According to an Aug. 22 announcement, asset manager Grayscale Investments unveiled a new Avalanche’s native token, AVAX, investment fund.

Per the company, the Grayscale Avalanche Trust will “offer investors the opportunity to gain exposure to Avalanche (AVAX), a three-chain smart contract platform designed to simultaneously optimise for scalability, network security, and decentralisation.”

Avalanche is a layer-1 blockchain network aimed at tokenising real-world assets (RWA), which involves converting tangible assets into digital o-chain tokens.

On Aug. 22, Franklin Templeton expanded its blockchain-based money market fund to Avalanche.

Grayscale’s Avalanche Trust enables investors to engage in the advancement of RWA tokenisation through Avalanche’s strategic partnerships and multi-chain structure. However, the fund is only available to qualified investors and is not exchange-traded.

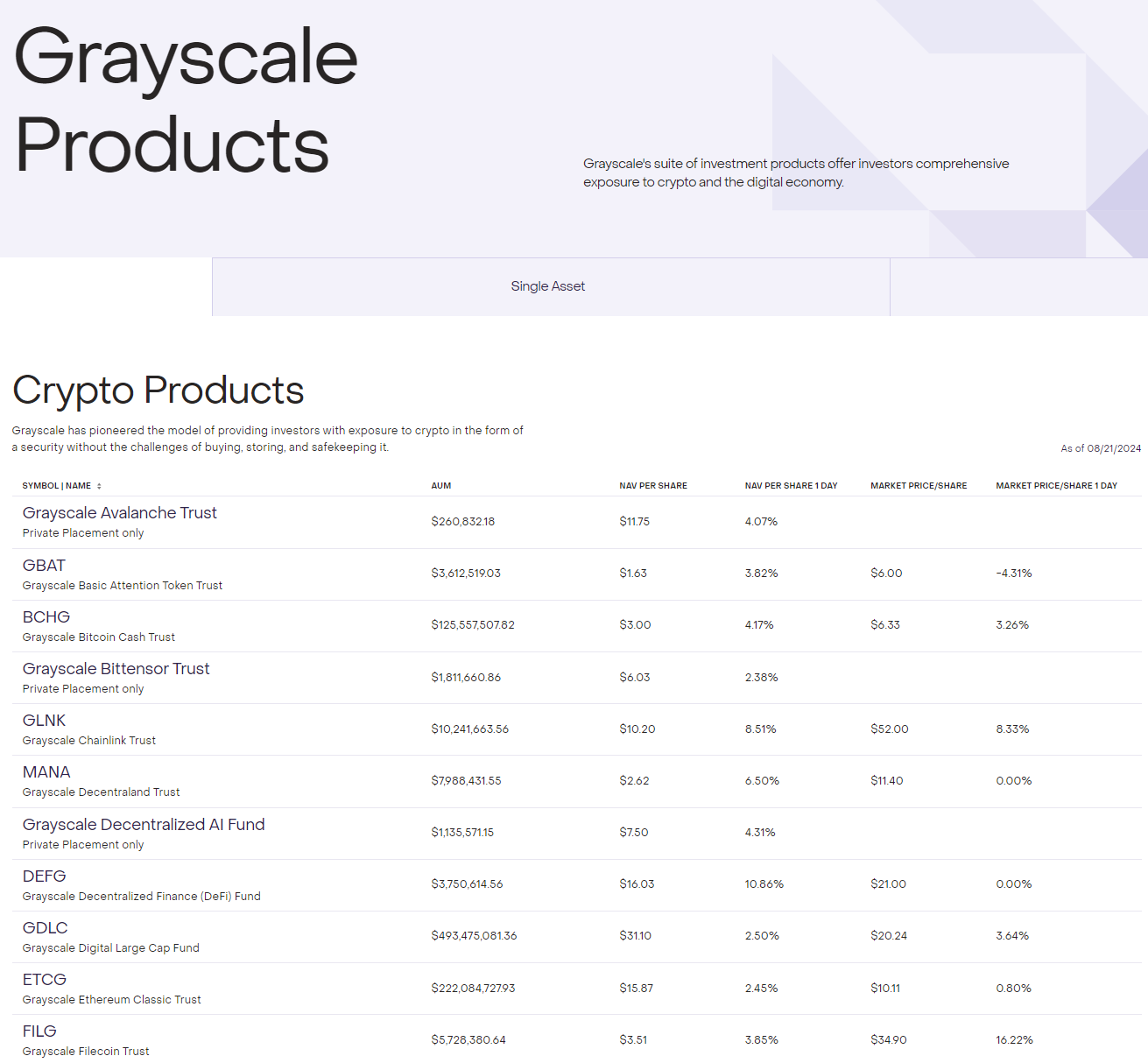

This new fund adds to Grayscale’s portfolio of over 20 crypto investment products. In recent weeks, Grayscale launched trusts for MakerDAO’s MKR token, Bittensor’s token, and Sui’s token. Grayscale manages over $25 billion in assets and is recognized for its flagship Bitcoin and Ether ETFs, including the Grayscale Bitcoin Trust (GBTC) and Ethereum Trust (ETHE).

During an August 12 webinar, Grayscale’s global head of ETFs, Dave LaValle, predicted the cryptocurrency ETF market would expand to include more single-asset products and diversified crypto index funds.