Crypto startup Hamilton has introduced tokenized US Treasury bonds on Bitcoin’s layer-2 blockchains. Hamilton is the first company to launch these bonds.

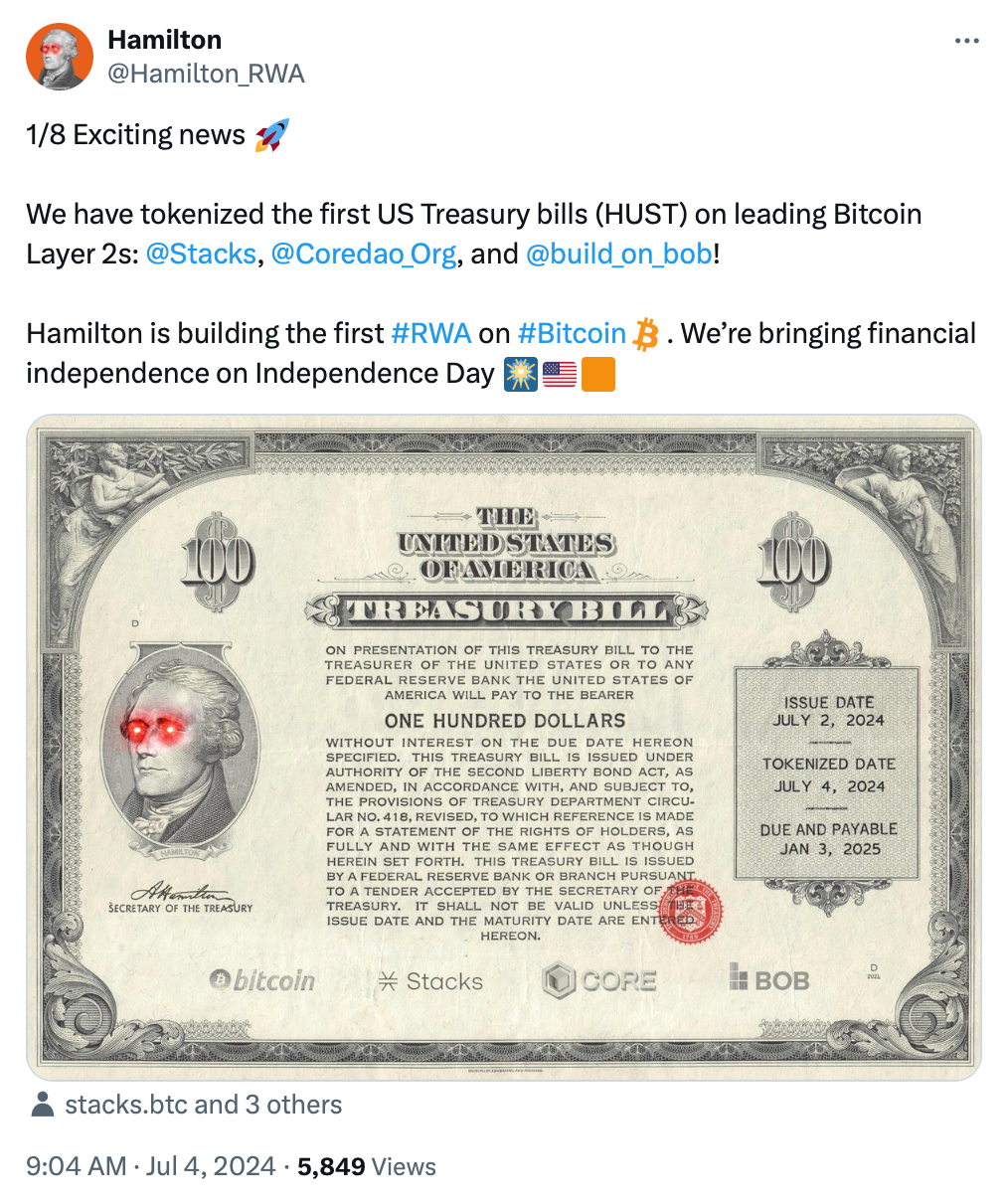

Hamilton’s issued bonds are now available on the Stacks, Core, and Build on Bitcoin (BoB) solutions under the name Hamilton U.S. T-Bills (HUST), with the first transaction occurring on July 4.

Advantages of Bitcoin Layer-2 for Stability and Yield

Hamilton highlights that utilising Bitcoin layer-2 decentralised finance ecosystems leverages the stability of the Bitcoin network and the reliability of the US dollar. These layer-2 solutions improve scalability and functionality. Hamilton’s co-founder and CEO, Kasstawi, emphasised:

“Combining US Treasury bills with Bitcoin’s security and transparency marks a historic step towards financial independence, providing crucial exposure to emerging markets.”

The Hamilton executive was only identified as Kasstawi. There is an investor in the blockchain space named Mohamed Elkasstawi.

Growth of Bitcoin Layer-2 Solutions

Tokenised real-world assets, including T-Bills, real estate, and securities, are increasingly integrated into the Web3 economy, enabling their exchange, transfer, and leverage.

These assets have reached $8 billion in total value locked. The competitive yields of T-Bills, driven by the US Federal Reserve’s interest rate policies, make them an attractive alternative to stablecoins with lower risk.

Since 2023, the Bitcoin network has introduced three token standards, enhancing its functionality. Ordinals, introduced in early 2023, allow for non-fungible tokens inscribed on satoshis, and Runes, launched in April 2024, enable the issuance of altcoins directly on the Bitcoin blockchain. The rising network traffic has spurred the development of layer-2 solutions to address slower processing times and higher fees. The Bitcoin layer-2 Lightning Network, for instance, facilitates faster BTC transfers compared to layer-1.

Layer-2 solutions also enable smart-contract-dependent decentralised finance, known as BTCfi, on the Bitcoin network. Core DAO, which hosts HUST, operates a layer-1 blockchain alongside its Bitcoin layer-2 solution and has received support from cryptocurrency exchanges such as Bitget and MEXC.