If you’re searching for new crypto ventures to invest in, Aptos can be an exciting choice. This cryptocurrency, supported by venture capital, is currently capturing the interest of the crypto community. Aptos’ ultimate vision involves enhancing scalability alongside introducing distinctive security and usability features. But how to buy Aptos (APT) in Australia? If you aim to invest in Aptos, here is a quick guide for buying APT.

What is Aptos (APT)?

Aptos is a Layer 1 blockchain rooted in the Proof-of-Stake protocol, intertwining parallel transaction processing with an innovative smart contract language named Move. Founded by the collaborative efforts of two former Meta engineers, Mo Shaikh and Avery Ching, it emerged as the technological heir to Meta’s discontinued blockchain venture, Diem.

Aptos envisions a blockchain realm that bridges the gap for mainstream adoption within the web3 domain, enabling a spectrum of Decentralised Applications (DApps) to address tangible real-world user challenges. Through its Proof-of-Stake architecture, the blockchain has the potential to achieve an impressive theoretical transaction capacity exceeding 150,000 transactions per second (tps) via parallel execution.

The genesis of Aptos unfolded on October 12, 2022, culminating in the launch of its mainnet “Aptos Autumn”, on October 17, 2022. The blockchain’s financial backing has garnered considerable investment thus far. Aptos, a Layer 1 blockchain, is constructed using the Rust-based programming language, Move. Its defining features encompass a parallel execution engine, and strong security measures, and economical transaction fees.

The APT token is at the core of the Aptos platform’s blockchain network, serving as its native token. Beyond functioning as a payment medium within the ecosystem, APT also incentivises network engagement through staking and governance mechanisms. Holders of APT tokens wield power to influence project trajectories and participate in decision-making within the Aptos ecosystem through voting privileges.

How Does the Aptos Blockchain Work?

The Aptos blockchain has the potential to achieve a theoretical transaction rate of 160,000 transactions per second (TPS), all the while upholding security and dependability. Several groundbreaking principles underlie the remarkable performance of the Aptos blockchain.

Block-STM Technology

Block-STM technology establishes an efficient engine to manage smart contracts seamlessly. Within the Aptos blockchain, parallel execution is harnessed to simultaneously process numerous transactions, accelerating the process significantly, as the failure of one transaction doesn’t disrupt the entire chain. Instead, transactions can progress concurrently, with validation occurring post-execution. Further, a collaborative scheduler prioritises specific Aptos blockchain transactions and precisely manages crucial validations. Ultimately, the potential exists to process up to 160,000 transactions concurrently.

Move Programming Language

A standout feature that lends allure to Aptos crypto is Move, a tailor-made programming language initially crafted for the Diem blockchain. Move operates as a form of executable bytecode language. Its adaptability caters to the distinctive requirements of Aptos developers, and its global storage surpasses the security benchmarks of typical programming languages. It enables users to define unique resources that resist duplication or disposal, heightening the challenge for malicious entities seeking control over the Aptos blockchain.

BFT Consensus Protocol

Unlike conventional consensus protocols that must adhere to transaction sequencing, Aptos separates these two processes and allows them to unfold in parallel. This reduction in latency concurrently enhances processing speed. To ensure precision, Aptos has introduced a Byzantine fault-tolerant (BFT) engine that examines individual on-chain states and automatically updates validators when necessary.

What Makes Aptos Different?

While it’s prudent to approach Aptos with a measured approach, it does warrant a degree of excitement. An active and engaged community, substantial investor interest, and access to unique engines and programming languages collectively distinguish the Aptos blockchain. Should it fulfil its commitments, it could substantially diverge from the landscape of existing Layer 1 chains.

Aptos vs. Solana

One of the primary contenders challenging the Aptos blockchain’s position is Solana, the current frontrunner in high-performance Layer 1 solutions. Both Aptos and Solana exhibit similar velocity levels, leveraging parallel computing engines. Nevertheless, closer scrutiny of the Solana and Aptos blockchains reveals Aptos to be the more steadfast option. Solana has exhibited vulnerability to failures, with notable outages and downgrades.

The Aptos blockchain incorporates redundancy within its network architecture, mitigating its failure susceptibility. In the Aptos structure, each block is synchronised with leader nodes and proximate nodes., ensuring that if a leader node falters, another node can seamlessly assume control. This results in slightly elevated computational prerequisites, rendering Aptos hardware requisites marginally larger than Solana’s. Ultimately, Aptos prioritises enhanced reliability over Solana, albeit at the expense of increased hardware demands.

Aptos vs. Avalanche

Initial assessments suggest that the Aptos blockchain surpasses Avalanche under ideal test conditions. Avalanche boasts a marginally quicker transaction finalisation time of about 0.7 seconds compared to Aptos. However, in real-world scenarios, Avalanche’s time to finalise transactions tends to be approximately 0.3 seconds slower than Aptos’s. When assessing transactions per second (TPS), Aptos significantly outperforms Avalanche. While Avalanche manages roughly 4,500 TPS per subnet, the Aptos blockchain attains a range of 130,000–160,000 TPS.

Avalanche and Aptos exhibit impressive performance, but the Aptos blockchain notably excels in user-friendliness. Avalanche frequently experiences elevated gas fees, particularly during surges in transaction volumes due to NFT-related activities. Meanwhile, Aptos prioritises economical fees for its users. Its distinctive storage approach based on the Move programming language empowers users to consolidate items to minimise expenses.

Aptos vs. Ethereum

The Aptos blockchain has already demonstrated superior speed compared to Ethereum. While Ethereum’s transaction finality time exceeds a minute, Aptos can confirm transactions in less than a second, a result of both hardware and architectural distinctions. Notably, Ethereum relies on a solitary CPU core, whereas Aptos capitalises on 16.

However, Ethereum’s dependability unquestionably surpasses Aptos. While Aptos encounters fewer outage issues, it can’t match Ethereum’s steadfastness: Ethereum’s stability is nearly impervious to disruptions. As long as users are amenable to higher fees and lengthier waiting times, Ethereum remains the more popular choice.

How to buy Aptos (APT) in Australia?

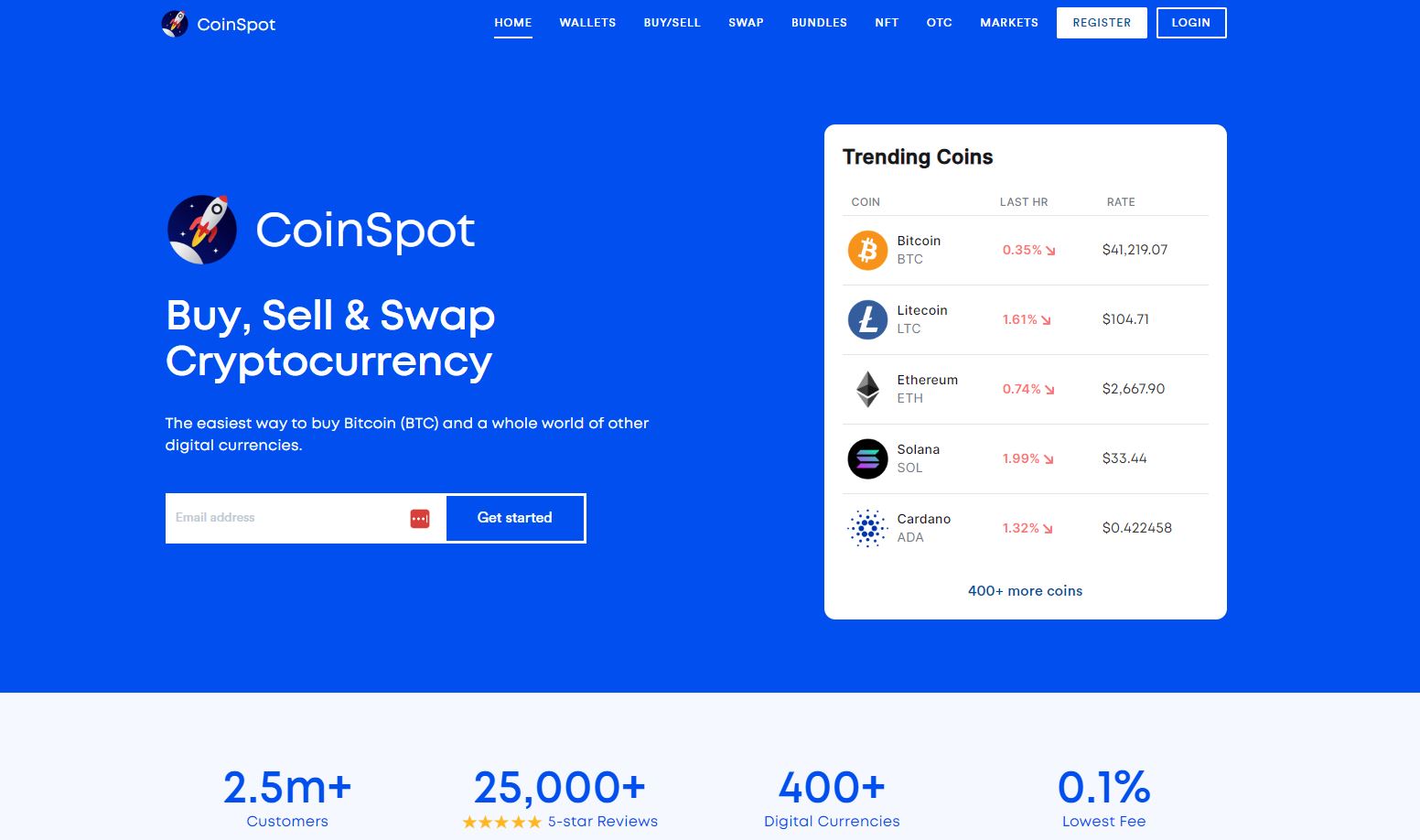

Follow the below steps to buy Aptos in Australia. We will use CoinSpot as an example.

Step 1: Choose a Crypto Exchange

Curious about where to buy Aptos tokens? Several well-regarded exchanges offer the option to purchase APT tokens, including platforms like CoinSpot, Binance, OKX, Coinbase, KuCoin, and Kraken. As you navigate diverse crypto exchange platforms for buying APT, consider their fees, security protocols, user interface, and supported payment methods. Note that certain exchanges might be restricted to specific countries or regions.

Check out this review of the best Australian crypto exchanges if you’re unsure where to start. If you plan on using a mobile device to buy and sell altcoins, you can read our review of the best crypto apps in Australia.

Step 2: Sign up for a CoinSpot account

First, sign up for a CoinSpot account. You can skip this step if you’re already a CoinSpot account holder. For registration, navigate to the CoinSpot website and locate the “Register” button in the web page’s upper right corner. Subsequently, you’ll receive prompts to input your email address and create a secure password.

To buy APT through CoinSpot, you need to complete mandatory identity verification. You’ll be required to provide a valid government-issued passport or driver’s license.

Step 3: Purchase APT Tokens

Several avenues exist for acquiring Aptos within the CoinSpot exchange, ultimately hinging on your preference. Let’s delve into popular approaches for purchasing Aptos on CoinSpot.

Option 1: Fund your account with crypto

This method proves advantageous for individuals holding cryptocurrencies on different platforms or wallets. After transferring your Bitcoin to a CoinSpot account, you can acquire Aptos using Bitcoin, as CoinSpot facilitates trading through the BTC/APT pairing.

To fund your CoinSpot account with cryptocurrency, click on the “Deposit” button in the upper right corner of the page. You’ll be prompted to choose the specific coin to deposit. You can proceed with the Aptos purchase once your crypto has been successfully deposited.

You can use a market order to convert your assets at the prevailing market price, as indicated in the quote. Alternatively, you can choose a limit order to purchase APT, allowing you to establish an order for asset conversion at a predetermined limit price.

Option 2: Fund your account with fiat

If you lean towards pre-funding your account with your chosen fiat currency, this route is well-suited. Users can deposit fiat directly into their CoinSpot account through bank transfers or credit/debit card transactions.

When opting for the bank transfer method to fund your account, ensure that the account name corresponds to the name registered on your CoinSpot account. Following the successful deposit of fiat currency, it will be held as your cash balance within your CoinSpot account. With this balance, you can instantly purchase Aptos using your preferred fiat.

Step 4: Choose How to Store Your APT

Most crypto exchanges offer an integrated wallet at no cost, serving as an automatic repository for your APT holdings. Yet, for better security, you can opt for a distinct third-party wallet. Transferring your coins from the exchange to an independent crypto wallet diminishes the vulnerability of potential losses in case the exchange platform experiences a breach.

There are two categories of wallets: a “hot” wallet, which holds your digital asset online, and a “cold” wallet, which safeguards it within an offline device such as a hard drive. While hot wallets are more susceptible to hacking, providers can assist in regaining access if you misplace your access credentials.

Cold wallets, offering superior security, keep your APT offline, making them impervious to hackers. However, if you lose the access credentials for your cold wallet, there is no recourse for recovery, leading to a permanent loss of access to any stored currencies.

Is Aptos a Good Investment?

Is it wise to follow venture capital firms and invest in the Aptos blockchain? In the grand scheme, Aptos emerges as one of the most dependable cryptocurrency ventures of 2022. Yet, undertaking is only partially impervious to challenges, and a complete evaluation of Aptos hinges on its forthcoming launch. Nevertheless, the insights amassed thus far regarding Aptos project it as a robust investment contender.

Numerous factors are converging to position Aptos as a compelling opportunity. The venture stems from a Meta-originated initiative that showed positive outcomes before its suspension. Besides, the development team steering Aptos comprises seasoned professionals who have contributed to noteworthy endeavours. Augmenting these strengths, Aptos has substantiated its assertions with impressive transaction-per-second (TPS) rates during testing.

Aptos has distinctive architecture, segregates consensus and execution, and employs the Move programming language for enhanced security. Buoyed by the momentum of venture capital interest and a proficient ex-Diem team, Aptos envisions a promising trajectory, aiming to materialise its launch strategies and achieve widespread adoption in the crypto realm as the secure Layer 1 endeavour However, dissenting voices from certain engineers allege that Aptos blockchain’s actual TPS falls short of its purported claims.

As with any crypto investment, prior to acquiring APT, conducting thorough research and gaining clarity about the associated risks is recommended.

Aptos FAQs

Who are the founders of Aptos?

The founders of Aptos are Mo Shaikh and Avery Ching, who previously served at Meta. Mo, presently the CEO, is a seasoned founder with extensive international financial services and blockchain/crypto expertise. By contrast, Ching holds the position of CTO at Aptos, bringing his software engineering prowess as one of the principal software engineers during his tenure at Meta.

How is the Aptos network secure?

Aptos implements two consensus protocols: Proof-of-Stake and AptosBFT. AptosBFT bears a resemblance to DiemBFT, initially developed for Diem. “BFT” stands for ‘Byzantine Fault-Tolerant,’ signifying a network’s resilience even if certain members go offline or act maliciously. While the technical intricacies surrounding the protocol’s network security measures are intricate, the algorithm autonomously evaluates on-chain states and updates leader rotations to accommodate unresponsive validators without requiring human intervention.

How many Aptos are in circulation?

APT has an initial total supply of 1 billion, with its circulating supply of 130 million. The distribution is structured as follows: Community (51.02%); Core Contributors (19.00%); Foundation (16.50%); Investors (13.48%). Within the Community allocation, around 80% is held by the Aptos Foundation, with the remaining portion under the purview of Aptos Labs. These reserves serve to bolster community expansion and support Aptos Foundation initiatives, with the remainder gradually unlocked over the ensuing decade.

Is the Aptos platform decentralised?

At the time of the mainnet launch, validators primarily consisted of those set up by Aptos Labs. The main net’s inauguration featured 102 validators, with the majority under the control of Aptos Labs. Thus, Aptos isn’t genuinely decentralised, with only a minority managed by third-party entities, making it predominantly a centralised blockchain.

Should I buy the Aptos token?

As with any investment, it’s crucial to grasp their mission and how the Aptos platform aspires to revolutionise decentralised finance. There’s little information about the Aptos team, coupled with the absence of a clear project roadmap. Also, the utility of the APT token is currently confined to the Aptos platform. Despite these considerations, Aptos presents an enticing investment prospect, especially for short-term gains, given its established achievements on the testnet. Ultimately, individual investors must meticulously weigh the risks and potential rewards before making investment decisions.

Final Words

Aptos (APT) is a captivating cryptocurrency endeavour that presents users with a spectrum of possible applications and tokens. While the platform presently faces certain constraints regarding its existing utility, it has ample space for expansion as it advances and evolves within the decentralised finance and gaming arena. If investing in Aptos interests you, the best crypto platform to buy APT is CoinSpot. This platform provides spot trading without fees and extra charges, making it a prime choice for potential investors.