A spot Solana exchange-traded fund (ETF) in the U.S. might only become a reality with a change in the administration and the head of the SEC, according to Bloomberg ETF analyst Eric Balchunas.

On June 27, VanEck announced filing for a spot Solana ETF with the U.S. Securities and Exchange Commission (SEC).

Matthew Sigel, VanEck’s head of digital assets research, stated that the VanEck Solana Trust aims to capitalise on Solana’s decentralised nature, high utility, and economic feasibility.

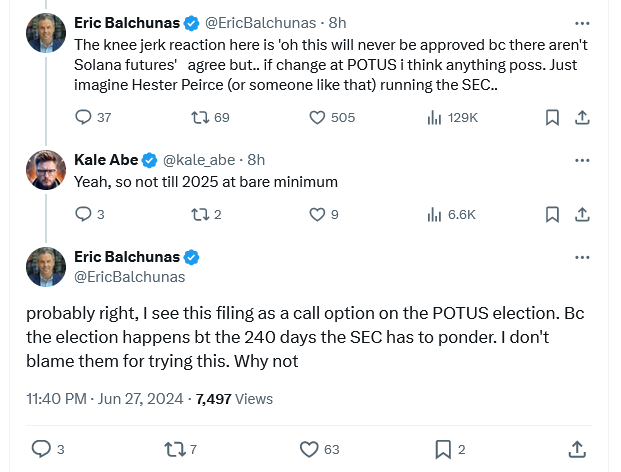

However, Balchunas expressed scepticism about the ETF’s approval. He cited the absence of Solana futures ETFs in the U.S as Both Bitcoin and Ether had futures products before spot ETFs due to SEC concerns over fraud and market manipulation impacting spot ETF products.

However, Balchunas suggested that a new U.S. President and SEC leadership in 2025 could change this scenario.

“Just imagine Hester Peirce (or someone like that) running the SEC.”

Jake Chervinsky, chief legal officer at Variant Fund, supports this sentiment, indicating that Peirce’s interpretation of the Securities Exchange Act might favour spot Solana ETF applicants.

The SEC, under Chair Gary Gensler, labelled the SOL token as a security in its lawsuits against Binance and Coinbase.

Debate Over Solana ETF’s Prospects

Adam Cochran, a partner at venture capital firm Cinneamhain Ventures, argued that it would have been wiser to clear up SOL’s alleged security status before VanEck filed for the ETF.

Should Solana get an ETF at some point? Absolutely.

But this is also reckless by VanEck, when futures volume, unsettled SEC claims, etc are outstanding with Solana.

Really hope this isn’t giving Gensler an easy setup. https://t.co/93TkQLAl66

— Adam Cochran (adamscochran.eth) (@adamscochran) June 27, 2024

The news received a positive response from Bitcoin advocate Anthony Pompliano, who said, “VanEck filing for a Solana ETF is further proof that altcoins are coming to Wall Street.”

Others, however, remain doubtful. Evgeny Gaevoy, CEO of cryptocurrency trading firm Wintermute, predicted minimal inflows into the soon-to-be-launched spot Ether ETFs, implying even fewer flows for a spot Solana ETF.

“I’m saying this all while Wintermute is long both SOL & ETH, so no fud, just being realistic here. Adoption takes time.”

This filing comes a week after cryptocurrency asset manager 3iQ filed for a spot Solana ETF in Canada, marking a first in North America.

The Solana ecosystem has also been praised by $1.5 trillion asset manager Franklin Templeton recently.

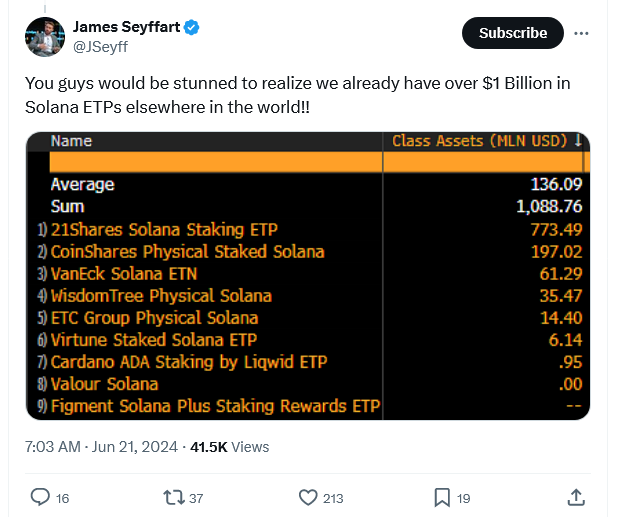

Over $1 billion worth of Solana exchange-traded products are already available worldwide, including the 21Shares Solana Staking ETP and the ETC Group Physical Solana product in Europe, according to Bloomberg ETF analyst James Seyffart, who cited June 20 data.