Superhero Trading is a platform for trading assets such as Australian and US stocks, ETFs, and commodities. It also provides up-to-the-minute market data, insightful analysis, and tools to facilitate well-informed trading choices. If you are interested in the Superhero platform, its fees and features, read our Superhero review below.

Superhero Overview

Superhero emerges as a recent addition to the online stock brokerage landscape, officially launching in Australia on September 7, 2020. The platform offers commission-free US trading, a flat fee of $5 for Australian trades, cost-free brokerage for Australian ETF purchases, and a $100 minimum investment requirement.

Superhero also stands out thanks to its provision for trading stocks and ETFs within your superannuation without necessitating the establishment of a Self-Managed Super Fund (SMSF).

Pros

Cons

How Does Superhero Work?

After registering for AUD trading, you will have a Superhero Wallet as your cash management hub. It provides insights into uninvested cash, records of trading activities, and any income or investment distributions received. The funding of your USD wallet can be conveniently accomplished through either PayID or BPAY methods.

When executing Australian share trades, it involves Finclear, a recognised ASX market participant. But the legal ownership of these shares rests with a custodian entity named Superhero Nominees, meaning that you retain the beneficial ownership of the shares while not assuming the legal ownership.

For US share trades, the operational aspect involves the Apex Clearing Corporation, which takes on both clearing and custodial responsibilities. Similar to the custody for Australian shares, US shares are also held under custody on your behalf.

The execution of trades can be tailored as either market or limit orders. For ETFs, a “marketable limit orders” strategy is recommended. This entails employing a limit order and positioning it slightly above the ask price for purchases or marginally below the bid price for sales. Any potential surprises stemming from rare deviations between the ETF price and the underlying value of its constituent stocks can be effectively mitigated.

Superhero Investment Options

The essence of Superhero lies in its commitment to simplicity, a principle that finds resonance in the range of markets it provides access to.

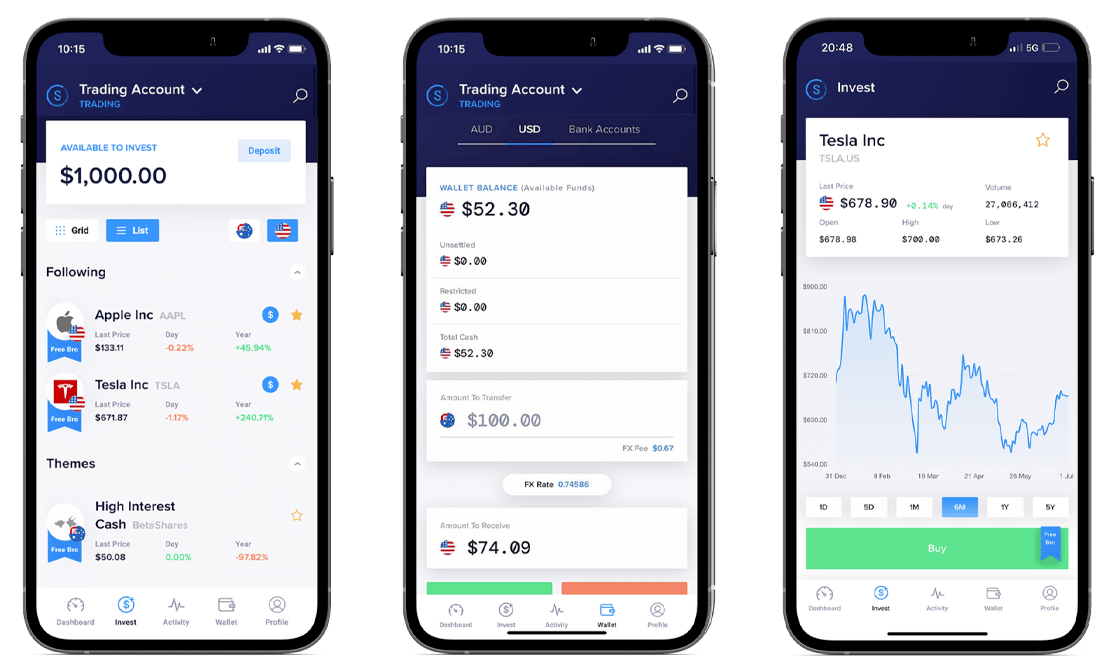

United States

Superhero facilitates entry into a vast expanse of over 5,000 US-listed stocks and ETFs, opening up a world of investment avenues for those intrigued by the American market. It includes the opportunity to invest in globally renowned corporations like Tesla, Apple, NVIDIA, Amazon, and more.

The US markets further present an exceptional assortment of ETFs, endowing investors with the power of diversification within a singular asset. It enables individuals to engage in targeted investments in specific domains of promise, encompassing fields such as robotics, artificial intelligence, green energy, and beyond.

Australia

While the Australian Stock Exchange (ASX) may not boast the diversity as its US counterpart, it is by no means lacking in its own array of stocks and ETFs. The ASX is often sought after for investments in resources, particularly mining, technology, and financial enterprises. The ASX also hosts several New Zealand-based companies that have made their presence felt:

- Auckland International Airport (AIA)

- Spark New Zealand (SPK)

- Fisher & Paykel Healthcare Corporation (FPH)

- a2 Milk Company (A2M)

- Laybuy Group Holdings (ASX: LBY)

Live Data and Reporting

Superhero equips you with fundamental data and reporting functionalities, including:

- Live pricing updates

- Real-time market depth insights

- Performance charts that reflect price trends over the past year

- Watch lists to monitor selected assets

In its initial stages, Superhero introduced these features exclusively through a premium monthly subscription. However, that model was swiftly abandoned, and now these capabilities are accessible free of charge to all users.

While this suite meets the needs of many, active traders may find it falls short. Performance charts are restricted to one year, and the absence of buy-sell ratings, technical analyses, and detailed company financials limits their applicability.

While the data and reporting offered by Superhero surpass that of some online brokers, they don’t match the comprehensive range provided by Commsec. For further information, please read our Commsec review.

- Advanced charting, encompassing heat maps, graphs, and comparison charts

- Extensive historical data

- Pricing alerts (delivered via email or mobile notifications)

- Buy-sell ratings and stock recommendations

- A news feed coupled with technical analyses catering to traders’ needs, albeit less relevant to long-term investors.

Should you desire such expanded capabilities, a strategic approach could involve using Superhero for your trades while simultaneously opening a cost-free Commsec account. This way, you would harness the benefits of both low-cost brokerages via Superhero and extensive reporting, coupled with historical data, facilitated by Commsec.

Superhero Trading & Brokerage Fee

Superhero positions itself as Australia’s most cost-effective online broker, initiating trading at a mere $5 per trade for Australian shares, while ETF trades are entirely free. This starkly contrasts to alternatives like Commsec, which charges $19.95 per trade, and SelfWealth, with a $9.90 fee. While ETF purchases bear no brokerage fee, a $5 charge applies for selling them. Conversely, US-listed securities entail no brokerage fees.

Superhero eliminates concerns regarding monthly account maintenance charges; no invoices for account upkeep will cross your path. Moreover, the platform refrains from imposing a monthly fee for maintaining funds within your Superhero Wallet.

For every 100 AUD converted to USD, an additional 70 US cents are charged as a currency conversion fee. For example, if you possess 100 AUD earmarked for investing in Tesla shares, with an AUD/USD trading pair of 0.7500, you could acquire 75 USD worth of Tesla shares. However, a 70 USD cent FX transfer fee subtracts, leaving you with 74.30 USD worth of Tesla shares.

Superhero spares its clients from inactivity fees, ensuring no penalties for underutilised accounts. Withdrawal from your account is fee-free with Superhero. Bank transfers and PayID deposits come at no charge. If you choose BPay deposits, a $1 fee applies. Transferring current shares between Superhero accounts within the AU trading setup incurs a fee of $22.00 per security. Besides, off-market external transfers demand a fee of $55.00 per security.

Superhero Superannuation

Through Superhero Super, you gain the remarkable opportunity to allocate 75% of your super towards ASX market shares and ETFs, all without the need for a Self Managed Super Fund (SMSF). You have two distinctive levels of investment control:

- Autopilot Account

- Control Account

With the Autopilot account, a striking feature enables you to invest 30% of your super balance across six dynamic themes: US Tech, Asia Tech, Global Healthcare, Global Sustainability, Gold, and High-Interest Cash. These theme investment options open up an exciting spectrum of possibilities. A key rule is that a maximum of 10% of your super balance can be assigned to a single-themed investment. Moreover, the cumulative total of all themed investments must not exceed 30% of your super balance. The remaining 70% of your super funds align with your Diversified Global Index Portfolio.

In contrast, the Superhero Control account offers a more expansive range of investment avenues within your superannuation, surpassing the offerings of the autopilot mode. These encompass Diversified Global Index, ETFs and LICs, Direct Equities, Cash Accounts, Life Insurance and Death and TPD Insurance.

The scope widens further in the Control account setup: you can invest up to 75% of your super in the ASX market shares 300 index, LICs, and ETFs. The remaining 25% balance strategically finds a place within the Diversified Global Index Option.

To be eligible for an autopilot or control account, you must be between 25 and 55 years.

Superhero Investing App

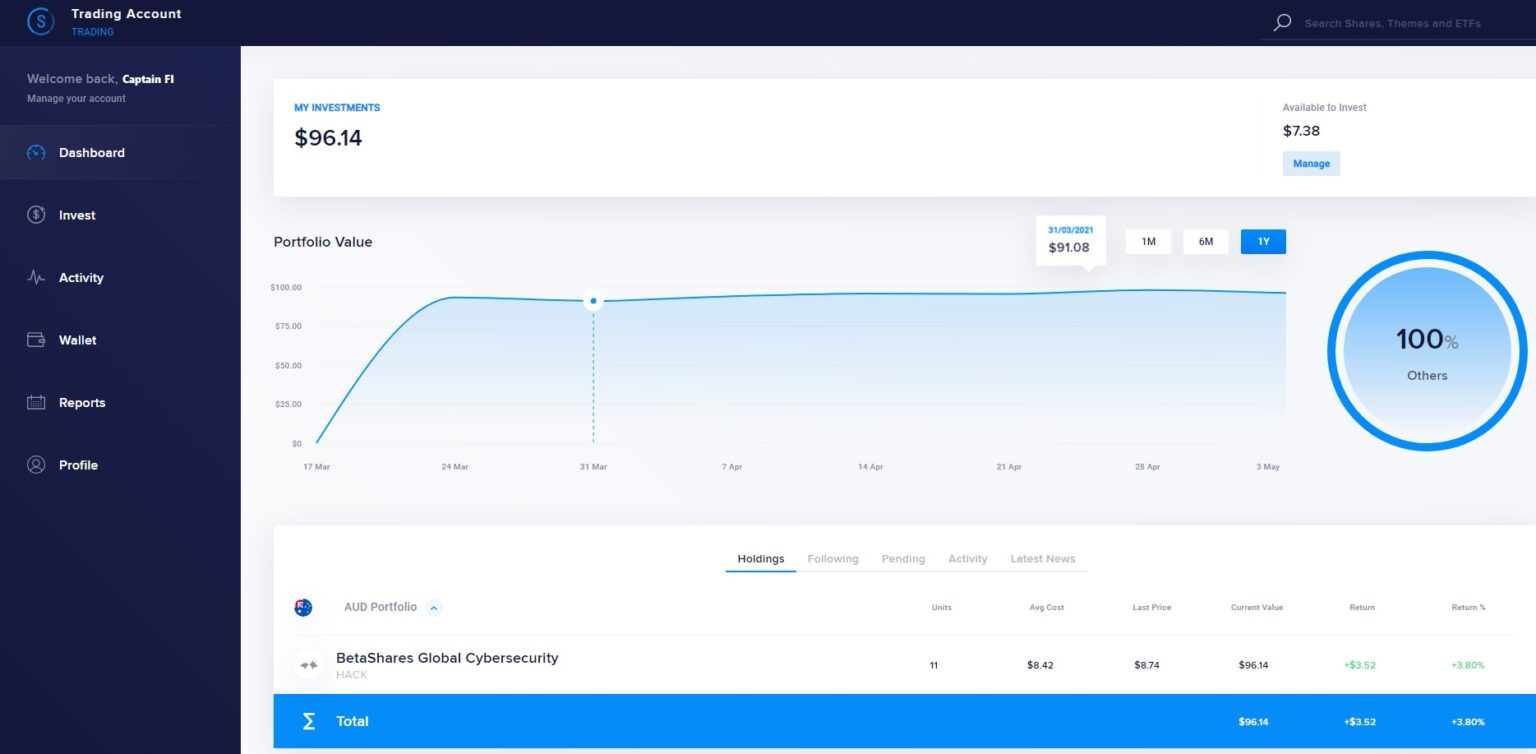

The Superhero App emerges as an excellent solution for individuals seeking a user-friendly and more accessible entry point into stock market investing.

It is available on both the App Store and Google Play platforms, boasting an array of features tailored for monitoring your investments and tracking your progress. You can traverse through the app’s dashboard, investment, activity, wallet, and profile sections. The app empowers you to swiftly invest, observe fluctuations, and gain insights into the evolution of your investment portfolio over time.

The adept Superhero development team ensures the utmost confidentiality of your personal and financial data. Rigorous security protocols are meticulously employed to safeguard your privacy, offering you peace of mind.

Is Superhero Safe?

Superhero operates under its own financial services licence in Australia and is regulated by the Australian Securities and Investment Commission (ASIC). Australian share trading involves a custodian model through Superhero Nominees Pty Ltd, where shares are held on your behalf, making you the beneficial owner, though not the legal owner. It safeguards your shares from claims by Superhero’s creditors and can be transferred if needed.

Superhero uses Finclear, a CHESS-sponsored market participant, for real-time trade execution. They partner with Apex Clearing Corporation LLC (Apex) for US trading to provide clearing and custodial services. Apex’s safety is validated through its FINRA registration and SIPC membership, which secures cash and securities held by customers in case of financial turmoil.

Superhero Customer Service

Superhero prides itself on its responsive customer support, accessible through two distinct avenues:

- Superhero Live Chat

- Email at [email protected]

Regardless of the communication medium you opt for—whether it’s live chat or email—you can rest assured that your inquiries or concerns will be addressed with professionalism and promptness. The brokerage maintains a stringent resolution protocol that guides the process.

Characterised by their approachability and expertise, the Superhero customer service team is known for its friendliness, extensive training, and seasoned experience. They consistently go above and beyond to ensure that every customer’s service experience is met with satisfaction.

How to Buy Crypto with Superhero?

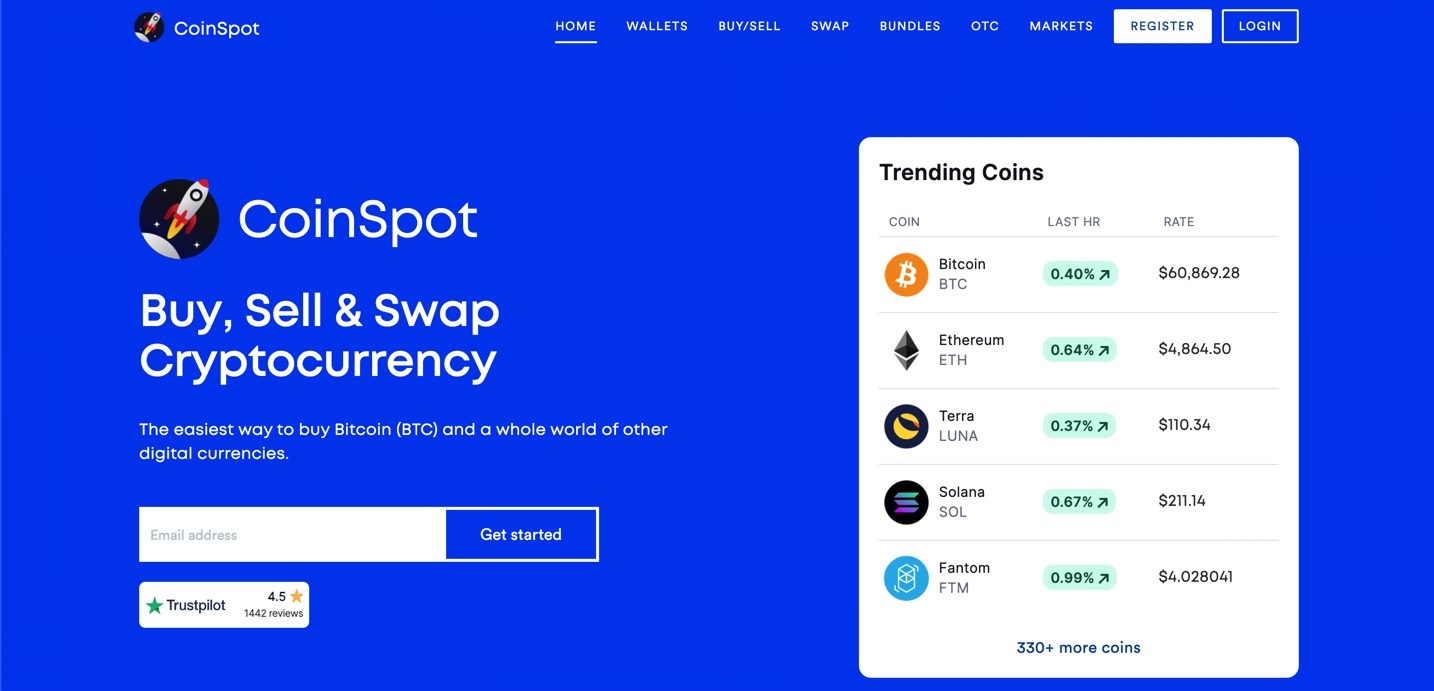

The Superhero trading platform doesn’t support direct crypto buying and selling within its interface. Instead, users can exclusively invest in Crypto-related stocks and ETFs rather than the underlying digital assets.

In the interim, you can buy cryptocurrencies via a locally regulated crypto exchange in Australia, endorsed by AUSTRAC. CoinSpot is among Australia’s best options for buying digital assets like Bitcoin or Ethereum. The platform offers many features, including access to 380+ coins, staking services, an NFT Marketplace, NFT Wallets, and more.

To embark on this alternative cryptocurrency journey, follow these steps:

- Register on the CoinSpot Australia trading platform.

- Deposit AUD from your bank account using Bank Transfer, POLi, PayID, Osko, BPAY, or Cash.

- Locate the desired digital asset on the platform.

- Specify the AUD amount you intend to invest and execute the trade.

After you finalise your investment, your digital assets will be automatically housed in your secure CoinSpot-managed wallet. You can leave it within this wallet or transfer it to another. For further information, please read our CoinSpot review.

Superhero FAQs

Is Superhero suitable for beginners?

Superhero is an excellent choice for beginners due to its user-friendly features. Newer investors benefit from fee-free ETF purchases and low minimum deposits. Superhero steers investors from speculative trading by excluding riskier assets like CFDs.

Who should opt for Superhero?

The platform’s ease of use and fee-free transactions make it appealing to most investors. Its $5 brokerage fee for Australian trades and zero cost for US trades is competitive. However, it’s less suitable for those outside Australia or the US or those seeking advanced research or alternative trading options beyond shares.

How can I open a Superhero account?

Opening an account is a swift process taking just 10 minutes. Here’s how:

- Visit the Superhero website.

- Provide your details, including your name, email, and phone number.

- Verify your identity using your Australian passport, driver’s licence, or Medicare card.

- Fund your account by transferring money to your Superhero Wallet via BPAY or PayID. Wallet details can be found in the app’s wallet section.

Who holds ownership of investments made via Superhero?

Superhero Securities manage Australian shares on your behalf, while US shares are managed by Apex Clearing Corporation LLC (Apex). The platform ensures your ownership rights by stating that others, including creditors of Superhero, cannot access your shares within the Superhero account cannot be accessed by others, including creditors of Superhero. Neither Superhero Securities nor Apex Clearing Corporation LLC can exercise ownership rights without your instruction.

What happens if Superhero goes bust?

With Superhero’s custody structure for holding investors’ shares, your ownership and rights to the investments remain intact, and you retain full beneficial ownership, including dividend entitlements if applicable. Any actions related to your investment require your instruction to ensure the safety of your shares. Should Superhero face financial difficulties, you can transfer your shares from Superhero Securities to another share trading service of your choosing.

Superhero Review: Final Thoughts

All in all, Superhero is a prominent Australian trading platform with diverse features and assets. The company is committed to delivering top-notch user-friendly options, encompassing AU & US stocks, ETFs, and commodities. Its real-time market data, analysis, and robust toolkit empower users to make well-informed trading choices.

Nevertheless, Superhero’s platform does not currently support crypto trading or custody. Those interested in digital assets like Bitcoin or Ethereum in Australia can seek other platforms. The best option is CoinSpot, a leading exchange that offers an array of advanced features, including Crypto Staking and an NFT Marketplace.