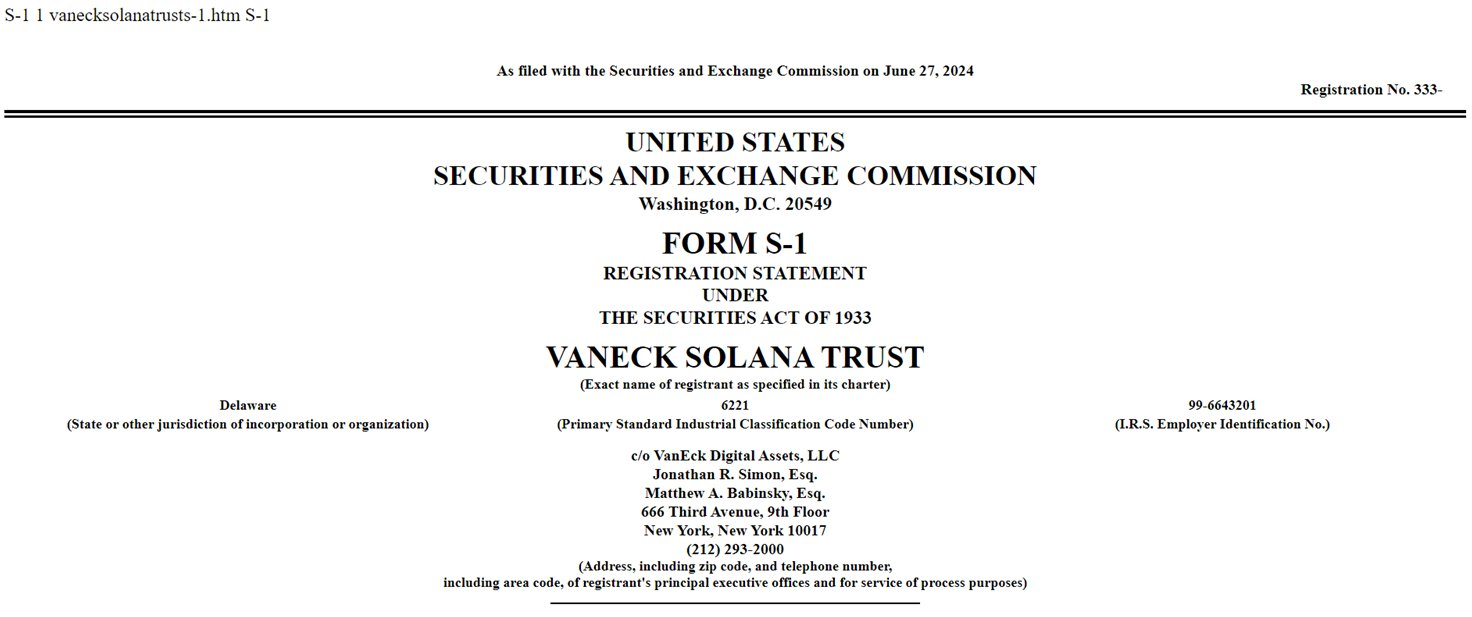

VanEck, one of the first issuers of spot Bitcoin ETFs in the U.S., has filed for a new Solana ETF.

On June 27, Matthew Sigel, VanEck’s head of digital assets research, announced on X that the firm has submitted an application to the U.S. Securities and Exchange Commission (SEC) for a Solana ETF.

The new fund, called VanEck Solana Trust, aims to capitalise on Solana’s decentralised nature, high utility, and economic efficiency, according to Sigel. He stated that this is the first Solana ETF filing in the U.S.

Sigel also elaborated on why the company views SOL as a commodity in the post:

“We believe the native token, SOL, functions similarly to other digital commodities such as Bitcoin and Ether. It is utilised to pay for transaction fees and computational services on the blockchain. Like ether on the Ethereum network, SOL can be traded on digital asset platforms or used in peer-to-peer transactions.”

In their SEC filing, VanEck mentioned that the VanEck Solana Trust would be listed on the Cboe BZX Exchange, should it be approved by the SEC.

The VanEck Solana Trust’s goal is to track the performance of Solana’s cryptocurrency price, minus the trust’s operational expenses.

The filing also notes that the trust will determine its share value daily using the MarketVector Solana Benchmark Rate index. This index is based on prices from the top five SOL trading platforms, as identified by the CCData Centralised Exchange Benchmark review report.

This Solana ETF filing by VanEck follows the SEC’s approval of spot Ether ETFs in the U.S. on May 23, 2024, which confirmed ETH as a commodity rather than a security. Consequently, on June 19, the SEC dropped its investigation into whether Ether is a security.