The SQUID token, named after the popular Netflix hit from South Korea, collapsed in a rug pull, leaving investors empty-handed and furious.

Squid Game shows up out of nowhere

Squid Game was the talk of the town a few weeks ago. The ten-episode-long South Korean production broke records and quickly went viral on all social media channels thanks to its brilliant writing, character drama, and very meme-able production design. And crypto would not be crypto if someone did not offer a meme coin named after a viral social media trend.

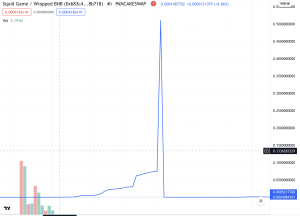

To no one’s surprise a SQUID token showed up soon after the Netflix hit, promising a play-to-earn game inspired by the show. Players would have to purchase 456 SQUID (a nod to the 456 participants in the death match in the series) to participate in the Squid Game. The SQUID token skyrocketed in value within days thanks to deflationary mechanisms and a token design that impeded selling. Fear of missing out ensued, and participants started piling into the token without being aware of the dangerous game they were playing.

The rug gets pulled

Eventually, SQUID topped out at a value of over $2,800, which is mind-blowing even in the notoriously volatile crypto space, considering the token started at a price of literally zero. In a clip that went viral on Crypto Twitter and beyond, the anonymous developers behind the token pulled the rug and stole all funds that were locked in the system. The loot was estimated to be around $3.4 million, and SQUID token lost 99.99% of its value within mere seconds of the rug pull.

However, investors can hardly complain, as the warning signs were there from the beginning for everyone to see. The developers were anonymous, and the token design was dangerous at best and outright malicious at worst. The price action was unsustainable and reports of investors that could not sell their SQUID were circulating even before the scam, however not being able to sell was part of the token design.

Scams are part of the game in crypto

Squid Game is hardly the first, nor will it be the last scam in the crypto space. This particular rug pull received an outsized amount of attention, with major news outlets around the world leveraging the popularity of the Netflix series to report on the crypto scam based on it. However, within this year, crypto has suffered from email hacks, exchange hacks, and countless lesser-known rug pulls. While financial institutions are working on combating money laundering in crypto, the space is still rife with dubious schemes that prey on gullible investors. Squid token is actually quite mild in comparison to other rug pulls.

So, what can the victims and spectators take away from this?

One definite lesson would be that crypto is an inherently risky game and that the risk grows exponentially with the returns investors target. For every successful “meme coin pump,” countless scams benefit only those organising the scheme. Moreover, crypto proponents also need to ask themselves whether they are doing the space a favor by stubbornly refusing any kind of regulation that would protect unknowing investors at least somewhat. Because if crypto has shown us one thing in 2021, it’s that there is always another potential scam around the corner.