The Australian Transaction Reports and Analysis Centre (AUSTRAC), a financial intelligence government agency, reported a rise in the criminal use of cryptocurrencies and related services in its latest money laundering report.

The 2024 AUSTRAC Money Laundering National Risk Assessment highlights how criminals are increasingly using digital currencies, digital currency exchanges, and unregistered remittance services to launder money.

Cash Still Dominates Money Laundering

Most money launderers now still favour traditional methods such as cash, real estate, and luxury goods.

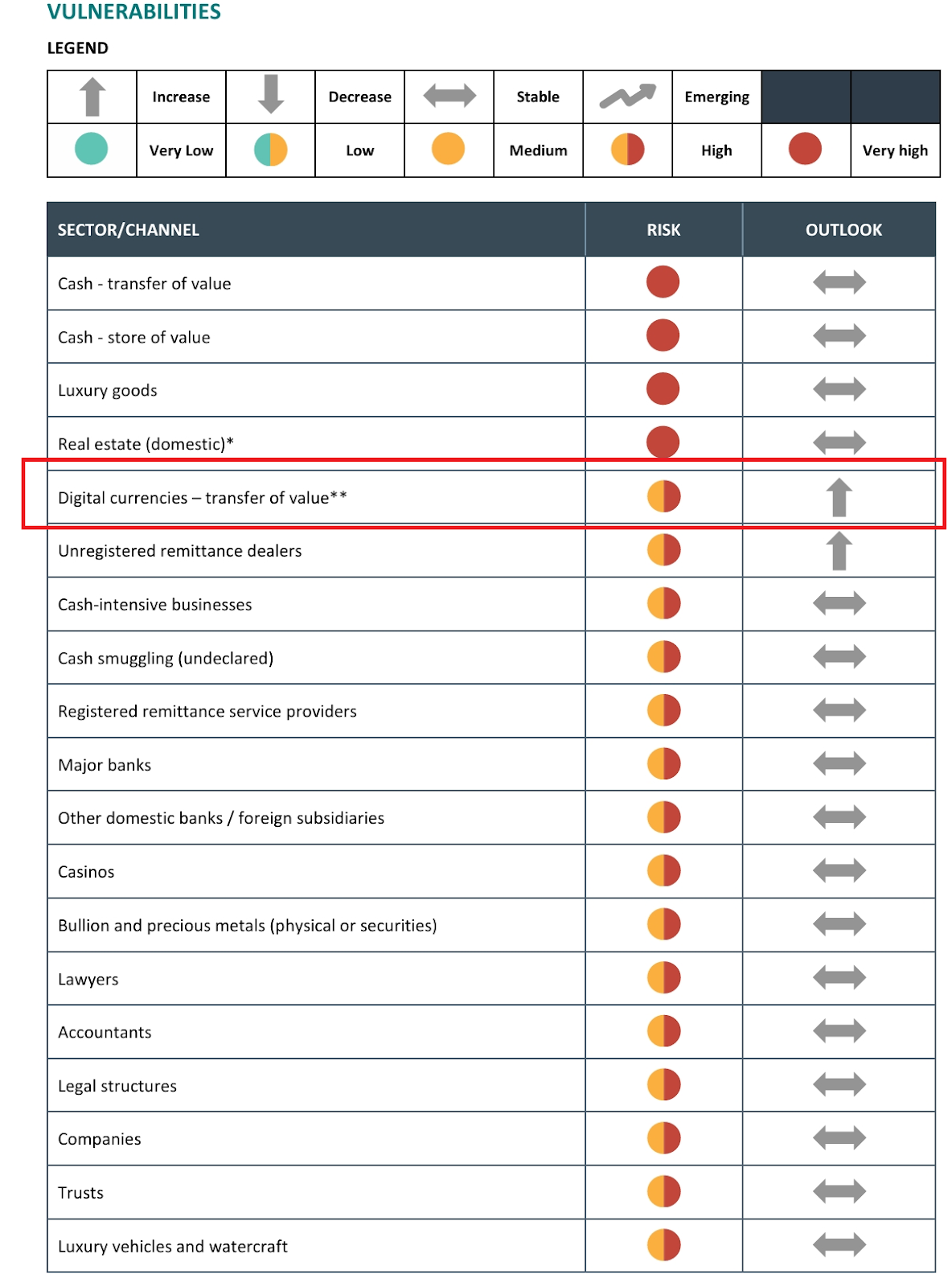

These traditional methods received a “very high” risk rating, whereas digital currencies were rated with a “high” risk. However, AUSTRAC expects the criminal use of cryptocurrencies to rise due to their anonymity and transaction speed.

The report’s key findings state:

“Criminal use of digital currency, digital currency exchanges, unregistered remitters and bullion dealers is increasing.”

Criminals Rely on Crypto’s Anonymity and Speed

AUSTRAC emphasised the need for crypto exchanges to register under the AML/CTF Act.

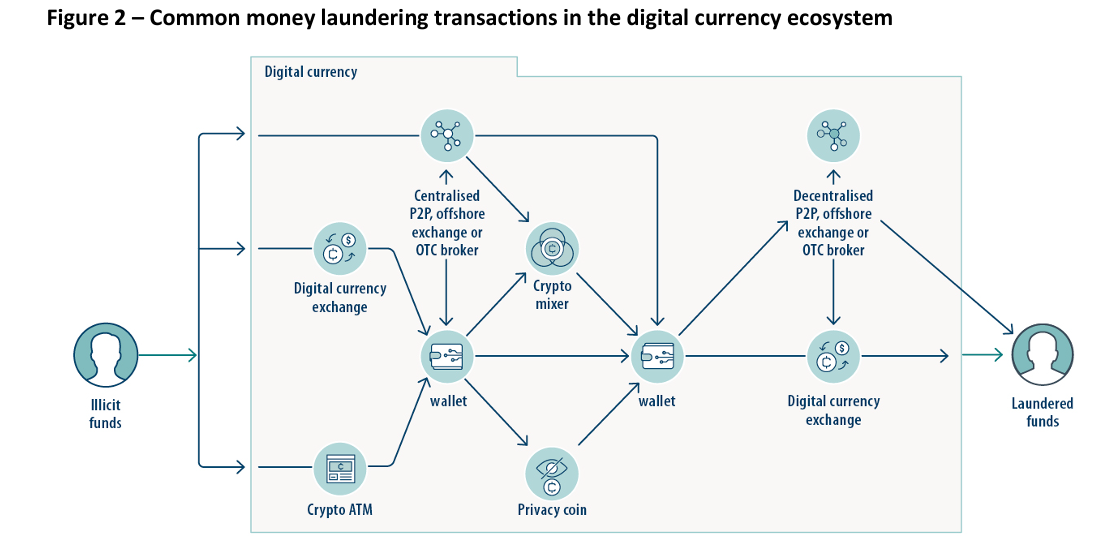

The report suggests: “The use of digital currency as a value transfer mechanism will pose an increasing money laundering vulnerability over the next three years. As the use of digital currency expands for legitimate use, opportunities for criminal use will also increase.”

Recently, the Australian government has banned the use of crypto and credit cards for online gambling. Companies that fail to comply with this new regulation could face fines up to approximately 234,750 Australian dollars ($155,000).

Kai Cantwell, CEO of Responsible Wagering Australia, supports this move, stating that it helps people better control their gambling behaviour. He commented:

“This is an important measure to protect customers, making it easier for people to stay in control of their own gambling behaviour.”