined just a day after hitting a record average of $128 on April 20 – the fourth Bitcoin halving day.

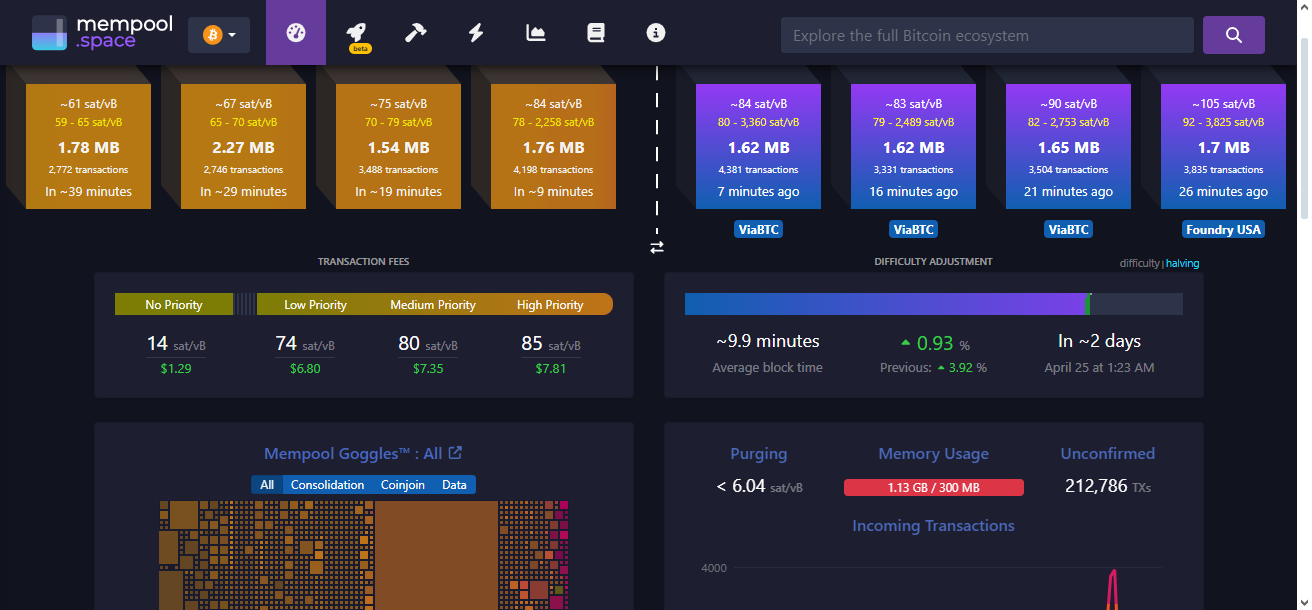

As of April 22, Bitcoin (BTC) fees have dropped to an average range of $7.45 for medium-priority transactions, as reported by mempool.space.

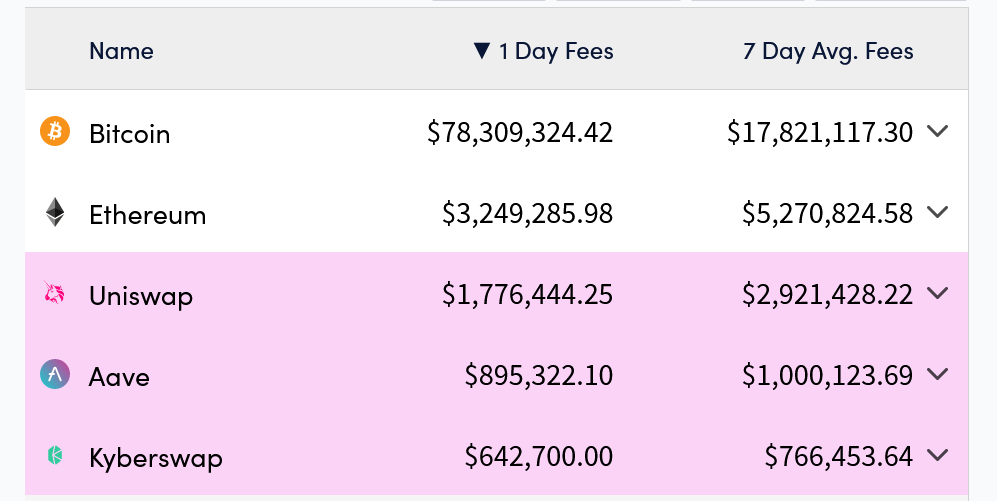

On the previous day, Bitcoin registered $78.3 million in total fees, surpassing Ethereum by more than 24 times, according to Crypto Fees.

A notable event occurred during the Bitcoin halving block at block height 840,000, where a staggering 37.7 Bitcoin ($2.4 million) was paid to Bitcoin miner ViaBTC, marking it as the most coveted piece of digital real estate in the network’s 15-year history.

Much of the demand at block 840,000 came from enthusiasts of memecoins and non-fungible tokens (NFTs), vying to engrave and embed rare satoshis via the Runes protocol—a new token standard introduced at the halving block.

The block included 3050 transactions, resulting in an average user fee of just under $800.

Although higher-than-normal block fees persisted until approximately block 840,200, they have since declined to around 1-2 Bitcoin, according to mempool.space.

Initially, the substantial block fee payouts to miners on halving day shielded them from the impact of the block subsidy halving, reducing from 6.25 Bitcoin to 3.125 Bitcoin. However, with the current average block fee well below 3.125, miners are no longer immune to this change.

Meanwhile, Bitcoin has outpaced Ethereum in terms of fees for six consecutive days from April 15-20, with its 7-day fee average now standing at $17.8 million.

Despite the halving event, Bitcoin’s price has seen a modest increase of 1.5% since then, reaching $64,840, as per CoinGecko.