Solana is seeing substantial ecosystem growth driven by technical advancements and key partnerships, particularly with financial industry giants PayPal and Stripe, which have integrated Solana into their payment systems.

These integrations reflect increasing confidence in the Solana network from both institutional and retail sides. Retail investors flock to platforms like pump.fun, generating millions in fees over recent months.

Institutional Adoption and Ecosystem Growth

On July 18, the Solana Foundation highlighted a report by Messari analyst Peter Horton, which mentioned key partnerships and platforms driving Solana’s success.

In Q2 2024, PayPal and Stripe integrated Solana into their platforms. PayPal expanded its PYUSD stablecoin to the Solana network, while Stripe supported Solana payments. Both companies aimed to leverage Solana’s scalability and low fees for more efficient platforms.

Some Solana-native platforms have also thrived. Memecoin launchpad pump.fun, known for facilitating celebrity memecoin launches, have collected $48 million in total fees during the quarter.

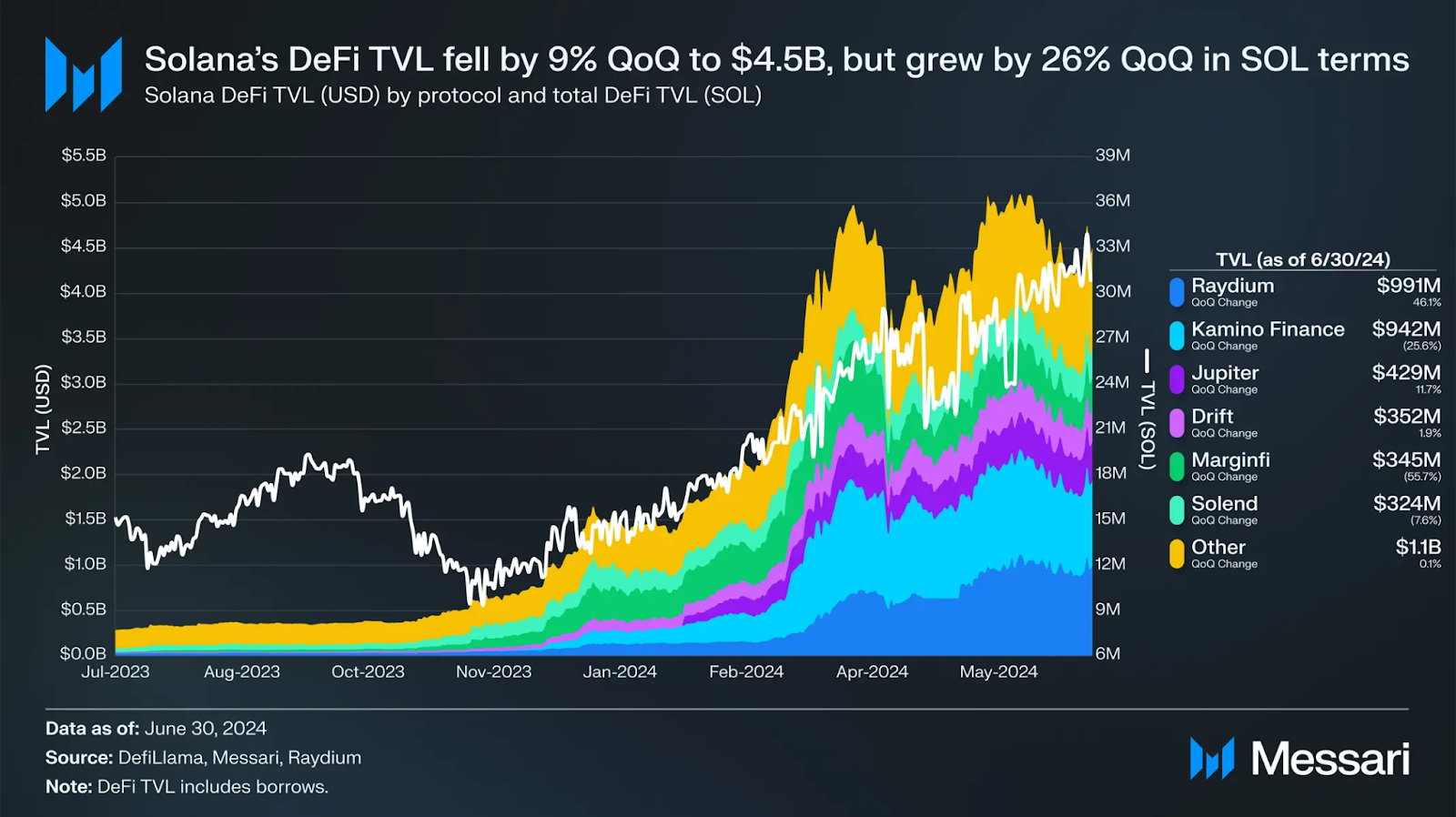

Impact on Raydium and Total Value Locked (TVL)

Raydium, Solana’s largest decentralised exchange (DEX), benefited significantly from pump.fun’s success. The platform’s average daily volume surged by 77% quarter-over-quarter, reaching $867 million. This activity contributed to a 46% increase in Raydium’s Total Value Locked (TVL), bringing it to $991 million.

Despite Raydium’s growth, Solana’s overall TVL in USD fell by 9% quarter-over-quarter to $4.5 billion in Q2 2024, placing it fourth among blockchain networks. This decline was primarily due to token price depreciation rather than a reduction in capital outflow. Conversely, TVL denominated in SOL, Solana’s native token, grew by 26% QoQ.